- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

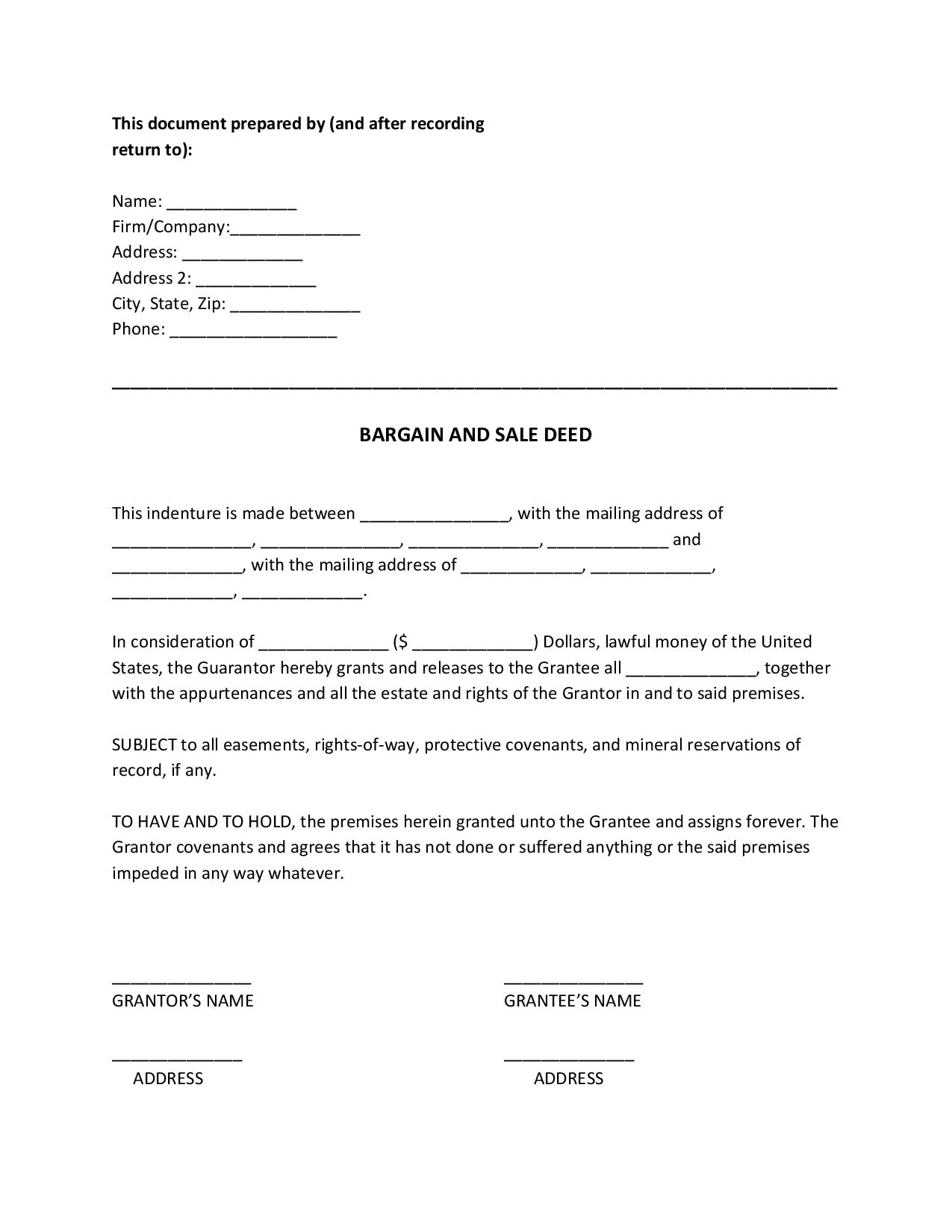

Bargain and Sale Deed

A parcel of land or a building is both a good long-term investment. Since they’re both real properties, they require a legal document that shows the interests having been transferred to the new owner. If the property is or was involved in a tax sale, foreclosure, a court seizure, or a deceased person’s estate settlement, you need a bargain and sale deed. This deed form contains all the relevant information regarding the transaction between a grantor and a grantee. Learn more about the background of this type of deed by reading the article. Read More

What Is a Bargain and Sale Deed?

A bargain and sale deed is a legal instrument used to transfer property from the grantor to a grantee, pursuant to a tax sale, foreclosure, a court seizure, or a deceased person’s estate settlement. A bargain and sale deed can either be with covenants or without. The former provides protection to the grantee that the grantor has title of the property, and has the right to sell it. Meanwhile, the latter does not provide any warranties that the property is free from claims nor the title is free of defects. A bargain and sale deed with covenants is similar to a grant deed.

How to Create a Bargain and Sale Deed?

Making a bargain and sale deed doesn’t have to complicated. Read and apply our tips below:

1. Identify the Grantor and Grantee

Deed forms always start with the introduction of both parties. Since the property has been confiscated by a third party due to the aforementioned reasons, the grantor is either a bank or a taxing authority. Identify the grantor and the grantee along with your mailing addresses. Use complete and legal names only.

2. Detail the Property’s Legal Description and Amount

The property’s legal description includes its whereabouts, inclusions, and limitations. The legal description helps both parties determine what property is involved in the transaction. This can be found in the property tax records or in the deed. Also, include the price that was issued by the grantee to the grantor, both in words and in figures.

3. Be Transparent About Absent Warranties and Titles

It’s common knowledge that this type of deed form does not offer a warranty to the grantee. Therefore exposing the grantee to heightened risks when it comes to claims. This is a worry-free sale on your end because of the lack of liability. Ensure that they are aware of the risks before signing the document.

4. Sign the Document and Notarize

This deed cannot be executed without the signatures of both parties. Once you have arrived at an understanding, sign the document. Dated signatures are extremely crucial because they will be used to backtrack in case of legal disputes in the future. Depending on state laws, you should notarize the deed for additional enforcement. Sign the document in the presence of the notary public and witnesses.

5. If All Else Fails, Consult a Real Estate Lawyer

It’s understandable if you are having qualms about this deed. Don’t be hesitant to approach and consult a real estate lawyer if there are any stipulations that need to be cleared from confusion. A real estate lawyer will ensure that you are indeed not answerable to any claims or title defects in the future. Also, a lawyer ensures that the whole deed is compliant with the real estate laws of your state. That way, you are more comfortable transacting with the grantee.

Frequently Asked Questions

What is the difference between a quitclaim deed and a bargain and sale deed?

According to This Matter, A quitclaim deed implies that the grantor has a previous interest in the property. This interest refers to the fact that the property was inherited from a family member. The grantor does not guarantee the full title of the property. It also carries no warranties. Meanwhile, a bargain and sale deed implies that the grantor holds the title of the property. However, it doesn’t guarantee that the title is free of defects nor the property is free of claims.

What is the difference between a title and a deed?

According to Rocket Lawyer, a title is a legal document that states that you own the property and that you have the full right to use it. Whereas a deed shows the transfer of the property from the current owner (grantor) to the new owner (grantee). A title and a deed must in written form.

What should I include in my bargain and sale deed?

You should include the names of both parties with the full mailing addresses, legal description of the property, the price, signatures of both parties, signatures of witnesses, and the notary acknowledgment.

Can I make the bargain and sale deed myself?

Yes. You can make the bargain and sale deed yourself by making use of templates and samples online. However, you should strive to be on the safe side by consulting a real estate lawyer first before you make it official.

Should I throw my bargain and sale deed away after the transaction?

No. A deed is as important as a title. It serves as evidence that the property has been transferred to a new owner. And you will need it in case someone asks for it. Store it in a closed place that is safe from insects. Don’t throw any legal documents away that pertain to real estate.

From the buyer or grantee’s perspective, you’ll begin to question as to why they would bother to pay for a property that has higher risks. A grantee is only willing to risk that high if they have no choice or if they really need the property that bad. And as a guarantor who has the upper hand in this situation, it is your responsibility to be as transparent as possible of the risks that come with this deed. No matter how lenient the transaction is, there has to be evidence of the transaction. This bargain and sale deed will be the perfect instrument for such transactions.