A person’s credit report provides a detailed summary of his credit history. Credit bureaus collect information and create credit reports based on the person’s credit history. Because a credit report provides information on a person’s credit history, there are certain companies or business organizations that pull a copy of a person’s credit report to determine their credit worthiness or credit rating.

For this to be possible, the person would first have to authorize such an act using Credit Report Authorization Forms. Aside from these forms, you may also see our other Authorization Forms for other transactions that you would need to authorize, such as credit card transactions.

Credit Report Authorization Form

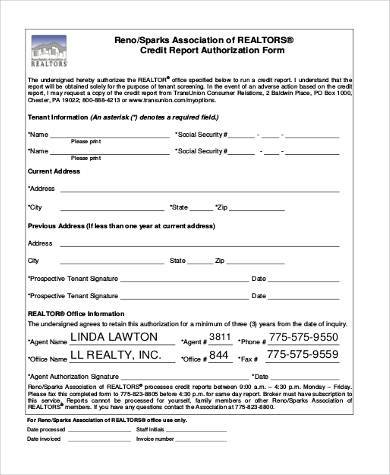

Tenant Credit Report Authorization Form

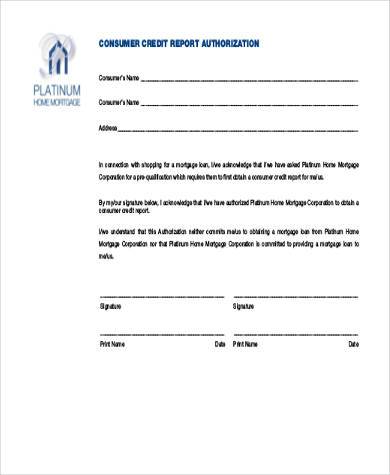

Consumer Credit Report Authorization Form

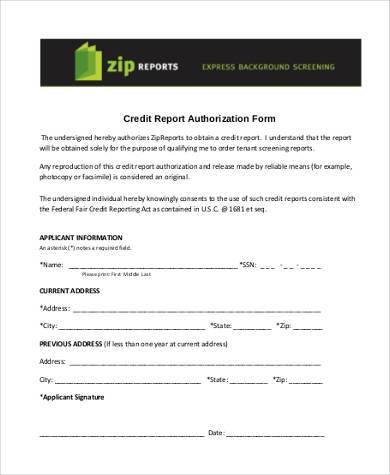

Generic Credit Report Authorization Form

Blank Credit Report Authorization Form

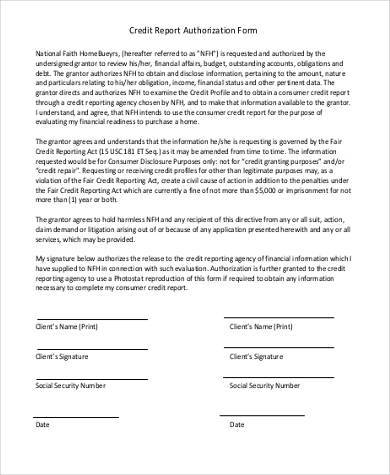

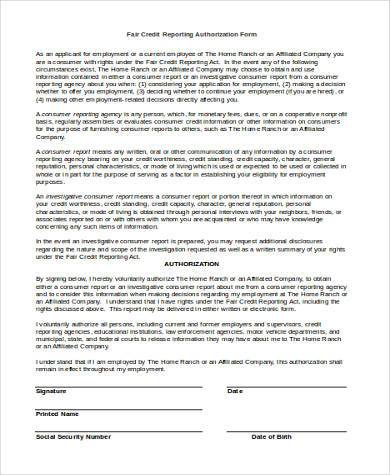

Fair Credit Reporting Authorization Form

Target Audience of Credit Report Authorization Forms

- Banks, lending companies, and other financial institutions use Credit Report Authorization Forms to be filled out by applicants who want to apply for a loan, mortgage, or credit card. Even if there is a security deposit or collateral involved, it can still be quite risky to approve someone’s application for a loan or mortgage. Financial institutions have to thoroughly check the background of the applicant, and that includes checking the applicant’s credit history as outlined on a credit report. They have to make sure that they do not give approvals for applicants with a bad or low credit rating.

- Landlords or owners of leased properties, whether commercial or residential, may also use Credit Report Authorization Forms so that they can pull a copy of the credit report of a potential tenant. They can use a credit report as basis on whether they will rent the property to the potential tenant.

- There are also employers who check an applicant’s credit report as part of the application process. They may use an applicant’s credit report to see how responsible and financially stable he is. Aside from Credit Report Authorization Form, there are also Credit Card Authorization Forms for authorizing credit card payments.

Credit Report Disclosure Authorization Form

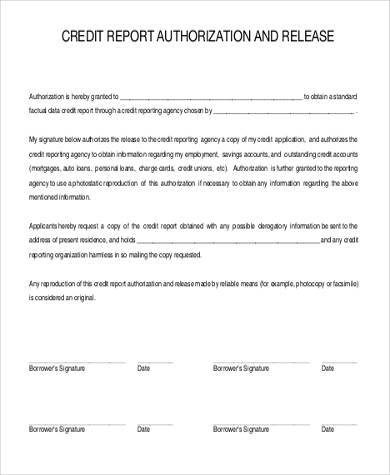

Credit Report Authorization & Release Form

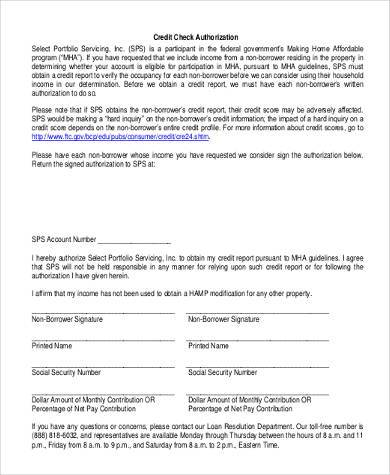

Credit Report Check Authorization Form

Credit Report Authorization Form in PDF

Information on Credit Report Authorization Forms

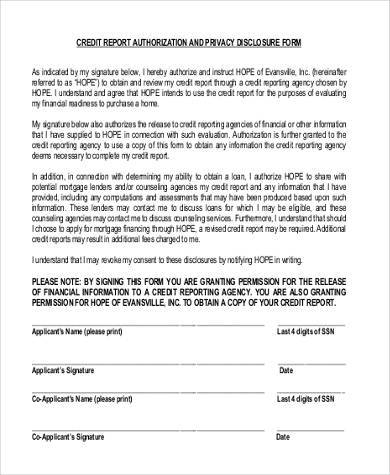

The Fair Credit Reporting Act protects an individual’s rights to the privacy of his consumer report or credit report contained in the files of the different credit reporting bureaus, such as Equifax, TransUnion, and Experian. Because of this, it is unlawful for another entity to access someone’s credit report without first having their permission. It is also by this same concept that HIPAA Authorization Forms are used. But instead of the Fair Credit Reporting Act, HIPAA Authorization Forms are used to be filled out by patients in compliance with the Health Insurance Portability and Accountability Act or HIPAA. For Credit Report Authorization Forms, the following are the information required:

- Applicant’s information: This includes the applicant’s name and address. Some companies may also require the applicant’s Social Security number.

- Authorization statement: There should also be an explicit statement of the authorization by the applicant for the company to pull a copy of his credit report and that in doing so, they are not violating his right to privacy. In this statement, the purpose of the credit report can also be indicated.

- Applicant’s signature: This is to make the form official. This has to be affixed with the applicant’s name and the current date.

Related Posts

-

FREE 8+ Sample Third Party Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Pre Authorization Forms in PDF | Excel

-

FREE 7+ Sample Parental Authorization Forms in PDF | MS Word

-

FREE 9+ Sample Authorization Release Forms in PDF | MS Word

-

FREE 9+ Sample Authorization Request Forms in PDF | MS Word | Excel

-

FREE 8+ Employment Authorization Forms & Samples in PDF | MS Word

-

FREE 9+ Sample Travel Authorization Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Tricare Authorization Forms in PDF | MS Word

-

FREE 8+ Direct Deposit Authorization Forms & Samples in PDF | MS Word

-

FREE 10+ Sample Credit Authorization Forms in PDF | MS Word | Excel

-

FREE 10+ Sample Work Authorization Forms in MS Word | PDF | Excel

-

FREE 8+ Sample Travel Authorization Forms in PDF | MS Word | Excel

-

Credit Card Authorization Form

-

Overtime Authorization Form

-

FREE 11+ Bank Authorization Forms in PDF | MS Word