Entering into a business transaction and an agreement is not often risky especially if financial decisions are involved. With this, it is important to keep documents and all relative forms to prove that an agreement indeed occurred between the parties. If a new transaction is made, then it is up to the legal representatives or the parties themselves to create a contract that will have their interests and intentions lined up. In the case of securing loans and backups, guaranty agreement contract forms are the exact documents to be constructed and signed by a guarantor, a contractor, and a representative of the lending and service providing company.

- Contract Agreement Form Templates

- Contract Forms in PDF

Guaranty Agreement Contract Form

What is a Guaranty Agreement Contract Form?

A guaranty agreement contract form is a document that is used for laying out the obligations and the promises of the parties involved in a project or a business transaction. The form must be signed and dated by the parties, namely the guarantor and the owner. One of the significance of having this contract form is due to the need for an organization or company to have an assurance that a client will provide a payment within the period stated on the form.

On the side of the client, a guaranty agreement contract form also ensures that the promised service and product quality will be delivered to him without delay and with its full capacity. In conclusion, a guaranty agreement contract form is important to both parties involved and promotes an effective and legal communication path for having a balanced transaction throughout the contract’s completion period.

Bank Loan Guaranty Agreement Form

Varieties of Guaranty Agreement Contract Forms

Guarantying that an obligation will be fulfilled must be conducted in writing to legalize and document the statements of the guarantor. With this, different guaranty agreement contract forms are being created to aid organizations and companies towards dealing with clients and fulfilling projects that are requested. Commonly, guaranty agreement contract forms are used by lenders and landlords. Bank loan guaranty agreement forms are provided to a guarantor of a loan or a mortgage wherein the guarantor must agree on his responsibilities towards paying the unpaid debts of the borrower to complete the loan.

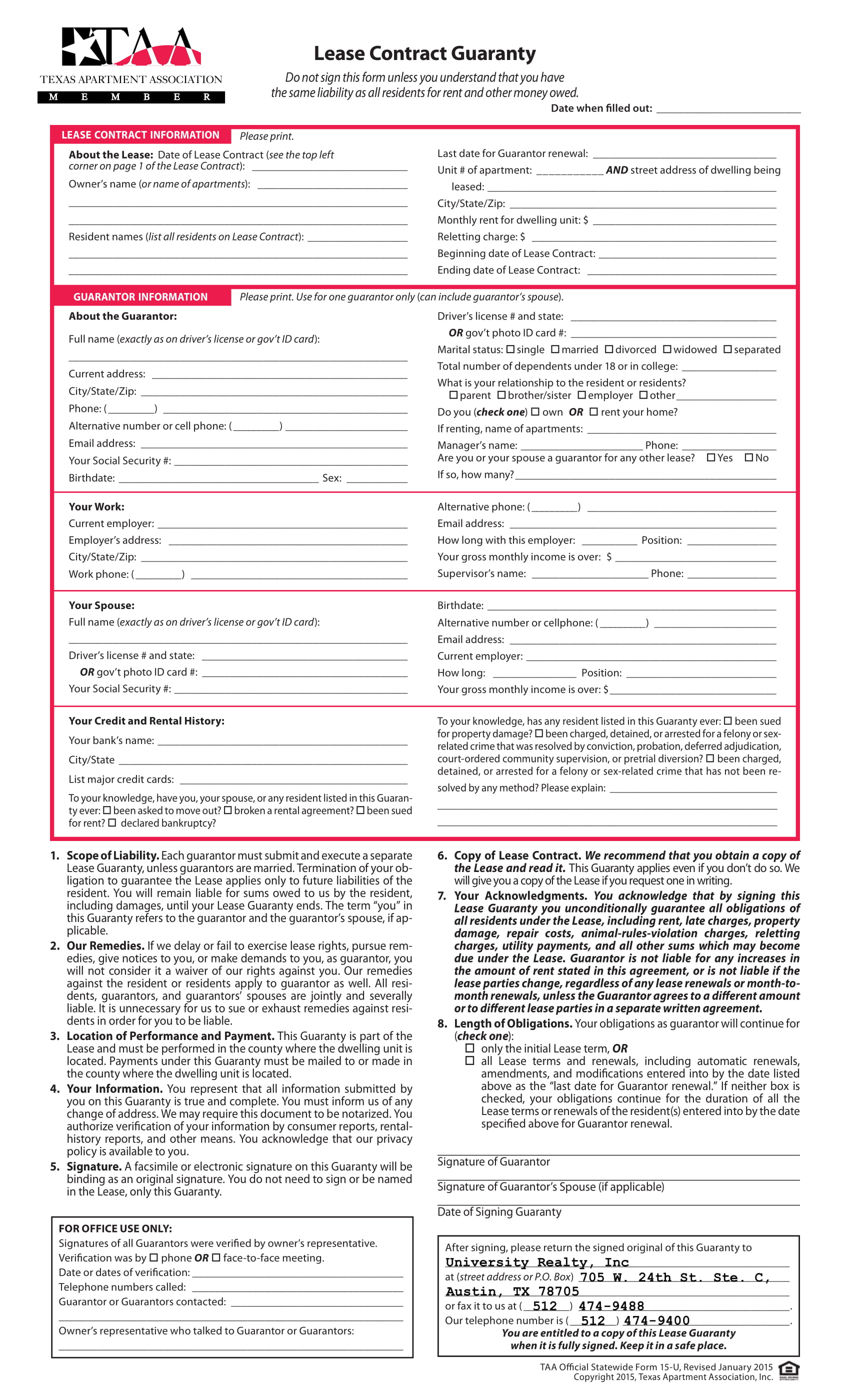

Another is a lease contract guaranty form which is used for the same reasons to that of a bank loan agreement; however, it is to be completed and signed by a guarantor who agrees with his rental obligations if a tenant fails to give the payment of a lease within a specified period.

Performance Guarantee Agreement Form

A performance guarantee agreement form, on the other hand, is also used by banks as well as insurance companies for their clients who deal with contractors for planning and constructing a project. This agreement contract is to assure that the client will be protected with his finances in the event that the contractor will fail to perform for the project. Significantly, the contract is also duplicated by the insurance company and bank for their documentation and to have a record of the contract’s length of execution. If the contractor will indeed fail to perform his duties and responsibilities, then the client will have to hire an alternate contractor to ensure the project’s completion. You may also see commission agreement contract forms.

Personal Guaranty Agreement Form

Tips to Have a Business Owner Sign a Personal Guaranty Contract

When signing legal agreements and contracts, both parties aim to ensure that they are well protected by the laws governing the contract and that they will be able to obtain benefits or advantages from agreeing on the contract’s terms. However, having a corporate representative or a company owner sign a personal guaranty contract can be quite troublesome since owners know that he must protect his company and business. With this, the following tips should be considered by any loan provider or entity when requesting for a signature from a company owner in order to approve a loan request from his relative or other individuals who named him as a possible guarantor:

1. Be Honest with the Purpose of the Contract

The act of honesty must also be accompanied by being concise and direct since business owners have a lot of scheduled meetings and agenda for their day which can be conflicted by needing the time to understand a contract by himself. This is why, as the authorized individual who will be asking for the owner’s signature, you must read the contract, summarize, and inform him about the terms stated along with the conditions and other clauses. Other relevant legal forms can also be enclosed such as the written statement and the claims of the borrower or the other party who chose the business owner to be his guarantor.

2. Provide Options for the Guarantor

The most common options include either he can sign as an individual guarantor or as someone who is under a joint personal guaranty. These options will allow the business owner to determine what choice will be better for the safety and the security of his business and his personal financial accounts in an unlikely event that a default will be conducted. Being in a joint personal guaranty will also lessen the responsibilities and the risks that the guarantor will be facing since the unpaid fees will be divided by the other parties involved in the contract.

3. Discuss the Risks with the Guarantor

Regardless of the choices that he makes of whether he will be an individual or a joint guarantor, the risks should be enlisted along with the remedies for each risk. This will promote a better understanding and a sense of ease for the guarantor since he will be prepared with whatever will occur within the period of guaranty status. Also, negotiations must be opened in order to acknowledge the ideas and the suggestions of the guarantor, which can provide a benefit for him and the company. You may also see sample contract forms.

Lease Contract Guaranty Form

Sections Found in a Lease Contract Guaranty Form

Creating a lease contract guaranty form is easy since this document focuses on the basic details of the guarantor. Nonetheless, the sections listed below must always be present in a lease contract guaranty form to assure that the purpose of using the document is met:

1. Lease Contract Information – This is where the guarantor or the user of the form will be able to disclose the details of the lease including the date on which the lease contract was signed by the tenant, the name of the property’s owner or the landlord, as well as the names of the residents or tenants of the lease. In addition to the data that will be collected regarding the lease, the guarantor can also indicate the date of when he was renewed as a lease guarantor alongside the rental price and the location of the property being leased out to the tenant. You may also see contract form templates.

2. Guarantor Information – This section must be composed of four subsections or categories allotted for the general information of the guarantor, the guarantor’s work history, spousal details, and his credit and rental histories. The general information section will gather the full name of the guarantor based on his driver’s license or any legal document, his residential address and phone numbers, his social security number and status, and the total number of dependents that the guarantor has under his liability and insurances.

The work history information section is for acquiring the name of the guarantor’s employer, their company address, his job position, number of years that he has been employed, and his gross monthly income along with the name of his supervisor. If a guarantor has a single marital status, then the spousal information section must be filled with “NA” or must be left blank while informing and proving to the landlord that he had not been married or have been divorced previously. You may also see sample free contract forms.

With regards to the credit and rental histories section of the contract, the guarantor will have to provide details of his credit card accounts such as the bank name where he is a registered account holder, and the list of his major credit cards. Other inclusions in this section are questionnaires that are intended to determine whether the guarantor had been sued due to property damage from his previous landlords as well as a felony or any crime during the period of his own tenancy.

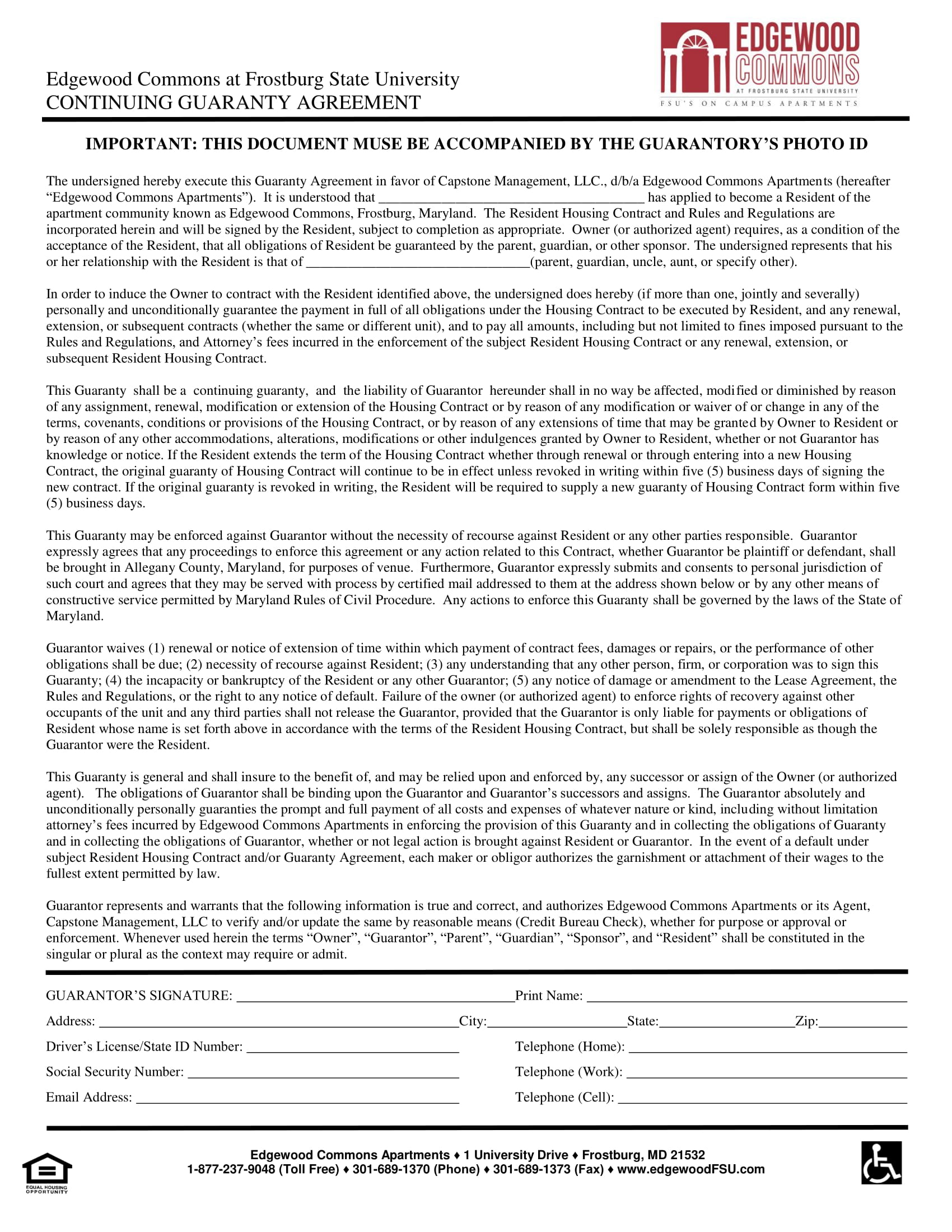

Continuing Guaranty Agreement Form

3. Terms and conditions – This section enlists the contract’s scope of liability, remedies for issues and concerns, payment and contract duplication, as well as the length of obligations for both parties. Upon agreeing to the terms, the guarantor must affix his signature on the provided area along with his spouse’s if he is married and the date on which the form is completed. You may also see sample contract agreement forms.

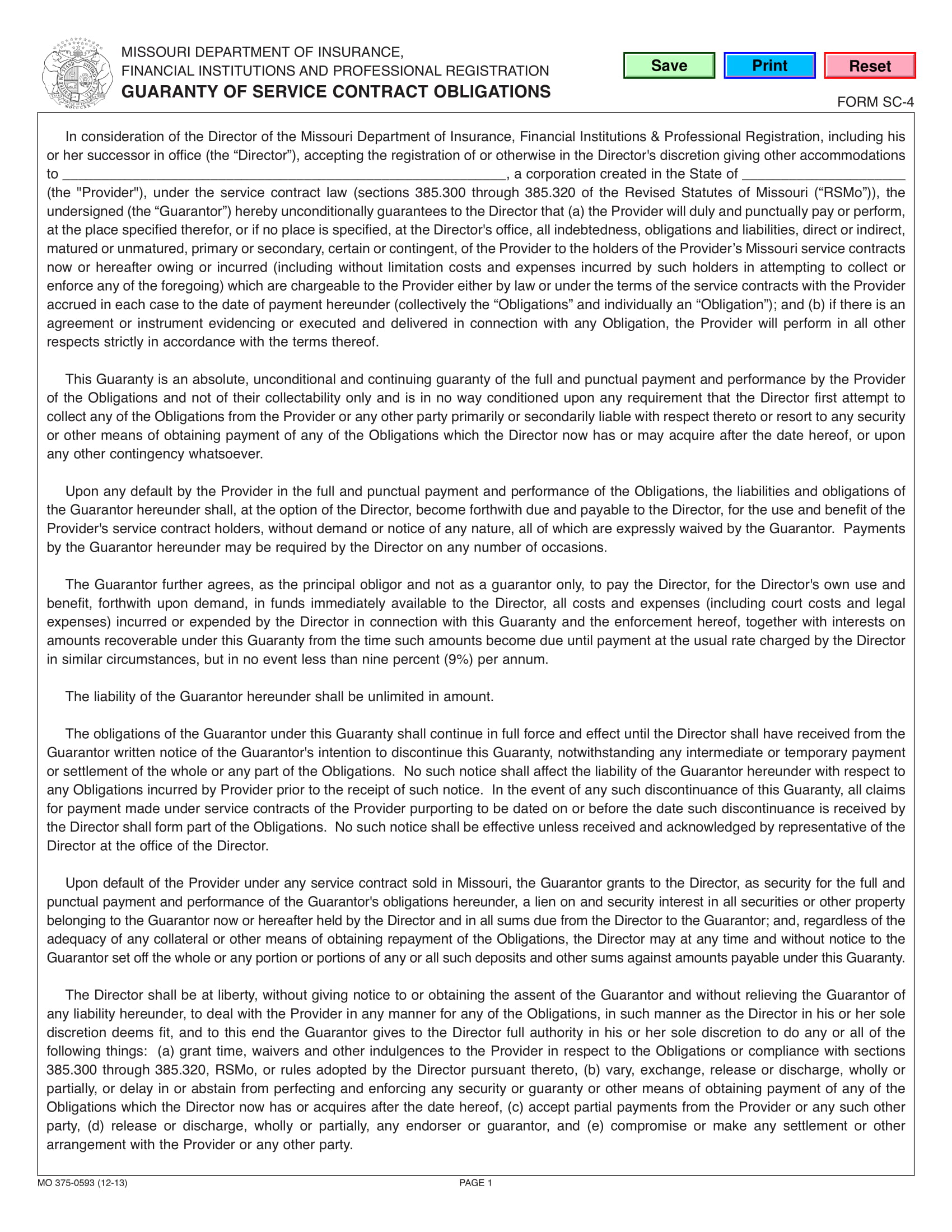

Guaranty of Service Contract Obligations Form

Aside from the three aforementioned sections, a lease contract guaranty form must also have areas that will indicate whether the guarantor has been invited to a face-to-face meeting with the landlord or any authorized person for the completion of the contract form or if the document was filled out through asking questions on the phone. The return address for the contract is also necessary if the document is sent by the landlord to acquire the guarantor’s date and information. You may also see sample financial contract forms.

Related Posts

-

FREE 5+ Merger Agreement Contract Forms in PDF | MS Word

-

FREE 3+ Limited Partnership Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Medical Release Agreement Contract Forms in PDF

-

FREE 5+ Office Lease Agreement Contract Forms in PDF

-

FREE 6+ Pledge Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Medicaid Agreement Contract Forms in PDF

-

FREE 8+ Non-Competition Agreement Contract Forms in PDF | MS Word

-

FREE 4+ Limited Liability Agreement Contract Forms in PDF | MS Word

-

Indemnity Agreement Form

-

FREE 3+ Sale of Goods Agreement Contract Forms in PDF | MS Word

-

FREE 5+ Home Sales Agreement Contract Forms in PDF | MS Word

-

FREE 10+ Easement Agreement Contract Forms in PDF

-

Contract Termination Letter

-

FREE 5+ Joint Venture Contract Forms in PDF | MS Word

-

FREE 8+ Consulting Contract Forms in PDF | MS Word