When the going gets tough, even buff guys cower against the passage of time. The world changes, and so do people. And with this, people look to insurance plans to help them in dire times. Who knows what the future holds?

Uncertainty is evident, and only by filling up an insurance form can you find even a little bit of comfort at the thought of the security. Security is elusive for some, and they opt to take insurance plans to save them or their children in the future to come. All this sense of safety starts by holding a pen and reading the insurance form.

FREE 25+ Insurance Forms in PDF | MS Word

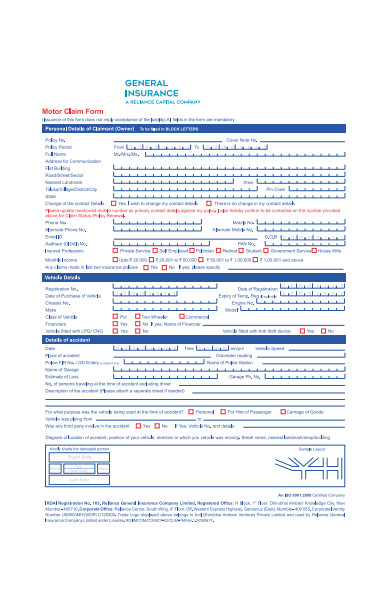

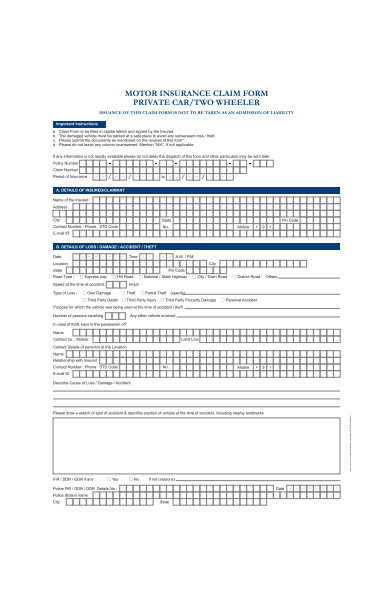

1. Motor Insurance Claim Form

2. General Insurance Form

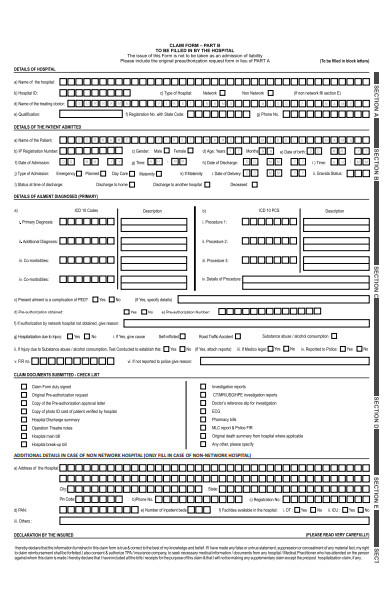

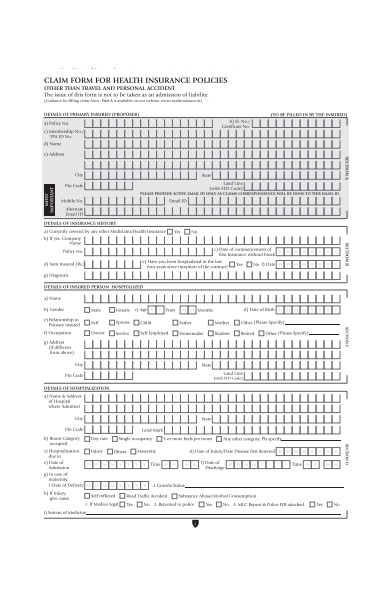

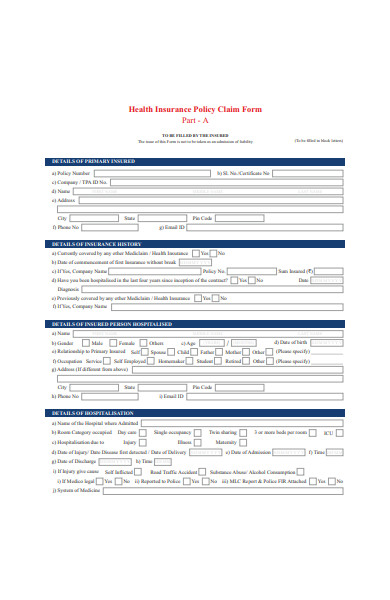

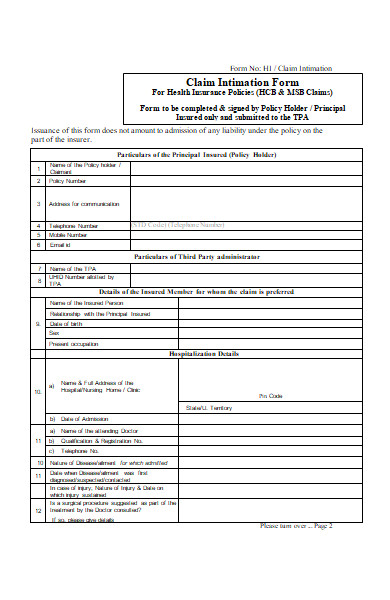

3. Health Insurance Policy Claim Form

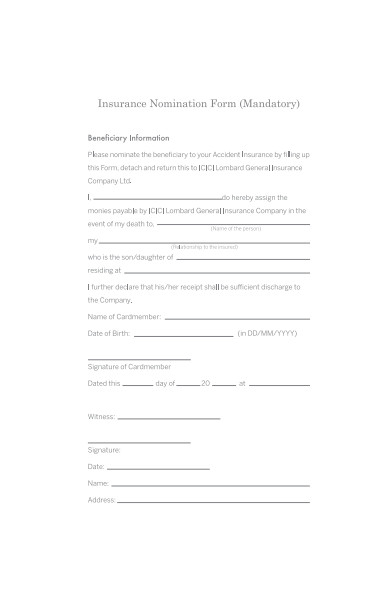

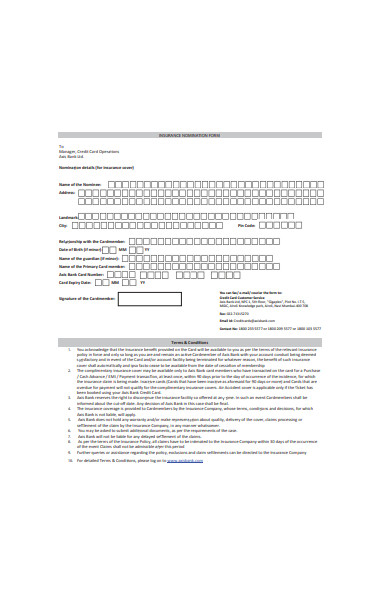

4. Insurance Nomination Form

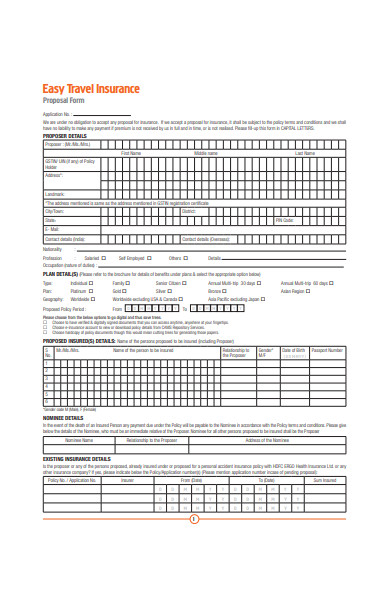

5. Easy Travel Insurance Proposal Form

6. Health Insurance Policy Claim Form in PDF

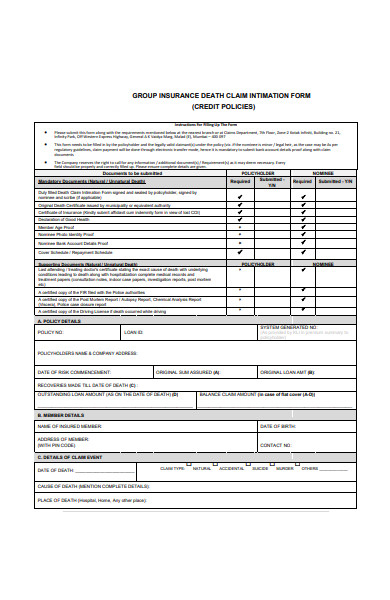

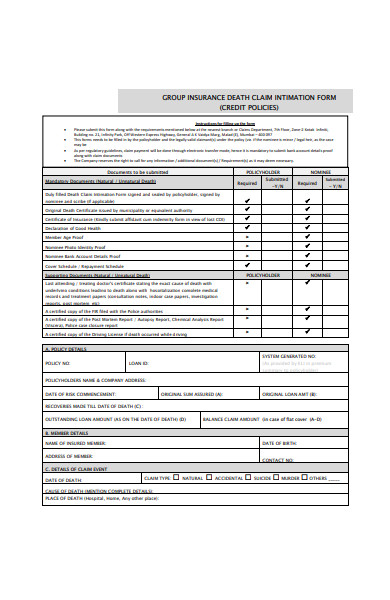

7. Group Insurance Death Information Form

8. Car Motor Insurance Claim Form

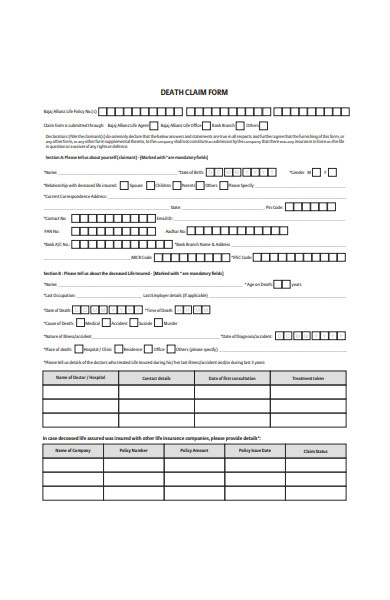

9. Life Insurance Death Claim Form

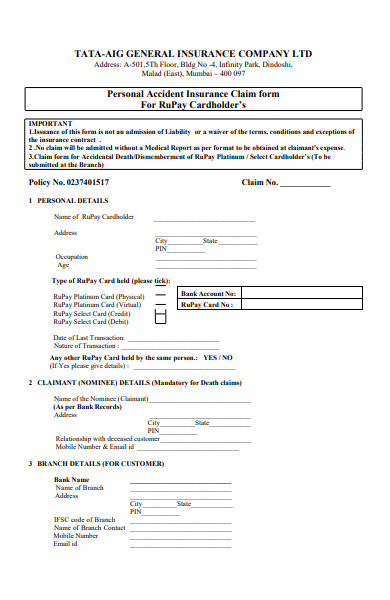

10. Personal Accident Insurance Claim Form

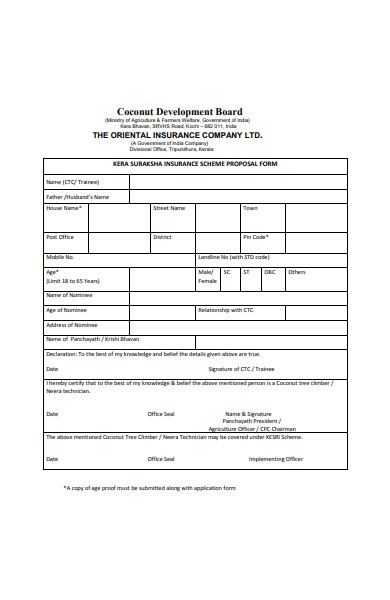

11. Insurance Scheme Proposal Form

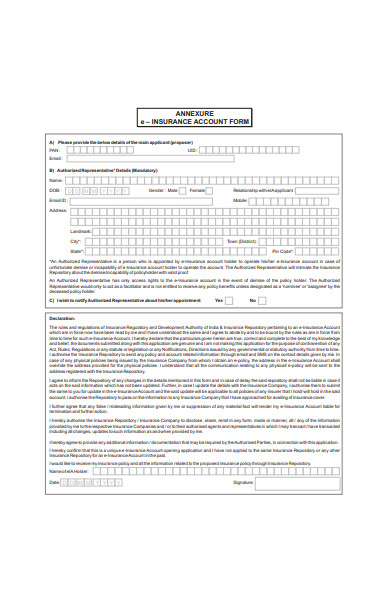

12. Insurance Account Form

13. Bank Insurance Nomination Form

14. Group Insurance Death Claim Information Form

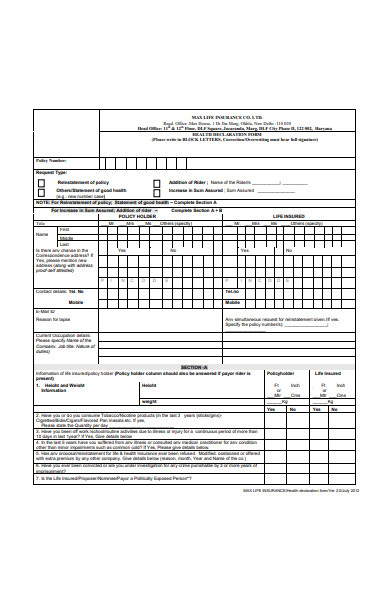

15. Life Insurance Declaration Form

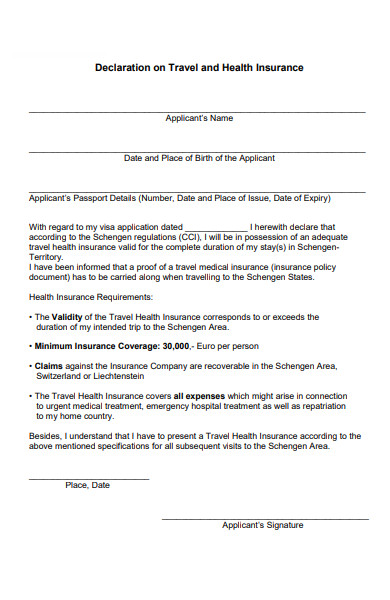

16. Travel and Health Insurance Form

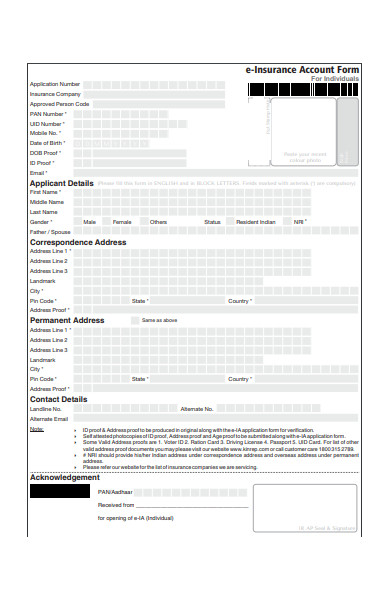

17. E Insurance Account Form

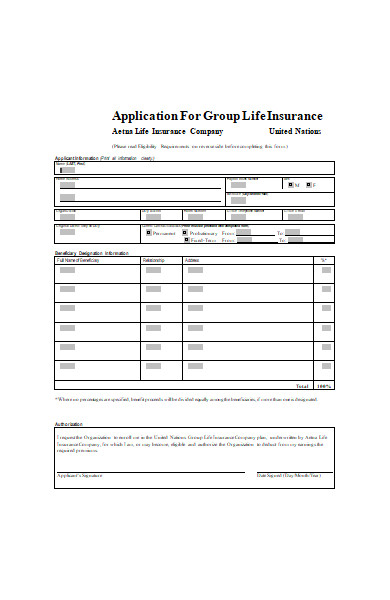

18. Life Insurance Application Form

19. LIC Insurance Claim Form

20. Insurance Proposal Form

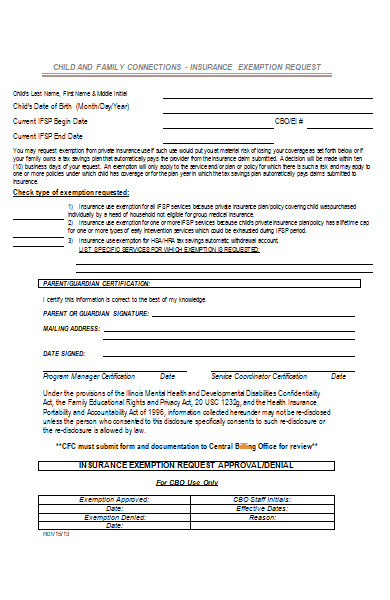

21. Insurance Exemption Form

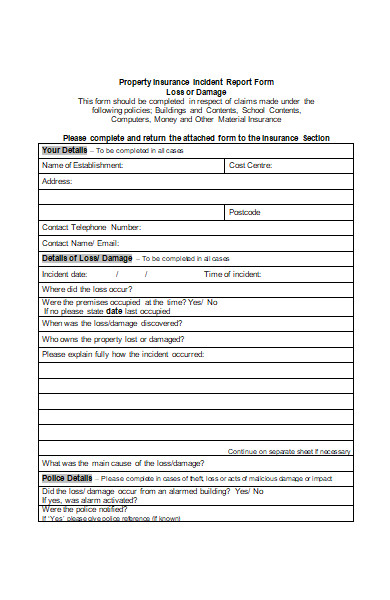

22. Property Insurance Incident Report Form

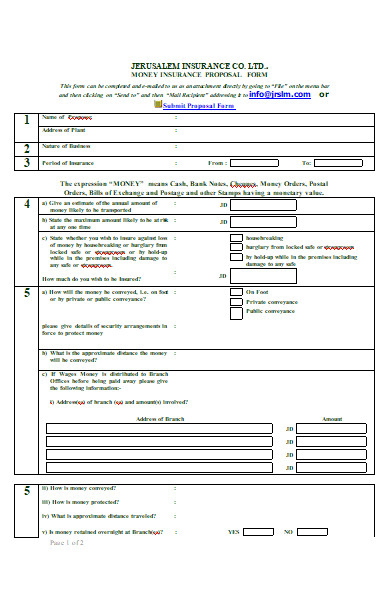

23. Money Insurance Proposal Form

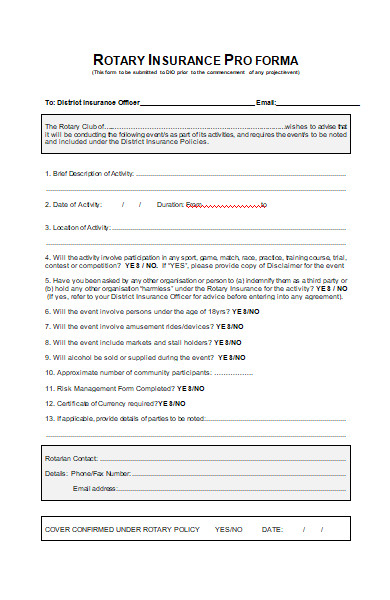

24. Rotary Insurance Pro Forma

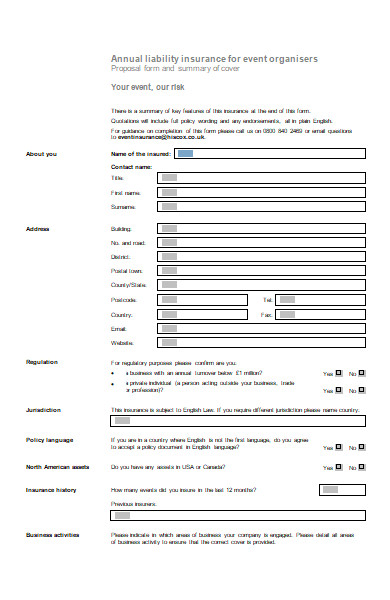

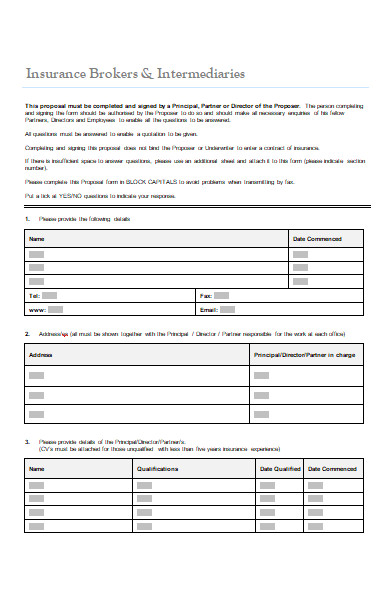

25. Insurance Brokers Proposal Form

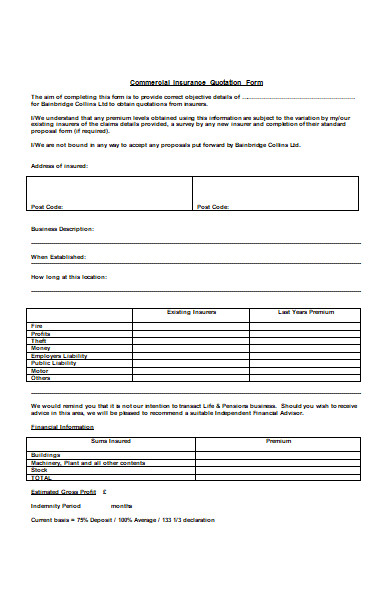

26. Commercial Insurance Quotation Form

What Is an Insurance Form?

Some may not admit it, but people do need to think about what will happen in the future. People need to be mindful and start investing their money on insurance plans to avoid not having enough money for a house and other necessities. One needs to start getting an insurance form and fill it up. However, what is an insurance form? We know what an insurance plan is, but what about the document? Why must one need to fill it up before having the insurance plan?

An insurance application form is a type of data-collecting document. The one who handles the insurance plan uses the gathered data from the insurance form for paperwork purposes, such as placing your name and other information to the account with the insurance plan. In this way, the gathered data serves to help you and the one who handles it the means to know that you have applied to their plan. Without the collected information, the handler will not know who owns the insurance plan account, and he might not be able to update you from time to time.

If the handler does not update you, you may also not be able to know that you already have insurance. Not knowing that one has insurance is a big deal for insurance plans to help cut payment costs from hospital bills and other expenses. This option is one of the many means that you can benefit from having an insurance plan.

Types of Insurance Forms

People have various needs, especially when they get old. When reaching a specific age, usually the age of sixty, people want to settle down and have the means to be secure and safe. Insurance plans do help satisfy this need. As you can see below, there is not only one type of insurance but also many. Various types of insurance exist to cater to multiple aspects of a person’s life. Understand the relevance and use of each type of insurance that we listed. Do know that there are other types of insurance, but the list here are the ones that are most evident and known by many people in America.

- Home Insurance – Tornadoes and other weather-based calamities are frequent in the majority of the American states. And many Americans face severe damages to their homes. Some even go homeless after a disaster since they cannot hope to accept more debt to fix their house. With the help of home insurance, a person or a family may be able to cut less on their repair expenses. The insurance will help the family pay for the severely damaged areas that demand expensive repair management. And some home insurance will be able to provide a home to those who lost one efficiently. Though, the house will not be exactly similar to the original.

- Travel Insurance – Your budget might not be enough when a flight gets canceled, or your luggage got lost. Many Americans face such a dilemma in the airport, and instead of going home safely to their family, they have to experience one last round of life’s obstacles. With travel insurance, one may not need to worry about the additional expenses since the plan will cover for the rebooking flights and hotel reservations, and other losses that occurred while traveling.

- Life Insurance – The popular trend is investing one’s money so that it will grow. And once an American reaches a specified age, he or she may reap the benefits of the years spent saving up money. Life insurance is one type of investment that most Americans register to since it caters directly to the individual, specifically their life itself. There comes the point when an American wants to live the American dream, which is a little house with a white fence and a family. But one cannot afford this without the aid of a life insurance plan that will help one save up enough money.

- Medical Insurance – A medical insurance is similar to life insurance but the difference is that the former focuses on giving cheaper medical care to the one who applied for the plan. Life is a struggle and struggle results in injuries. Some accidents may even lead to a severe health state. Having medical insurance prepares one for the oncoming medical bills that follow. This type is especially useful if an American has a huge family. Children often get sick due to their undeveloped immune system.

- Pet Insurance – If you think having a pet is easy, then think again. Pets are a part of the family. Pets have needs such as food, shelter, and even medical care. When a pet gets sick or gets into an accident, you’d be surprised by the medical expenses that will eat out your eyes and heart. Apply for a pet insurance plan to help you cut costs on some veterinary bills. Pet insurance is similar to a medical insurance but the distinction between the two is crucial since pets have a different body structure than humans.

How to Fill Up an Insurance Form

Picking out an insurance plan helps out a lot since it makes your life more comfortable in the future. The preparation for the insurance application seems easy, compiling requirements and then filling up the sample form. However, there are some things that you must take into consideration during the application process. Below are some steps that will help guide you through the application process of the insurance plan.

Step 1: Determine the Kind of Insurance

Determining what type of insurance you want to take is a crucial step to helping sort out your future. There are various types of insurance out there, and we even have a list above of the widely-known types. Before you head over to the nearest insurance office and make an insurance account, you need to have an idea of what insurance do you want to get. Remember that there are different types of insurance, so assess with yourself, or you may ask your family on what kind of insurance plan you want to get first.

Step 2: Ready All the Requirements and Data

Once you set your mind to what type of insurance you want to have, you must then manage your time and budget. Set appointments and schedules for acquiring or processing the needed requirements for the insurance plan. Some requirements take time to prepare, and some are also costly. Managing one’s time and budget is an excellent way to gather the requirements on time. By setting earlier dates for an appointment, you might save enough money from having to choose “rushed processing.” Usually, insurance plans require a national ID or government legal forms. However, some insurance plans require more materials to prove that you are what you state yourself to be.

Step 3: Read the Sections Ahead

There is always a statement that says, “Know the forest ahead before you go inside.” Proceed with caution in the simplest of terms. The statement applies to all aspects of life, even when you are filling up an insurance form. Answering or filling up documents is a big thing, especially when these are legal forms. You need to foster caution before you go in and start. Read and assess the sections of the document carefully. If you have questions regarding some parts of the paper, then note them down. Afterward, ask the handler about what you find. There might be some misconceptions. It is better to be safe than sorry.

Step 4: Keep It Clean

Cleanliness is a priority when making a document. The majority would think that when talking about cleanliness, the content’s layout needs to be spotless—free of errors to be precise. This idea is accurate, but it is not the whole thing entirely. By cleanliness, we also mean the organization of the paragraphs and the content in the sample business form.

Pay attention to official government files and observe the structure of the layout. You would say it is “clean.” Take note of the structure and design that you have seen. And apply it to your output.

Step 5: Find Time to Review

Students fail their subjects if they don’t review their answers. There might be something wrong with how one stated their idea. The same can be said for creating a document. It is always better to find the right time to assess, review, or edit one’s works.

Along with the review, you might even be able to polish and perfect the area that you saw an error. Reviews do not point out mistakes alone, but it can also help a work improve, eventually reaching its full potential. Do not be scared to review your work. Reviewing enables you to be mindful of what you can avoid in the future.

Step 6: Submit the Document

There. You finished answering the insurance form, and you reviewed it twice, too. The only thing left is to submit it to the insurance handler. Be sure to include the other requirements when passing the insurance form. Check if all of your requirements are with you so you don’t have to reschedule.

Insurance contributes not only to an individual but also to businesses as well. It is a medium or device that helps prevent loss of life and assets. Many young people are applying for an insurance plan as early as 20 already. The struggle of saving money instead of buying the latest trendy item is worth it if it means you have enough savings to use when you retire. Take that insurance form and start thinking of a better future ahead!

Related Posts

-

FREE 9+ Business Insurance Forms in PDF | MS Word

-

FREE 32+ Holiday Forms in PDF | MS Word

-

FREE 30+ Nonprofit Forms in PDF | MS Word

-

FREE 31+ Therapy Forms in PDF | MS Word | XLS

-

FREE 52+ Bid Forms in PDF | MS Word | XLS

-

FREE 32+ Communication Forms in PDF | MS Word | XLS

-

FREE 44+ E Commerce Forms in PDF | MS Word

-

FREE 30+ Animal Shelter Forms in PDF | MS Word

-

FREE 34+ Charity Forms in PDF | MS Word | Excel

-

FREE 35+ Advertising Forms in PDF | MS Word | XLS

-

FREE 53+ Sports Forms in PDF | MS Word | Excel

-

FREE 51+ Payment Forms in PDF | MS Word | Excel

-

FREE 52+ Subscription Forms in PDF | MS Word | Excel

-

FREE 50+ RSVP Forms in PDF | MS Word

-

FREE 50+ Recommendation Forms in PDF | MS Word