Navigating the world of financial transactions can be complex, but with the right tools, it becomes a breeze. Our comprehensive guide on Direct Deposit Forms is your key to simplifying the process. From understanding the basics of a Deposit Form to diving deep into the nuances of a Deposit Contract Form, we’ve got you covered. Discover the convenience of direct deposits and how they can enhance your financial management, ensuring secure and efficient payments every time.

Download Direct Deposit Form Bundle

What is Direct Deposit Form?

A Direct Deposit Form is a document provided by a bank or employer to enable the automatic transfer of funds into a bank account. This form is essential for setting up a direct deposit arrangement, where salaries, dividends, or any other payments are electronically transferred from the payer’s account to the payee’s account. It simplifies the payment process, ensuring funds are deposited safely and promptly, without the need for physical checks or manual transfers. The form typically requires the account holder’s bank information, including account number and routing number, to facilitate the transactions.

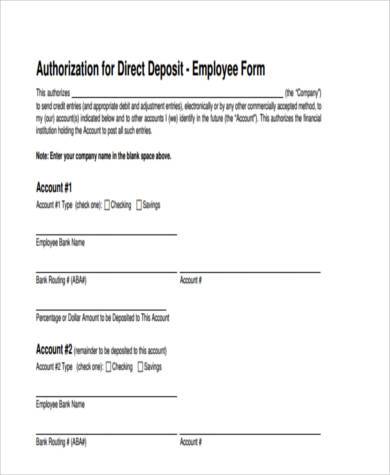

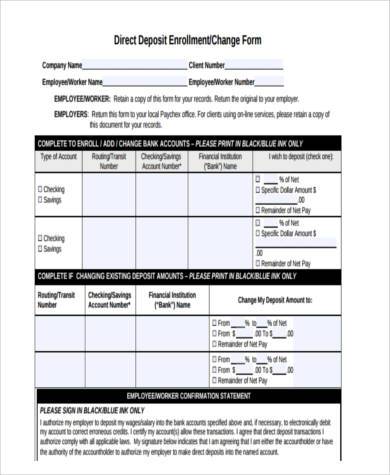

Direct Deposit Form Format

Heading

Instructions

Personal and Employment Details:

- Full Name

- Employee Identification Number

- Employer’s Name

- Employer’s Address

- Contact Information (Phone and Email)

Banking Information:

- Bank Name and Address

- Account Type (Checking or Savings)

- Routing Number

- Account Number

Deposit Preferences:

- Full Deposit or Partial Deposit

- If Partial, specify amount or percentage

Authorization and Consent:

- Signature Line

- Date

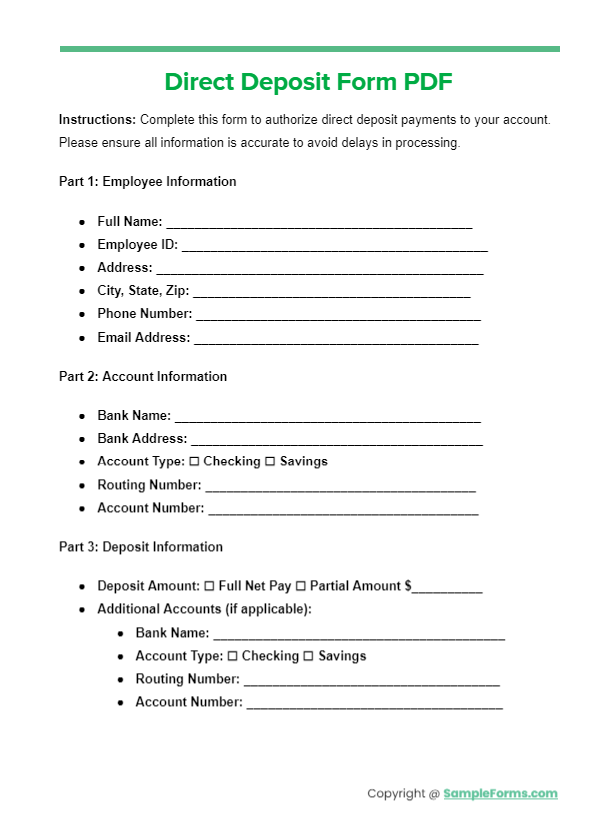

Direct Deposit Form PDF, MS Word, Google Docs

Discover the ease of managing payments with a Direct Deposit Form PDF. Ideal for streamlining Vendor Direct Deposit Form payments, payroll processing, and fund transfers, this form serves as a crucial tool for efficient financial transactions. From Refund Request Form to funding Payroll Direct Deposit Form, it ensures secure and swift transactions.

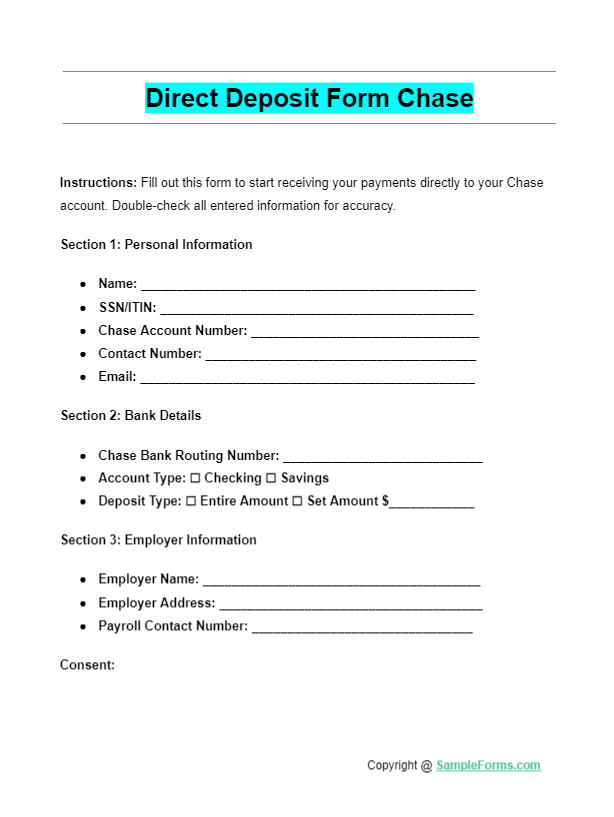

Direct Deposit Form Chase

The Chase Direct Deposit Form simplifies setting up deposits for a variety of needs, from ADP Direct Deposit Form payroll solutions to tenancy agreements. It’s your go-to form for ensuring timely vehicle deposits and managing direct Funding Proposal Form, streamlining your banking with Chase.

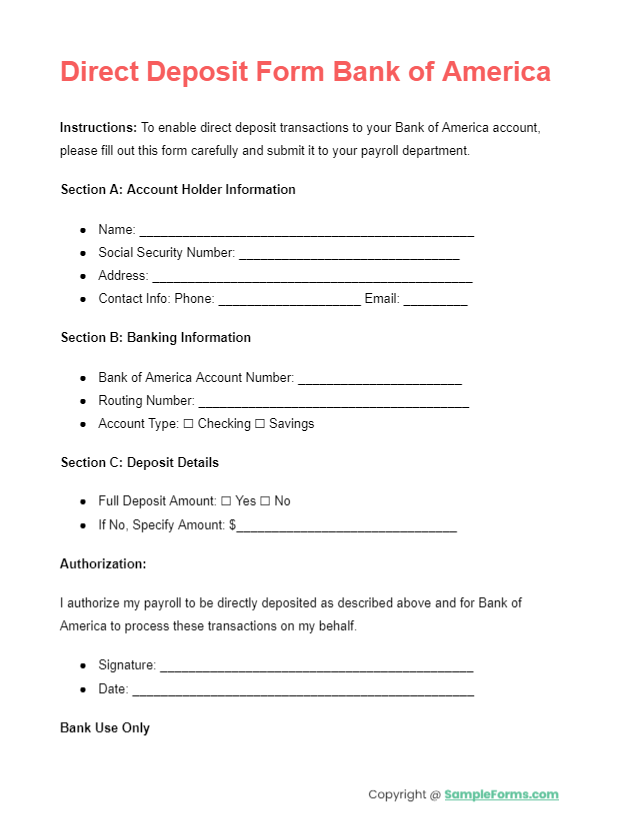

Direct Deposit Form Bank of America

Bank of America’s Direct Deposit Form is designed to cater to diverse financial needs, from vendor payments to ADP payroll processing. It’s an essential tool for efficient fund transfers, including Tenancy Deposit Form and vehicle purchase plans, ensuring seamless financial operations.

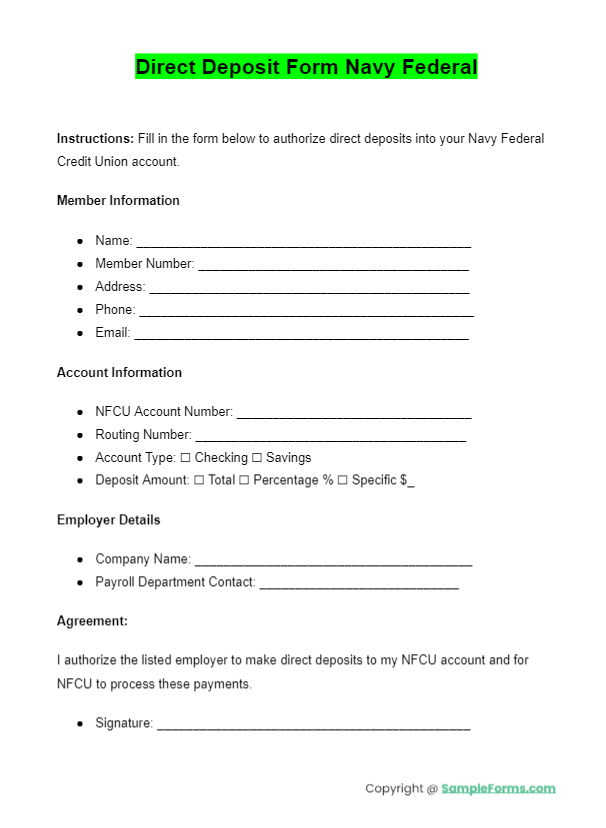

Direct Deposit Form Navy Federal

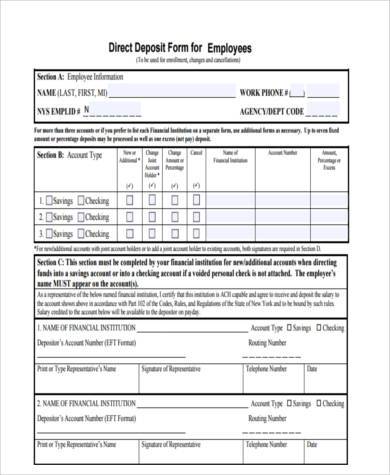

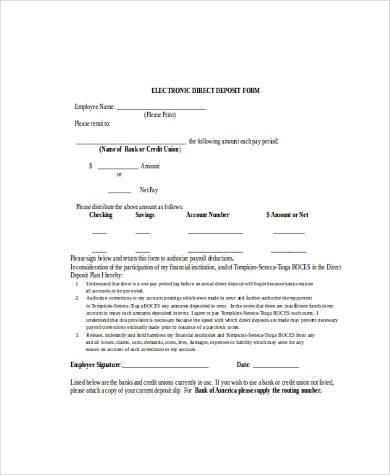

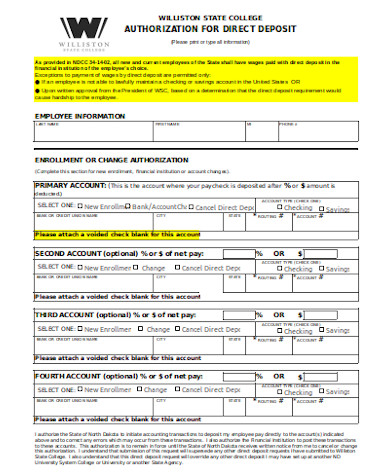

Employee Direct Deposit Form

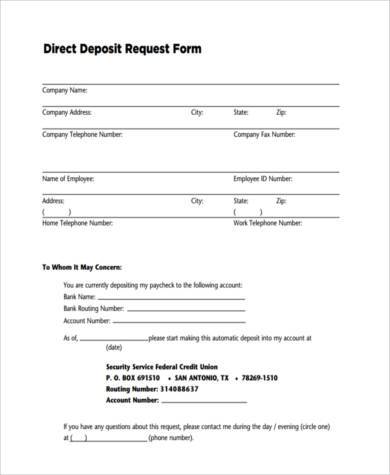

Direct Deposit Request Form

Direct Deposit Authorization Form

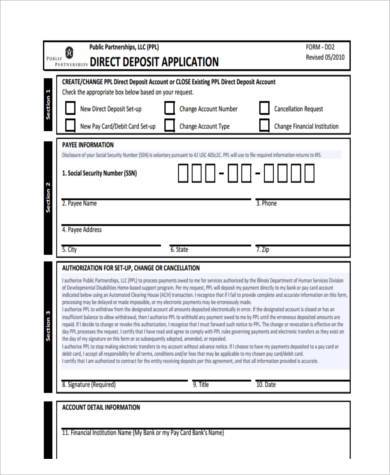

Direct Deposit Application Form

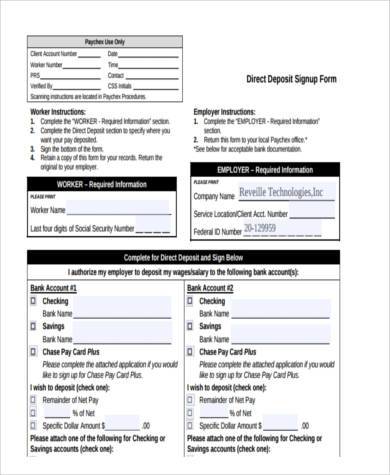

Direct Deposit Signup Form in PDF

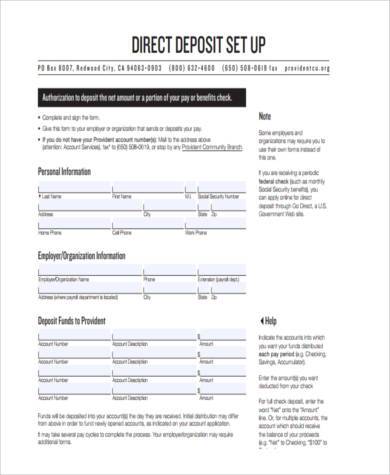

Direct Deposit Setup Form

Direct Deposit Enrollment Form

Direct Deposit Signup Form Example

Direct Deposit Form in Word Format

Printable Employee Direct Deposit Form

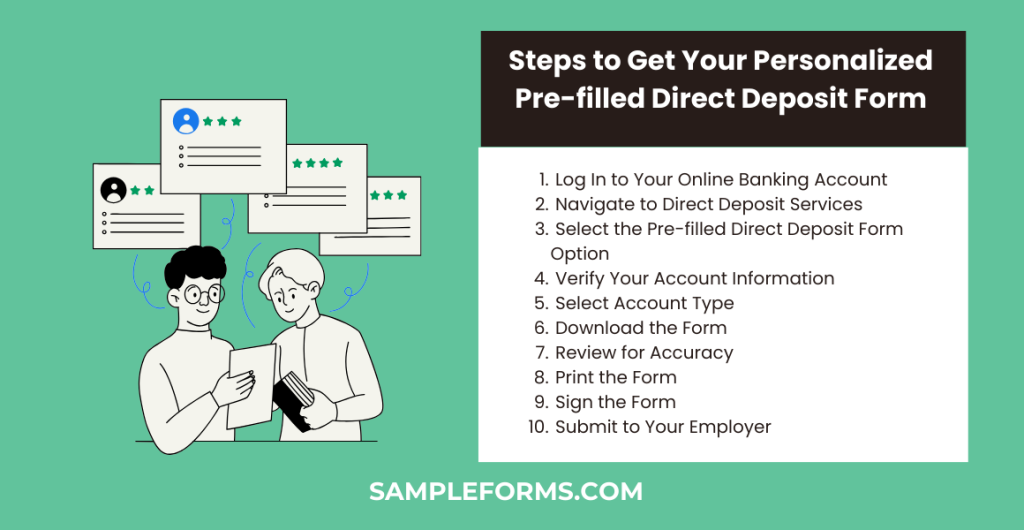

10 Steps to Get Your Personalized Pre-filled Direct Deposit Form

- Log In to Your Online Banking Account: Access your bank’s online platform where your personal accounts are managed.

- Navigate to Direct Deposit Services: Look for the direct deposit section within your online banking portal.

- Select the Pre-filled Direct Deposit Form Option: Choose the option to generate a pre-filled direct deposit form, which will automatically include your account details.

- Verify Your Account Information: Ensure your pre-filled information, such as account number and routing number, is correct.

- Select Account Type: Confirm whether the deposit should go into your checking or savings account.

- Download the Form: Once verified, download the pre-filled direct deposit form.

- Review for Accuracy: Double-check the form for any errors or missing information.

- Print the Form: Print a hard copy of the form if a physical signature or submission is required.

- Sign the Form (if Necessary): Some banks may require a handwritten signature on the form for additional verification.

- Submit to Your Employer: Provide the completed and signed form to your employer’s payroll department to start receiving direct deposits into your account.

What is the Purpose of a Direct Deposit Form?

The purpose of a Direct Deposit Form is multifaceted, serving as a bridge for seamless financial transactions. It is essential for automating payments, from salaries and contractor payments to Fundraiser Order Form. This form facilitates the swift transfer of funds into an individual’s bank account, ensuring the security and efficiency of transactions such as security deposit refunds, rental deposits, and earnest money deposits. By eliminating the need for physical checks, it streamlines the process of receiving payments, making it an indispensable tool in modern financial management. You should also take a look at our Notice of Deposition Form.

What do you Need for a Direct Deposit Form?

To complete a Direct Deposit Form, certain information and documents are crucial. Firstly, you need your bank account details, including the account number and routing number, to facilitate the fund transfer. Additionally, identification documents may be required to verify your identity. For specific transactions like contractor payments or rental deposits, related documents such as a Contractor Payment Form, Payment Application Form, or Rental Deposit Form might be necessary. Ensuring the accuracy of this information is vital for the smooth processing of your direct deposit setup. You should also take a look at our Deposit Agreement Form.

How do I get a Direct Deposit Form?

Obtaining a Direct Deposit Form is a straightforward process that can be approached in several ways:

- Bank or Financial Institution: Visit your bank’s website or physical branch. Most banks, including those Holding Deposit Agreement Form or Security Deposit Refund Form, offer downloadable direct deposit forms online.

- Employer: For payroll purposes, your employer’s HR department can provide you with an ADP Direct Deposit Form or a generic Receipt of Payment Form tailored to their payroll system.

- Government Agencies: For government benefits, the respective agency’s website is a reliable source for downloading the necessary direct deposit forms.

- Real Estate Transactions: For earnest money or holding deposits, the real estate agency or escrow company may provide a specific Earnest Money Deposit Receipt or Holding Deposit Agreement Form. You should also take a look at our Deposit Receipt Form.

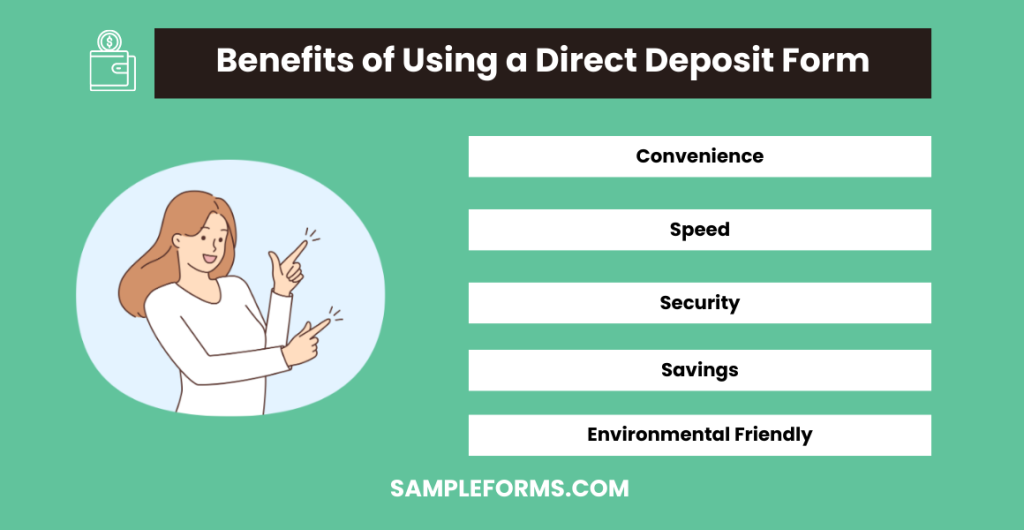

5 Benefits of Using a Direct Deposit Form

- Convenience: Direct deposit automates the payment process, eliminating the need to deposit checks in person.

- Speed: Funds are available faster than traditional check deposits, often accessible the morning of the payday.

- Security: Reduces the risk of lost or stolen checks, ensuring your money goes directly into your account securely.

- Savings: Some banks offer lower fees or other incentives for accounts receiving direct deposits, potentially saving you money.

- Environmental Friendly: Direct deposit reduces the need for paper checks, contributing to environmental conservation efforts.

How do I print a Direct Deposit Form from US Bank?

Access your US Bank online account to print the Direct Deposit Authorization Form, ensuring seamless transactions similar to using a Security Deposit Form.

Can I fill out a Direct Deposit Form Online?

Yes, you can fill out a Direct Deposit Form online, streamlining the process akin to submitting a Cash Payment Receipt Form for immediate transactions.

What is a Direct Deposit Form PDF?

A Direct Deposit Form PDF facilitates electronic payments efficiently, mirroring the precision required in a Credit Report Authorization Form for accurate fund disbursement.

What happens if you don’t have a voided check for Direct Deposit?

Lacking a voided check, utilize a Credit Authorization Form or Direct Deposit Authorization Form, ensuring your account details are securely verified, much like a Credit Report Form.

Can someone else Direct Deposit their Paycheck into My Account?

With proper authorization via a Direct Deposit Authorization Form, akin to the thoroughness in a Business Credit Check Form, another’s paycheck can be deposited into your account.