- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

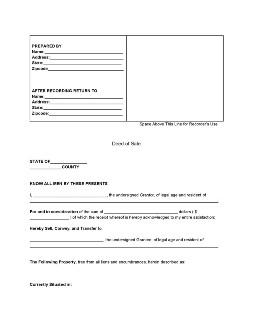

Deed of Sale

From selling houses and other types of property, a simple record of a real estate transaction wouldn’t count as proof of ownership. Such conveyance and transfer of property must be executed correctly in a deed of sale. However, there’s more than one way of how you can close a real estate deal using this instrument. Read on in this article and find out more. Read More

What Is a Deed of Sale?

A deed of sale formalizes the conveyance and transfer of ownership of a real estate property from one party to another—the Grantor and Grantee. This instrument certifies that the Grantor has full disposal of the property, as well as guarantees that the property is free from any liens and encumbrances. Moreover, this instrument also certifies the legitimacy and legality of the conveyance of the property and the transfer of its ownership to the Grantee.

How to Prepare a Deed of Sale

Deeds of sale are written and executed after concluding or closing a real estate transaction. You do this mainly to certify the Grantor’s right to dispose of the property and the legality of its transfer to the Grantee. Now, if you need to transfer your property’s ownership to your buyer officially, here’s how you can prepare a deed of sale for that purpose.

1. Choose The Best Type of Deed to Use

As mentioned, there are two ways in which you can transfer the ownership of a property. One of them involves selling the property, while the other consists of moving without anything in exchange. By determining which transaction is used during the transfer, you can choose the proper deed to prepare and use. Again, you can use a general warranty for a more secure transfer and sale of the property, and you can use a quitclaim deed if its simply transferring and conveying the property to a family member without selling it.

2. Name The Parties of The Transaction

Now that you’ve chosen the proper deed to write and use, the next step is to begin writing it. To do so, you must name and identify the parties involved in the transaction along with their names and addresses. And in this document, the parties are the Grantor and the Grantee—the seller and the buyer, respectively. Additionally, you must also state the Grantor’s relationship with the Grantee if writing a quitclaim deed.

3. Describe The Property

Deeds of sale are put into public record right after its execution, so you need to describe the property when writing a deed of sale entirely. A full description of the property includes the type of property sold, its location, and its other specifications and particulars. You may also include its fixtures, fittings, and inclusion if you need to do so.

4. Include The Covenants Affecting the Property

Since real properties are subject to specific rules and regulations, there are some things that the new owner can or cannot do with the property. So you must include the covenants that affect your property in your deed of sale. These covenants can either be building restrictions set by your local building code or some rules set by the homeowner’s association. It’s better to check on these as well first, before writing a deed for your property.

5. Sign and Close the Property Transfer

Once you get everything ready for the preparation of the property, the last thing to do is to sign and close the transfer. You must do this by signing in front of a notary public and several witnesses. However, signing requirements for deeds of sale may vary from state to state, so better check on them first before writing a deed of sale.

Frequently Asked Questions

Who prepares a deed of sale?

The Grantor, otherwise known as the seller, is the party that prepares a deed of sale for the property that he sold. However, he can also have his real estate agent or attorney prepare a deed of sale for him as well.

How is a deed of sale different from a real estate bill of sale?

Both documents legally record the sale and transfer of real property between two parties. However, unlike a real estate bill of sale, a deed of sale includes the covenants that affect the Grantee’s use of the sold property.

What are the other types of deeds aside from a general warranty and quitclaim?

Aside from a quitclaim and general warranty, there other types of deeds that you can use in transferring and conveying the ownership of a property. These includes:

- Deed of Trust

- Mortgage Deed

- Bargain and Sale Deed

- Special Warranty Deed

- Grant Deed

- Fiduciary Deed

Why do we need to use a deed of sale for a property transfer?

Having a deed is a primary requirement for acquiring a title for a property under the Grantee’s name. Without it, the ownership of the purchased property remains to the Grantor. Not only that. A deed of sale also protects you from any future claims against the estate by transferring your rights on to its new owner.

Written laws and procedures govern ownership and disposal of real property. In that effect, anything that revolves around a property’s possession and transfer must be stamped on paper. And regardless of how they’re acquired and conveyed, a real property’s lifecycle begins and ends with a deed of sale.