There are a lot of areas in which a questionnaire serves a helpful purpose, such as doing a Customer Service Survey, or granting the statistics for a country’s population census annually. Using questionnaires allow the surveyors to conduct an unbiased decision and result which were given by the respondents.

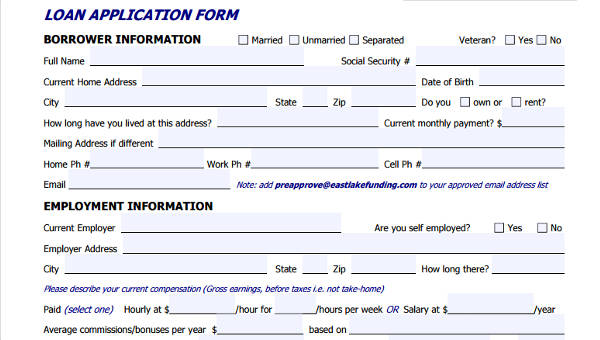

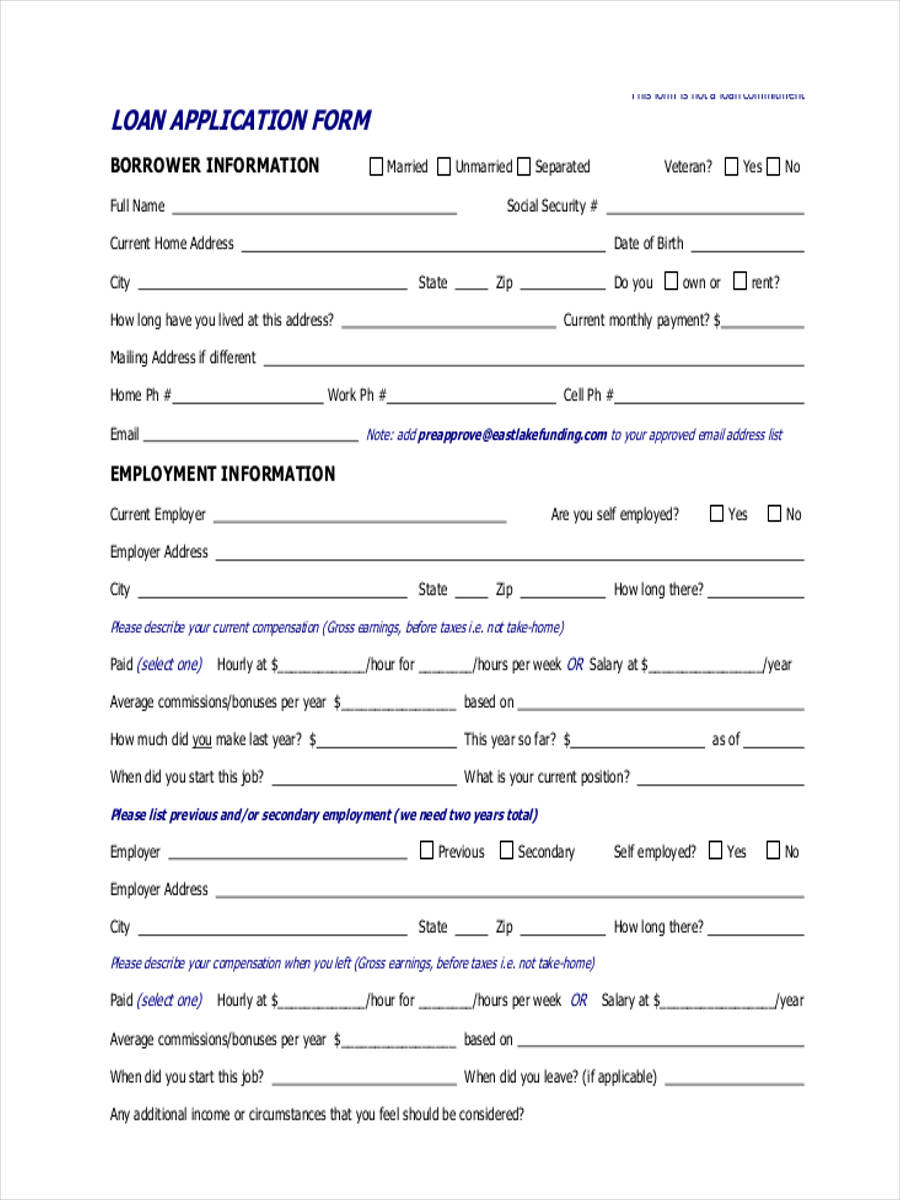

Questionnaires in research methods allow a quick and efficient collection of data and information. This is useful for those professionals who deal with helping clients make a decision in the fields of investing, applying for a loan, and even in selling a property.

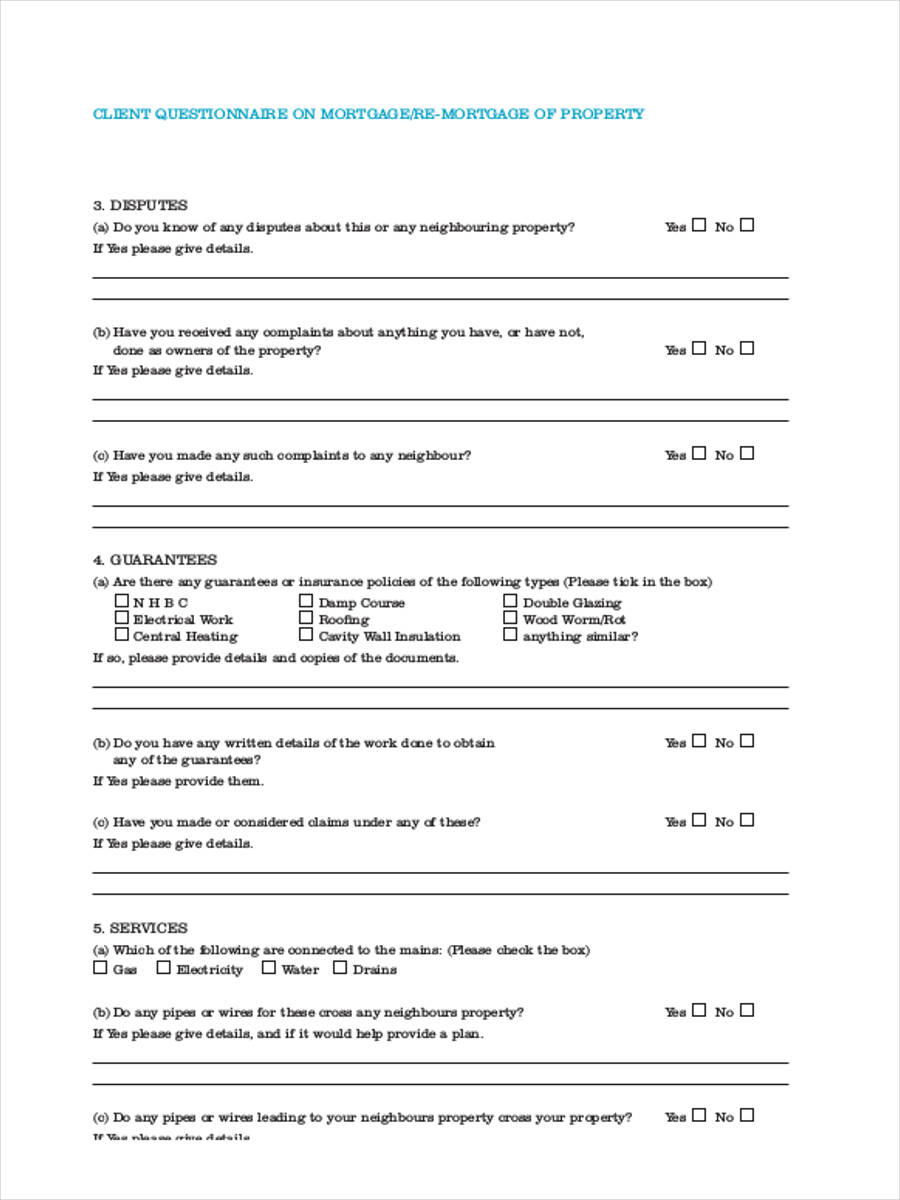

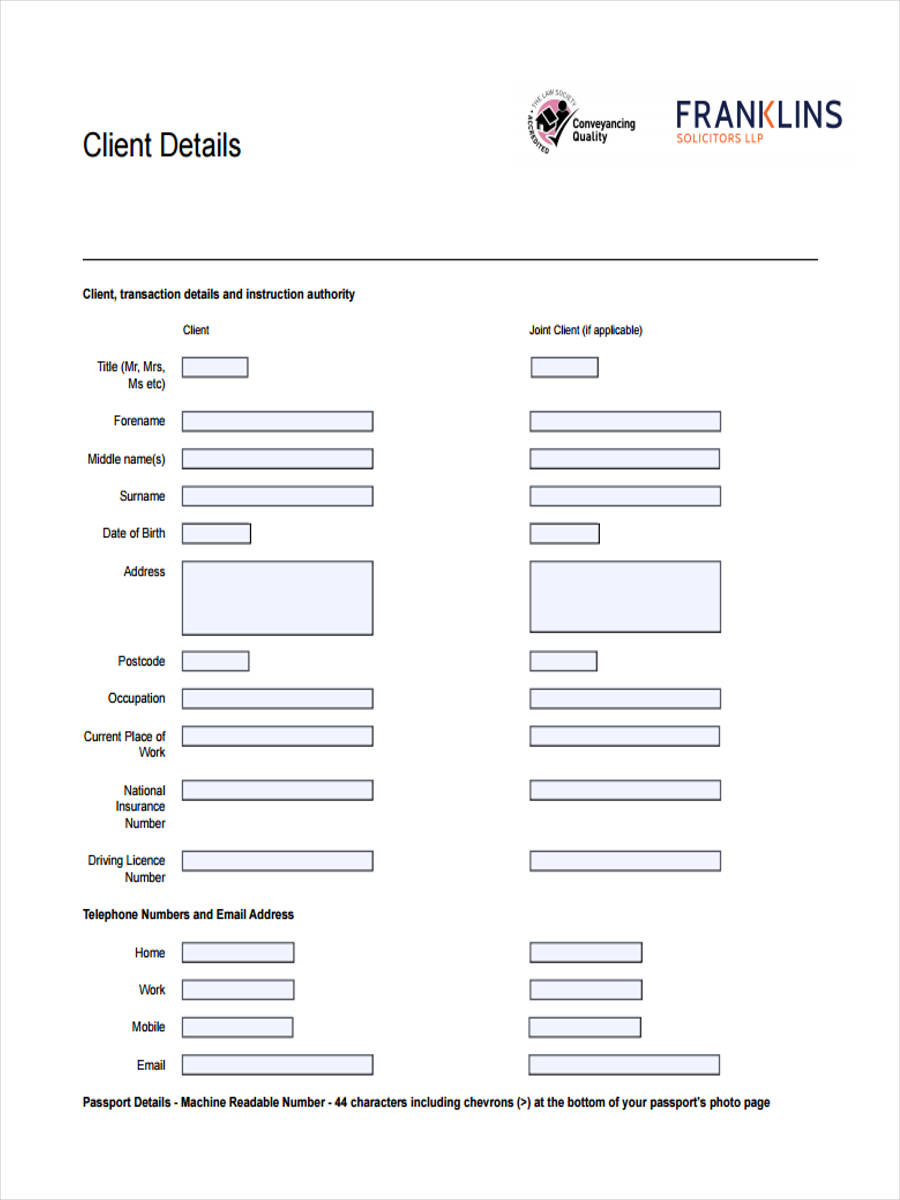

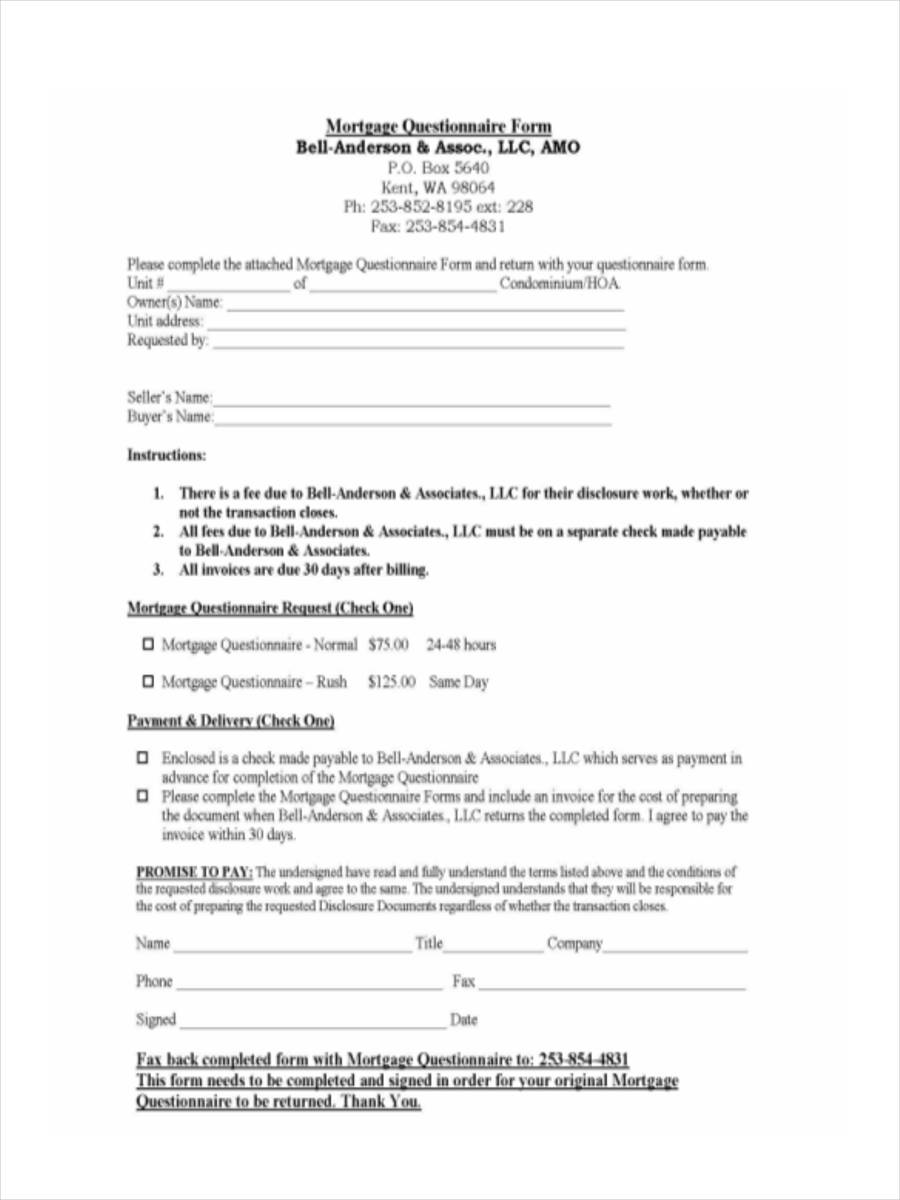

Client Mortgage Questionnaire

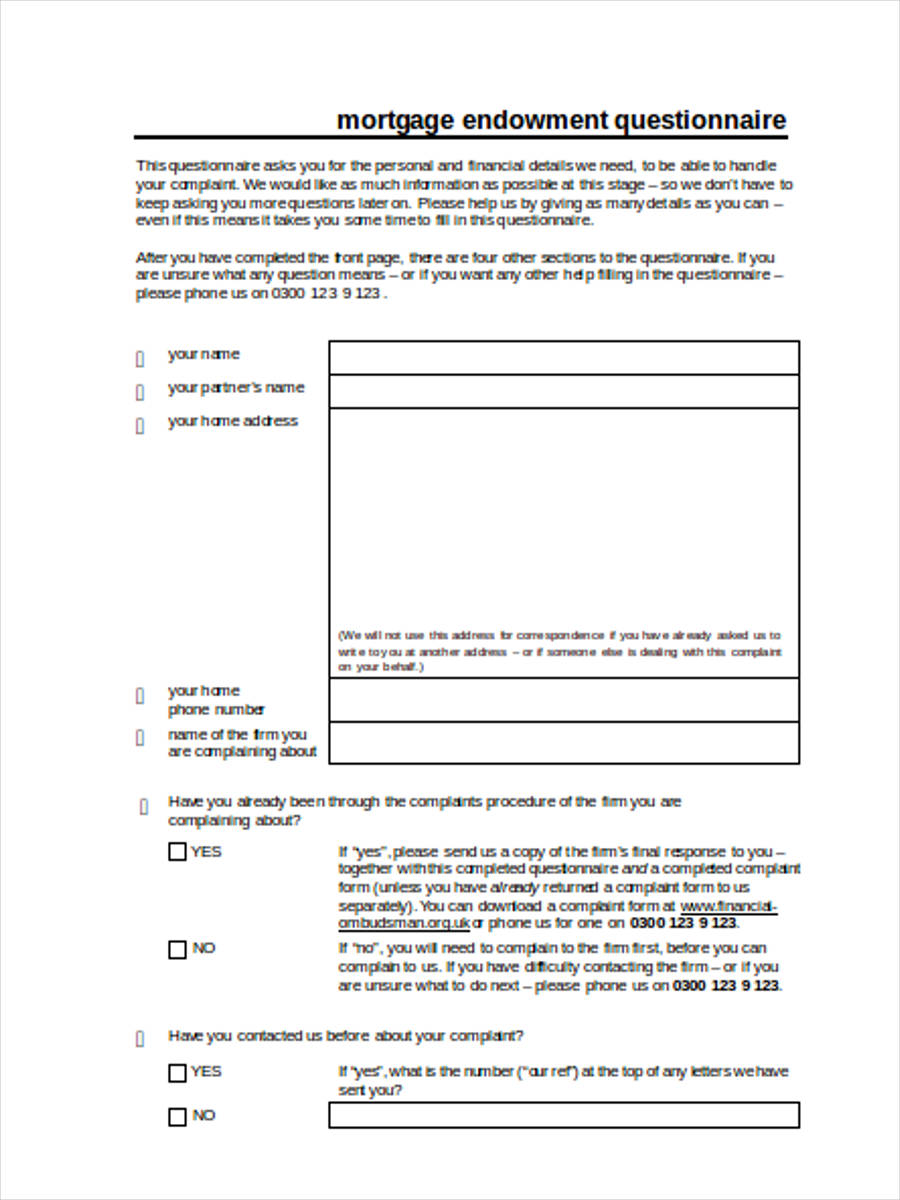

Mortgage Endowment

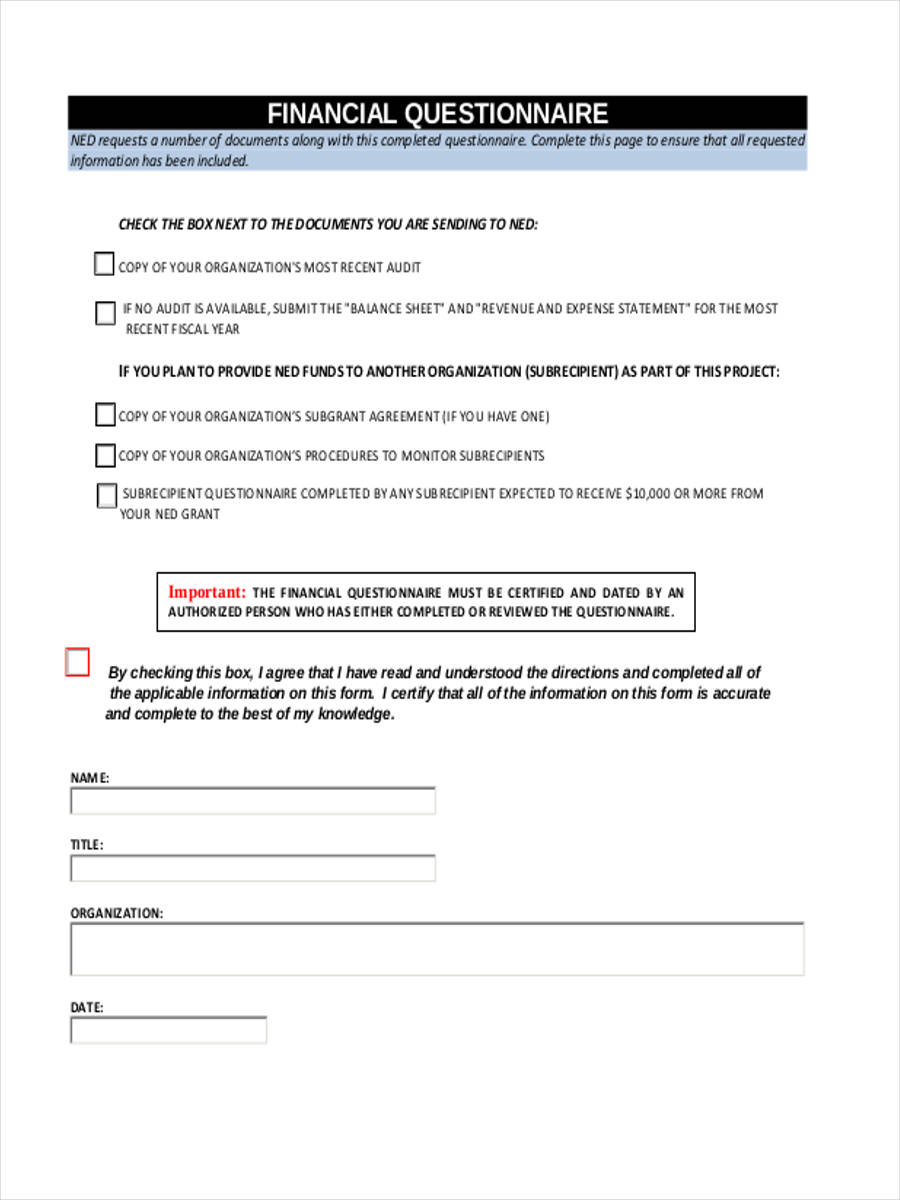

Financial Questionnaire Form

Re-mortgage Questionnaire

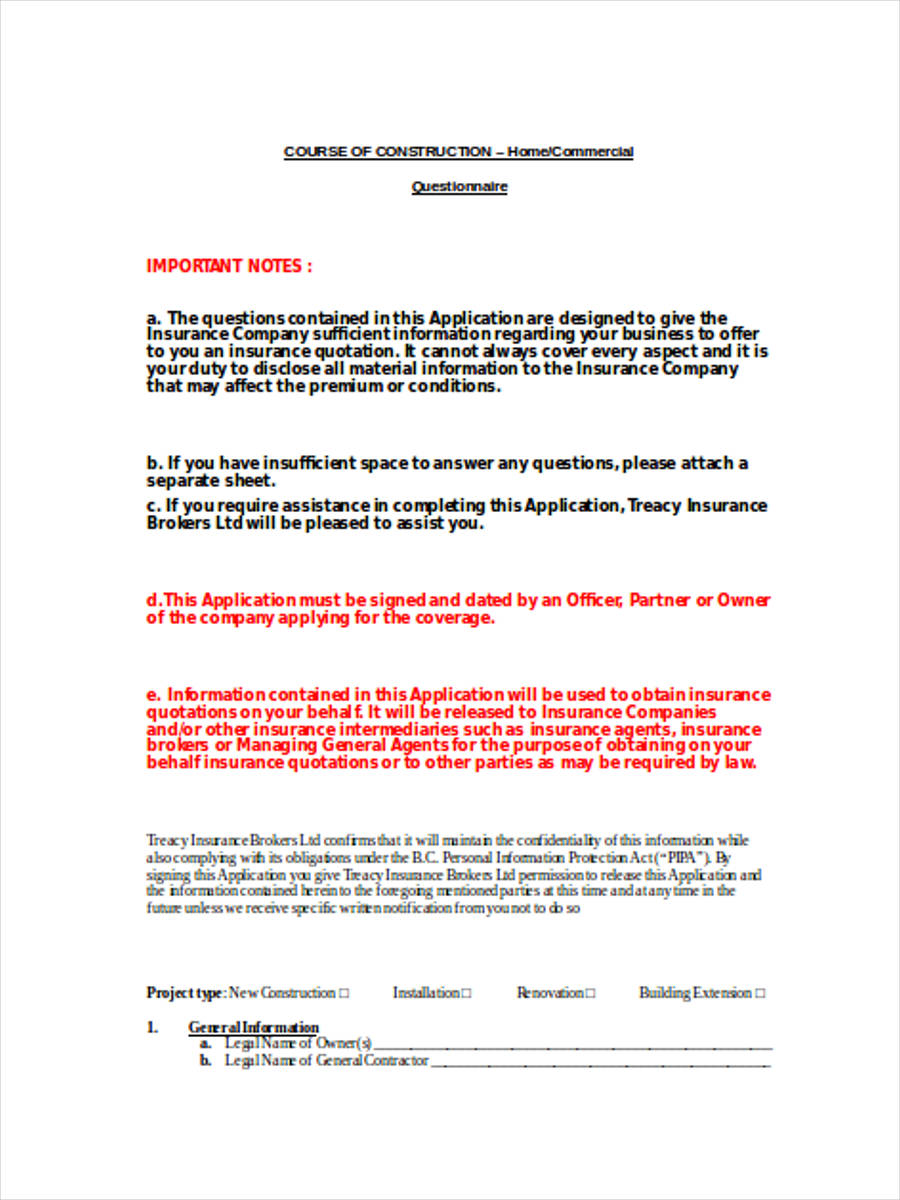

Commercial Mortgage Form

What is a Mortgage Questionnaire?

A Mortgage Questionnaire is a document which consists of questions for the applicant who plans on financing a home. By honestly answering the questions, the applicant will know the type of financing strategy he needs, the kind of house he can afford and the goals in which he will be required to set. A construction of analysis will be done by the mortgage lender after the applicant will finish supplying answers on the form.

The services provided by the mortgage company will be rated by their clients at the end of every consultation session with the use of a Client Satisfaction Questionnaire Form. The ratings will be documented to aid the company to know which areas in their services require further improvement.

What is the Lowest Mortgage Rate?

The mortgage rate that an applicant pays will depend on his mortgage score. The lowest recorded mortgage rate currently has been 3% which is in the United States for the credit score of 760 and above. When an applicant has a high credit score, his interests and rates for his loan will be lower. The employment status of an applicant is also one of the criterion for determining his mortgage rate.

Some lenders also provide a separate sheet of questionnaires for acquiring the applicant’s financial status, which is often a Financial Questionnaire Form. This will contain questions regarding the income and savings of an applicant.

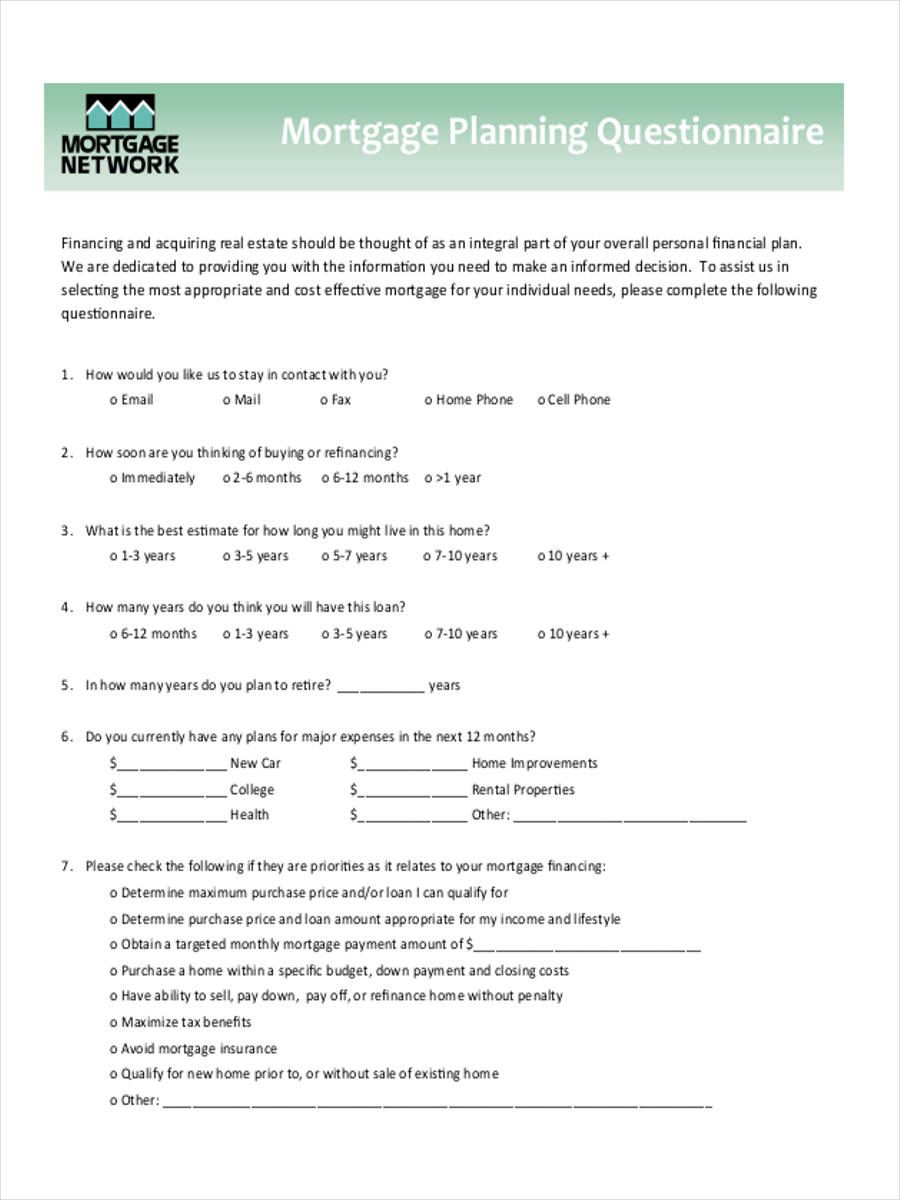

Mortgage Planning Questionnaire

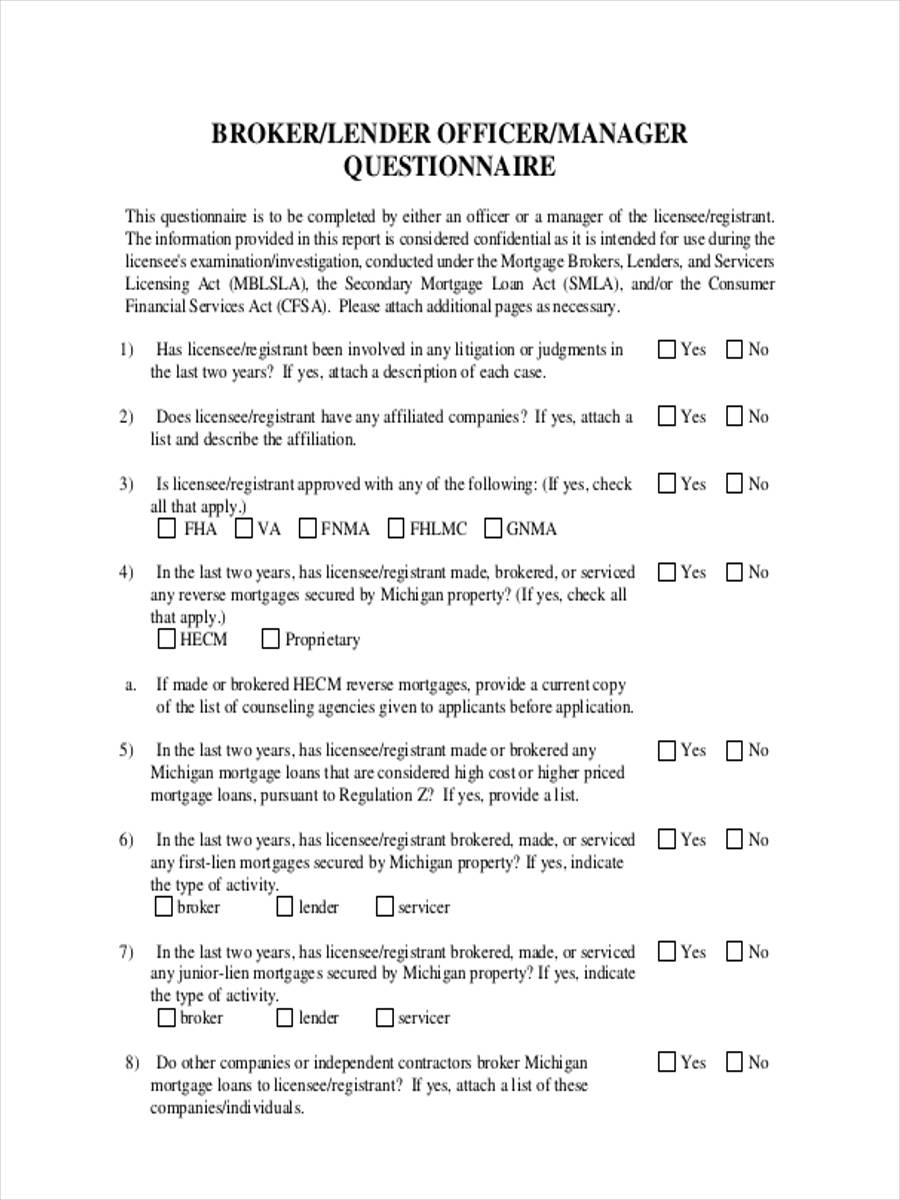

Mortgage Origination Examination

Sample Mortgage Questionnaire

Pre-Approval Questionnaire

Mortgage Questionnaire Guidelines

A Mortgage Questionnaire should:

- State the basic information of the mortgage loan applicant.

- Have the specified time period for repaying the mortgage.

- Indicate the future plans of the applicant with regards to his retirement and employment plans.

- Include the details about the applicant’s salary and state of occupation.

- Have questions regarding the applicant’s bills and debts.

- State the lifestyle of the applicant and how he manages his finances.

- Be simple in it’s outline and use a common language for all individual.

- Not discriminate the beliefs of an applicant.

- Ask for available physical documents as proof of a financial and loan statements.

Now, before you supply answers on an official mortgage questionnaire, might as well scan through the questions available on our Free Questionnaire Forms above so you will have an idea of what the specific areas that a mortgage lender will ask you. Also, the Sample Questionnaire Forms that we cater for you does not only focus on mortgages and finances, but also on health-related inquiries and even for gathering information about a prospective tenant.

Related Posts

-

FREE 8+ Sample Buyer Questionnaire Forms in PDF | MS Word

-

FREE 9+ Sample Will Questionnaire Forms in PDF | MS Word | Excel

-

FREE 8+ Sample Patient Health Questionnaire Forms in PDF | MS Word

-

FREE 9+ Sample Questionnaire Consent Forms in PDF | MS Word

-

FREE 11+ Sample Medical Questionnaire Forms in PDF | MS Word | Excel

-

FREE 12+ Sample Satisfaction Questionnaire Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Secret Santa Questionnaire Forms in PDF | MS Word

-

Demographic Questionnaire

-

Client Satisfaction Questionnaire Form

-

Financial Questionnaire Form

-

Food Frequency Questionnaire Form

-

Supplier Questionnaire Form

-

Questionnaire Form

-

Interview Questionnaire Form

-

Survey Questionnaire Form