Accounting might seem like a complicated task to many and the absence of relevant forms could be one reason behind it. But, the actual question is why should you use forms? The answer is mentioned in the following two reasons. First, accounting forms were designed to enable every accountant to do their work efficiently without spending too much time on design. Secondly, the accounting forms help you do the job right from start to the finish.

Printable Business Accounting Form

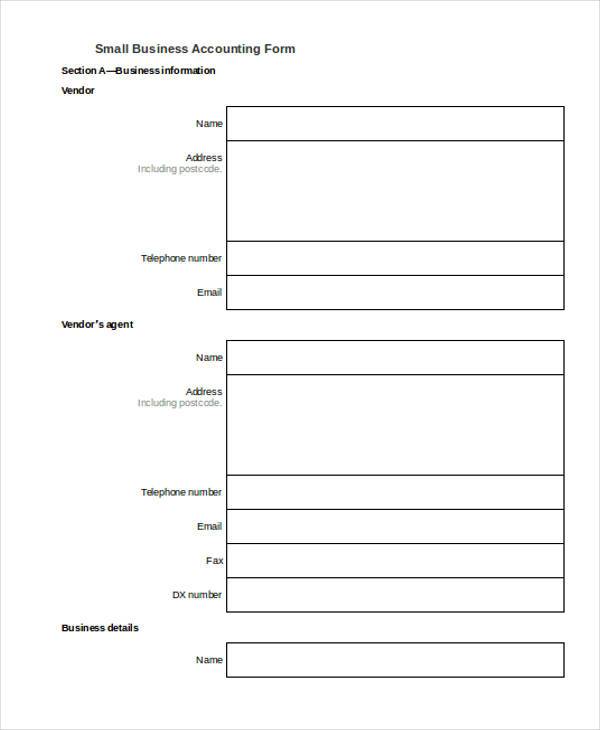

Printable Small Business Accounting Form

Free Printable Business Accounting Form

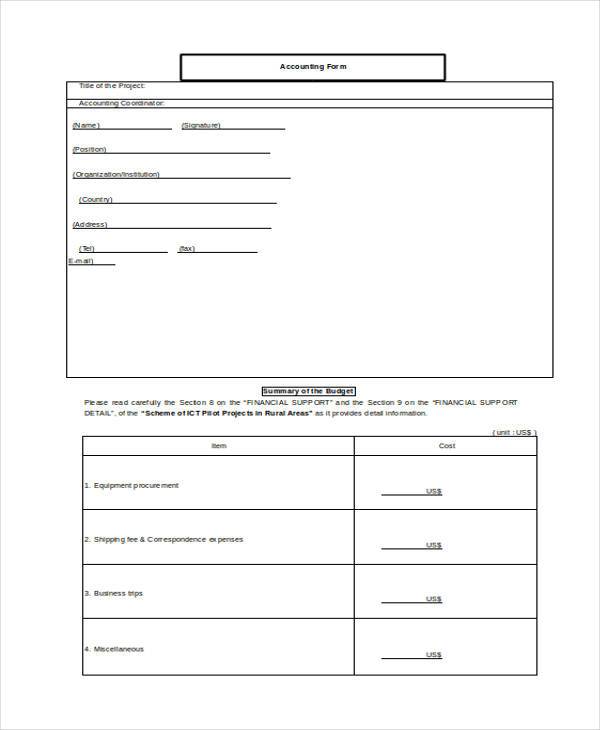

Free Printable Accounting Form

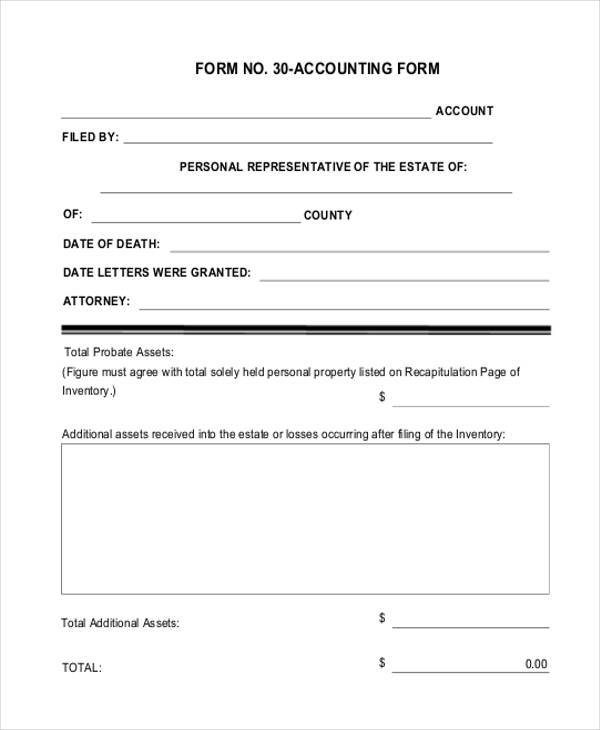

Free Blank Printable Accounting Form

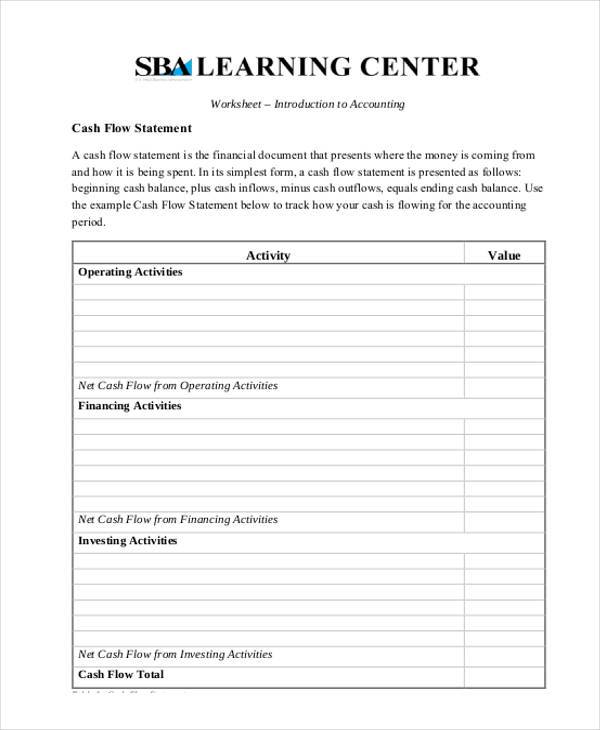

Printable Accounting Worksheet Form

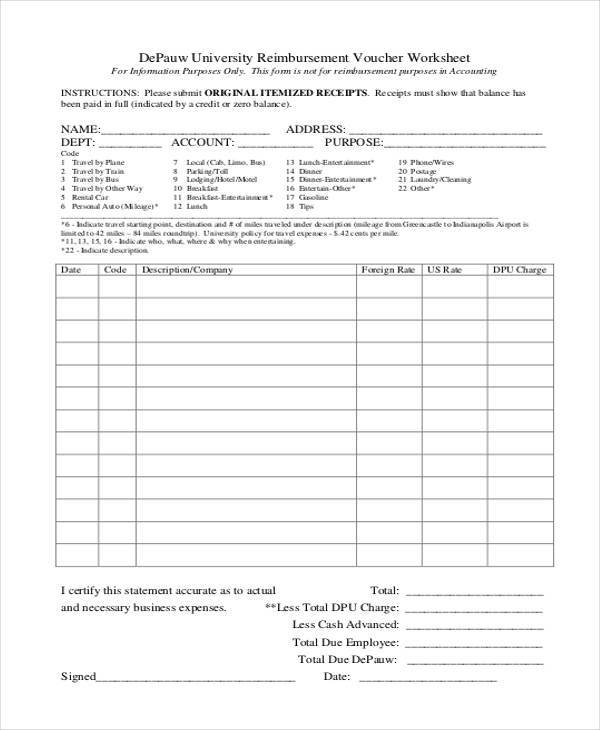

Accounting Reimbursement Voucher Worksheet Form

Printable Blank Accounting Worksheet Form

Business Accounting Forms

What are Business Accounting Forms?

Business accounting forms are enterprise documents used by the accountant to analyse the finances of the companies or businesses that they work with. Without accounting forms, it would be hard for a business to have a systematic recording of its finances and subsequently find it difficult to track the progress and performance.

Benefits of Business Accounting Forms

The preliminary goal of using business accounting forms, downloaded from the internet for free, is to save time and money on design. But, it does not necessarily end here. These forms are unique in the sense that they make the accounting process somewhat quick, making it easy for you to conduct the process with ease.

Overall, the task of designing all these yourself has been lifted away. You can now download the best template with a single click of a mouse. The sample templates are editable, although you can also use them as it is.

Printable Financial Statement Form

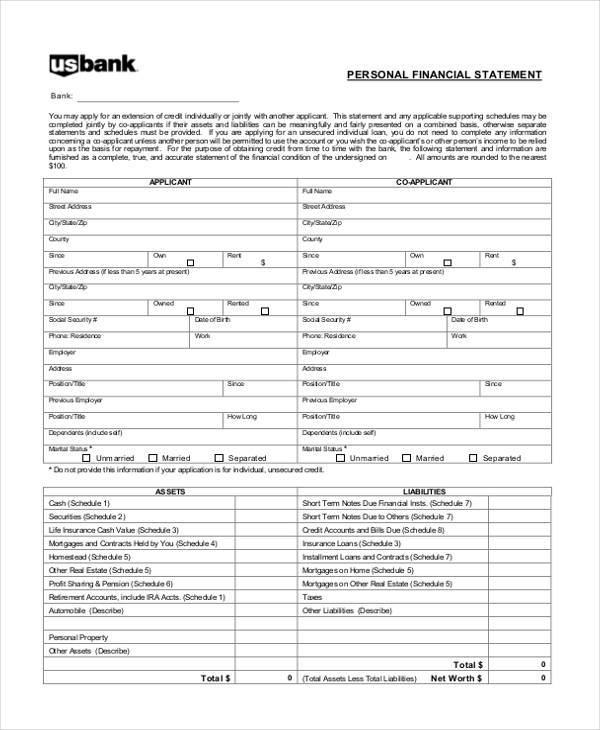

Printable Personal Financial Statement Form

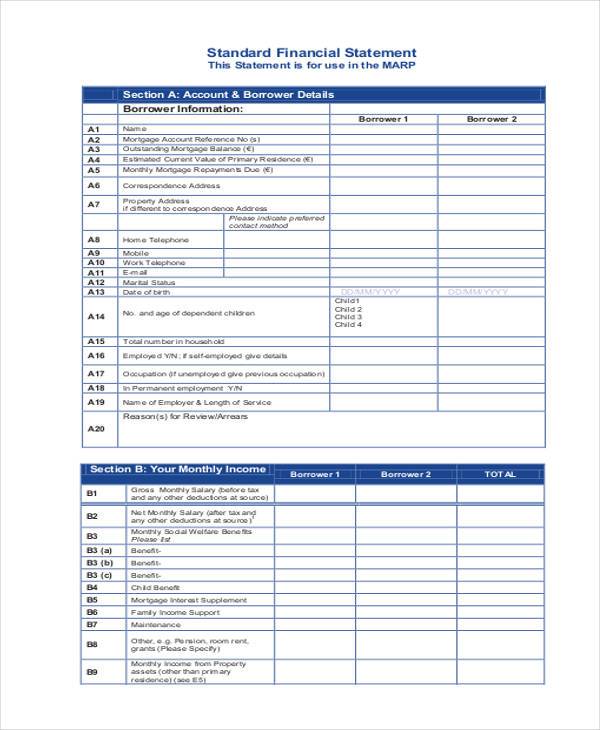

Printable Standard Financial Statement Form

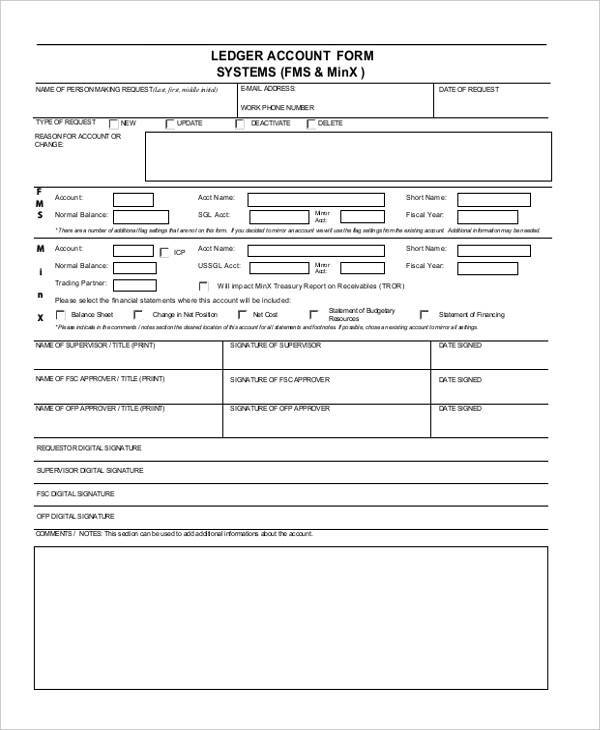

Accounting Ledger Form

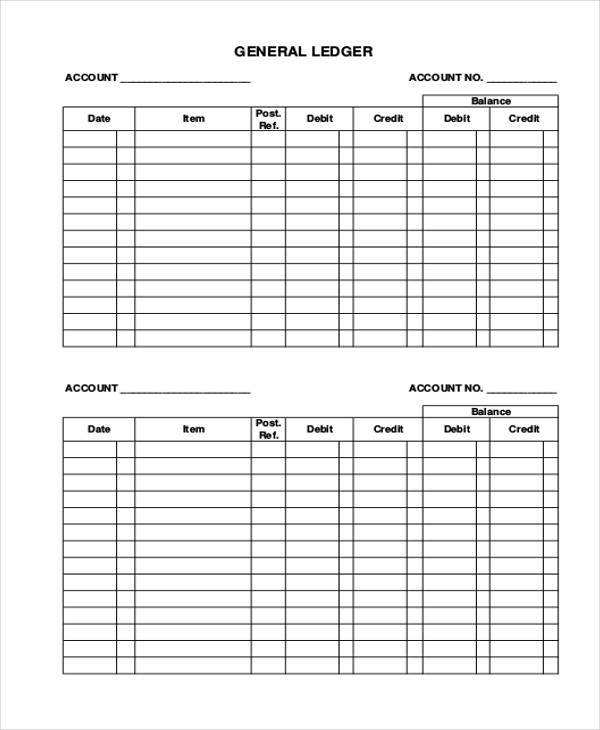

Accounting General Ledger Form

Accounting Ledger Form PDF

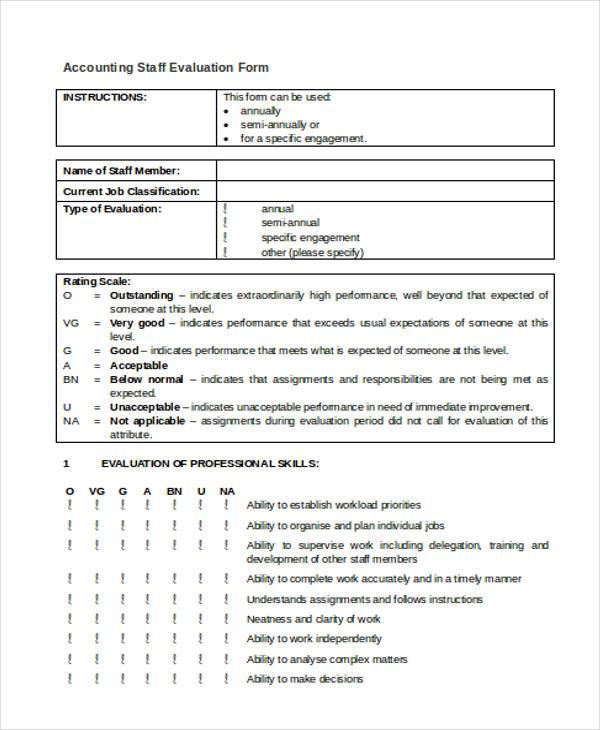

Accounting Evaluation Form

Accounting Staff Evaluation Form

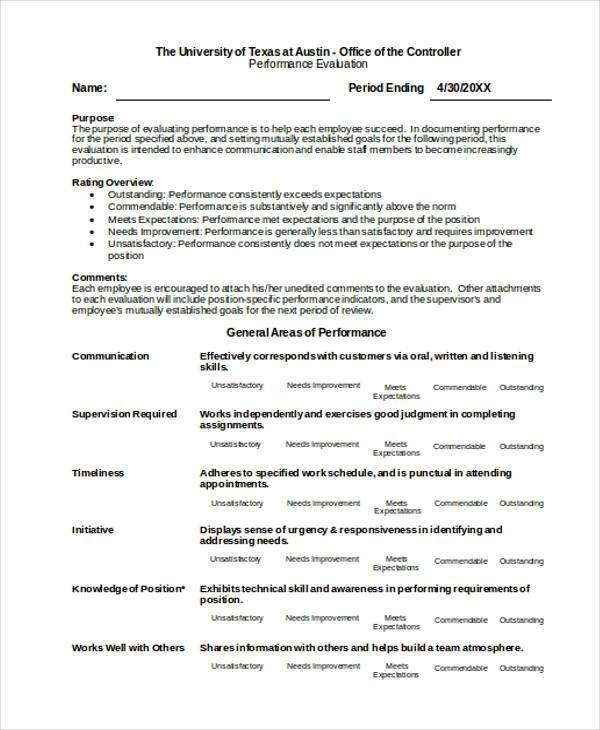

Accounting Performance Evaluation Form

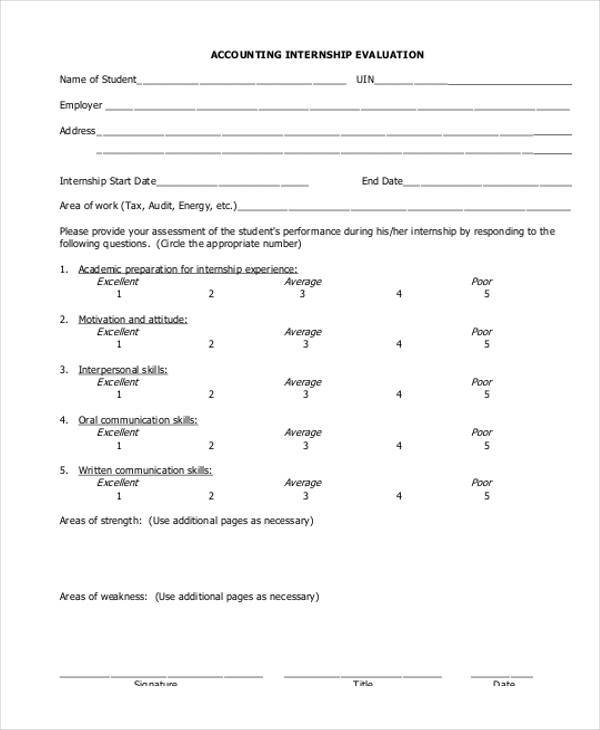

Accounting Internship Evaluation Form

What are the Different Forms of Accounting?

Accounting is a wide topic. There are equally as many sections as much as the accountants on the field. When you start to look at the different forms of accounting, you will realise that there is no such thing as general accounting. In the ideal world, where real people count money and use their rational thinking to make financial decisions, accounting cannot be generalised. More often than not, accounting will always fall into two groups: business accounting and personal accounting.

Personal Accounting

In personal accounting, you account for your own money by making relevant financial decisions. The model individuals use for personal accounting are not necessarily similar and definitely not complex. In most of the cases, all you need is a pen and a paper, money on the table, and of course your personal judgement and, you are good to go. Planning doesn’t seem hard here.

Business Accounting

This is another broad form of accounting, but it is usually more complex than the personal accounting. It involves the use of pre-designed templates, accounting software, and complex business models. In the end, the goal is often to use the results to make important decisions that will affect every person and processes in the company.

How to Create Accounting Forms

When it comes to creating the best accounting forms, it is easy to take the shortest route, which is to download a customizable accounting template and use it to save time, energy and money. It as simple as it sounds. And it is easier said and done.

Your company has one very important asset: time. Take it with a grain of salt, but understand that you can never waste time and expect to recover it. If you have identified the best and the easiest way to create ample amount of accounting files, you should not hesitate to stick with it.

While you can use excel to create the best accounting form, wouldn’t it be better if you download a file that already exists on the web? Of course, it makes a lot of sense to download a free sample template than spending the time to create a new one every time you want to do accounting.

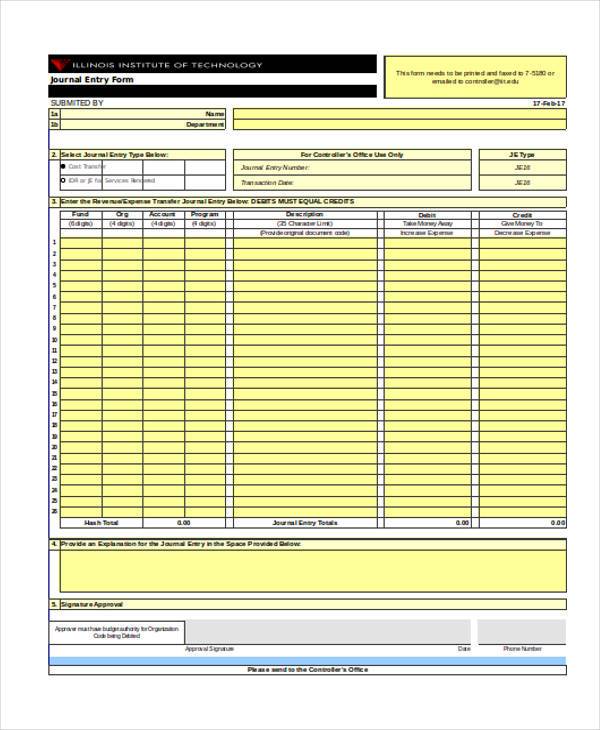

Accounting Journal Form

Accounting Journal Entry Form

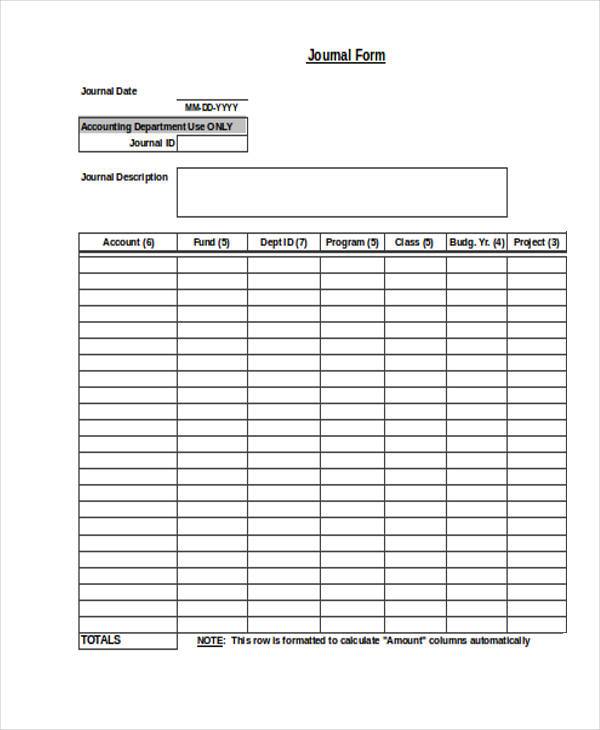

Blank Accounting Journal Form

Basic Accounting Form

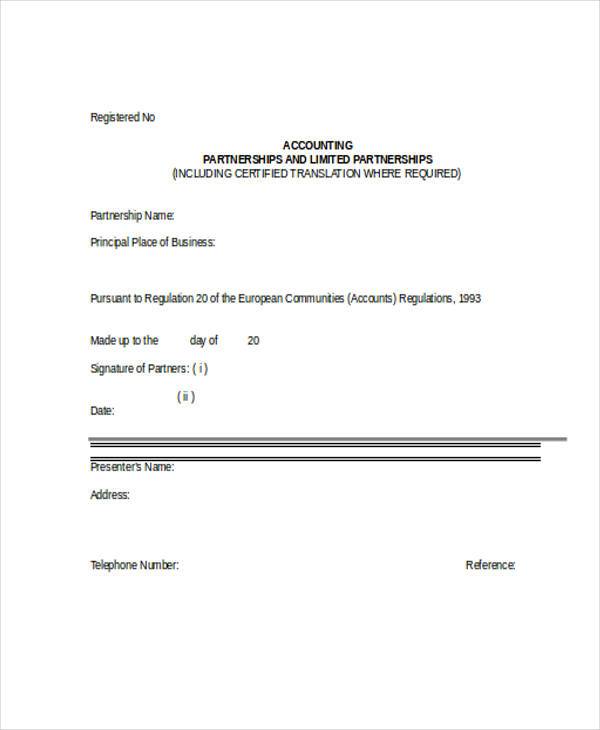

Basic Partnership Accounting Form

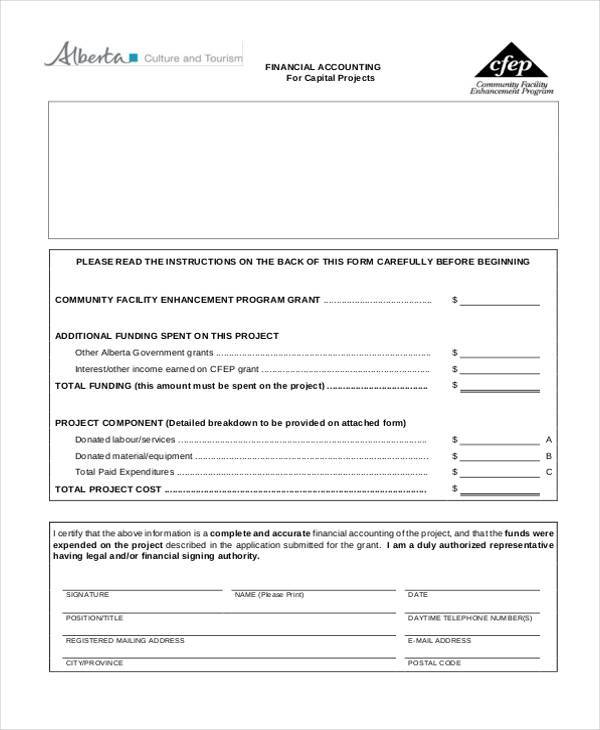

Basic Financial Accounting Form

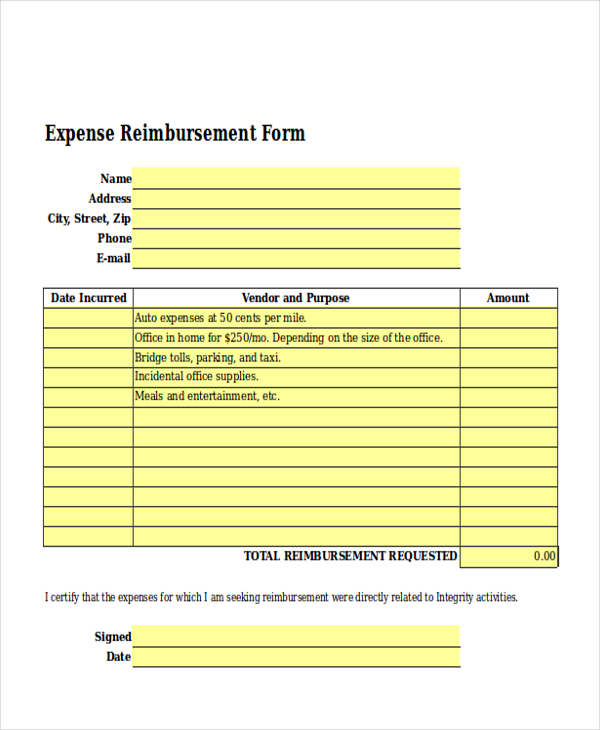

Free Expense Reimbursement Form in Excel

Different Forms of Accounting

Public Accounting

If you have the mindset of a generalist, and you love to deal with financial planning and money-related decision-making, then you should consider becoming a public accountant. In simple terms, a public accountant provides a range of accounting services to different customers, who are usually companies, small businesses, and individuals. A public accountant can be a full-time employee in a company or someone who is running an own business. There are also freelance accountants in this field. The preliminary role of a public accountant is to ensure that a customer’s bookkeeping is accurate and meets the standards of the customers.

Management Accounting

The thing about public accountants is that they work with the person of their choice. Though, the similar case does not apply to management accounting. Management accountants are full-time employees who work for and within specific companies. Their primary role is to make sure that the company’s records are accurate by creating and monitoring internal budgets, auditing the operations of specific segments of the company, and evaluating how the company performs financially after a given period.

Government Accounting

Although, it is based on assumption, but we can largely say that government accounting is perhaps the most popular forms of accounting in the world today. But being a government accountant means working in a single office and sometimes handling an entire department. In short, the government accountants have the responsibility of helping the administration to review tasks, audit individuals who are questionable, and carry out all related duties according to the set rules and regulations for managing the process. There are many accountants working with the government. So, if being a government accountant is an area where you can fulfil your accounting passion, you are more likely to benefit from this kind of an engagement.

Auditors

There are mainly two types of auditors. The first group is the internal auditors. These are accountants who are employed to work within the company. They conduct their duties according to the instructions provided to them. Usually, they do not handle any accounting details of an external source. Their sole focus is only their own company.

External auditors are those who can work with and for anyone. Some companies find it more convenient to hire external auditors to analyse and report their financial findings as opposed to hiring full-time employees.

Related Posts

-

FREE 7+ Contemporary Sales Statement Samples in PDF

-

FREE 7+ Sample Loan Estimate Forms in PDF | MS Word

-

FREE 8+ Sample Accounting Expense Forms in PDF | MS Word | MS Excel

-

FREE 5+ Accounting Transfer Forms in PDF

-

FREE 7+ Accounting Application Forms in PDF | Ms Word

-

FREE 9+ Request Accounting Forms in PDF | Ms Word | Excel

-

FREE 6+ Corporate Accounting Forms in PDF

-

FREE 7+ Claim Accounting Forms in PDF

-

FREE 11+ Accounting Request Forms in PDF | Excel | MS Word

-

FREE 6+ Credit Accounting Forms in PDF

-

FREE 7+ Accounting Registration Forms in PDF

-

FREE 8+ Change Accounting Forms in PDF

-

What are Accounting Forms? [ Purpose, How to Create, Includes, Importance ]

-

What are Financial Accounting Forms? [ Objective, How to, Benefits, Guidelines ]

-

FREE 5+ Health Accounting Forms in PDF | MS Word