- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

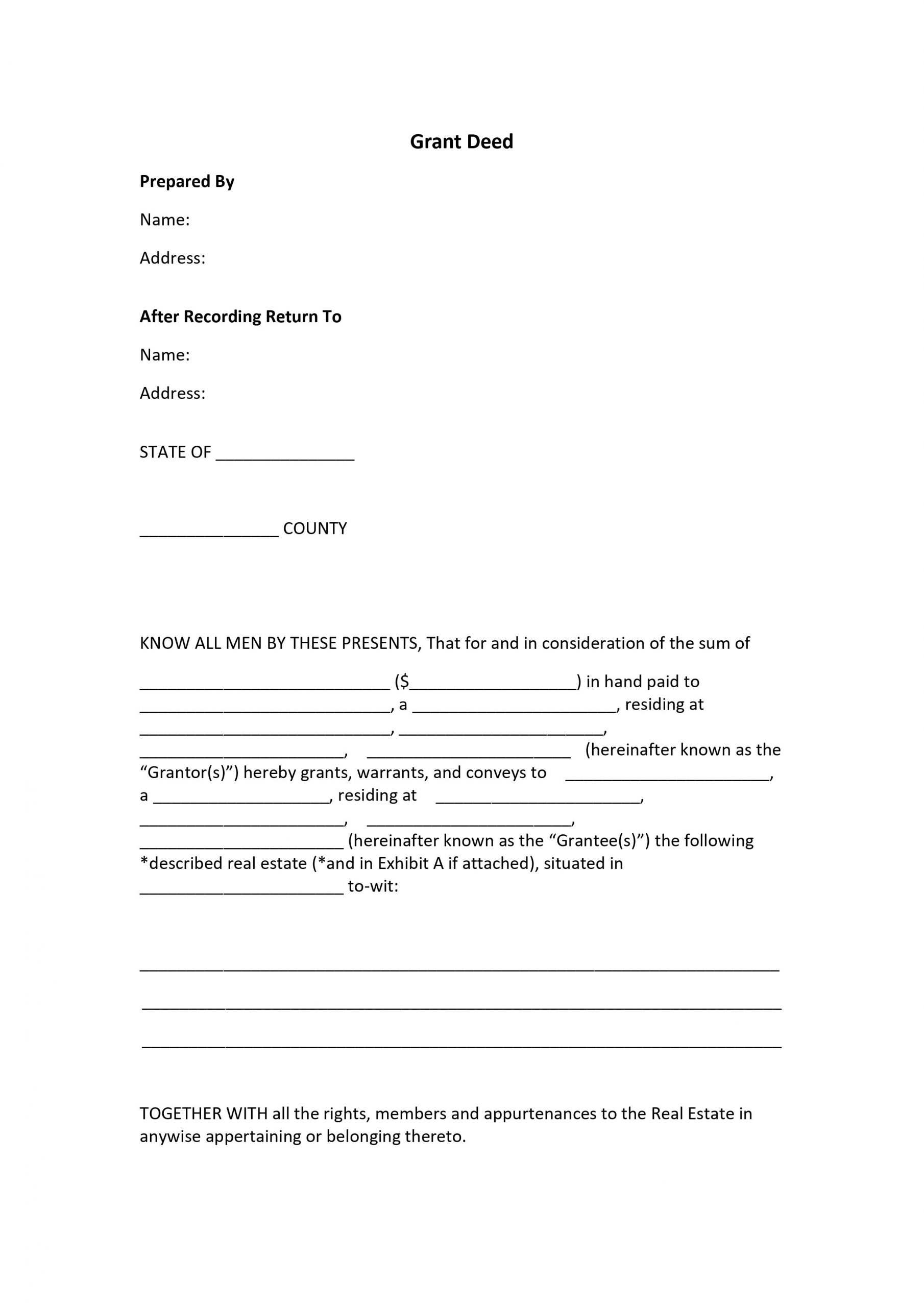

Grant Deed

Purchasing and selling a home takes a lot of processes. The buyer must consult a property agent, look for a home to buy, negotiate a price, secure a loan and insurance, and arrange a home inspection. While all these are crucial, so is the legal process. To ensure the smooth transfer of property from the seller (the grantor) to the buyer (the grantee), a grant deed is used. It’s a legal document that assigns property ownership. Find out more about this form below and how it smoothens every real estate transaction. Read More

What Is a Grant Deed?

A grant deed, also known as a special warranty deed, is a property deed (or property title) with two guarantees: (1) The property is unsold to anyone else; and (2) the property has no undisclosed lien or restrictions. It means that third parties have no legal claims to the property. And, the taxes that might restrict its sale has been settled.

Furthermore, whoever owns the deed, owns the property. Thus, when a grantor sells a property, they should transfer the deed from their name to the buyer. The grant deed settled many disputes related to property ownership. Since the county courthouse records every deed, and anyone has access to these records, you can check the deed owner’s name to support the claim.

How Do You Craft a Grant Deed In Four Easy Steps?

Although the 2007-2009 recession significantly impacted the housing market in the US, it has since recovered. In 2012, the property prices grew and exceeded its value from 2006 since 2016. According to Statista, an average American home costs 385 thousand US dollars. By June 2020, there are 139.64 million housing units in the US; 80.68 million housing units are owner-occupied, and 43.28 million are renter-occupied. Because of the growing demand for real estate properties, grant deed becomes a crucial instrument in this market. Thus, the need to properly create a grant deed form. Below are the steps to help you:

1. Identify the Grantor and the Grantee Clearly

In most cases, a grant deed is used if the parties don’t know each other when they transfer property ownership. That’s why this document should start with the introduction of the grantor and the grantee. Include their complete names and addresses as well as identify their status as seller or buyer. Doing this will clarify both parties’ participation in the transaction. Additionally, it’s best to seek legal advice from a certified real-estate attorney before transferring the property to ensure the document’s validity.

2. Include a Granting Clause to Transfer Ownership

Since a grant deed offers the grantee less protection because it only warrants the defects during the grantor’s ownership, then provide a granting clause or word of conveyance. A granting clause is a statement that conveys the grantee’s official ownership of the property. It indicates the grantee’s rights and what they will receive after signing the document. Then, emphasize legal descriptions to set the boundaries and elaborate on the restrictions of the deed. You can even include a termination clause in case of violations.

3. Identify the Payment Arrangement and the Property’s Description

After laying out the parties’ information and indicating the granting clause, the grant deed should also identify the payment arrangement. Include the essential details like the principal amount and interest. Also, state the effective date and execution date if necessary. These details are crucial in calculating the buyer’s monthly dues. Moreover, the parties should be aware of the property’s upkeep regulations and insurance because it may add to the payable.

Next, write a full description of the property, such as lot number, tract number, city address, and state address. Or attach “Exhibit A” (the real estate agreement) on the grant deed. This is helpful when you arrange a property inspection.

4. Sign and/or Notarize the Grant Deed

Now that everything is set let the grantor and the grantee sign the grant deed. Some states require to notarize the document. If that’s the case, then consult a notary public. Signing a legal document that contains property ownership claims has consequences if breached. Hence, the participating parties must be equally aware of the repercussions of violating the document’s terms and conditions. That why it is imperative to specify the obligations of both parties, too.

Frequently Asked Questions

How do I obtain a grant deed?

You can get a grant deed directly from your state’s county registrar-recorder or county clerk—no need for third party assistance. After the county registrar-recorder records the original grant deed, they will mail it to the homeowner. Therefore, you should have the grant’s deed original copy.

What is the difference between a grant deed and a deed of trust?

A grant deed is a tool used to transfer property ownership from one person to another. It means that the deed comes with certain warranties. On the other hand, a deed of trust is a document given to a lender to secure repayment and other obligations.

Is a grant a contract?

A grant deed is not a contract. Its main purpose is to transfer the property title from a seller to a buyer. Also, the document shows that an individual actually owns the property likewise provides title guarantees to the owner.

The grant deed makes the transfer of property. That said, it must contain certain essential elements to be legally operative. Also, both sellers and buyers should know the different types of deeds because they provide various protection levels. Since deeds are important legal documents, anyone who plans to buy a property should be aware that it is as important as the purchasing and selling process. Without a grant deed, the property you bought won’t be under your ownership.