- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

Bill of Sale (Purchase Agreement)

Trade is a basic economic concept that we engage with every day. Trade involves the selling and buying of goods and services partnered with its compensation, ranging from necessities to splurges. Even the littlest and most insignificant trade deals help turn the gears of a nation’s economy. With these transactions, a record is necessary to keep track of the exchange of ownership, especially among business assets. A bill of sale or purchase agreements is a key tool that officially records the deal. Read More

By State

By Type

- Airplane Bill of Sale

- Puppy Bill of Sale

- Camper Bill of Sale

- Printable Bill of Sale Form

- RV Bill of Sale

- Mobile Home Bill of Sale Form

- Fillable Bill of Sale

- Sample Bill of Sale

- Used Car Bill of Sale

- Equipment Bill of Sale

- Dirt Bike Bill of Sale

- Horse/Equine Bill of Sale

- Trailer Bill of Sale

- Car Bill of Sale

- General Bill of Sale

- All-Terrain Vehicle (ATV) Bill of Sale

- Home/Property Bill of Sale

- Online/Craigslist Bill of Sale

- Truck Bill of Sale

- Basic Bill of Sale

- Auto Bill of Sale

- Real Estate Bill of Sale

- Bicycle Bill of Sale Form

- Boat Bill of Sale

- Motor Vehicle Bill of Sale

- Aircraft Bill of Sale

Bill of Sale (Purchase Agreement)

What Is a Bill of Sale (Purchase Agreement)?

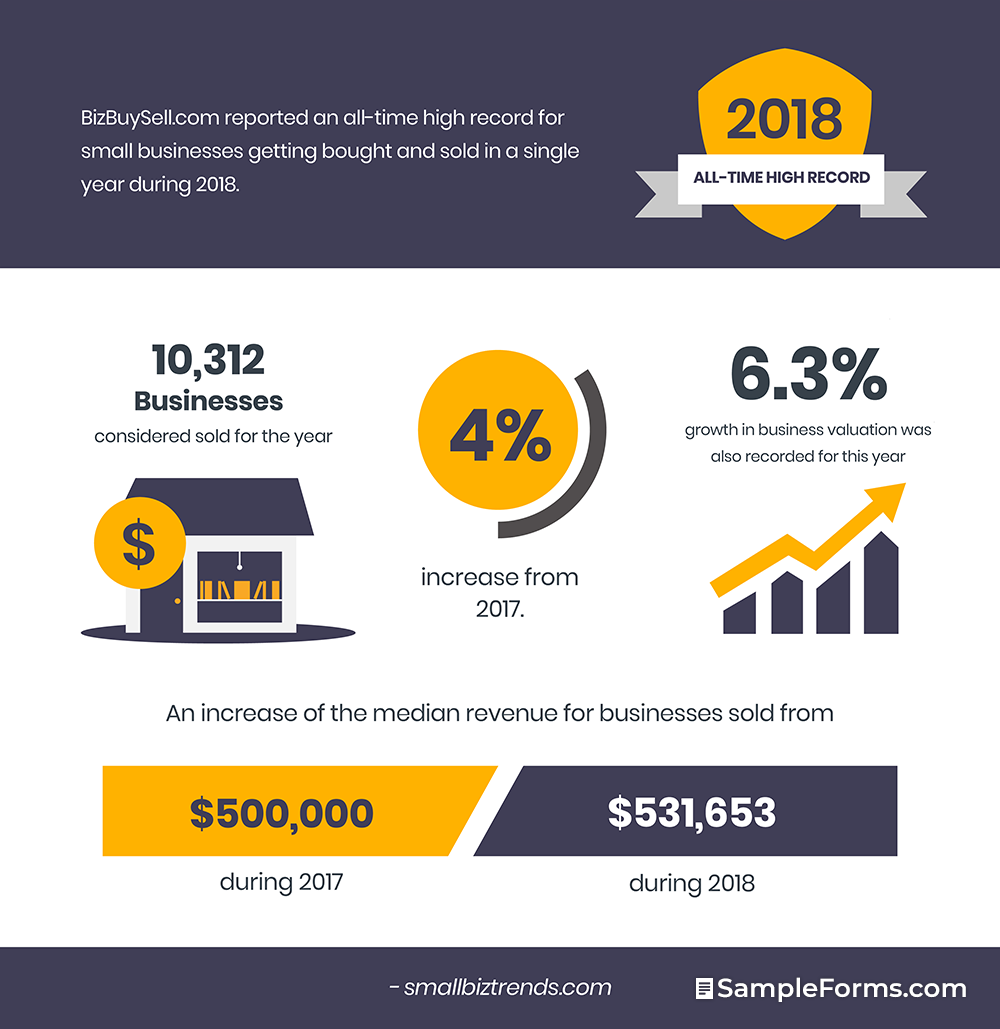

An article in smallbiztrends cited a BizBuySell.com report of an all-time high record for small businesses getting bought and sold in a single year during 2018. There were 10, 312 businesses considered sold for the year, which is a 4% increase from 2017. A 6.3% growth in business valuation shows an increase in the median revenue for businesses sold from $5000, 000 during 2017 to $531,653 in 2018.

When a business decides to purchase another entity or property, such as storage warehouses, the deal cannot only be a verbal format. The transaction needs to be in writing. This written document is the business bill of sale or more commonly termed as purchase agreements.

How to Create a Bill of Sale (Purchase Agreement)?

Considering the nature of a business’s bill of sale, we can assume that this document is essential for any industry. Moreover, there are broad scenarios where you’ll need a general bill of sale in your business transactions. These are especially helpful when you need to trace payment and receipt of items purchased and paid for, thus serving as standard documentation for sale transactions across many, if not all, industries. Find out how you can create your bill of sale form by reading on the steps listed below:

Step 1: Know the Existing Parties

Any agreement, in itself, presents the conditions of the transaction. The responsibilities of both parties are in the document. In the business bill of sale, the introductory paragraph introduces the parties involved. It assigns the role for each one, either as the seller or as the buyer. Aside from the names, the addresses of the parties are also indicated for further recognition. You can opt to add other identification details in this paragraph.

Step 2: Determine the Specifics of the Property

The next element that this document introduces is the property that was for sale. It explicitly states the defining factors of the property. Say, for example, the buyer acquires an office space from a particular seller. This part of the bill of sale will state the name of the property, address, and current condition. Other than these details, make sure to include the agreed selling price.

3: Settle the Payment Arrangement

After the elements mentioned above, the details of the payment arrangement comes next. This section of the agreement is, most likely, the part that needs to be checked before finalizing the material. The payment arrangement includes the reiteration of the total selling price, the percentage for the down payment amount, and the conditions of the payments. A pro-tip tells us to be careful with the wording with the payment arrangement.

Step 4: Acknowledge the Transfer of Ownership

The last part of the document presents that both sides acknowledge the transfer of ownership before an attorney. Although this step is not necessary to all federal states, the majority of them still require a bill of sale to be notarized to be enforceable.

FAQs

Do both parties need a copy of the bill of sale?

For most cases, both parties need to sign the document, but there are times when only the buyer is required to affix their signature. In this manner, the buyer should have a copy of the bill of sale.

Is there a need to notarize the bill of sale?

The majority of the states stipulate that notaries are optional. Thus, for these states, a bill of sale is legal and enforceable without the signature of a notary public. But, as for Maryland, Louisiana, Nebraska, New Hampshire, Montana, and West Virginia, a notary public needs to affix their signature on the document to make it legal.

What is the difference between a bill of sale and a title?

The title is the legal proof of ownership. On the other hand, the bill of sale finalizes the transaction between the parties. It merely acknowledges the transfer of ownership but does not legalize it. If you simply present the bill of sale as proof of purchase, the other party or the law may not honor it.

What is the difference between a bill of sale and an invoice?

The confusion of distinguishing a bill of sale from an invoice or receipt is understandable because parties usually present both after the transaction. However, the details in an invoice only include the list of what is owed and when to receive the payment. The bill of sale has additional detail that acknowledges the transfer of the good’s ownership.

Is a Bill of Sale legally binding?

Even if a business bill of sale is not a contract, it is still legally binding. It is binding in a sense that it ensures that both parties are of sane minds when making the decisions within the document.

Bills of sale are one of the most effective tools that record business transactions. They acknowledge the transfer of ownership from one party to another. This movement turns the cycle of a nation’s economy. As current issues add to the dynamic nature of the economy, it rises to the need for well-written bills of sale to document these receipts and transfers of ownership so, as your company takes the role of either a seller or buyer, business bills of sale play a significant role in your business dealings.