- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

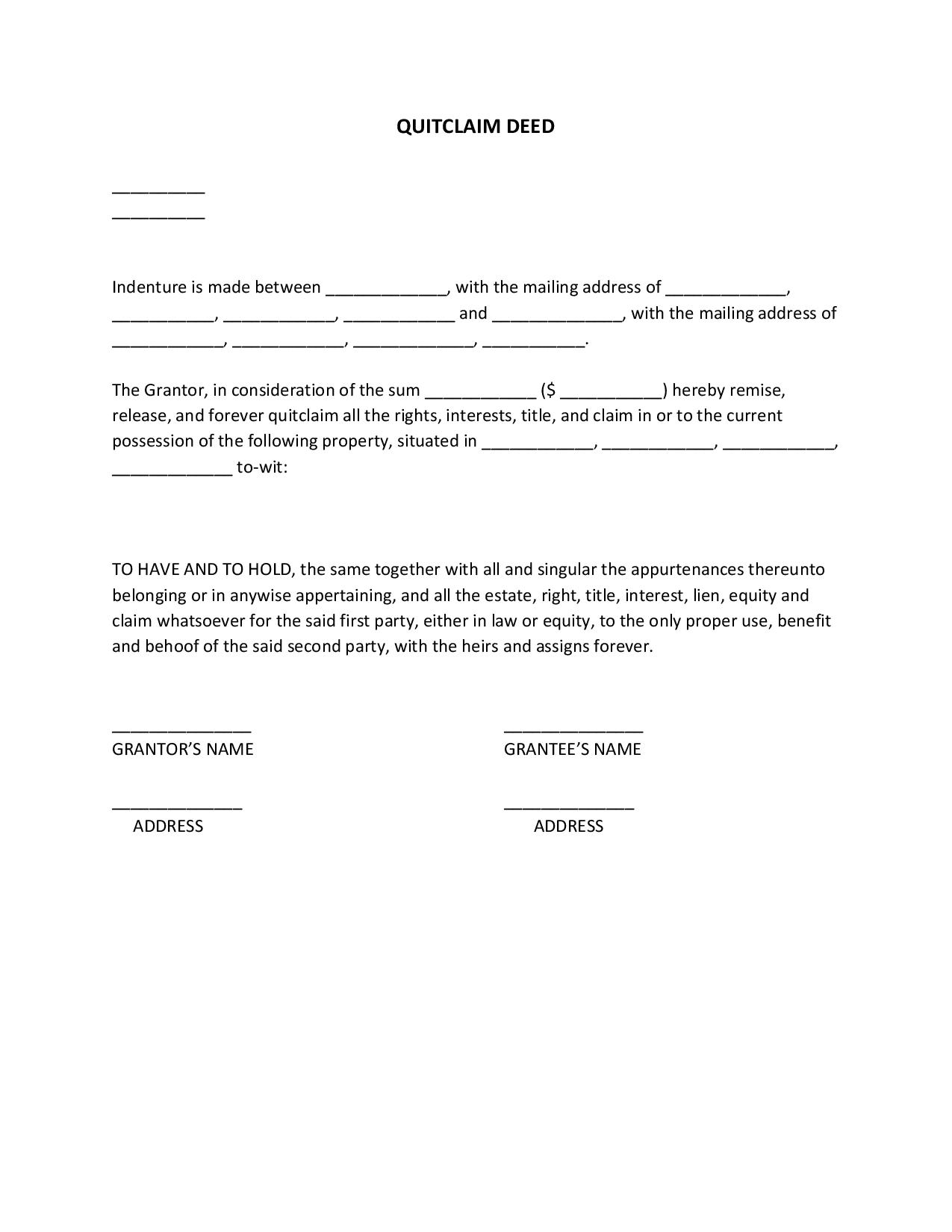

Quitclaim Deed

Real properties need to be backed up by papers that show the legal ownership of an individual. When the guarantor, or the original owner, decides to transfer the property to a guarantee for any reason, a quitclaim deed form is your perfect instrument. A quitclaim deed form allows an inexpensive yet seamless transfer from the grantor to the grantee. Divorce and transfer from the parent to child are among the main reasons for the said transfer. If you want a more extensive background about this type of deed, read further. Read More

What Is a Quitclaim Deed?

A quitclaim deed is a legally binding document that transfers ownership of land or home from a Grantor to a Grantee. The Grantor is the current owner of the property while the Grantee is the person being transferred to. Compared to a General Warranty Deed or a Special/Limited Warranty Deed, this type of deed is less secure. Therefore, making it legible for a family-to-family transfer only of land or home. What makes it less secure is the absence of warranties and/or promises regarding the title’s quality. Furthermore, in some cases where the property is given as a gift or transferred from family-to-family, no money is involved.

How to Create a Quitclaim Deed

A quitclaim deed can be made within the comforts of your own home. Read the tips below to help you make one:

1. Secure the Appropriate Template

It’s much easier to create a quitclaim deed if you have a sample template as a basis. It saves you time and there is less hassle during the process. Fill out the form accordingly and make sure it corresponds with your state’s requirements. You no longer have to spend your precious time making the deed from scratch because everything’s here. You may also modify the template if you think it needs more specification.

2. Specify the Details of the Property

This section will include the legal description of the property and its exact location. These can be found in the current deed or in your local county’s office. Assuming that money is involved, including the price of the property. State that you have transferred all interests of the property to the grantee.

3. Sign the Deed with the Witnesses

Once everything has been accounted for, sign the deed form with the guarantee and at least two witnesses. The deed form cannot be executed without the signatures of the parties involved and the witnesses. They should be dated signatures with the names of both parties and witnesses.

4. Notarize the Deed

Notarize the deed form even if your state does not require you to. A notary public’s acknowledgment provides an additional layer of validity and enforceability. Prepare to pay a notary fee after the notarization.

5. Look Up the Specific Process and the State Requirements

A state’s deed process and requirements vary. For example, in the state of New York, you have to file a Form TP-584 and pay nominal fees for it, a general recording fee, and other additional nominal fees. Meanwhile, in California, you have to file a Notice of Exempt Transaction of Document of Transfer Tax and a Preliminary Change of Ownership Report (Legalzoom). Notice the difference in fees and the required documents? After notarizing the filled out or completed deed form, approach your county clerk’s office to determine the process and state requirements.

Frequently Asked Questions

Should a lawyer process my quitclaim deed form?

Not exactly. You can process your own quitclaim deed form by downloading and using a template online. These templates differ from state to state. So, look up state-appropriate forms so it is catered to your state’s laws. However, you are free to consult your lawyer if you are more comfortable that way. Consulting a lawyer also foolproofs your deed form.

Who should sign the quitclaim deed form?

According to Home Guides, a quitclaim deed form implies that the grantor is “quitting” their “claim” over the property. Therefore, aside from the grantee signing the deed form, the grantor must also sign the document. Aside from the signatures of both parties, at least two witnesses must also sign the deed form.

How long should a quitclaim deed last?

According to Home Guides, the quitclaim deed form can be contested after two years since its filing. If either party has disputes regarding the durability of the deed form, they can do so during this period. Once the statute limitations take effect, they can no longer be allowed to raise disputes. For example, in the state of California, the statute limitation is five years. Any disputes shall be motivated by undue duress or procedural error.

Is there a benefit that comes with a quitclaim deed?

Yes. One benefit of this type of deed is the tax function. The price in the deed form will be used as a basis for the tax computation. If the property is transferred from family to family, aka no money involved, then the property is considered as a gift.

Can a parent quitclaim a property to their children?

Yes. According to Home Guides, in cases where the property is to be inherited by the child, the parent can use a quitclaim deed form. But the federal government imposes a gift tax on gifts exceeding a particular amount, and quitclaim-deed homes are no exception.

Owning a property is more than just stating that you own it. It will need to be backed up by some documents that will prove coincide with what you state. A quitclaim deed is one of these documents. A quitclaim deed will be used for taxes, encumbrances, and liens. In case something goes wrong in the future, this document will be your evidence that indeed the property has been rightfully transferred. Because in the court of law, verbal claims just don’t cut it. You have to have substantial evidence to prove that you are in the right. Think of this as an arsenal in a future dispute. Be safe in advance and secure yourself a completed quitclaim deed form.