People always need to take charge over how well they handle their money. If they’re want to live a life where property taxes, homeowners insurance, and social security aren’t a problem, then they best learn how to properly handle their finances.

And that’s why they have to properly assess just how well they’re doing financially. People and companies always need to know how much they’re making and where their money is going. If they don’t know how to assess it themselves, then there are professionals who can help them out.

These assessments have to be official for reasons, such as if a person needs a loan and the bank needs to find out about their current financial status. One of the things that can help them out is the use of Financial Assessment Forms.

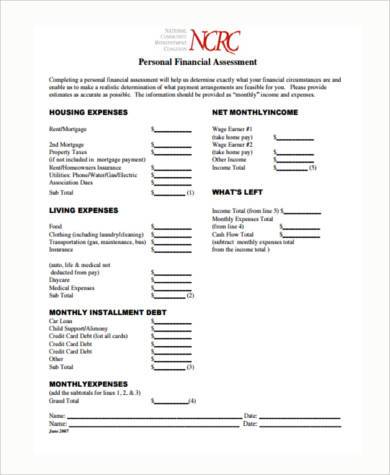

Personal Financial Assessment Form

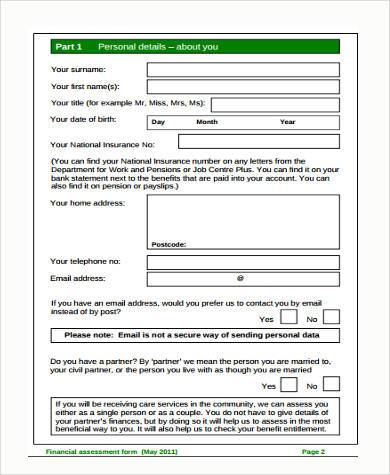

Free Financial Assessment Form

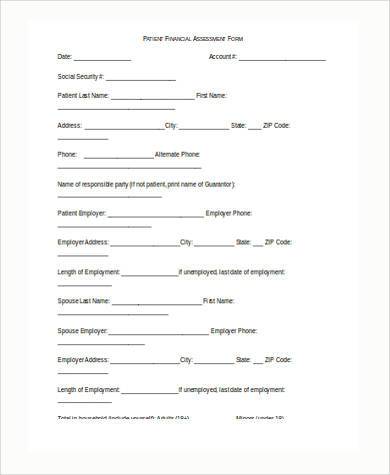

Patient Financial Assessment Form

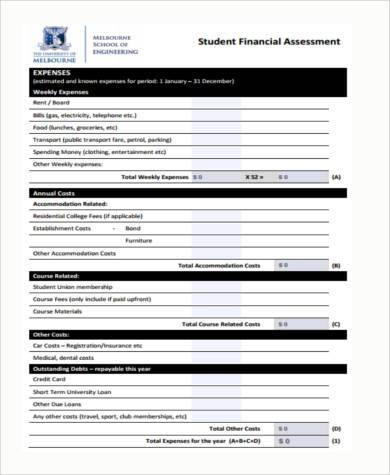

Student Financial Assessment Form

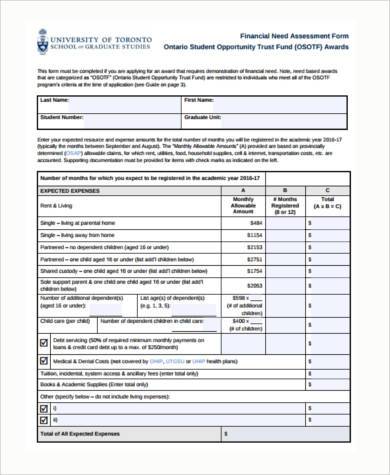

Financial Need Assessment Form

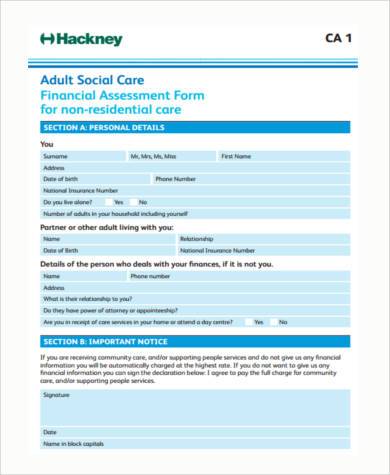

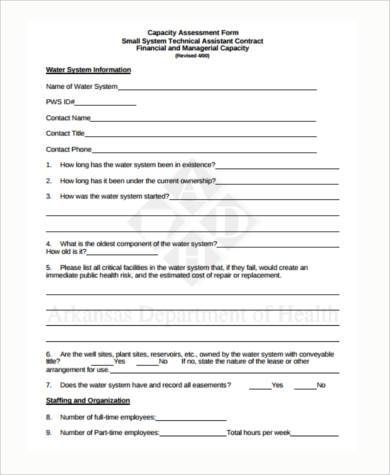

The Different Types of Financial Assessment Forms

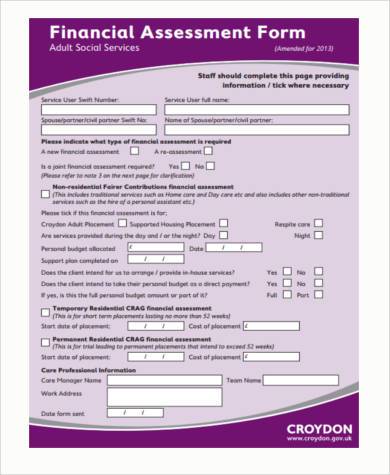

There are many varieties of these types of forms, such as Financial Property Assessment Forms, that just about any person or company can make use of to fully understand their financial situation or someone else’s. Here are some examples of these types of forms.

- Patient Financial Assessment Forms are the kind of forms that are used by hospitals to properly assess the financial situation of any one of their patients. This is used to see if they can afford any of the treatments that they require and for their stay at the establishment.

- Student Financial Assessment Forms are mainly used by schools to check on the financial status of any of their students and to see if they can continue paying for their education. If the school assesses that the student is no longer able to pay for his or her studies, then they may either help that student through the use of scholarships, or halt their education.

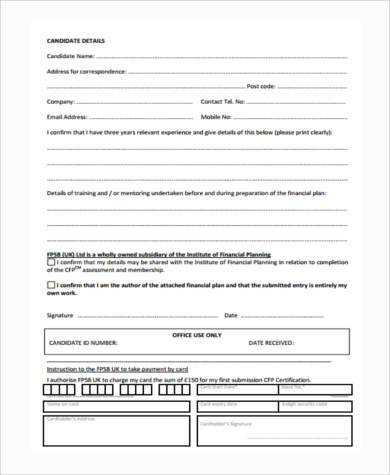

- Financial Planning Assessment Forms are for companies that wish to assess theirs or someone else’s financial planning and if it needs any changes or not. These forms are specifically used to check everything that that involves how they, or someone else, handles their finances. So that means checking on how much they make and their expenses over a period of time.

Individual Financial Assessment Form

Financial Assessment Form Example

Financial Fraud Risk Assessment Form

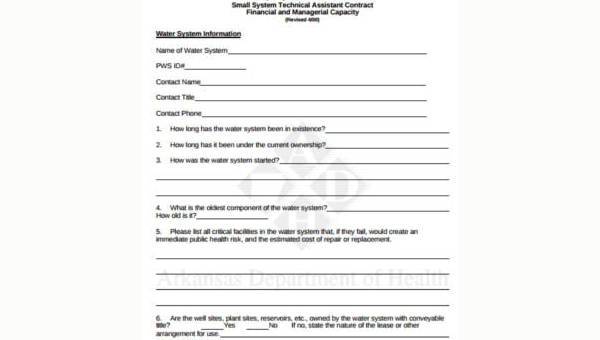

Financial Capacity Assessment Form

Financial Planning Assessment Form

Financial Assessment Form in PDF

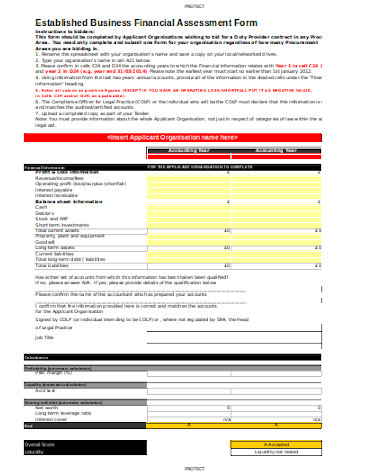

Business Financial Assessment Form

The Importance of Having Financial Assessment Forms

The reason for having forms such as Financial Self Assessment Forms is because people and businesses need to know how much they’re making, how much they’re spending, where their money is going, and why.

These forms can even help out those who are in a serious financial crisis. Say for example that a company is close to bankruptcy and needs to apply for a loan. The bank needs to check the status of the company and if they are indeed applicable for one. By having these forms, it can help out businesses to help guarantee that they still have a shot at financial success.

If it’s not for the sake of a business, then these forms can be used for personal matters. Because the everyday-man has to know what it is he’s making in a period of time and how he’s spending his money to ensure he maintains a healthy lifestyle. So in the event that you think you might be entering serious financial problems, then make sure you make good use of these forms.

Related Posts

-

How to Conduct a Risk Assessment? [ With Samples ]

-

FREE 4+ Sample Child Assessment Forms in MS Word | PDF

-

FREE 7+ Sample Health and Safety Risk Assessment Forms in PDF | MS Word

-

FREE 8+ Sample Supplier Assessment Forms in PDF | MS Word

-

FREE 7+ Sample Caries Risk Assessment Forms in PDF | MS Word

-

FREE 7+ Sample Management Risk Assessment Forms in PDF | MS Word

-

FREE 7+ Sample Infection Control Assessment Forms in PDF | MS Word

-

FREE 8+ Income Assessment Form Samples in PDF | MS Word

-

FREE 8+ Education Assessment Form Samples in PDF | MS Word

-

FREE 22+ Sample Self-Assessment Forms in PDF | MS Word | Excel

-

FREE 8+ Job Assessment Form Samples in PDF | MS Word

-

FREE 10+ Sample Vendor Assessment Forms in PDF | MS Word | Excel

-

Physical Therapy Assessment Form

-

FREE 11+ Assessment Forms for Teachers in PDF | Ms Word | Excel

-

FREE 10+ Nutrition Assessment Forms in PDF | Ms Word