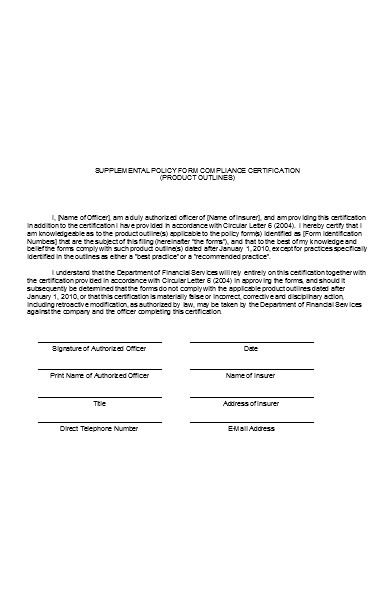

A Policy Form is a foundational document that outlines rules, guidelines, and procedures within an organization or institution. It serves as a crucial reference for decision-making and conduct, ensuring consistency and compliance. There are various types of policy forms, each tailored to specific needs, from company policies to government regulations. This comprehensive guide for printable forms explores the meaning, types, real-world examples, the art of creating effective policy forms, and essential tips for ensuring their clarity and effectiveness.

What is the Policy Form ? – Definition

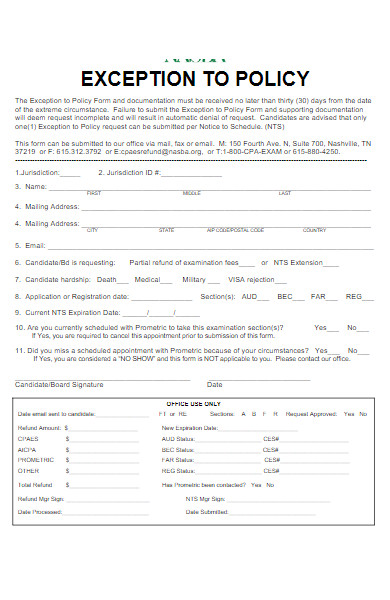

A Policy Form, in essence, is a documented set of guidelines and regulations created to outline specific rules, procedures, and standards within an organization or institution. It provides a comprehensive framework that defines how activities and decisions should be conducted to ensure consistency, compliance, and adherence to established norms and objectives. These fillable forms often serve as vital references for employees, members, or stakeholders to understand and follow the governing principles and expectations within the entity.

What is the Meaning of the Policy Form?

The meaning of a Policy Form lies in its role as a structured document that imparts clarity and direction within an organization or institution. It provides a precise definition of rules, procedures, and standards, ensuring that all stakeholders understand the expected behavior and compliance requirements. By detailing the how and why of decision-making and actions, a Policy Form plays a pivotal role in fostering consistency, mitigating risks, and achieving organizational objectives. It serves as a reference point for individuals to navigate and align their conduct with established guidelines and principles.

What is the Policy Sample Policy Form?

Creating a Sample Policy Form involves several steps to ensure it’s effective and comprehensive. Here’s a guide on how to develop such a document:

Step 1: Define the Purpose

- Begin by clearly defining the purpose of the policy. What aspect of your organization or institution does it address? Identify the specific issue or area it aims to regulate.

Step 2: Research and Gather Information

- Conduct research to gather information relevant to the policy’s subject matter. This may include industry standards, best practices, legal requirements, or internal data.

Step 3: Identify Key Stakeholders

- Determine the key stakeholders who will be impacted by or involved in the policy’s implementation. This may include employees, management, or regulatory bodies.

Step 4: Draft the Policy

- Begin drafting the policy by outlining the key sections, including the policy’s purpose, scope, responsibilities, procedures, and consequences for non-compliance.

Step 5: Define Clear and Measurable Objectives

- State clear and measurable objectives for the policy. What specific outcomes do you aim to achieve by implementing it?

Step 6: Establish Procedures and Guidelines

- Detail the procedures, guidelines, and steps that need to be followed to ensure compliance with the policy. Use clear language and provide examples where necessary.

Step 7: Specify Roles and Responsibilities

- Clearly define the roles and responsibilities of individuals or departments involved in the policy’s enforcement and oversight.

Step 8: Include Legal and Compliance Aspects

- If applicable, incorporate any legal requirements or compliance elements related to the policy. Ensure that the policy aligns with relevant laws and regulations.

Step 9: Review and Edit

- Review the draft policy thoroughly for clarity, consistency, and accuracy. Edit for language, grammar, and formatting.

Step 10: Seek Feedback

- Share the draft policy with key stakeholders and seek their input and feedback. Consider their suggestions for improvements.

Step 11: Approval and Adoption

- Present the final draft to the appropriate authority for approval and adoption. This may involve senior management or a governing body.

Step 12: Communicate the Policy

- Communicate the policy to all relevant stakeholders within your organization or institution. Ensure they understand its contents and implications.

Step 13: Training and Implementation

- Provide training and support to employees or members to ensure they can effectively implement and adhere to the policy.

Step 14: Monitoring and Enforcement

- Establish a system for monitoring and enforcing policy compliance. Define consequences for non-compliance and a reporting mechanism for violations.

Step 15: Regular Review and Updates

- Periodically review and update the policy to ensure it remains relevant and aligned with changing needs, regulations, and best practices.

By following these steps, you can create a Policy Sample Policy Form that effectively addresses a specific issue or area within your organization or institution. It serves as a valuable tool for maintaining clarity, consistency, and compliance. You also browse our Insurance Forms.

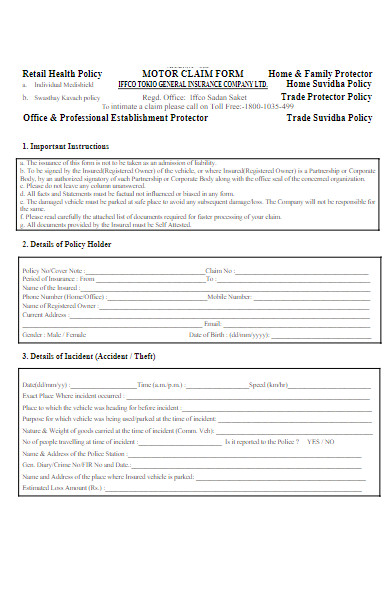

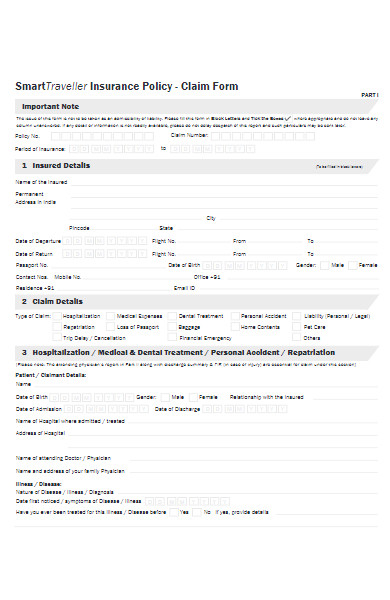

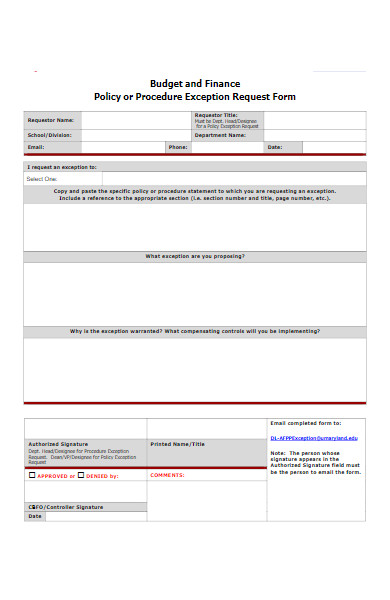

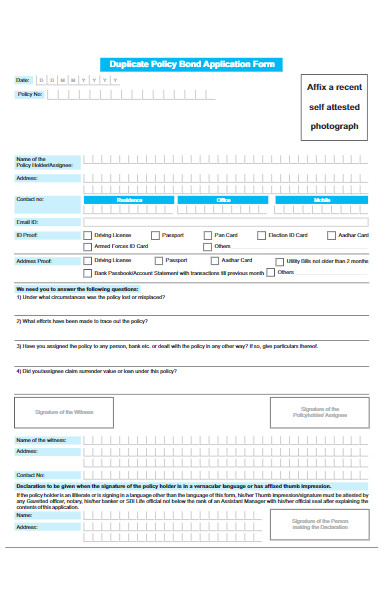

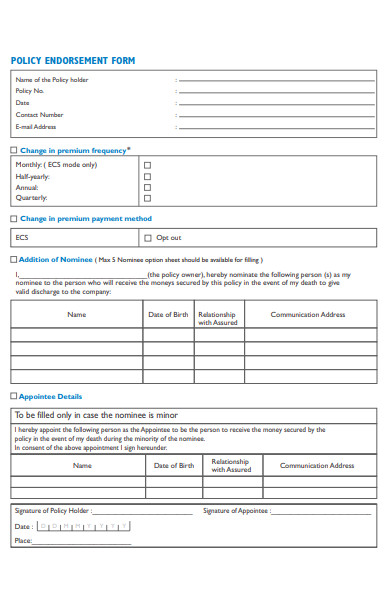

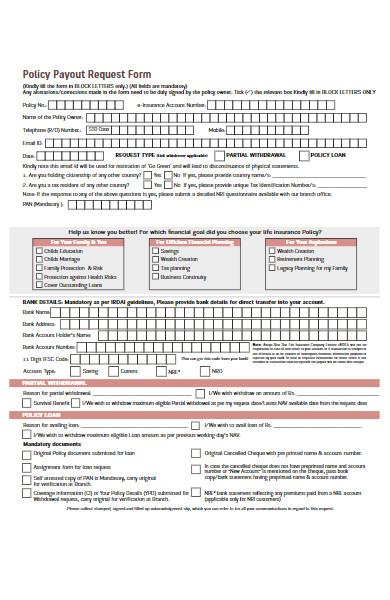

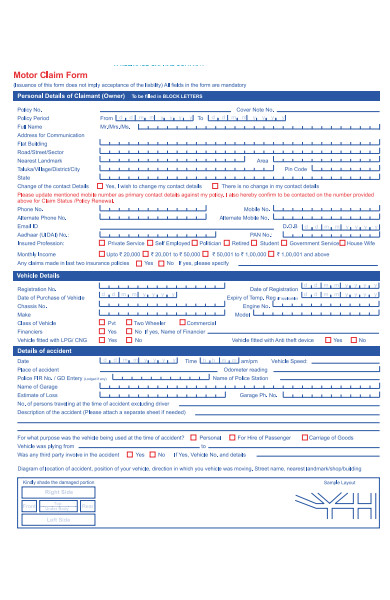

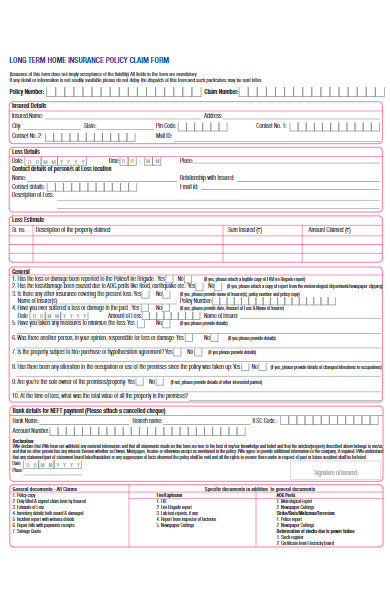

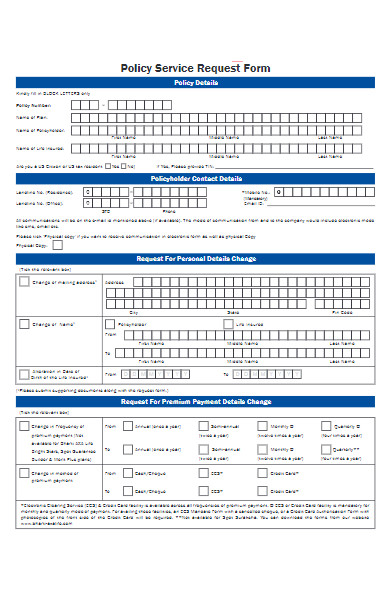

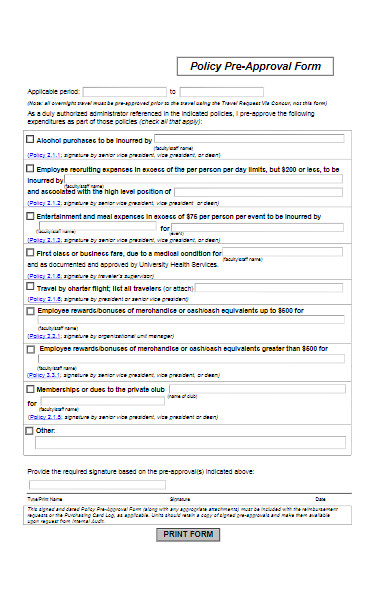

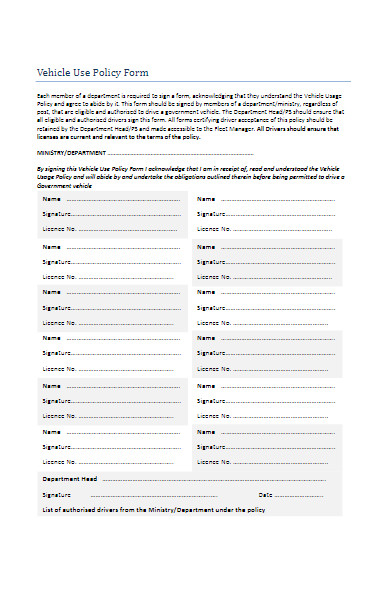

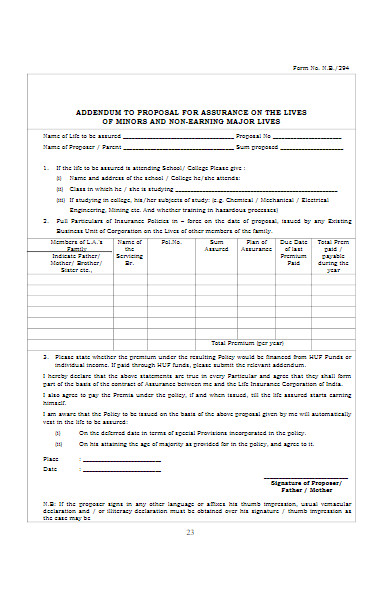

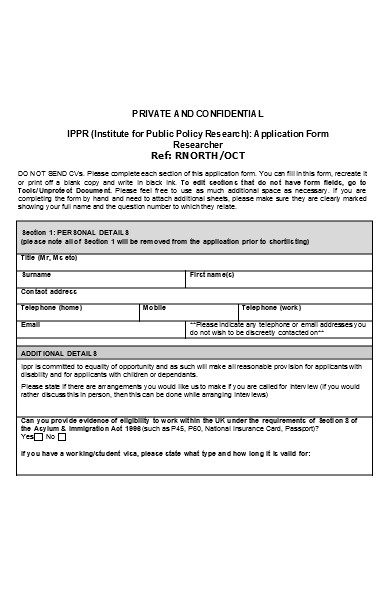

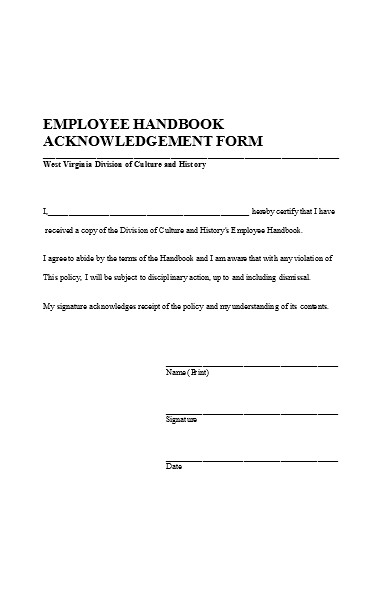

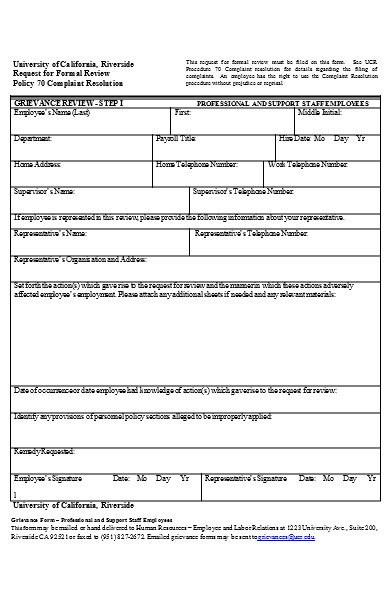

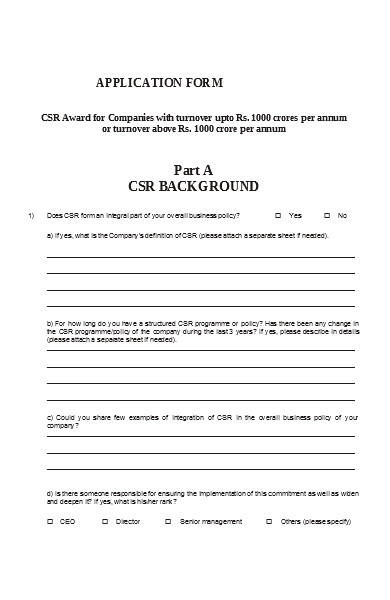

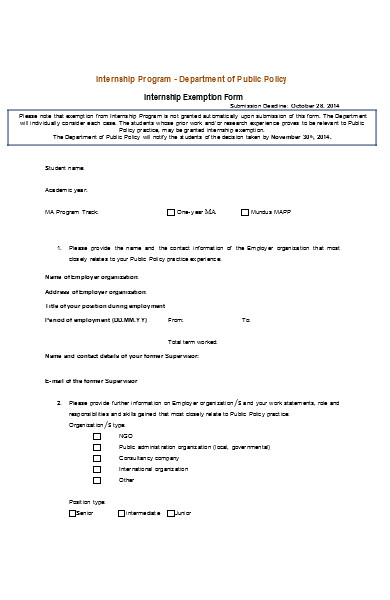

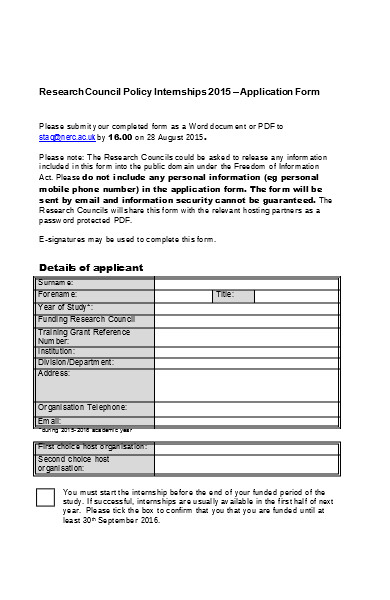

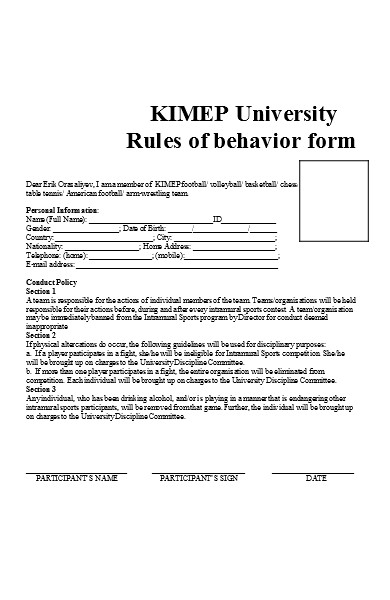

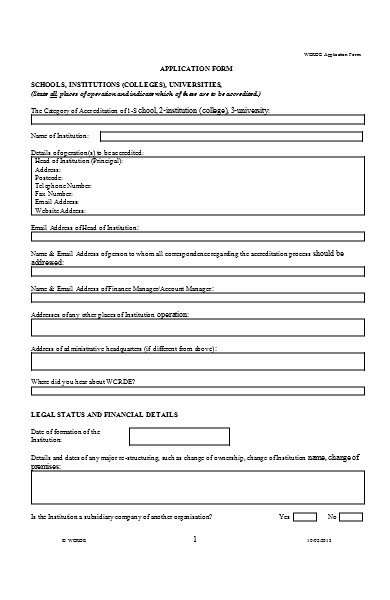

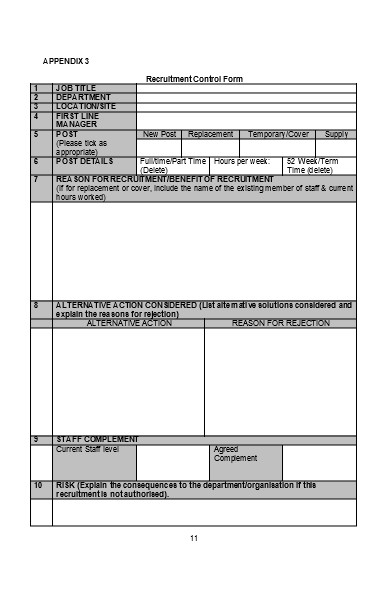

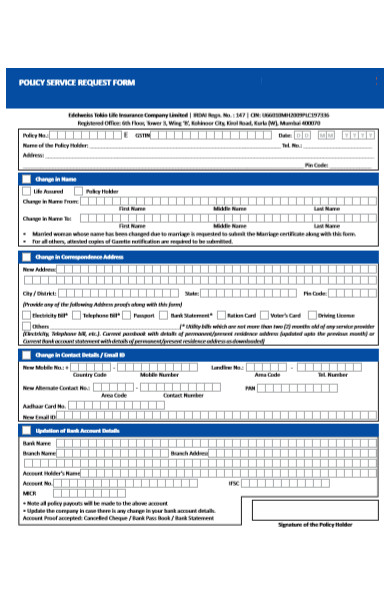

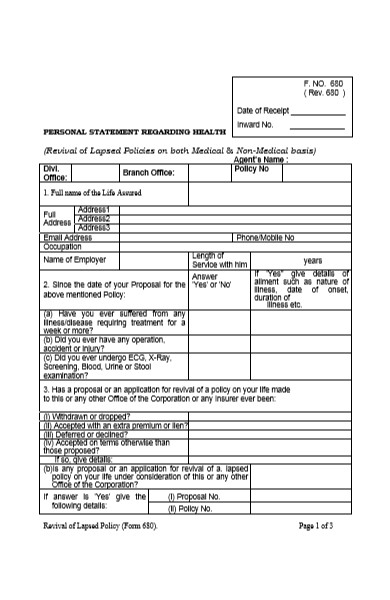

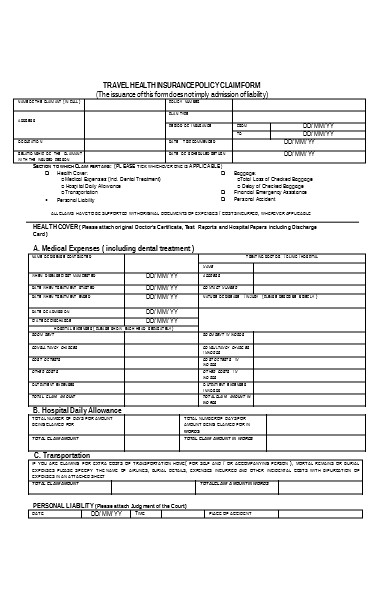

FREE 50+ Policy Forms

What is a standard policy form?

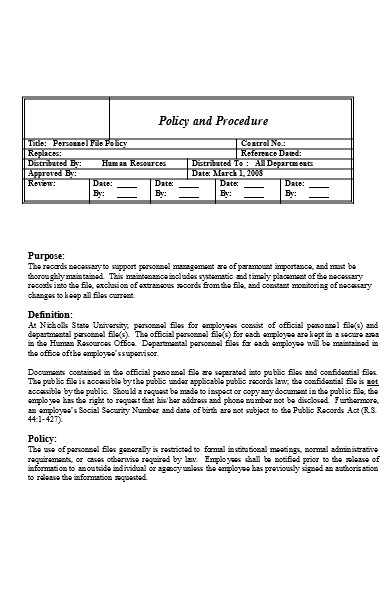

A standard policy form is a pre-defined and widely accepted template or document used to create consistent policies within an organization or industry. These blank forms serve as a structured framework for drafting policies, typically covering a specific area of governance, such as human resources, safety, or compliance. Standard policy forms are designed to ensure clarity, conformity, and alignment with best practices and legal requirements, making policy creation more efficient and reducing the risk of errors or omissions.

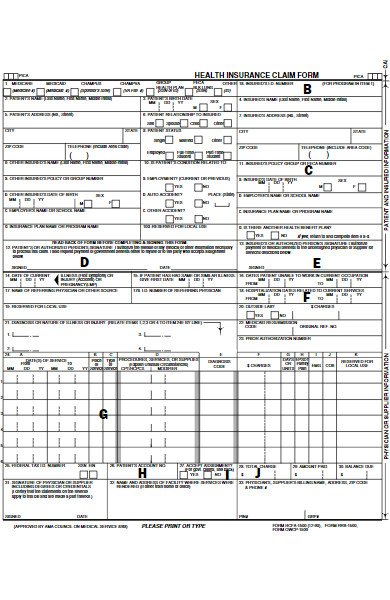

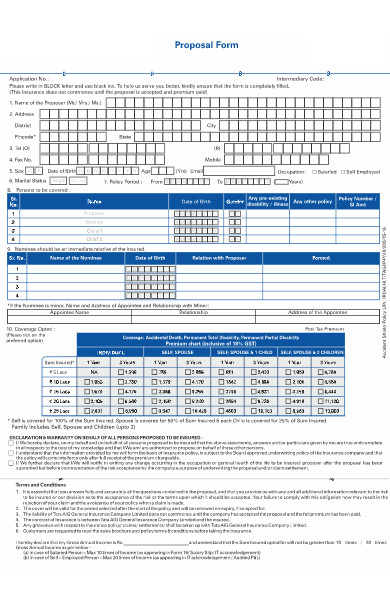

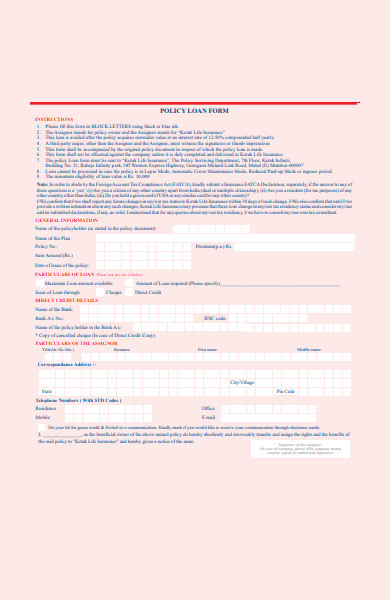

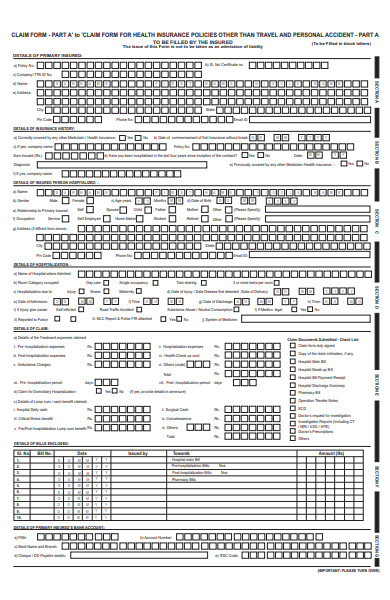

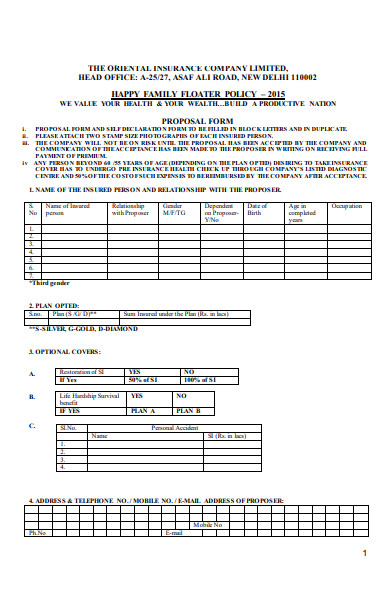

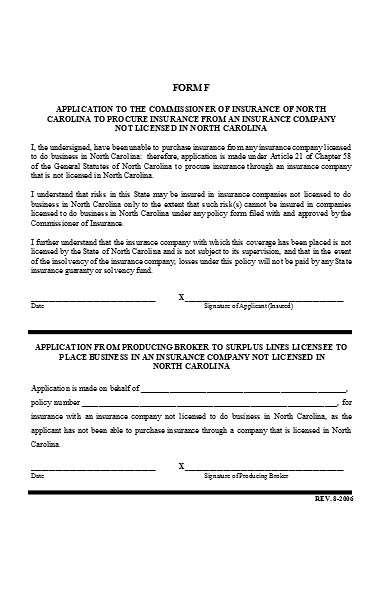

What is a policy a form of insurance contract?

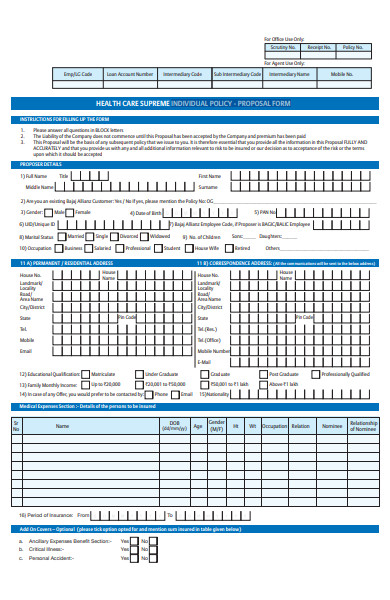

A policy in the context of insurance is indeed best form of an insurance contract. An insurance policy is a legally binding agreement between an insurance provider (the insurer) and an individual or entity (the policyholder). It outlines the terms, conditions, coverage, and obligations of both parties regarding a specific type of insurance, such as life, health, auto, or property insurance. The policy serves as a formal written document that defines the rights and responsibilities of the insurer and policyholder, ensuring clarity and protection for both parties.

How to fill a policy form?

Filling out a policy form requires attention to detail and accuracy to ensure that you obtain the insurance coverage you need. Here’s a general guide on how to fill out a policy form:

Step 1: Read Instructions

- Start by carefully reading the instructions provided with the policy form. This will give you an overview of the information required and how to complete the form.

Step 2: Provide Personal Information

- Begin by entering your personal details, such as your full name, date of birth, contact information, and any other information specific to you as the policyholder.

Step 3: Choose Coverage

- Select the type and level of insurance coverage you need. This may include options like coverage amount, policy term, or additional riders for specific situations.

Step 4: Answer Health Questions

- If it’s a health or life insurance policy, you may need to answer questions about your medical history, lifestyle, and health conditions. Be honest and accurate in your responses.

Step 5: Financial Information

- Provide financial information, such as your income, assets, or other financial details relevant to the policy. This is often necessary for certain types of insurance.

Step 6: Beneficiary Information

- Specify who should receive the insurance benefits in case of your demise. You may need to provide the full name, relationship, and contact details of the beneficiary.

Step 7: Review and Sign

- Review the entire form for accuracy and completeness. Ensure that you’ve answered all questions and provided all required documentation.

Step 8: Seek Clarification

- If you have any doubts or need clarification on specific questions, don’t hesitate to reach out to the insurance provider or agent for assistance.

Step 9: Attach Supporting Documents

- Include any necessary supporting documents, such as identification, medical records, or financial statements, as required by the policy.

Step 10: Make Copies

- Before submitting the form, make copies or digital backups for your records. These can be valuable for reference or in case of disputes.

Step 11: Submit the Form

- Follow the submission instructions provided in the form. This may involve mailing the form, submitting it online, or delivering it to an insurance agent.

Step 12: Confirmation

- After submission, it’s a good practice to confirm with the insurance provider that they’ve received your application. This ensures it’s in the processing queue.

Step 13: Review the Policy

- Once your application is approved, carefully review the policy document you receive from the insurance provider. Ensure it accurately reflects the coverage you applied for.

By following these steps, you can accurately fill out a policy form and secure the insurance coverage you need. Remember to be truthful and provide all required information to ensure a smooth and successful application process. You should also take a look at our Sample Policy Review Forms.

What is a policy declaration form?

A policy declaration form, often referred to as a “declarations page,” is a crucial component of an insurance policy. It’s a one-page summary that provides key information about the insurance policy’s coverage and terms. This document typically includes:

- Policyholder Information: Details about the policyholder, including their name, address, and contact information.

- Policy Number: A unique identification number assigned to the policy.

- Coverage Period: The effective date and expiration date of the policy, specifying when the coverage begins and ends.

- Premium Amount: The cost of the insurance coverage, including any applicable fees or discounts.

- Coverage Details: A summary of the types and limits of coverage provided by the policy, such as liability limits, deductibles, and any optional endorsements or riders.

- Insured Items: Information about the insured items, such as vehicles, property, or individuals, depending on the type of insurance.

- Exclusions: Any specific situations or events that are not covered by the policy.

- Endorsements: Additional provisions or modifications to the policy that may alter the standard coverage.

- Contact Information: How to reach the insurance company, agent, or broker for inquiries, claims, or changes to the policy.

The policy declaration form is a critical reference for policyholders as it provides a snapshot of their insurance coverage and the terms of the policy. It is often provided at the start of the policy and may be updated when changes are made to the coverage during the policy period.

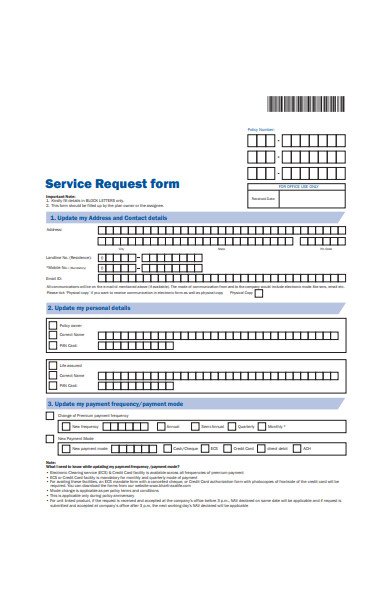

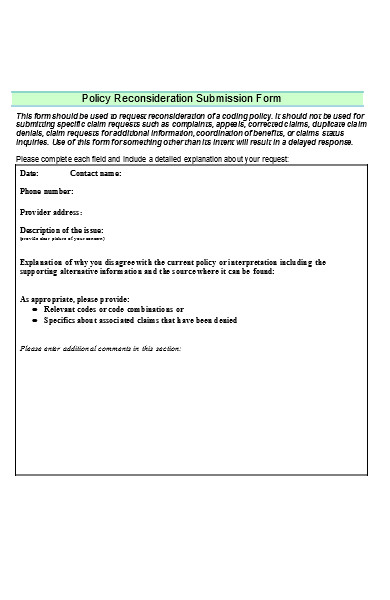

What steps should I follow if I need to update or revise an existing Policy Form?

Updating or revising an existing Policy Form involves a structured process to ensure that changes are made accurately and communicated effectively. Here are the steps to follow:

Step 1: Identify the Need for Revision

- Determine the specific reasons and objectives for revising the policy. Is it due to changes in regulations, business processes, or other factors?

Step 2: Review Current Policy

- Thoroughly review the existing policy to identify the sections or aspects that require revision. This includes assessing the policy’s language, provisions, and overall effectiveness.

Step 3: Gather Input

- Seek input from relevant stakeholders, such as legal experts, compliance officers, employees, or affected parties. Their insights can be invaluable in shaping the revisions.

Step 4: Draft the Revised Policy

- Begin drafting the revised policy, incorporating the necessary changes and improvements. Ensure that the language is clear and unambiguous.

Step 5: Legal Review

- Have the revised policy reviewed by legal counsel to ensure it complies with all relevant laws and regulations. Address any legal issues or concerns.

Step 6: Obtain Approvals

- Seek approvals from the appropriate authorities within your organization or institution. This may involve upper management or a governing board.

Step 7: Communicate Changes

- Notify all affected parties of the upcoming changes to the policy. This includes employees, members, or other stakeholders who are subject to the policy.

Step 8: Training and Education

- Provide training and education to individuals who will be impacted by the revised policy. Ensure that they understand the changes and how they affect their responsibilities.

Step 9: Documentation

- Maintain thorough documentation of the revision process, including draft versions, feedback, approvals, and communication records.

Step 10: Implement the Revised Policy

- Once approved, implement the revised policy and ensure that all relevant parties adhere to the new requirements.

Step 11: Monitor and Evaluate

- Continuously monitor the effectiveness of the revised policy. Collect feedback and data to evaluate its impact on operations and compliance.

Step 12: Periodic Review

- Establish a regular schedule for reviewing policies to ensure that they remain up-to-date and aligned with changing regulations and business needs.

By following these steps, you can successfully update or revise an existing Policy Form, ensuring that it remains relevant, compliant, and effective in achieving its intended objectives. Our employee dress code policy forms is also worth a look at

What is the overall purpose of Policy Forms within our organization or institution?

The overall purpose of Policy Forms within an organization or institution is to establish a clear and structured framework for governance and decision-making. These forms serve several essential functions:

- Guidance and Consistency: Policy Forms provide clear guidelines and standards that help ensure consistency in operations, decision-making, and conduct across the organization. They act as a reference point for employees and stakeholders.

- Compliance: Policies help the organization adhere to legal and regulatory requirements. They outline the necessary steps to remain compliant with industry-specific rules and standards.

- Risk Management: Policy Forms identify and mitigate risks by setting out procedures and protocols to handle potential challenges or issues, reducing the likelihood of legal or operational problems.

- Transparency: Policies promote transparency by making the organization’s rules and expectations visible to all. This transparency builds trust and accountability among employees and stakeholders.

- Conflict Resolution: Policy Forms offer a structured approach to resolving conflicts or disputes within the organization. They provide a foundation for fair and equitable decision-making.

- Efficiency: By providing predefined procedures, policies contribute to the efficient operation of the organization. They reduce uncertainty and ambiguity in daily activities.

- Protection of Resources: Policies protect the organization’s resources, including assets, data, and intellectual property, by setting out guidelines for their responsible use and safeguarding.

- Accountability: Policies hold individuals and departments accountable for their actions and decisions, fostering responsibility and ethical behavior.

- Communication: Policy Forms facilitate effective communication within the organization, ensuring that everyone understands the rules and expectations.

- Adaptability: As the organization evolves and external factors change, Policy Forms can be updated to reflect new requirements and opportunities.

In summary, Policy Forms play a pivotal role in governing an organization or institution, promoting order, compliance, and responsible behavior while ensuring adaptability to meet evolving needs and standards.

How should I go about filling out a Policy Form accurately and efficiently?

Filling out a Policy Form accurately and efficiently requires attention to detail and a structured approach. Here’s a step-by-step guide to help you complete a Policy Form effectively:

Step 1: Read Instructions

- Begin by thoroughly reading the instructions provided with the Policy Form. This will give you a clear understanding of what is expected and any specific requirements.

Step 2: Gather Information

- Collect all the necessary information and documents that will be needed to complete the form. This may include personal details, financial information, or other relevant data.

Step 3: Follow a Logical Sequence

- Fill out the form in a logical sequence, starting with your personal information and moving on to the specific sections of the form.

Step 4: Be Accurate and Honest

- Ensure that all the information you provide is accurate and truthful. Inaccurate information can lead to issues with your policy or claims in the future.

Step 5: Use Clear Handwriting

- If filling out a paper form by hand, use clear and legible handwriting. Neatly print or use block letters to avoid misinterpretation.

Step 6: Double-Check Entries

- Review each section of the form as you complete it. Verify that you haven’t missed any fields or made any errors.

Step 7: Attach Supporting Documents

- If the Policy Form requires supporting documents, such as identification, proof of income, or medical records, ensure that you include these with your submission.

Step 8: Seek Clarification

- If you encounter any questions or sections that you don’t understand, reach out to the insurance provider or agent for clarification. It’s better to ask for guidance than to provide incomplete or inaccurate information.

Step 9: Proofread

- Before finalizing the form, take the time to proofread it for errors, typos, or missing information.

Step 10: Keep Copies

- Make copies or digital backups of the completed form for your records. This can be valuable for reference or in case of disputes.

Step 11: Submit the Form

- Follow the submission instructions provided with the form. This may involve mailing the form, submitting it online, or delivering it to an insurance agent.

Step 12: Confirmation

- After submission, it’s a good practice to confirm with the insurance provider that they’ve received your application. This ensures it’s in the processing queue.

By following these steps, you can efficiently and accurately fill out a Policy Form, ensuring that your application form is complete and that you’ve provided all necessary information for your insurance coverage.

What is the process for submitting a completed Policy Form, and where should I submit it?

The process for submitting a completed Policy Form and where to submit it can vary depending on the insurance provider and the type of insurance you’re applying for. However, here are some general steps to follow:

Step 1: Review the Submission Instructions

- Carefully review the submission instructions provided with the Policy Form. These instructions will specify where and how to submit your completed form.

Step 2: Choose Your Submission Method

- Determine the submission method based on the options provided. Common submission methods include:

- Online Submission: Many insurance providers offer the option to submit forms electronically through their website or a dedicated online portal.

- Mail: You may be required to send a hard copy of the completed form through postal mail. If so, verify the correct mailing address.

- In-Person: In some cases, you can submit the form in person at the office of your insurance agent or the insurance company.

Step 3: Gather Required Documentation

- Ensure that you’ve attached all required documentation, such as identification, financial records, or medical reports, if specified in the submission instructions.

Step 4: Double-Check Your Form

- Before submitting, review your completed Policy Form to verify that all information is accurate and complete. Ensure that you haven’t missed any sections or made any errors.

Step 5: Make Copies

- Make copies or digital backups of the completed form and attached documents for your own records. This can be useful for reference and documentation.

Step 6: Submit the Form

- Submit the completed Policy Form and accompanying documents through your chosen submission method. If submitting online, follow the prompts and provide any required electronic signatures. If mailing or delivering in person, ensure the package is securely sealed and properly addressed.

Step 7: Confirmation

- After submission, it’s a good practice to confirm with the insurance provider or agent that they’ve received your application. This can help you track the status of your application and ensure it’s in the processing queue.

Step 8: Await Response

- Once your completed form is submitted, you’ll need to wait for the insurance provider to process your application. This may take some time, so be patient.

The specific submission process may vary, so it’s crucial to closely follow the instructions provided by your insurance company or agent. If you have any questions or encounter difficulties during the submission process, don’t hesitate to reach out to your insurance provider for assistance. In addition, you should review our Insurance Forms.

How to Create the Policy Form? – a Step by Step Guide

Creating a Policy Form requires a systematic approach to ensure it’s comprehensive and effective. Here’s a step-by-step guide on how to create a Policy Form:

Step 1: Define the Purpose

- Clearly define the purpose and scope of the policy you intend to create. What area of governance or decision-making does it cover?

Step 2: Identify Stakeholders

- Determine the key stakeholders who will be affected by or involved in the policy’s creation and implementation.

Step 3: Research and Gather Information

- Conduct research to gather information relevant to the policy’s subject matter. This may include industry standards, legal requirements, best practices, or internal data.

Step 4: Draft the Policy

- Begin drafting the policy, including key sections like the policy’s purpose, scope, responsibilities, procedures, and consequences for non-compliance.

Step 5: Objectives and Goals

- Clearly define the objectives and goals the policy aims to achieve. What specific outcomes are expected?

Step 6: Legal Review

- Have the policy reviewed by legal counsel to ensure it complies with all relevant laws and regulations. Address any legal issues or concerns.

Step 7: Seek Input

- Solicit input and feedback from stakeholders, including employees, management, or relevant experts. Consider their suggestions for improvements.

Step 8: Approval Process

- Present the final draft to the appropriate authority or governing body for approval and adoption. Ensure that the policy aligns with the organization’s objectives.

Step 9: Communication and Training

- Communicate the policy to all relevant stakeholders, providing training and support to ensure they understand and can effectively implement the policy.

Step 10: Documentation and Record Keeping

- Maintain thorough documentation of the policy creation process, including drafts, feedback, approvals, and communication records.

Step 11: Implementation

- Implement the policy within the organization or institution. Ensure that all relevant parties adhere to the new requirements.

Step 12: Monitoring and Evaluation

- Continuously monitor the effectiveness of the policy. Collect feedback and data to evaluate its impact on operations, compliance, and objectives.

Step 13: Periodic Review

- Establish a regular schedule for reviewing and updating policies to ensure they remain up-to-date and aligned with changing regulations and best practices.

By following these steps, you can create a Policy Form that effectively addresses a specific area of governance or decision-making, ensuring clarity, compliance, and alignment with the organization’s objectives. You may also be interested in our Sample Health Insurance Forms.

Tips for creating an Effective Policy Form

Creating an effective Policy Form requires careful consideration and attention to detail. Here are some tips to help you develop a policy form that is clear, comprehensive, and useful:

1. Define Clear Objectives:

- Start by clearly defining the objectives and goals the policy aims to achieve. Understanding the purpose of the policy is essential for creating effective guidelines.

2. Involve Stakeholders:

- Engage key stakeholders, including employees, experts, and those directly affected by the policy, in the policy development process. Their insights can provide valuable perspectives.

3. Research and Compliance:

- Thoroughly research industry standards, legal requirements, and best practices related to the policy’s subject matter. Ensure that the policy aligns with these standards.

4. Use Clear and Concise Language:

- Write the policy in clear, concise language. Avoid jargon and complex terminology that may be unclear to the intended audience.

5. Organized Structure:

- Organize the policy into sections with headings and subheadings. Use a logical and sequential structure that makes it easy to find information.

6. Avoid Redundancy:

- Eliminate redundancy in the policy. Avoid repeating information across sections and ensure consistency in terminology.

7. Include Definitions:

- Define any terms or concepts that may be unfamiliar to the audience. This ensures that readers have a common understanding of key terms.

8. Be Specific:

- Provide specific details, examples, and step-by-step procedures where applicable. Specificity helps clarify expectations and actions.

9. Legal Review:

- Have the policy reviewed by legal counsel to ensure it complies with all relevant laws and regulations. Address any legal concerns.

10. Seek Feedback:

- Encourage feedback from stakeholders and experts during the policy development process. Make revisions based on their input.

11. Use Visual Aids:

- Incorporate visual aids, charts, and diagrams to enhance understanding and illustrate complex concepts.

12. Document Revision Process:

- Keep a record of the policy’s revision process, including drafts, feedback, and approvals. This documentation can be valuable for audits and updates.

13. Communication Plan:

- Develop a communication plan to ensure that all stakeholders are aware of the policy’s existence and understand how to access it.

14. Training and Education:

- Provide training and educational resources to help stakeholders understand and adhere to the policy’s guidelines.

15. Periodic Review:

- Establish a schedule for periodic review and updates to ensure that the policy remains current and relevant.

Creating an effective Policy Form is an ongoing process that requires collaboration, careful planning, and continuous improvement. By following these tips, you can develop a policy that serves its intended purpose and contributes to the organization’s success.

In conclusion, a Policy Form is a vital document that defines the rules, standards, and procedures within an organization or institution. It serves as a roadmap for governance, ensuring clarity, compliance, and accountability. With various types and examples, creating an effective Policy Form demands a structured approach and adherence to best practices. The step-by-step guide provides a framework for its creation, emphasizing clarity and legal compliance. It’s a dynamic tool that evolves with changing needs and regulations, contributing to an organization’s success. You may also be interested to browse through our other Sample Insurance Claim Forms and General Liability Forms.

Related Posts Here

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale

-

Landlord Consent Form

-

60-Day Notice to Vacate Form

-

Financial Statement Form

-

Product Evaluation Form

-

Construction Contract

-

School Receipt Form

-

Restaurant Training Form