Investing and starting out for the future can be an overwhelming thing to do, especially for young adults who are just starting to build an independent life. Most of the essential items that need to be bought or paid for – such as a home, a car, or college – can cost a lot.

Sometimes the only solution to affording these commodities is to apply for a loan. A loan is the act of lending money, property, or material goods to someone, which will then be repaid in the future together with an incurred interest. The person or the company is referred to as the lender while the person who is lent the money is referred to as the borrower. You can view our Sample Loan Application Forms for more loan application and agreement forms.

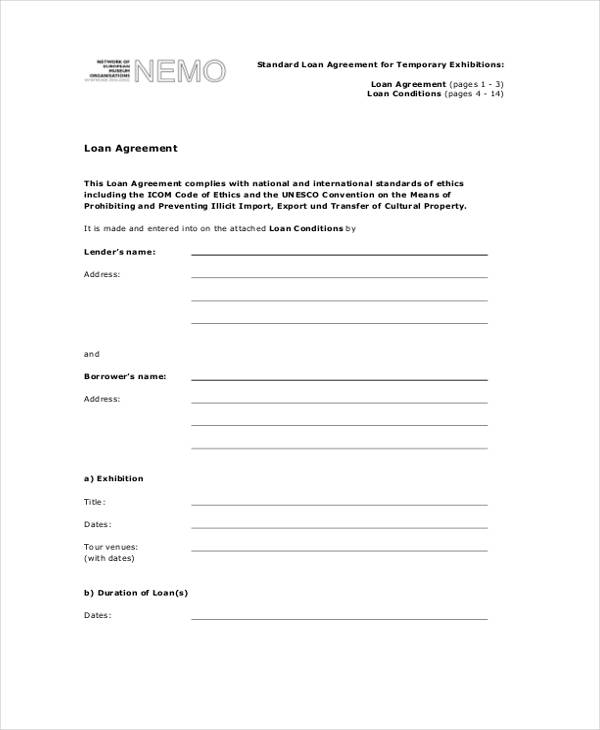

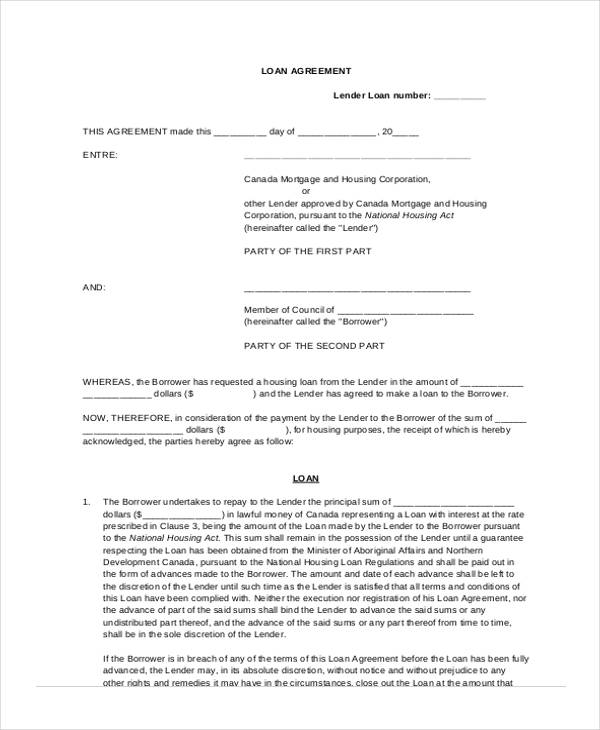

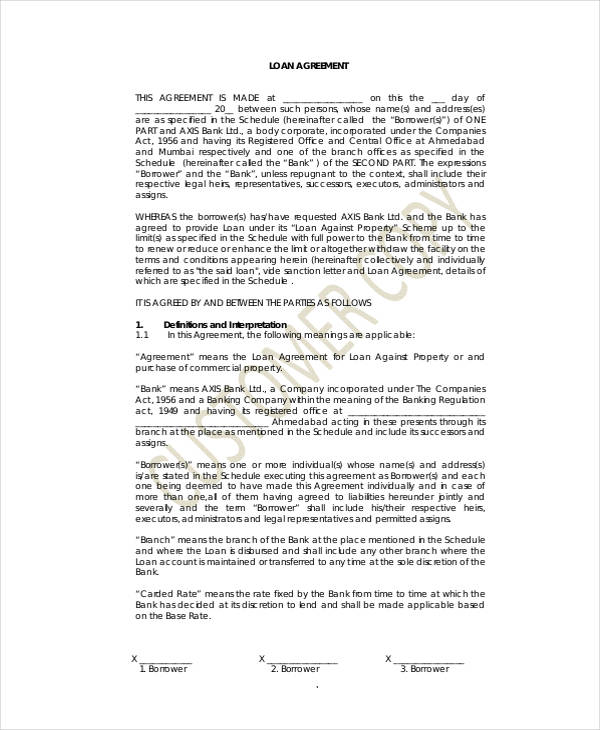

Free Loan Agreement Forms in PDF

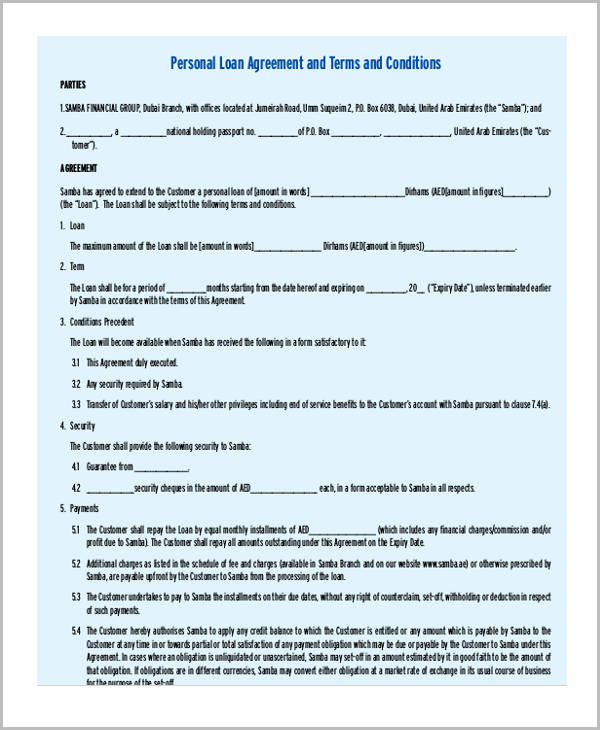

Personal Loan Agreement in PDF

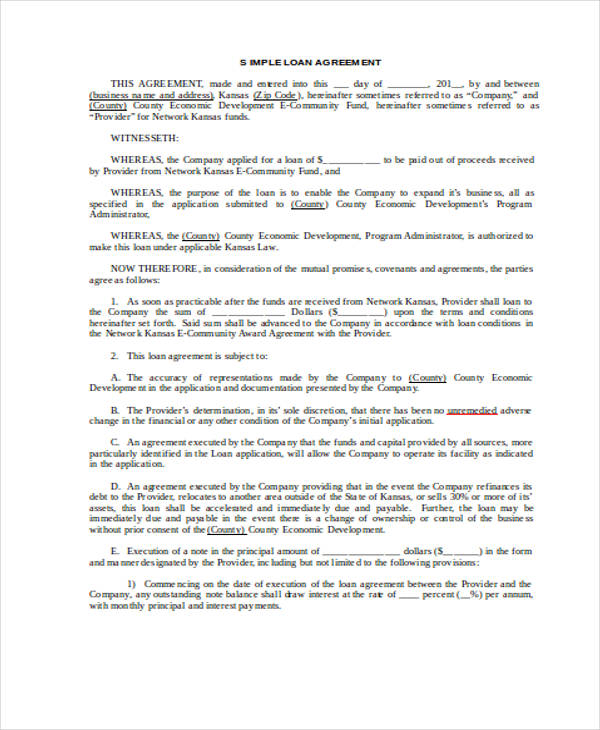

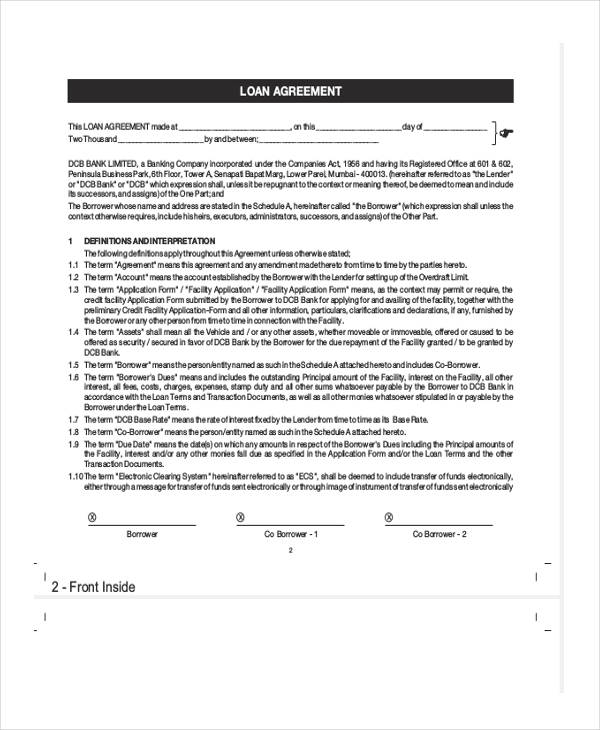

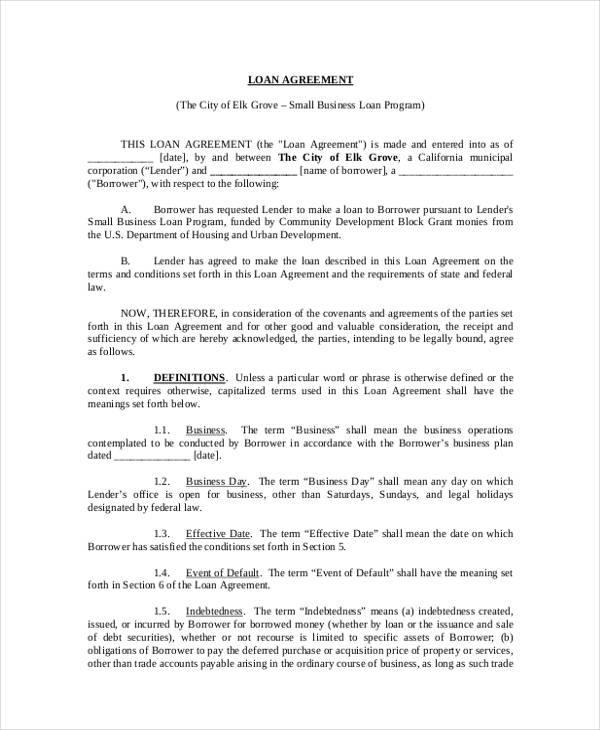

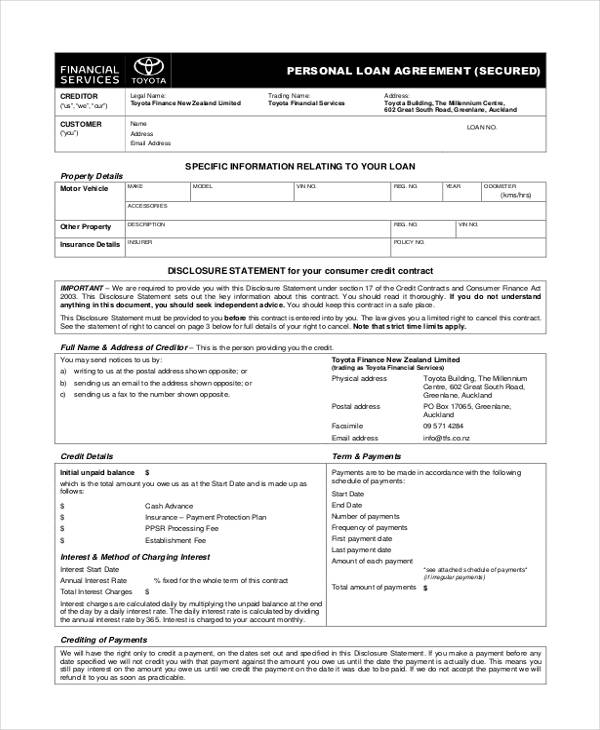

Business Loan Agreement Form

Simple Loan Agreement Form

Simple Free Loan Agreement Forms

Simple Personal Loan Agreement

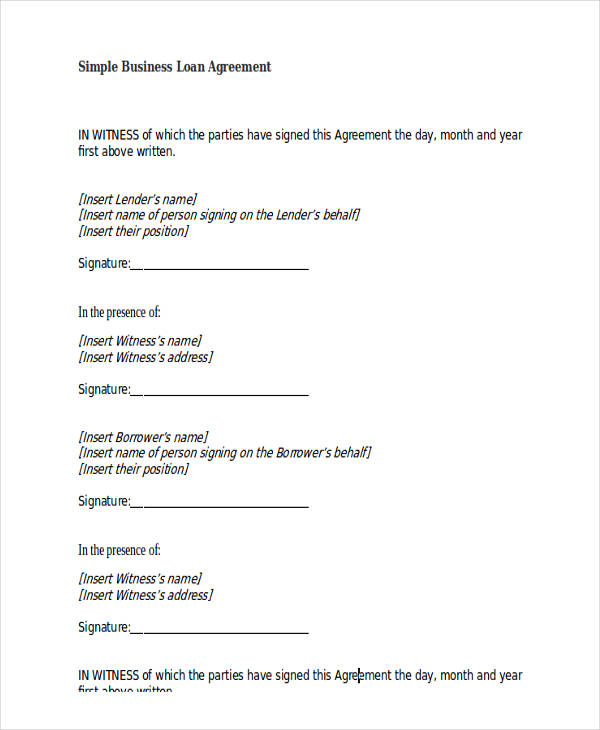

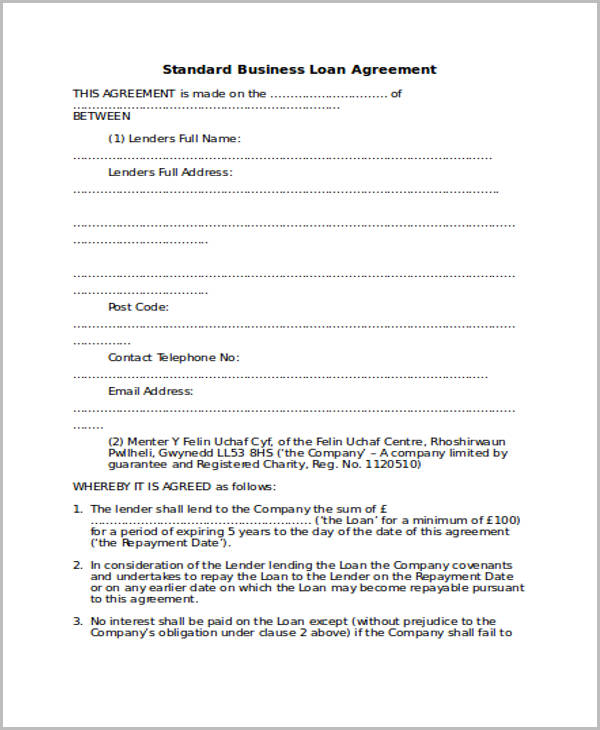

Simple Business Loan Agreement

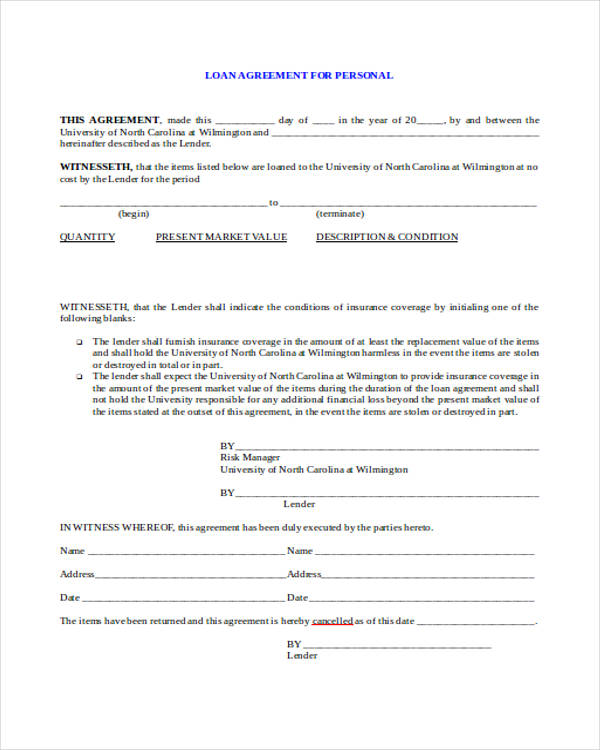

Free Personal Loan Agreement Forms

Personal Loan Agreement Doc

Sample Personal Loan Agreement

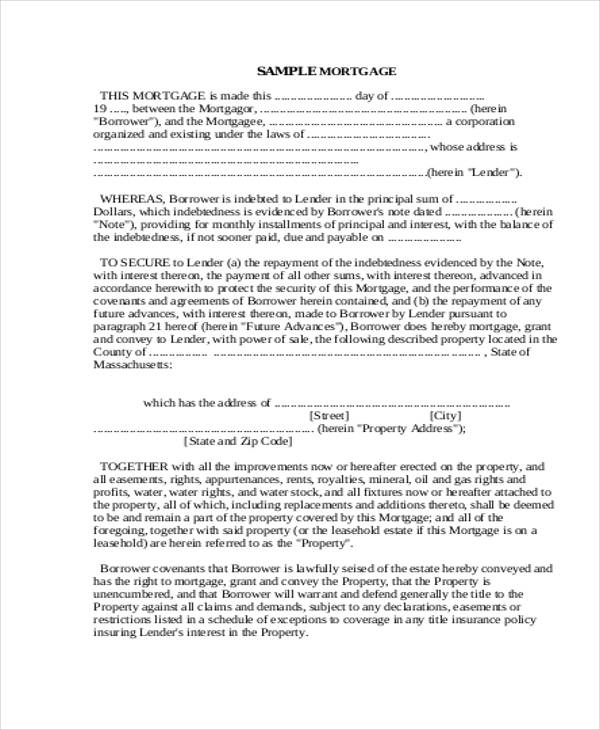

Personal Mortgage Loan Agreement

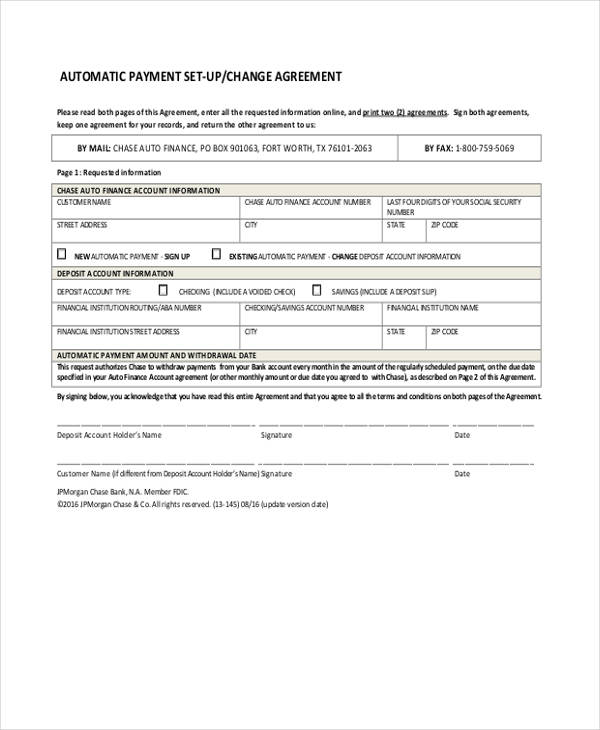

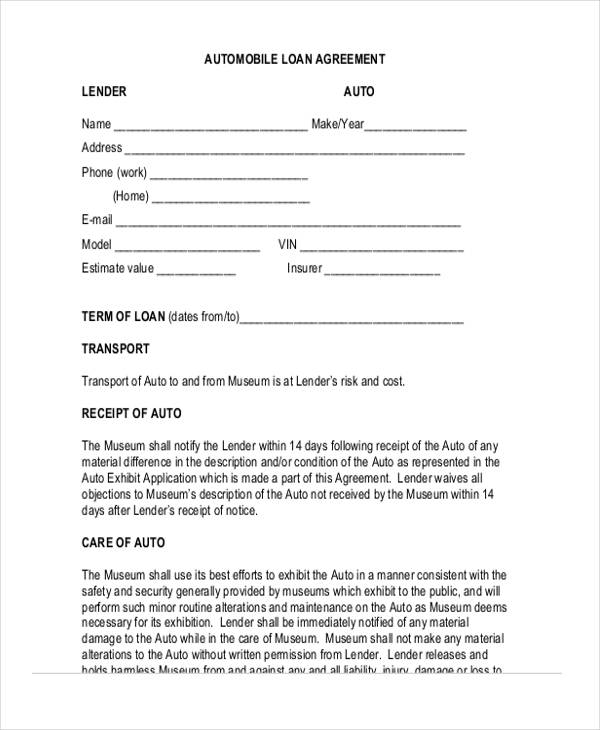

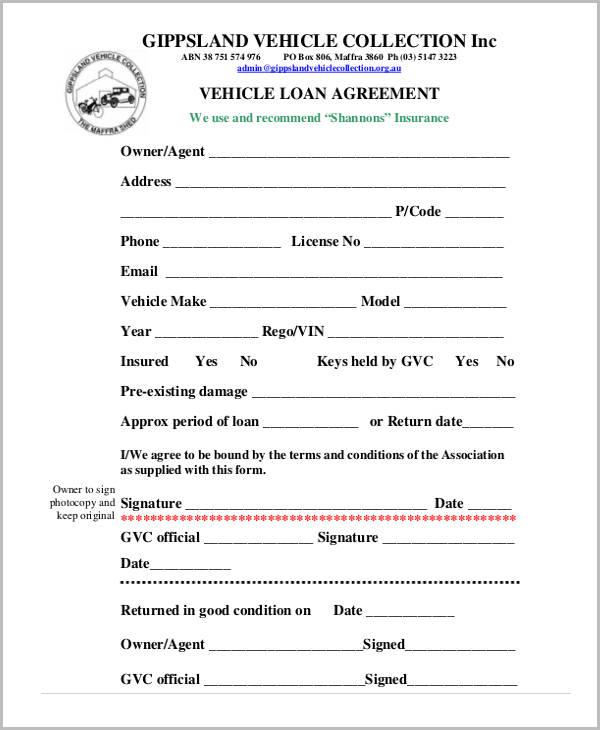

Free Car Loan Agreement Forms

Personal Car Loan Agreement

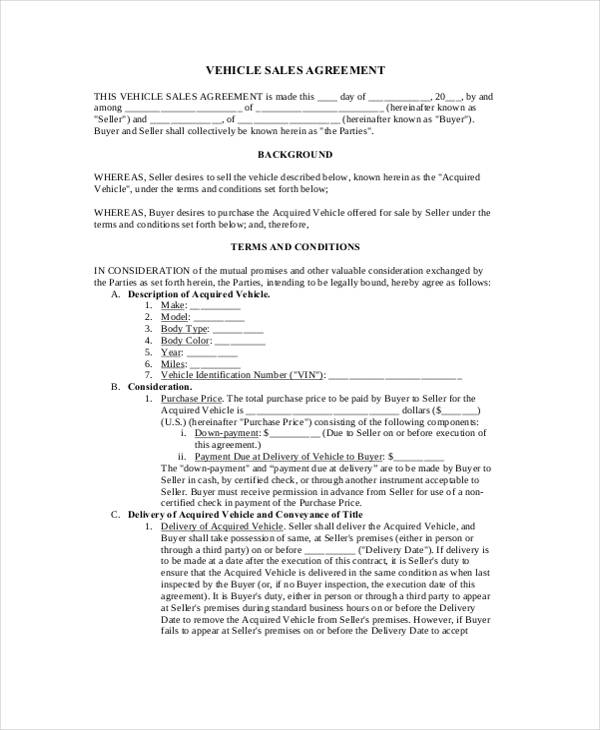

Car Sales Agreement Sample

Car Loan Payment Agreement

A loan is typically applied for. It is then approved or declined when it is being processed through big commercial financial organizations such as banks or cooperatives. However, there are also example of transactions where a loan is done between a person’s relatives, colleagues, workmates, family, or friends. In this manner, it usually doesn’t involve a complicated or long process before a particular loan is approved or rejected since it is commonly done within a small circle and in an informal manner.

Because lending money – whether to stranger, kin, or foe – is a risky business, having a written loan agreement is essential in order to protect the interests of both the lender and the borrower and to ensure that the money being lent was not a gift and needs to be paid.

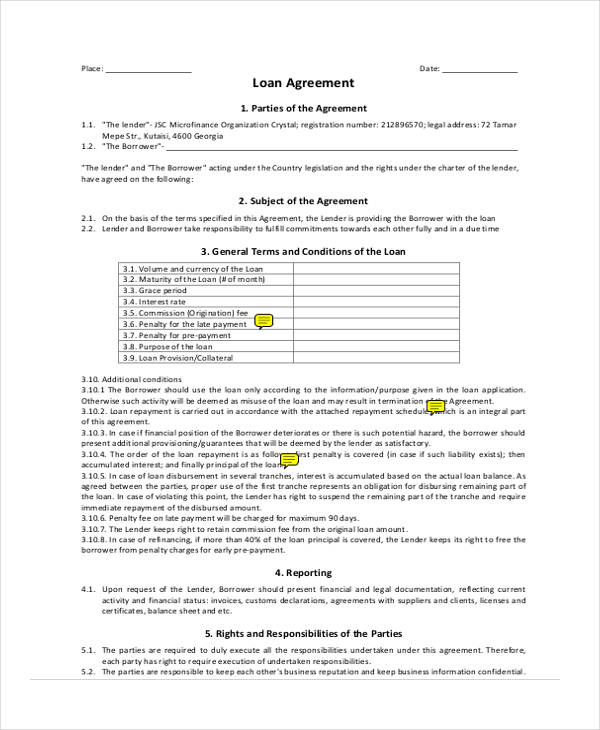

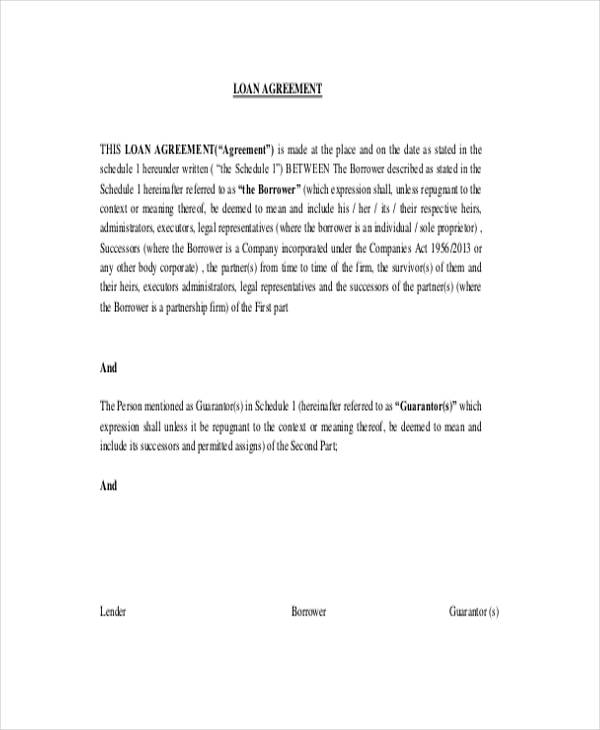

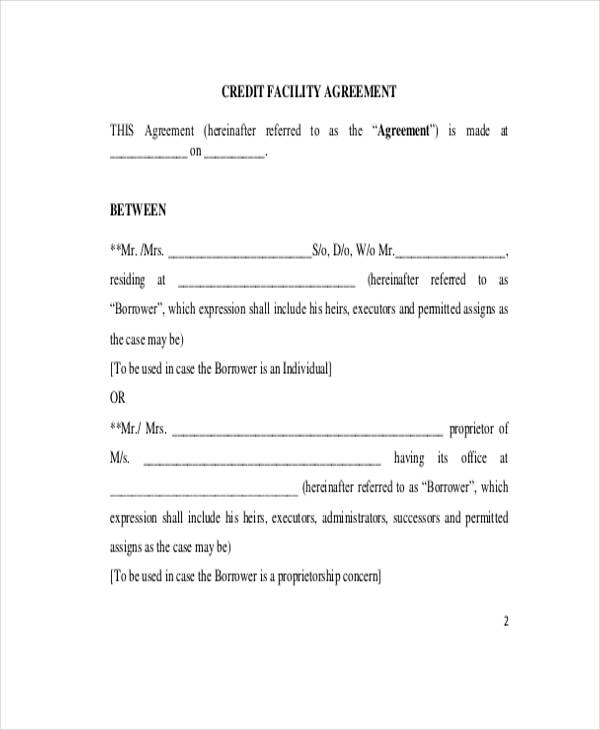

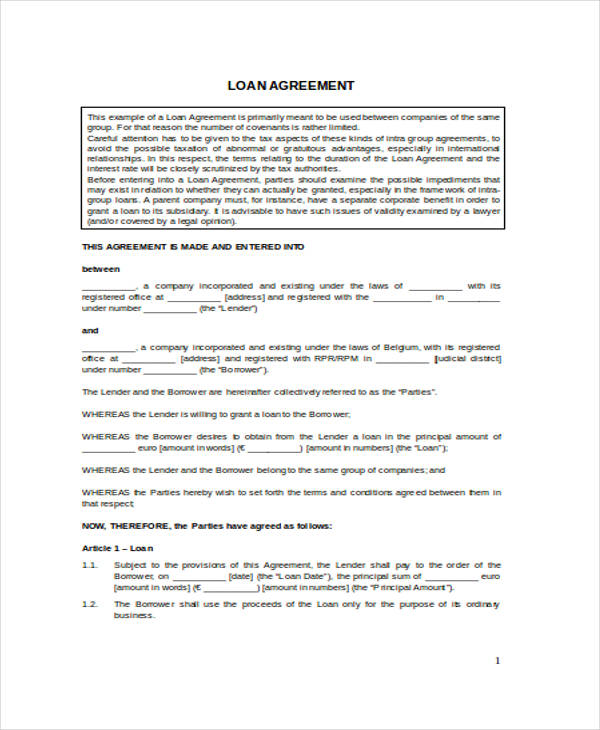

A Loan Agreement is a written document that is used by the borrower and the lender of the loan. The loan agreement outlines the terms that have been agreed upon by the two parties, which is the borrower and the lender. Since a loan is considered a formal transaction between two individuals, a loan agreement serves as a legally binding document to assure the lender that the amount will be repaid by the borrower of the money.

Before entering into any type of loan, most banks or loan organizations provide certain requirements to make sure that the borrower’s word can be banked on. A borrower is required to provide certain documents to prove that he/she is a credible candidate for the loan. He/she also needs to have a reliable character, a good cash flow, and a collateral or a guarantee that the loan will be repaid before the transaction can be finalized and approved by the lending company.

A loan agreement, which is a legally binding document, is important in order to formalize the loan or the transaction. Loan agreements can differ depending on how it is used as well as the purpose for creating one. For example, a loan agreement can be made through a promissory note, which is typically done between family and friends, and can also be as complicated as a contract that is used for transactions like an auto loan, a credit card application, a mortgage loan, and so on.

The Basic Content of a Loan Agreement

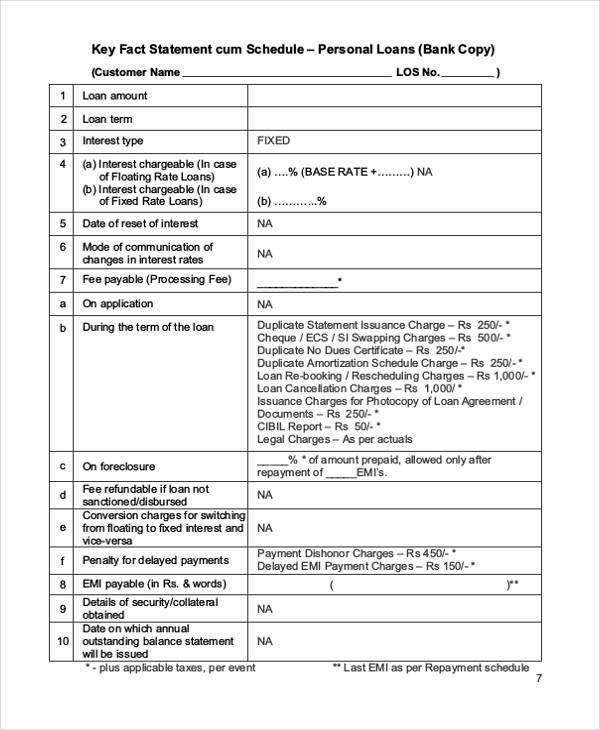

A loan agreement’s content will typically vary according to the amount of money being borrowed, the type of loan being made, and the terms and conditions of the loan. For example, if a particular individual has a Mortgage loan, he/she will have a different, and usually longer terms for payment as well as prerequisites, which is not the case in an Auto Loan. The terms and conditions laid out for the repayment of a loan will also depend on the laws and guidelines set forth by both the state and the federal government. These laws are usually constructed and implemented in order to make sure that interest rates for repayments are not illegally or excessively charged. However, despite the difference in coverage, a loan agreement typically contains:

- The names of both parties involved in the loan agreement

- The mailing addresses of the loan participants

- Definitions or clauses agreed upon by the two parties within the transaction

- The total and final loan amount

- The purpose of the loan transaction

- The terms and conditions by which the loan shall be used

- A precise and complete list of the terms for repayment

- Conditions for prepayment and possible loan cancellation

- The interest that will be applied for the loan transaction

- The periods by which interest will already apply

- The payment schedules and the methods of allowed payment

Aside from the specified items above, there are also other important information that should be well formulated for the parties involved in the loan agreement have a smooth transaction with one another. These information include the following:

- Provisions for lender’s fees and expenses

- Borrower and lender representations

- Covenants of the borrower and the parties’ amendments

- The terms for penalties and liquidated damages

- Amendments and waivers

- Legal clauses for set-off

- The formula that will be used for the calculation of payments and repayments

- The interest computation

Always remember that the content of loan agreements vary depending on the items that a lender and a borrower have discussed. It is essential to make sure that the contract details are clear and concise so that future disputes or any other form of misunderstandings will not occur.

Moreover, be keen with the specification of numbers especially those that are used for interest rates and interest movement agreement. Keep in mind that loan duration and all the information presented in the list above should also be carefully written and presented.

Free Printable Loan Agreement Forms

Printable Blank Loan Agreement

Printable Personal Loan Agreement

Printable Auto Loan Agreement

Free Sample Loan Agreement Forms

Sample Loan Agreement Doc

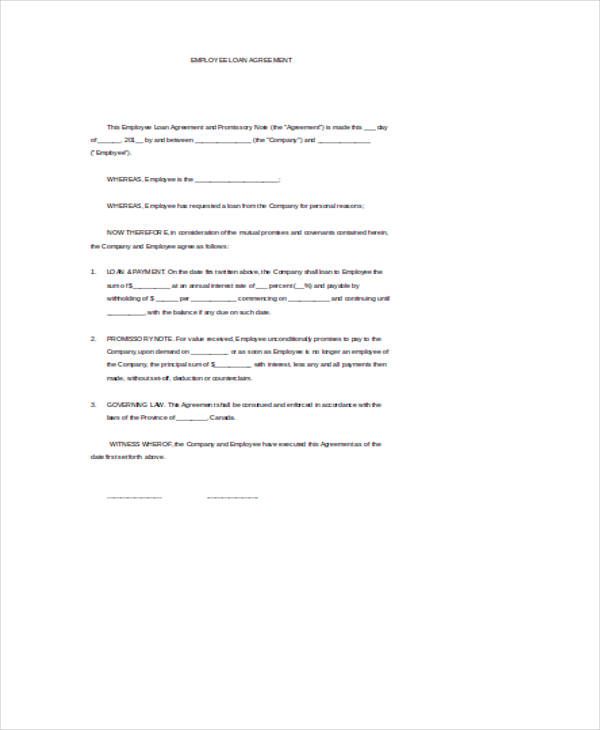

Sample Employee Loan Agreement

Free Blank Loan Agreement Forms

Blank Personal Loan Agreement

Blank Car Loan Agreement

Free Business Loan Agreement Forms

Business Loan Agreement Doc

Business Loan Agreement Format

Small Business Loan Agreement

Free Loan Repayment Agreement Forms

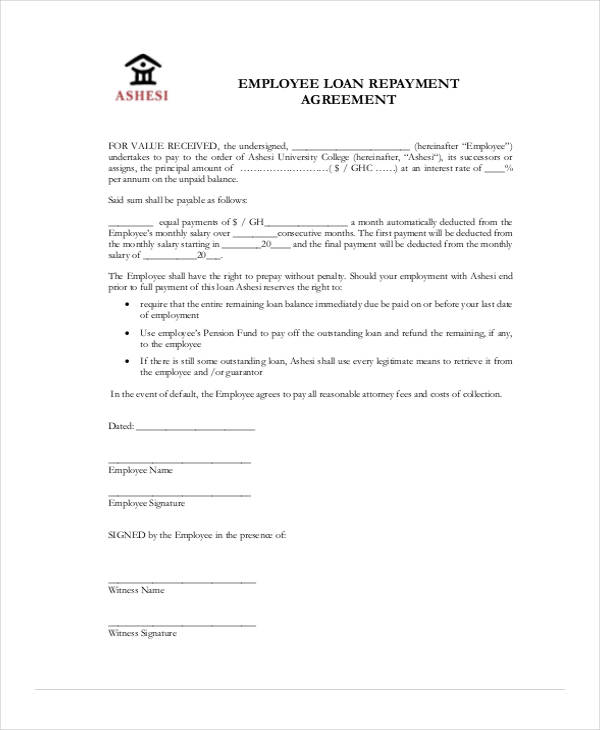

Employee Loan Repayment Agreement

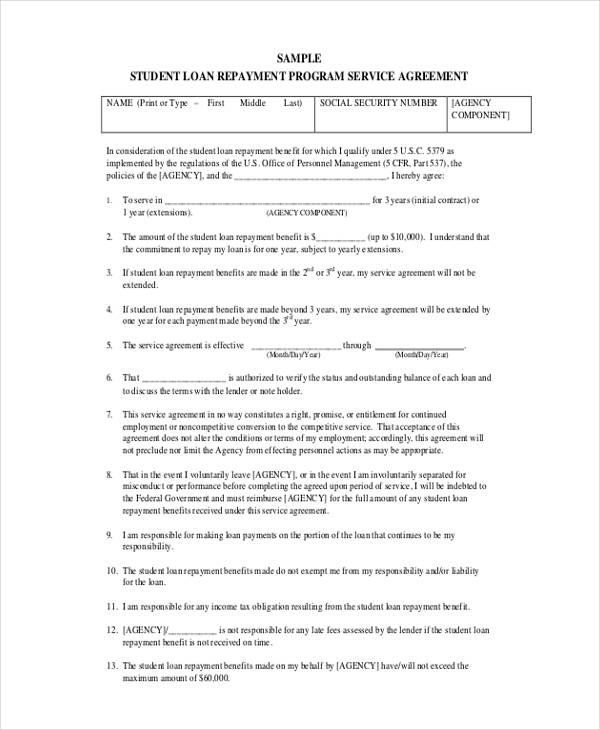

Student Loan Repayment Program Agreement

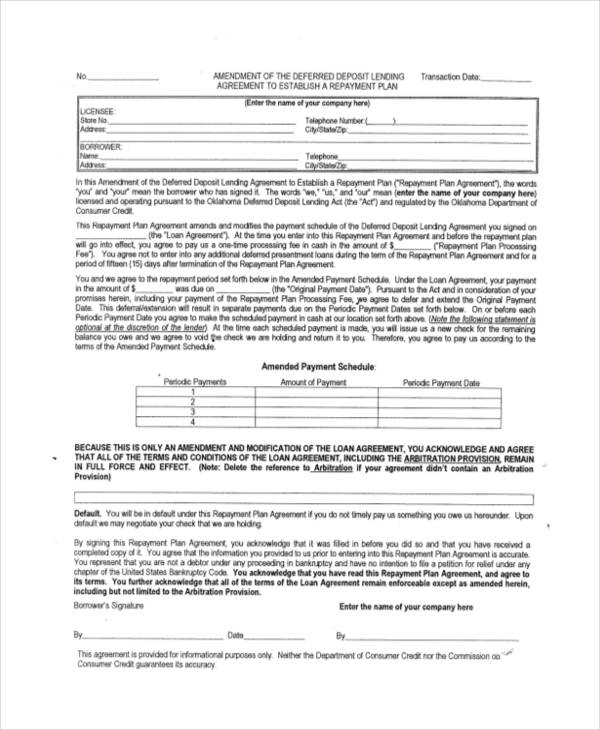

Sample Loan Repayment Agreement

The Advantages of Having a Loan Agreement

To Formalize the Agreement between Both Parties. A loan is technically something that is borrowed. In the case of financial loans, these are figures that are borrowed and repaid with interest. If there will be a written document that will be used to validate an agreement, the lender will be secured that the borrower is aware that the amount shall be paid and it is not a form of gift. This will allow the transaction to be legally binding, well-documented and properly recorded and handed over to concerned and involved parties.

Regulates Loan Terms. The regulation of loan terms can serve the purpose of creating protection both for the lender and the borrower. It enables the loan agreement to identify the interests of both parties and create conditions that can sustain the needs of each of them without abusing the rights of the other party. It is of importance to make sure that loan agreements follow the regulations and laws of the location, may it be a state or a city, where the transaction shall be done.

Provides a Sense of Security. Loan agreements legally bind both the lender and the borrower to the terms and conditions stipulated in the document. This is to ensure parties that the borrower will pay the amount that has been borrowed and that the lender will not take any advantage of the loan. In this manner, the borrower can also make sure that the lender will follow agreed upon payment schedules and interest rates.

Establishes Proper Terms and Conditions. Since loan agreements are put to writing, the agreed upon terms and conditions can be seen in it, including the duties and responsibilities of both the lender and the borrower.

Tangible Proof. While having a written loan agreement is not mandated by law, it is more enforceable and tangible than a verbal agreement as it serves as physical proof of the terms and conditions that have been agreed upon and signed willfully by both parties.

The Legal Provisions Incorporated in Loan Agreements

Because a Loan Agreement is legally binding, legal terms are usually used in order to properly outline the duties and responsibilities of both the lender and the borrower. Below are key terms that are typically incorporated within a loan agreement:

Involved Parties. It refers to both the lender and the borrower in the loan agreement. This is where the information about both parties are provided such as their name, current address, updated contact details, occupation, their Social Security number and many more. These information are needed to bind both the lender and the borrower to the loan agreement.

Choice of Law. The different states in the United States follow different laws. What is legal in one state may not be legal in another. That is why it is important that you are able to determine the jurisdiction of the law of the state where you have based the loan agreement contract. Being aware of this will keep you away from tons of trouble, especially legal problems.

Severability of Clause. It is important that this clause is included in the contract. It is because the severability clause states that if part of the contract is said to be illegal, the other parts or the rest of the contract will not be affected by it. The rest of the contract will still be considered legal. To put it simply, if one part of the contract is found to be faulty, only that part is considered faulty and the rest are still legal.

Entire Agreement Clause. This clause prevents other members of the agreement from making claims about other agreements that have been discussed while the contract was still being negotiated or before the contract was signed.

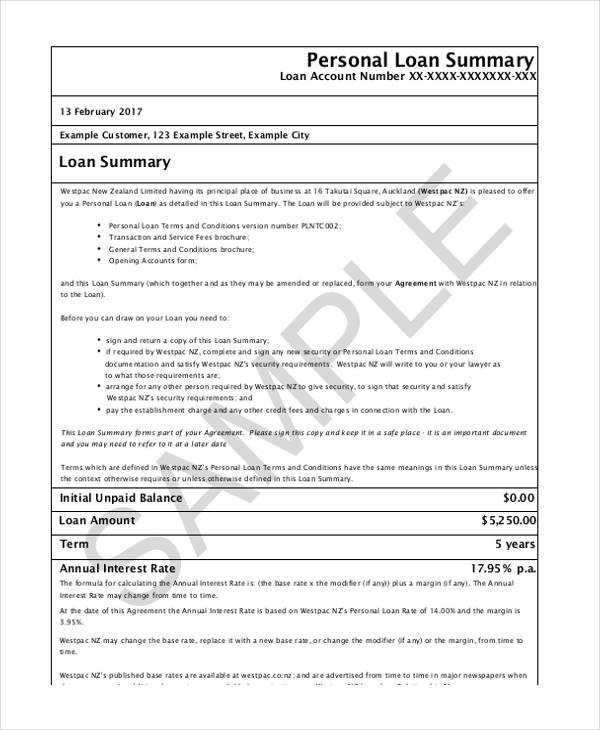

How Are Interest Rates Computed?

Loans are being offered by lending institutions, like banks or credit unions. These lenders are able to generate income by adding interest rates on top of the amount being borrowed. The interest rates applied to the loan depends on the amount being loaned, the type of loan the borrower applied for, the borrower’s credit score and the borrowers salary.

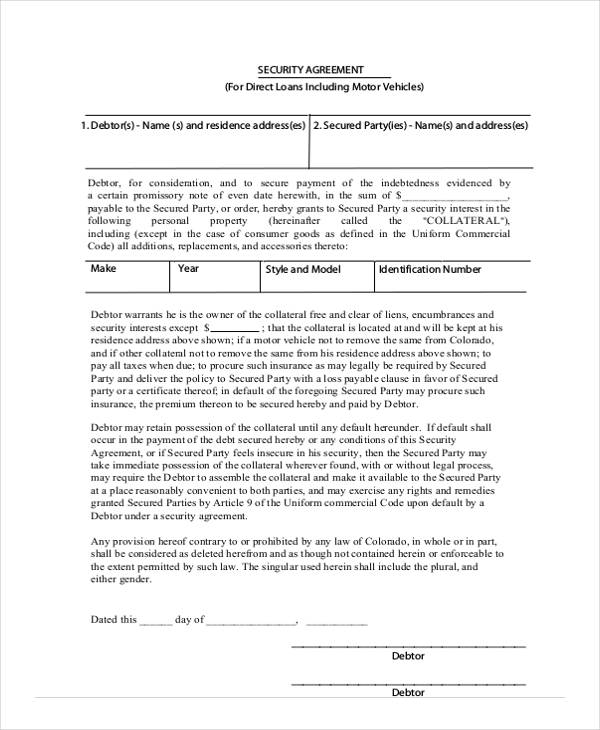

There are also loans that are considered secured and unsecured. Secured loans are those loans that require a collateral to get approved. The collateral may be a property or an asset such as a house or a car. By having a collateral, the lender can guarantee that the borrower will pay the loan. If the the borrower fails to pay for the borrowed amount, the property or asset in collateral may be foreclosed or repossessed. This means that it will be used to pay off the loan.

Since you are already aware of what a secured loan is, you also need to be knowledgeable of what unsecured loans are so you can easily identify their differences should you be involved in loan transactions where any of these loans can be applied. Unlike a secured loan that needs a collateral as one of the loan requirements, unsecured loans actually allow entities to apply for loans without the involvement of any assets that can be seized. Unsecured loans can be approved if a borrower has good credit history. More so, an individual should be backed up with a strong, solid, and current income source to ensure lenders that the borrower has the capacity to pay the loan at the right time. Once credit and income history has already been reviewed and results pass the qualifications of the lender, then the loan application can already be approved. With the absence of collateral, it is only acceptable that unsecured loans usually provide small amounts to the borrower. If you are thinking of what can be considered as an unsecured loan, both a Personal Loan and Student Loan perfectly fit the bill.

As a borrower, you need to make sure that the interest rates that will be applied in the loan are calculated accordingly. This is one of the items that you need to always clarify from the start of the transaction. Loan interest rates are usually computed by lenders varying on the conditions of each loan as well as the material assets tied in the loan – in case of a secured loan transaction. Also, take note that the governments of different countries also have various laws, regulations and orders that can protect, limit and regulate the interest rates that shall be imposed in loan agreements. This is to ensure that excessive interests will not be applied in such transaction to avoid the abuse of a borrower’s situation and lack of possible options.

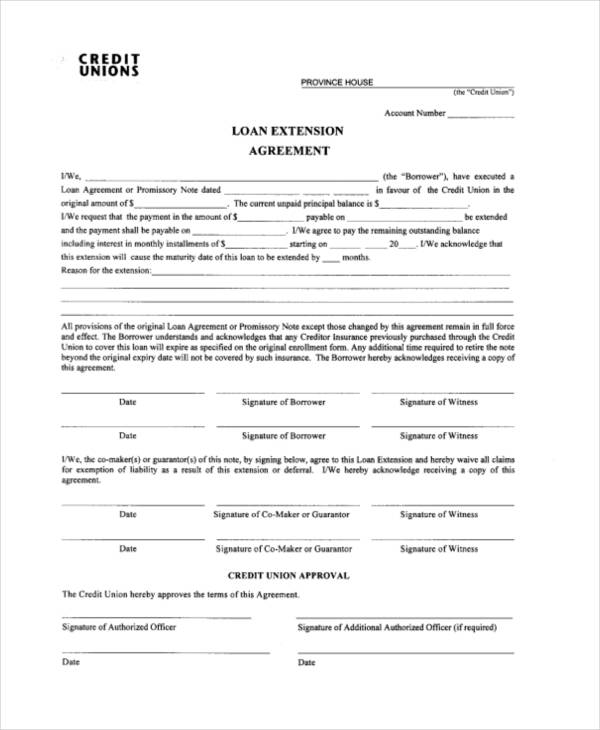

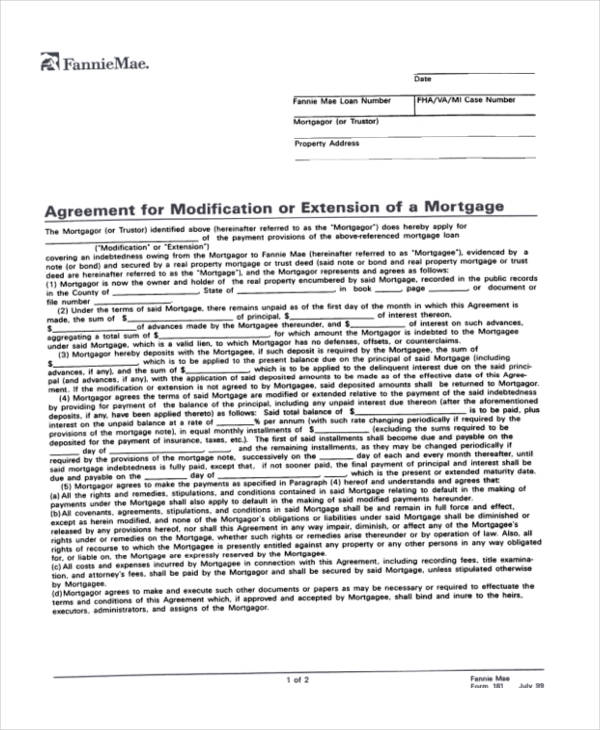

Free Loan Extension Agreement Forms

Simple Loan Extension Agreement Form

Mortgage Loan Extension Agreement Form

Construction Loan Extension Agreement Form

Free Legal Loan Agreement Forms

Legal Secured Loan Agreement Form

Legal Personal Loan Agreement Form

Legal Loan Contract Agreement Form

Free Secured Loan Agreement Forms

Secured Personal Loan Agreement Form

Secured Private Loan Agreement Form

Free Standard Loan Agreement Forms

Simple Standard Loan Agreement

Standard Business Loan Agreement

Free Employee Loan Agreement Forms

Employee Car Loan Agreement Form

Employee Personal Loan Agreement Form

How Long Does a Loan Contract Last?

The duration length of loan agreements can be different from one another. Usually, this duration can be based on the amortization schedule that should be honored within the transaction. The first thing that should be done to know the loan contract duration is to identify the final amount of money that a lender can provide a borrower with. After this, accurate computation of monthly payments should be made with the help of an amortization table. Interest amount will then be added on the payments that must be given by the borrower on a monthly basis.

If you are a borrower, try to pay the amount that you have borrowed at a faster time. This will cost you a lesser amount of money to shell out for your debt as the application of interest rates also consider the length of time that you can give back the entire amount specified in the loan contract.

However, you need to be careful with certain loan terms and conditions because while the goal of paying back a loan swiftly sounds like the best plausible way to get out of debt fast, some loan agreements have set an early pre-payment fee for borrowers. These types of conditions are often found in automobile or mortgage subprime loans as well as in refinancing a home or an auto loan. The application of pre-payment fees is a way used by banks to ensure that a specific time duration is set for the loan to be returned. This pre-payment fee can range from two to three percent of the loan’s amount. Hence, it can even equate to an interest payment good for six months. With that percentage amount of money, federal law actually does not allow FHA loans to be charged with pre-payment fees. However, this can be changed if the loan agreement specifically contains a clause for due-on-sale that has been presented in the mortgage.

What Happens during a Payment Default?

To put it straight, potential legal charges can be faced by the borrower if a payment default will occur. Payment default is technically the late payment of loans. This is considered as an act of dishonoring the contract as there are already set dates for payment that has been specified at the start of the loan agreement. Litigation in court can be pushed through if the lender decides to do so. A borrower, on the other hand and if proven guilty, should be accountable for the entire amount used for damage liquidation. In the case of a secured loan, the properties and/or assets of a borrower may be seized as well so they can help in covering the loan repayment.

What Is Mandatory Arbitration?

In the entire duration of a loan agreement, it is very possible for the lender and borrower to have misunderstandings especially if conditions of the loan agreement are unmet. A mandatory arbitration comes into place if the lender and the borrower decides to address or resolve an issue with an arbitrator rather than send it to court. Legal disputes are very important to be looked and worked at as the rights of any party should be protected.

Most lending businesses provide a mandatory arbitration clause within a loan agreement. This helps them to cut back on cost if there are legal disputes that are needed to be resolved. With this, it is typically the lenders that are favored by the usage of this clause.

Lending money to others requires a huge leap of faith while borrowing money requires huge financial dedication. It is essential to have a loan agreement so that borrowers are not being charged with outrageously high interest rates and that lenders are ensured that they will be repaid for the money that they have lent. A foolproof loan agreement contract is essential in making sure that miscommunication and misunderstandings do not get in the way of a smooth lending transaction. You can download our Loan Agreement Forms, Business Contracts, Agreement Forms, and Purchase Agreement Forms to help you save on time and money.

Related Posts

-

FREE 8+ Student Loan Agreement Forms in PDF | MS Word

-

FREE 34+ Loan Agreement Forms in PDF | MS Word

-

Personal Loan Agreement Form

-

FREE 8+ Sample Loan Agreement Forms in PDF | MS Word

-

Employee Loan Agreement

-

FREE 7+ Sample Loan Agreement Forms in PDF | MS Word

-

FREE 7+ Sample Personal Loan Agreements in PDF | MS Word

-

FREE 5+ Rent a Room Agreement Forms in PDF | MS Word

-

FREE 5+ Commercial Sublease Agreement Forms in PDF | MS Word

-

FREE 7+ Garage (Parking) Rental Agreement Forms in PDF | MS Word

-

FREE 7+ Office Lease Agreement Forms in PDF | MS Word

-

FREE 4+ Salon Booth Rental Agreement Forms in PDF | MS Word

-

FREE 5+ Roommate Rental Agreement Forms in PDF | MS Word

-

Electrical Subcontractor Agreement Form

-

FREE 5+ Construction Subcontractor Agreement Forms in PDF | MS Word