When you are running a business, it is important that you keep track of where your cash are coming from and where they are going. You need to know if your business is profitable or not. And in doing so, a profit and loss statement is what you need. A profit and loss statement is usually made quarterly and annually using the balance sheet and the cash flow or income statement.

This article will help you prepare an income statement for your business and will help you to understand why you have to use statement form in keeping track of your business’ financial data.

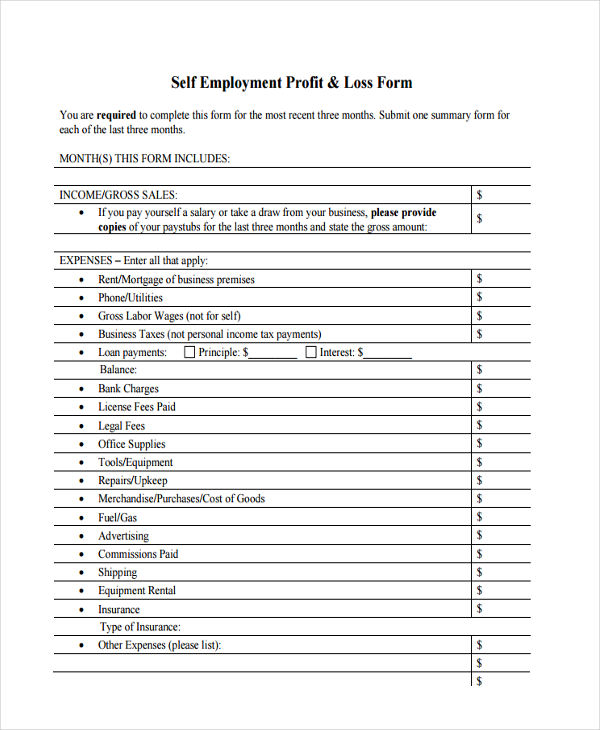

Self Employed Profit and Loss

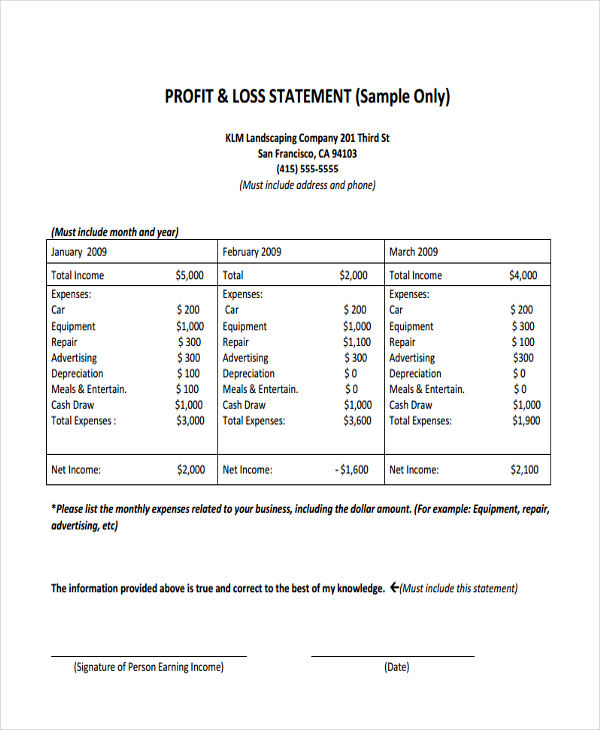

Monthly Profit and Loss Statement

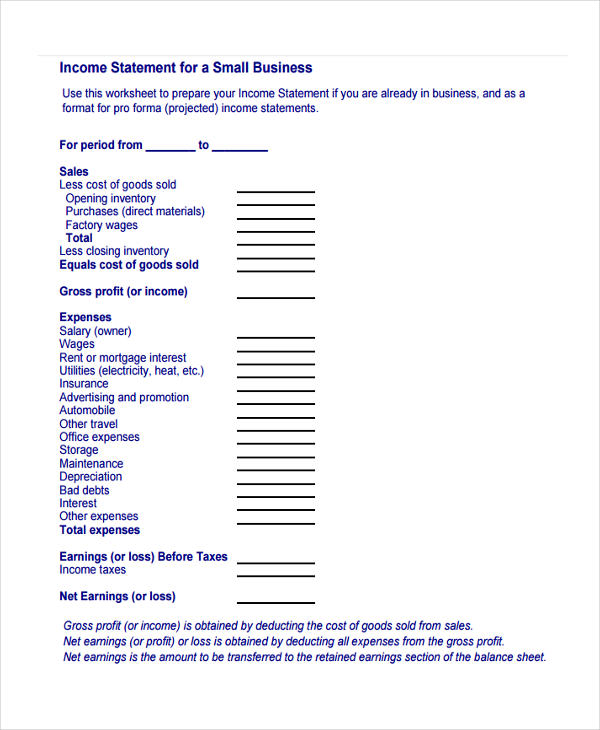

Small Business Profit and Loss

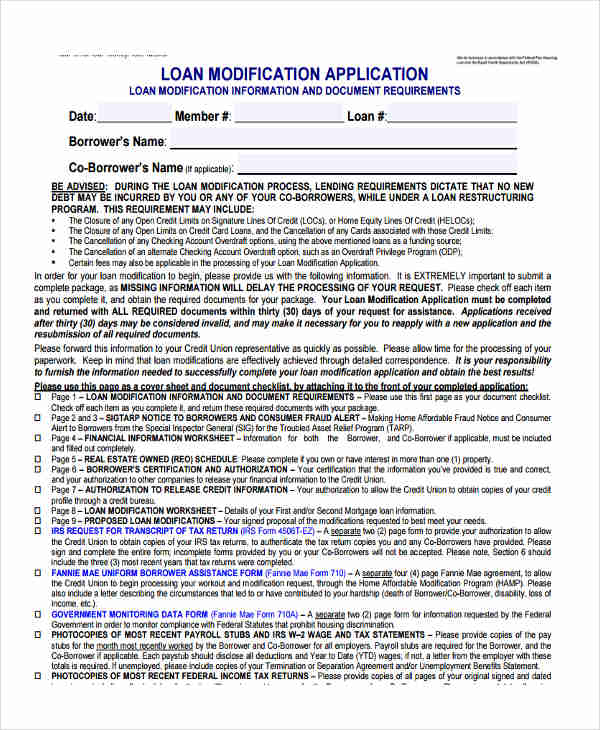

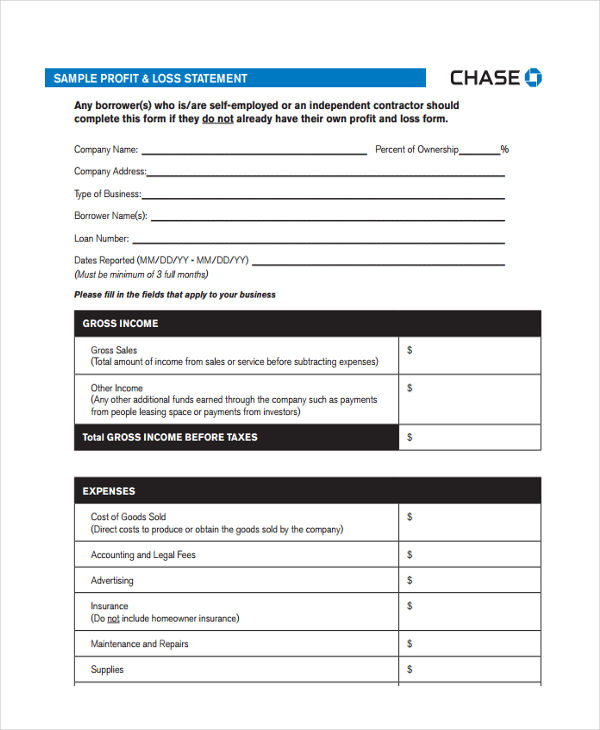

Loan Modification Profit and Loss

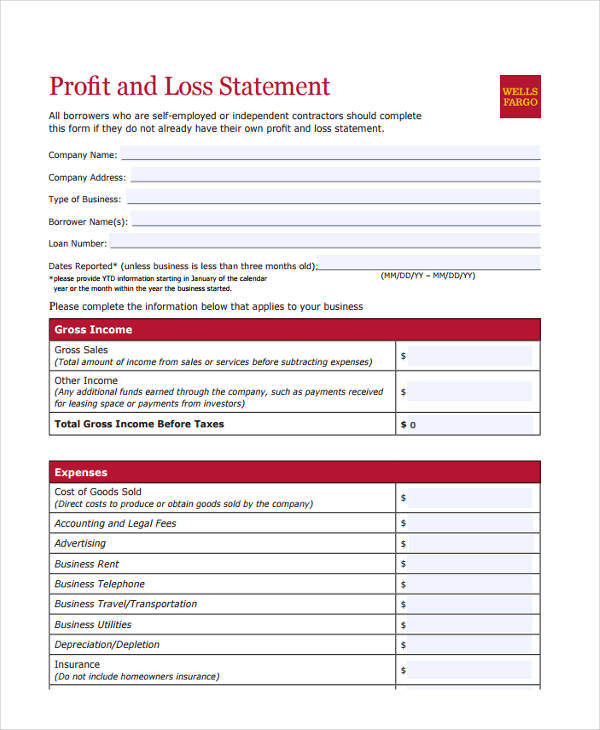

Mortgage Profit and Loss Statement

What Are The Benefits of Profit and Loss Statement Forms?

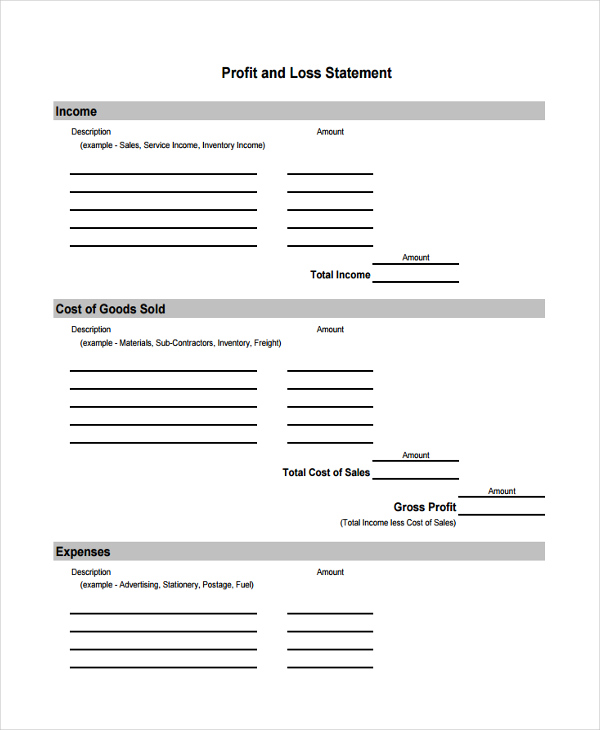

A profit and loss statement is used in order to keep track or monitor of the company’s profit and expenses within a specific period of time. The content of this statement is rendered of the two: the sales and the expenses. And below these two, there are categories that should be included.

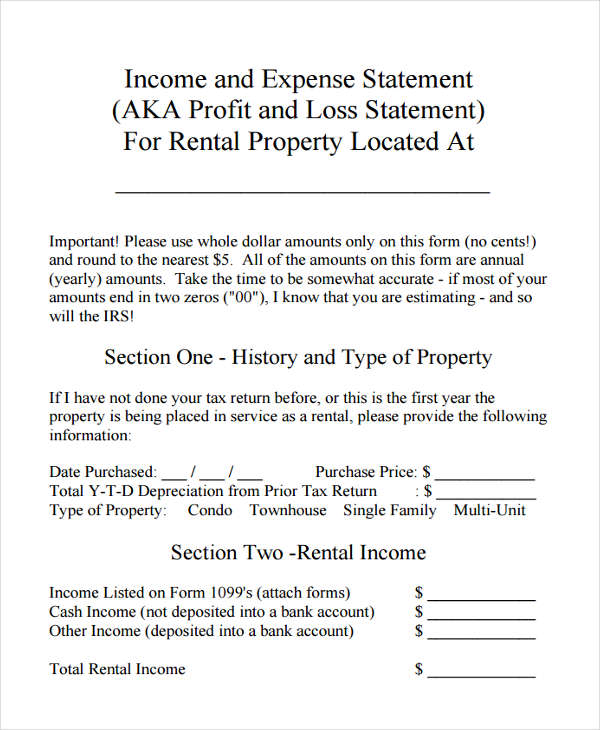

The categories used in constructing a profit and loss statement includes the net sales, gross margin, cost of goods sold, net profit, selling and operating expenses. The main benefit of having this statement is that you will be able to know the flow of cash into and out of your business.

The statement is best understood and specified with the use of the profit and loss statement forms. Using the forms makes it easier for you to document your financial statements and use them for reference in comparing the previous and current income and expenditures statement.

Who Can Use Profit and Loss Statement Forms?

A profit and lost statement is also known as income statement or earnings statement. Any company with different business structures such as corporation, self-employment or sole proprietorship, partnership, etc. can use this statement.

Because this will be able to help them compare the income with the cash flow by logging the revenues and expenses under the accrual method of accounting before cash changes hands. The elements in the income statements are often categorized into two: revenues/gains and expenses/losses.

Rental Property Profit and Loss

Sample Profit and Loss

Profit & Loss Statement Template

Tips on How to Read and Understand the Profit Loss

A profit and loss statement is written for two main reasons: (1) for the company to be aware if there are any necessary adjustments to be made in order to recoup losses and decrease expenses basing on the revenues and expenses, (2) the preparation of this statement is required by the Internal Revenue Services which records the operation of the business that are used to assess taxes on profits earned.

A profit and loss statement is written in order, starting with the summary of the business’ revenue followed by the details of the costs and expenditures, and the net profit (bottom line of the company). With this order, it is made easier for the company especially the accountants to read and understand the statement.

The elements or categories that are found in a profit and loss statement are the following: revenue, direct costs, gross margin, operating expenses, operating income, interest, depreciation and amortization, taxes, and net profit. The statement is best understood if you understand well these elements that are found in your statement.

A profit and loss statement is one of the financial statement where all financial data of the business are documented, tracked, and monitored regularly. This article shows different samples of statement forms, these are given to you for free and for your reference in tracking the cash flow in your company.

Related Posts

-

Billing Statement Form

-

FREE 14+ Tax Statement Forms in PDF | MS Word

-

Closing Statement Form

-

FREE 13+ Operating Statement Forms in PDF | MS Word

-

Instructions for Other Uses Statement Of Claimant [ What Is, Uses, Instructions ]

-

Creating a Sources and Uses of Funds Statement [ What Is, Steps, Sources and Uses ]

-

10 Tips for Writing a Personal Statement

-

Writing a Small Business Vision Statement [ What Is, How To, Steps ]

-

FREE 10+ Sample Disclosure Statement Forms in MS Word | PDF

-

FREE 7+ Business Statement Forms in MS Word | PDF

-

What is a Contingent Statement? [ Importance, Components ]

-

FREE 12+ Sample Medical Statement Forms in PDF | MS Word

-

FREE 8+ Voluntary Statement Forms in MS Word | PDF

-

What are Financial Statement Forms? [ How to, Include, Functions, Importance ]

-

FREE 9+ Sworn Statement Forms in PDF | Ms Word | Excel