Your everyday activities might encounter certain misfortunes which you may not see coming, and the best way to prepare yourself for these important matters is to obtain an Insurance Proposal Form in order to secure a significant amount of insurance coverage from your desired insurance organizations.

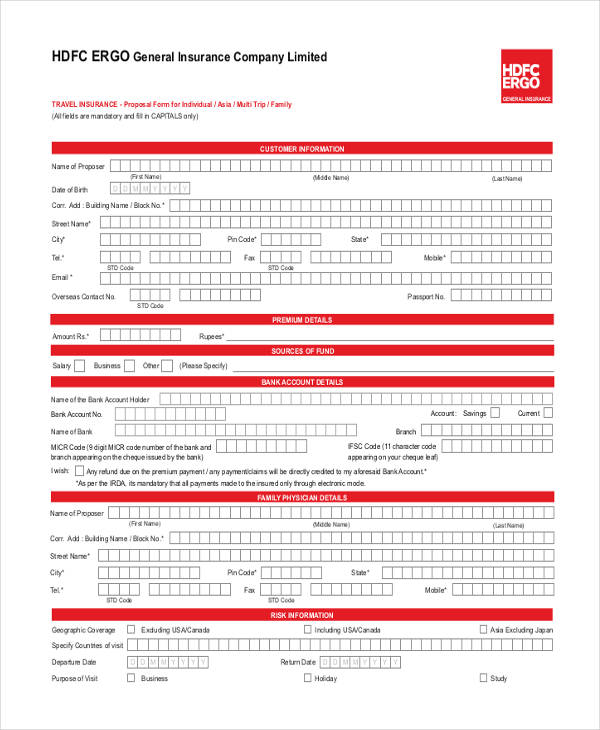

It is of utmost importance that you secure this type of insurance coverage as these mishaps may happen while you’re driving to work, sitting at home and watching TV or when you’re out and traveling the world. For this, you might also need to file your Travel Insurance Proposal Form.

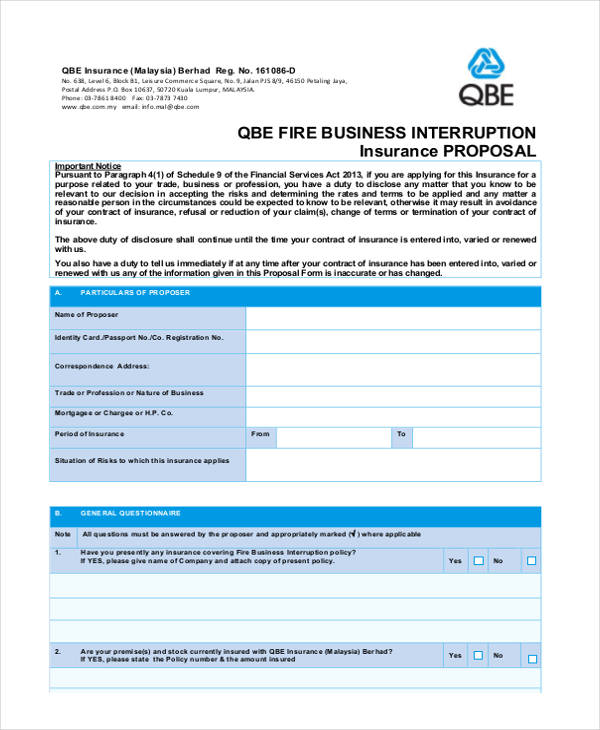

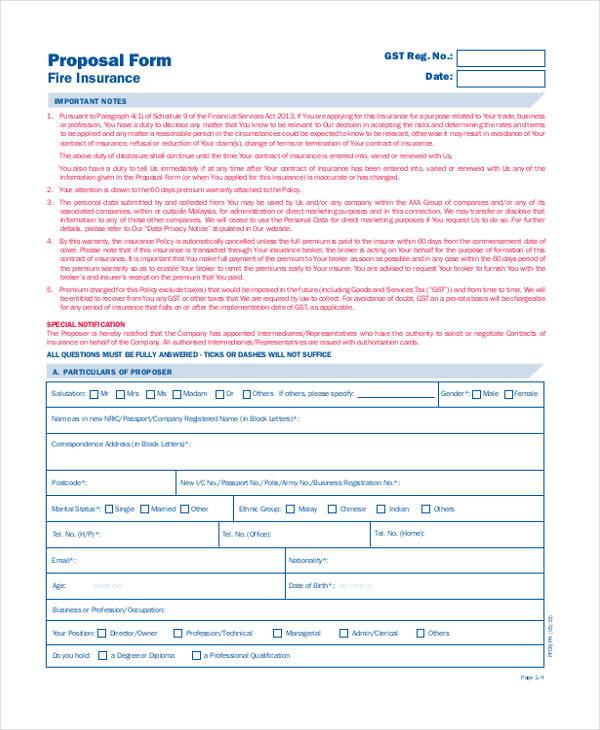

Fire Insurance Form Samples

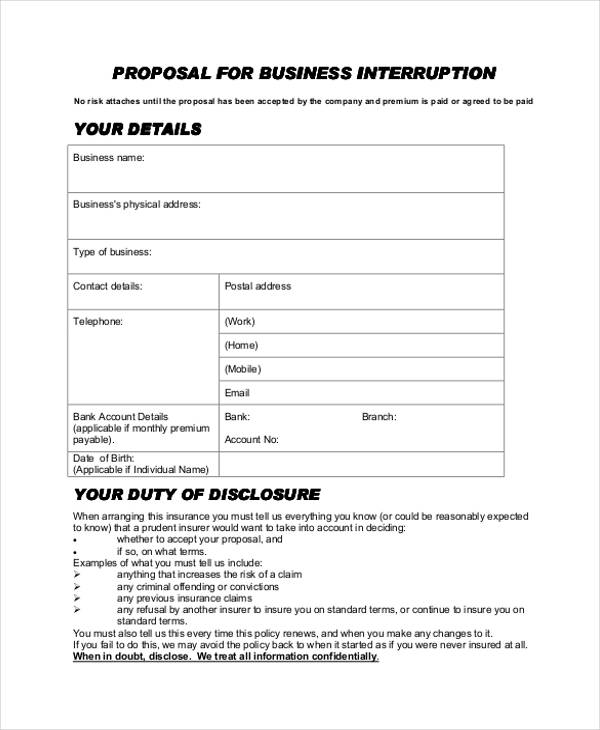

Fire Business Interruption Insurance Proposal Form

Sample Fire Insurance Proposal

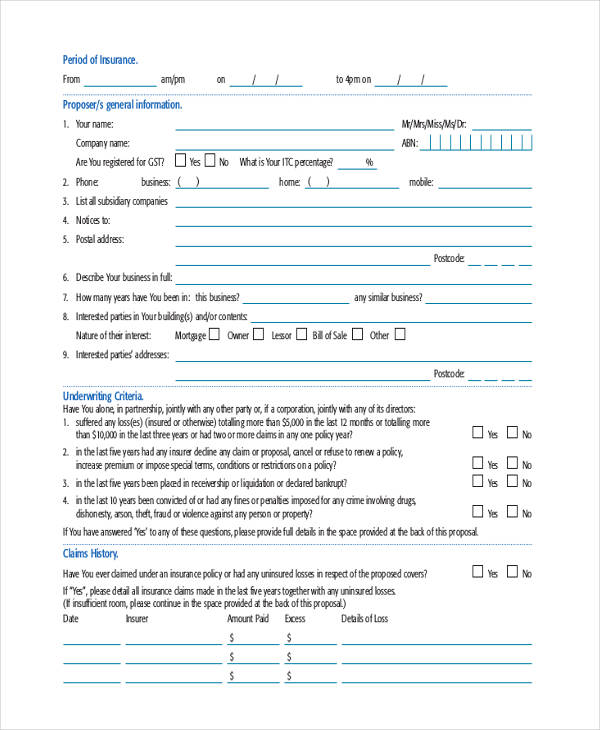

Business Insurance Proposal Forms

Business Pack Proposal

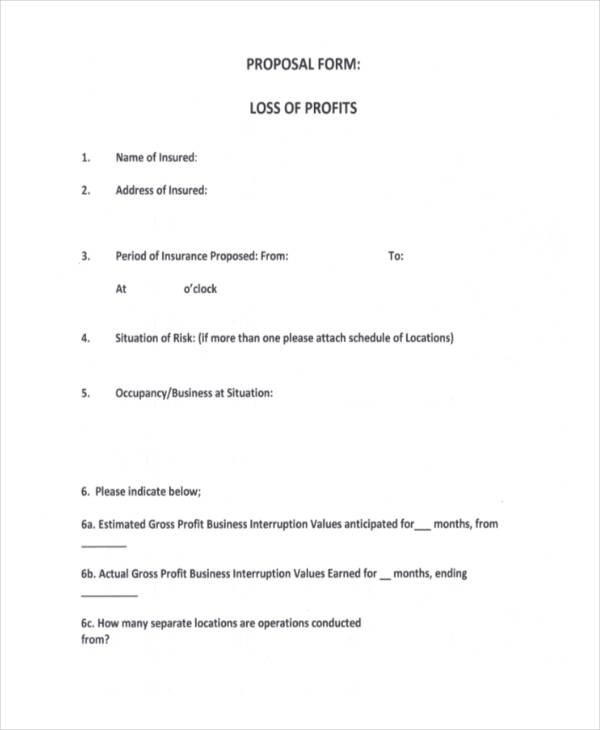

Business Proposal Form for Loss of Profits

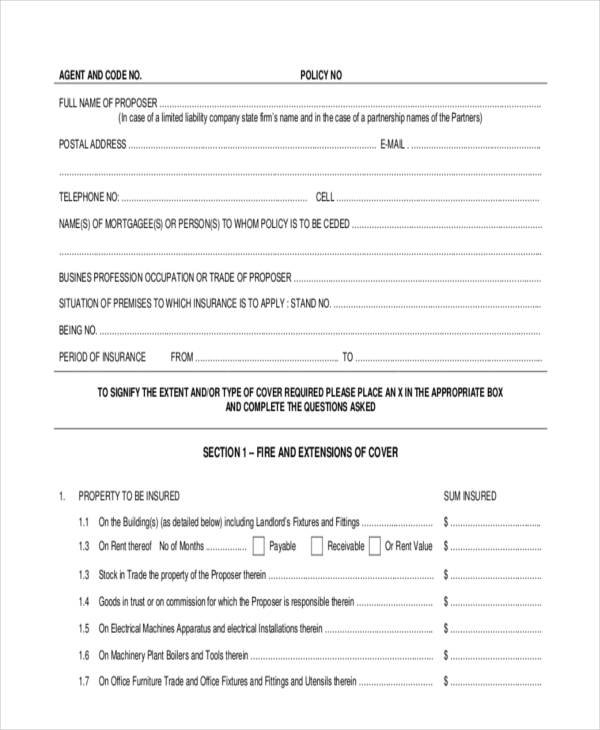

Business Package Proposal Form

How to File a Fire Insurance Form

As mentioned above, we’ll never see some risks coming like how we’ll never know when a fire hits our home. Without a Fire Insurance, we may end up with nothing and start life with zero. Filing a Fire Insurance Form is almost the same as filling out Health Insurance Sample Forms.

Upon knowing the guidelines of your chosen insurance system, you only need to fill up your basic information such as your name, address, contact details, properties insured including the sum of these properties, and affix your signature to show that you conform to system’s policy and guidelines.

What is Proposed Insured in Life Insurance?

A Life Insurance is basically a contract between an insured person and an insurer which states is that an insured person will make regular payments which culminates in an amount of money being paid out to the indicated beneficiary. This insurance money may be given to the person’s dependent or beneficiary or he may also get it after a set period of time.

A proposed insured, on one hand, is the person to which this life insurance applies to. This proposed insured will fill up a Life Insurance Contract detailing specifications of personal information and insurance coverage. In addition, you will be filling out a form similar to one of these Sample LIC Proposal Forms.

Car Insurance Proposal Form Formats

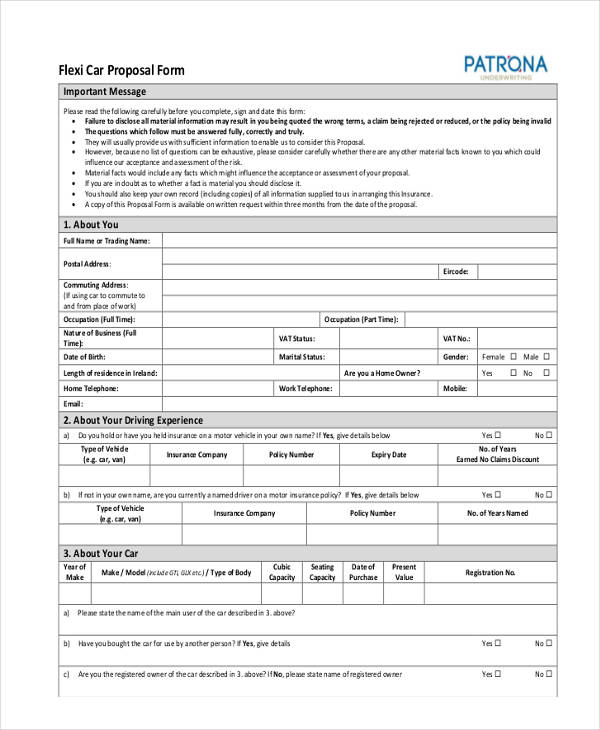

Flexi Car Proposal

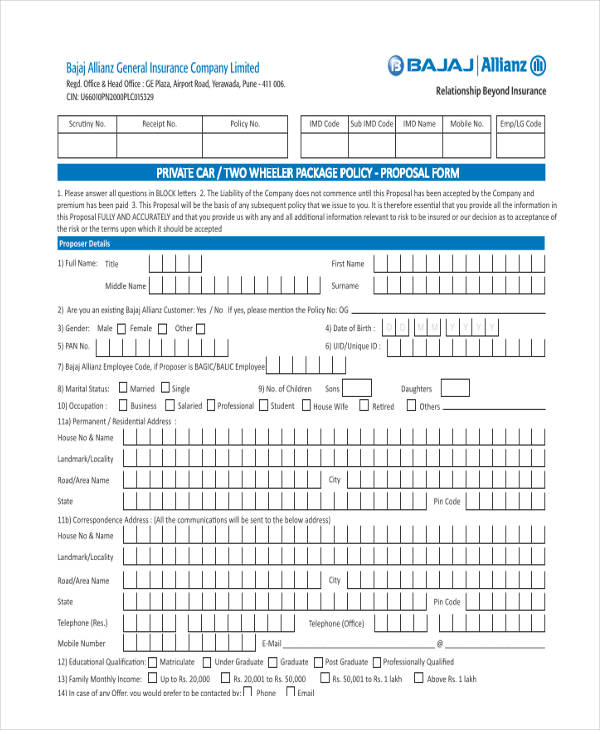

Private Car Insurance Proposal

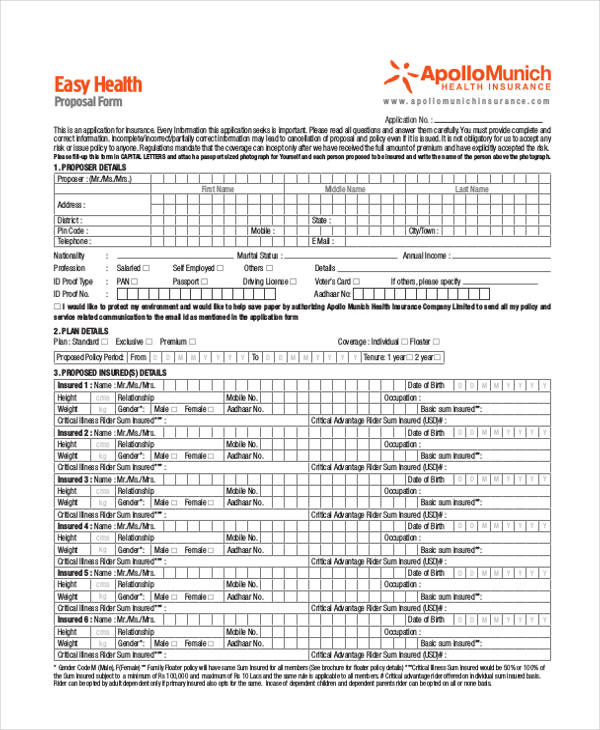

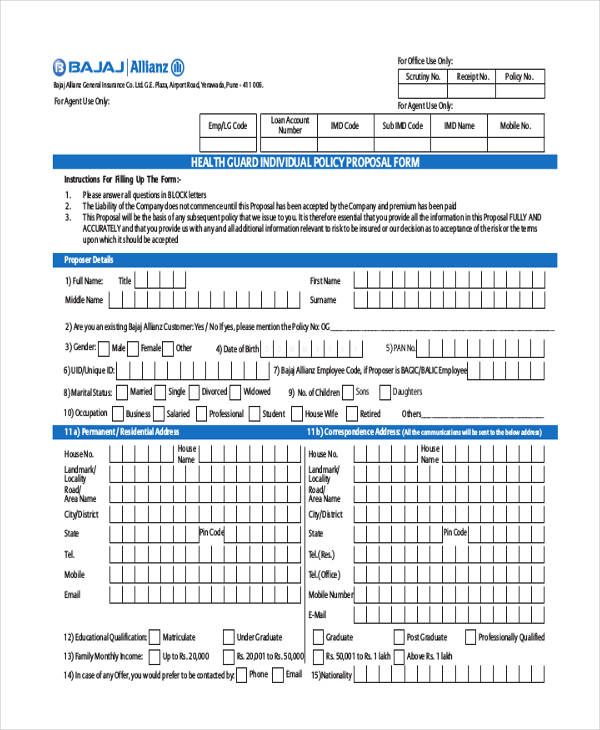

Health Insurance Proposal Forms

Easy Health Insurance Proposal

Individual Health Insurance

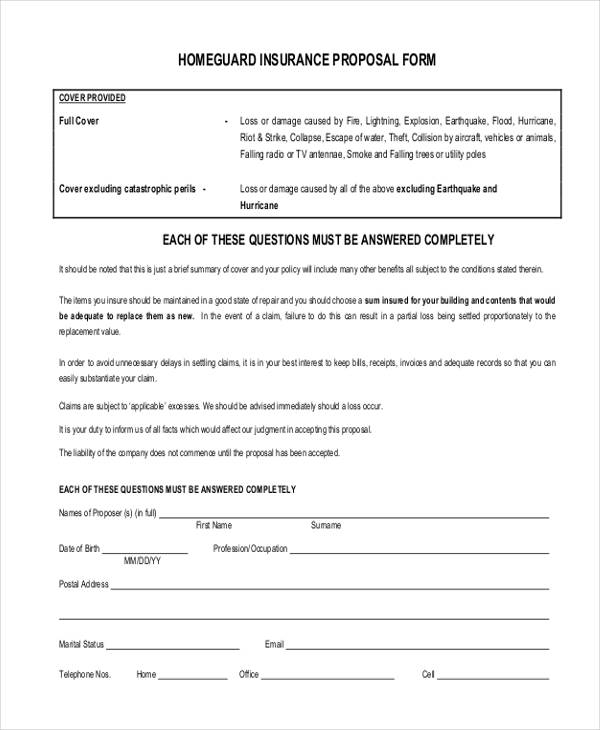

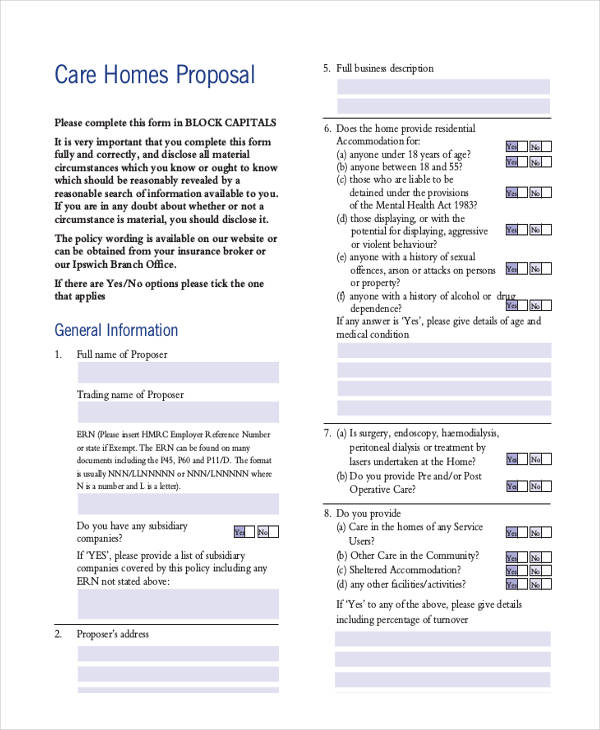

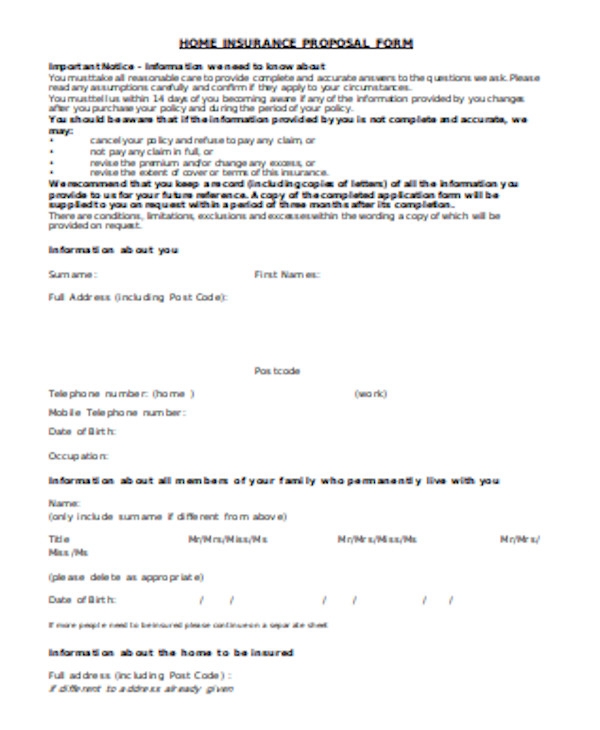

Home Insurance Proposal Forms

Homeguard Insurance Proposal

Care Homes Proposal

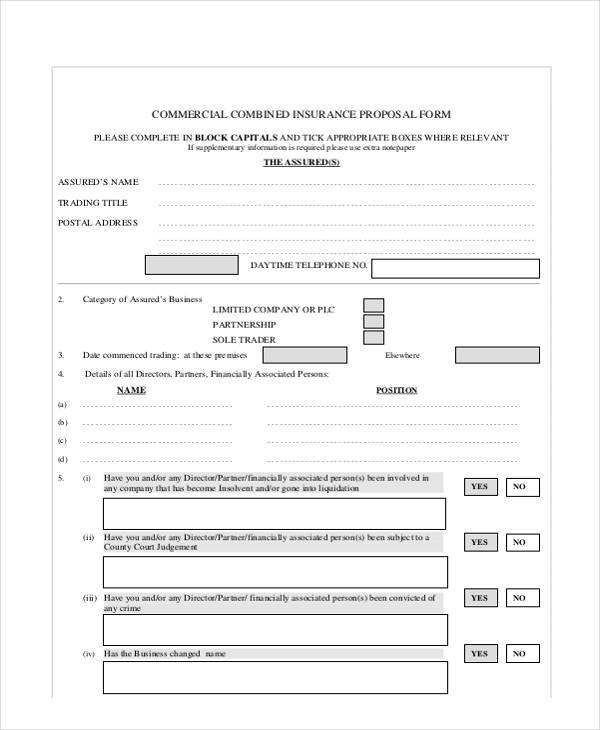

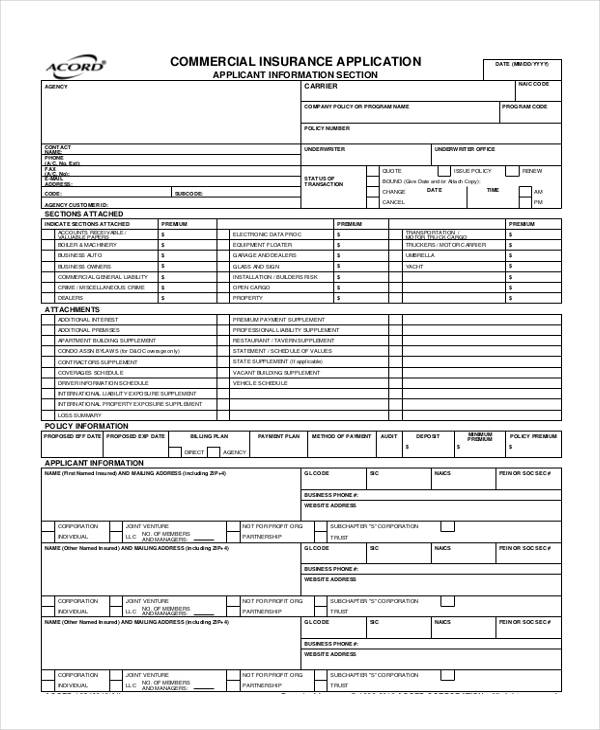

Commercial Insurance Proposal Forms

Commercial Combind Insurance Proposal

Commercial Insurance Application

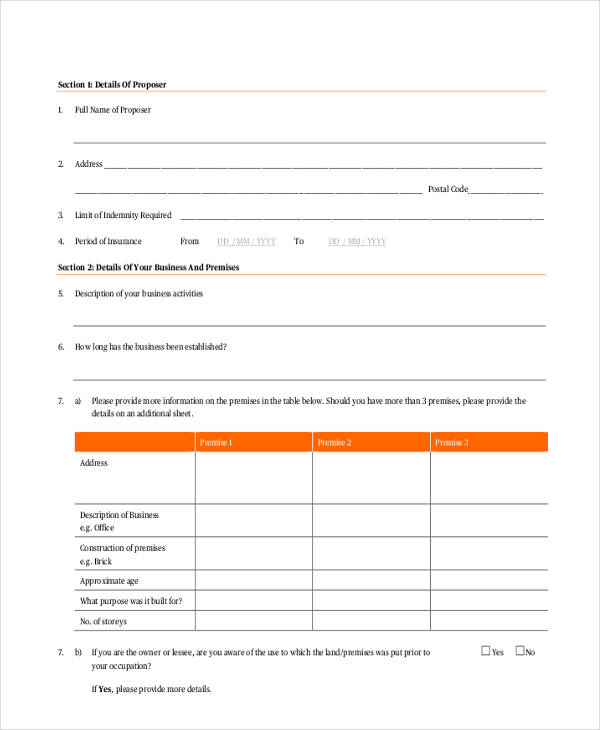

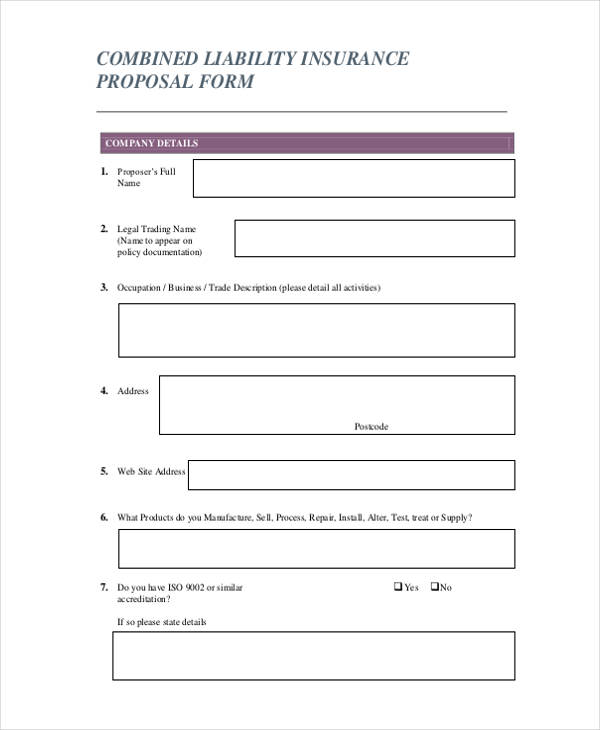

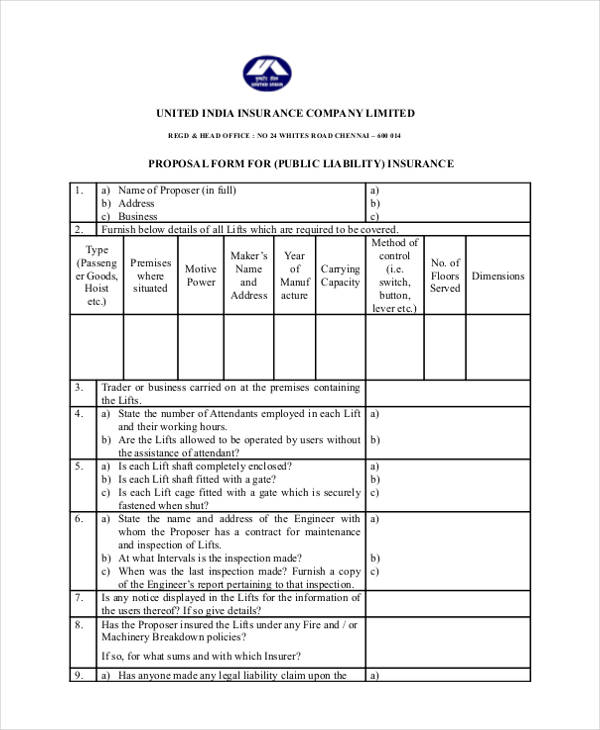

Insurance Liabilities Proposal Forms

General Liability Insurance Proposal

Combined Liability Insurance Proposal

Public Liability Insurance Proposal

Importance of the Proposal Form in an Insurance

In order for the insurer and the proposed insured to meet at a certain agreement of which is to be covered and the premium price to be paid by the insured, there is a need for the proposer (proposed insured) to complete a proposal form which is based accordingly to the policies of the insurance company he’s enrolling.

These proposal forms are sought after and researched thoroughly by the insurer as they have been consulting with life insurance advisers to meet the needs of the proposer. Thus, it should contain all the necessary information which leads to the decision-making of insurance coverage and premium amount to be paid.

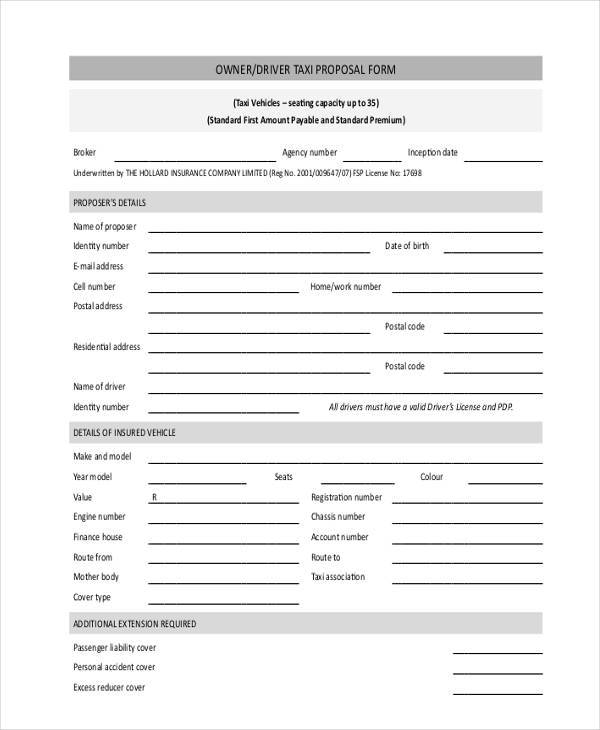

A proposal form in an insurance is as as valuable as a Taxi Proposal Form, which guarantees the taxi cab owners a sure income provided that they meet with the company’s guidelines.

A Proposal Form is of great value as they may cater to the following:

- Benefits of both insurer and proposed insured. Through an insurance proposal, both parties will be able to come between what benefits them. The insured shall get the right coverage at the right premium rate that fits to his ability.

- For assessment. Using the proposal form, the insurer will be able to identify which of their coverage is highly needed by the proposed insurer and thus, if case the proposer might not realize it, the insurer can therefore guide him toward an understanding of the need for such coverage.

- For legality’s sake. Through insurance proposals, all the terms and policies are secured by a legal agreement between both parties.

- For guarantee. For documentation purposes, you may find that proposal forms can give you a guarantee that you get everything that was agreed upon.

- For records. As proposal forms contain necessary details, these documents may be used as records which is useful in the future.

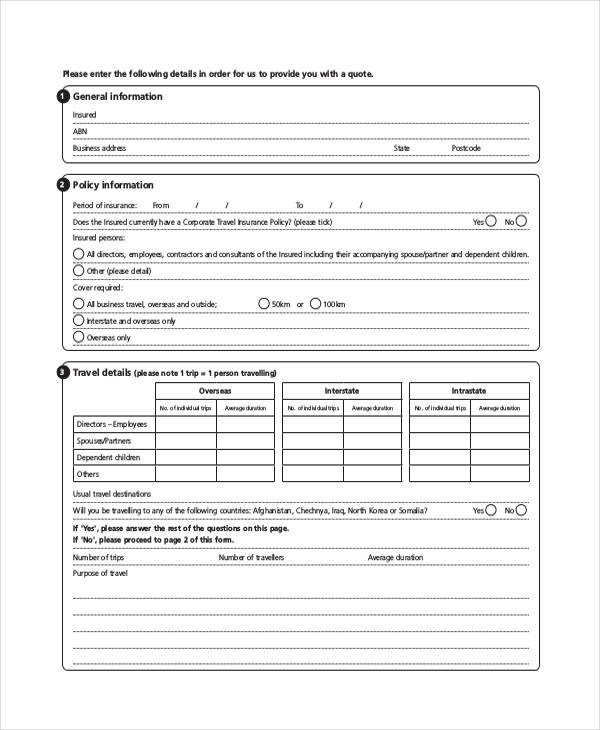

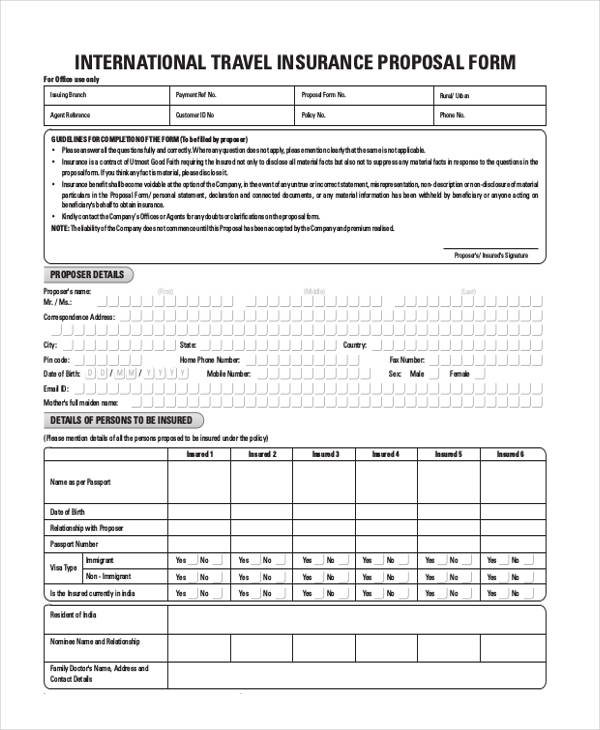

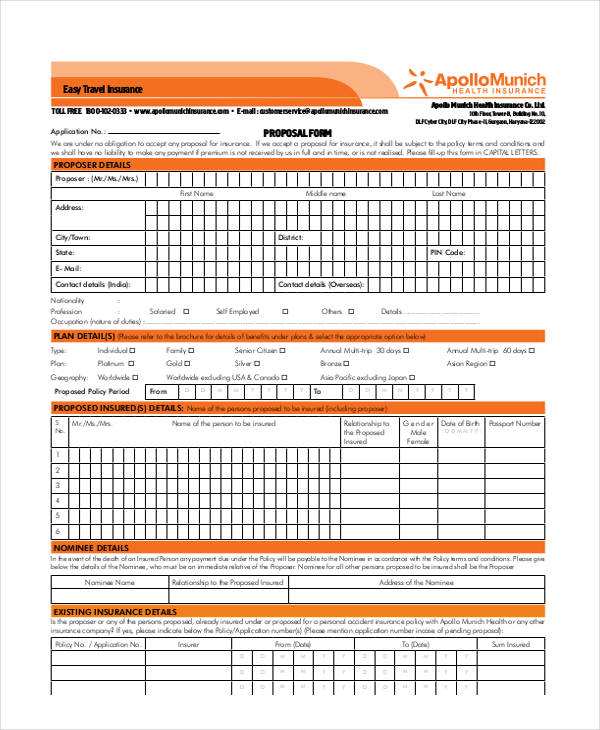

Travel Insurance Proposal Forms

Corporate Travel Insurance Proposal

International Travel Insurance Proposal

Easy-Travel Insurance Proposal

Office Insurance Proposal Form Sample

Office Comprehensive Insurance Proposal Form

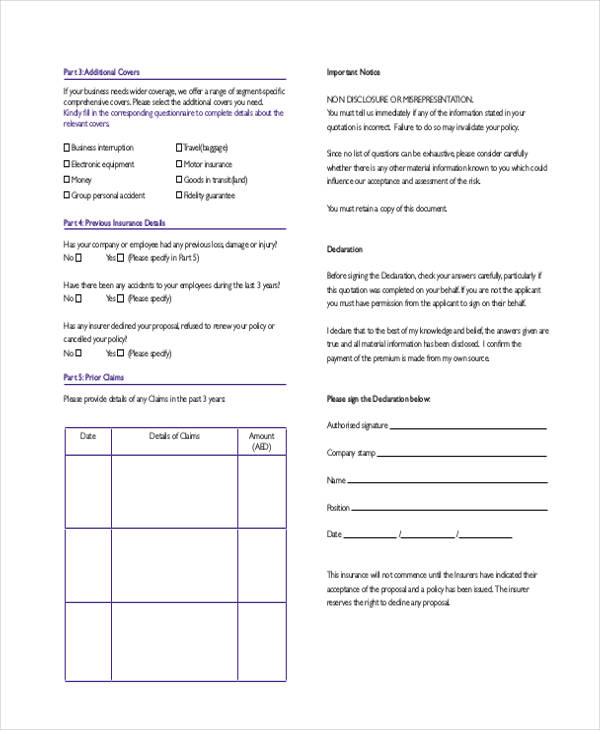

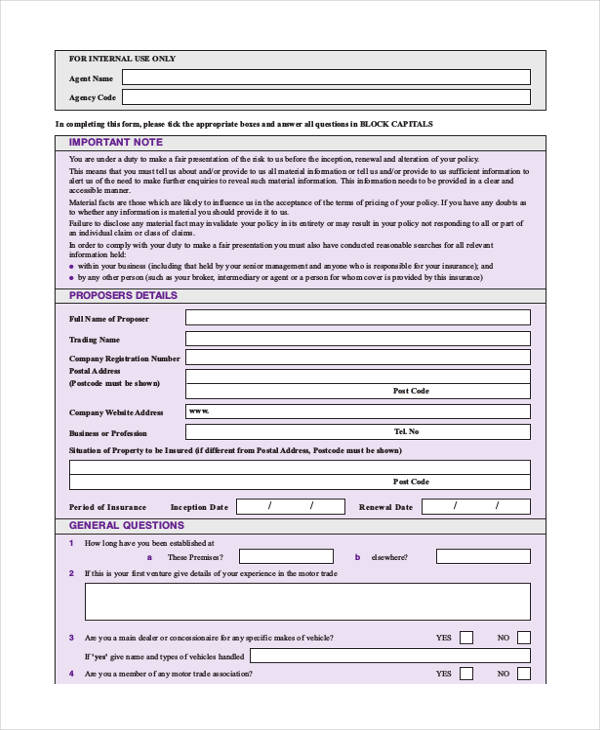

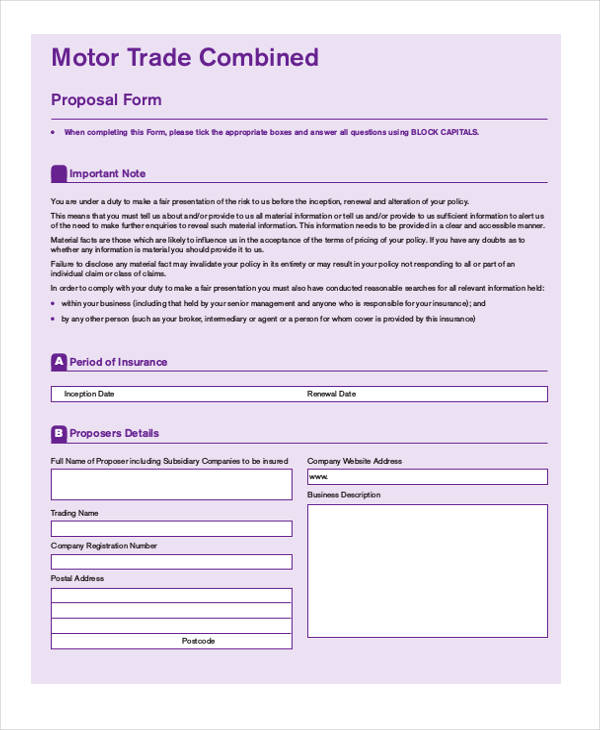

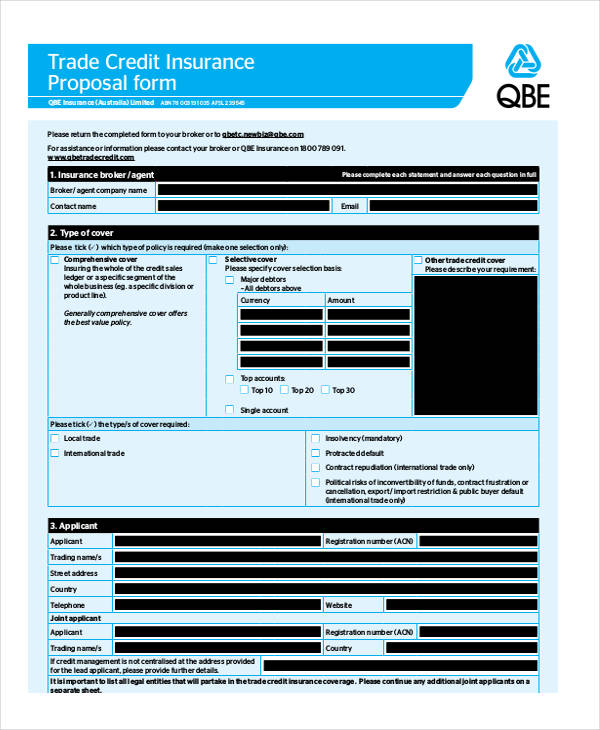

Trade Insurance Proposal Forms

Motor Trade Proposal Form

Motor Trade Combined Proposal

Trade Credit Insurance Proposal

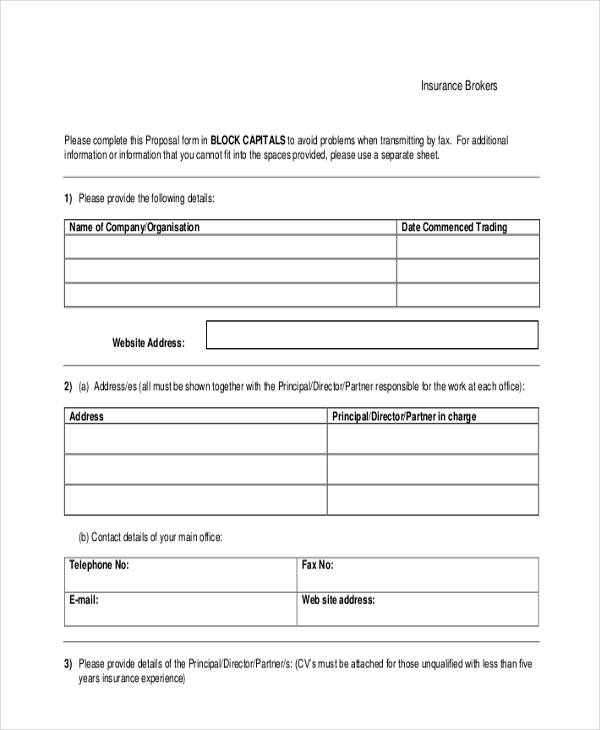

Insurance Brokers Proposal Forms

Insurance Brokers Proposal

Sample Insurance Brokers Proposal

Functions and Uses of a Proposal Form

Different fields use proposal forms for a single objective and that is to achieve a partnership, agreement or contracts. These proposal forms set as a good foundation for establishing relationships between two parties. Two other functions and uses of proposal forms are as follows:

Travel Proposal Form – these forms are usually prepared by travel insurance agencies to make their travelers at peace knowing that they will be covered in cases of lost baggage, accidents, canceled flights, medical expenses, and any other mishaps occurring during their travel.

Study Proposal Form – these forms are often used by students wishing to conduct any study as a load requirement.

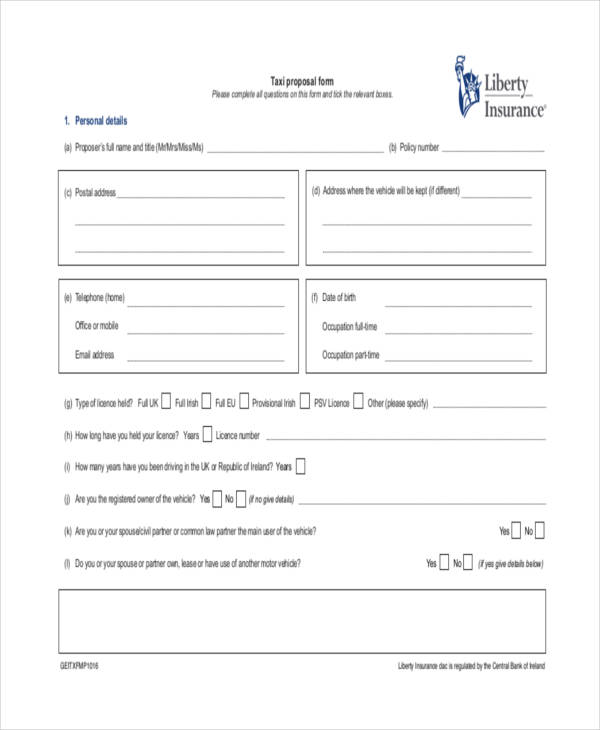

What is a Private Car Insurance Proposal Form?

A Private Car Insurance Proposal Form is used to seek insurance coverage for a privately owned car. Some of these forms don’t usually get into the hands of car-owners, instead they can get these through from where they purchased their cars from or from brokers.

With this form, you, as a car owner is insured that you get financial return if in case your private car will meet injuries or damages brought by collisions. Other car-owners also benefit from their car insurance in cases of theft. Some car insurance companies provide proposals similar to what we see with Sample Business Proposal Forms to ensure that they get clients with a good premium rate.

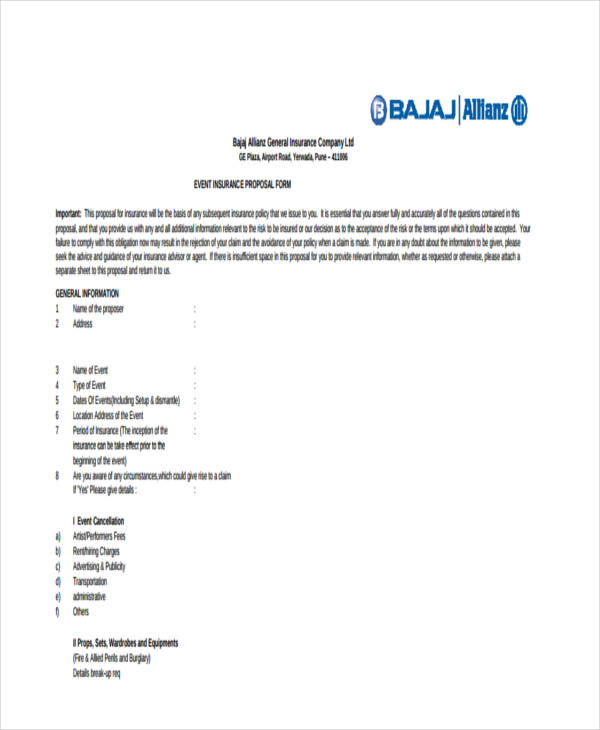

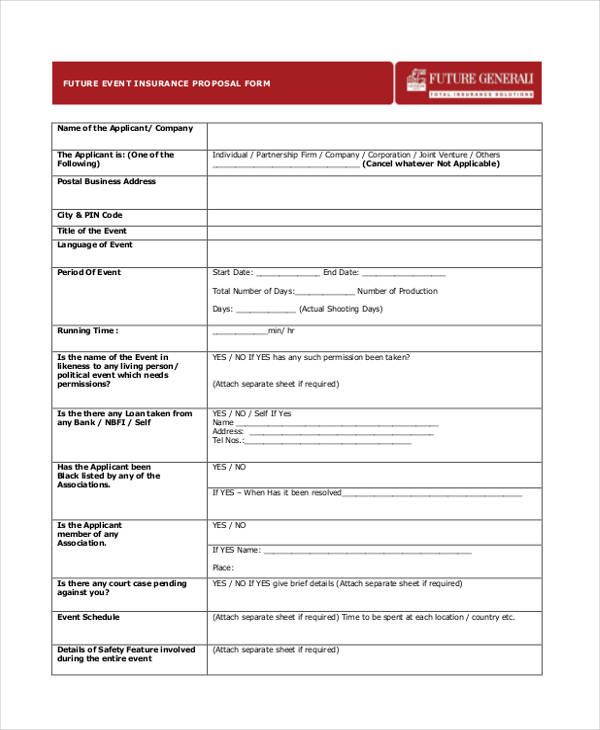

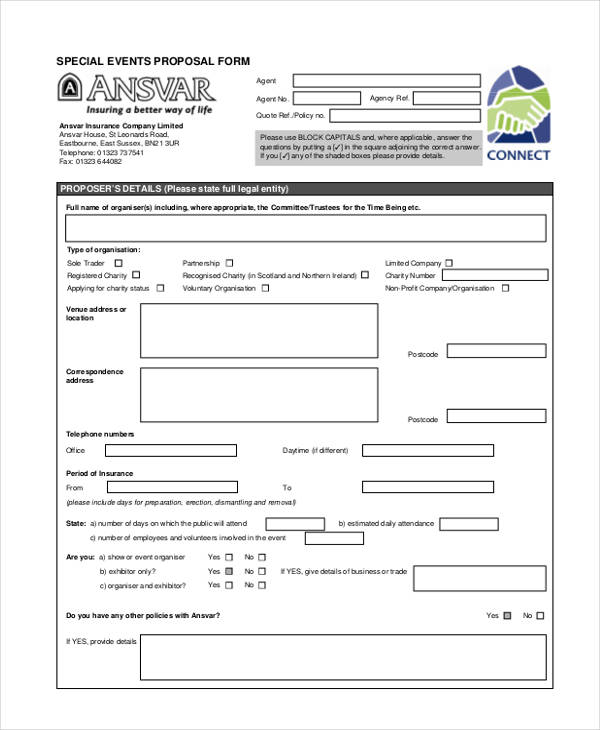

Event Insurance Proposal Forms

Event Insurance Proposal

Events Public Liability Proposal Forms

Future Event Insurance Proposal

Special Events Insurance Proposal

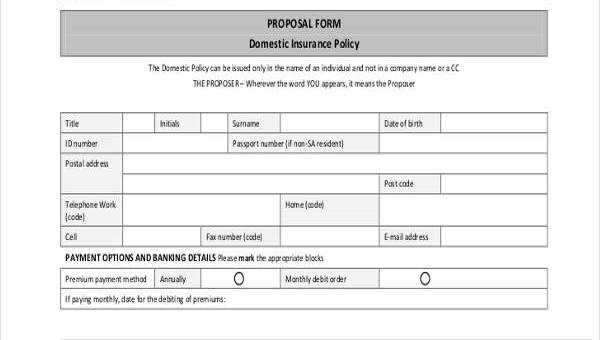

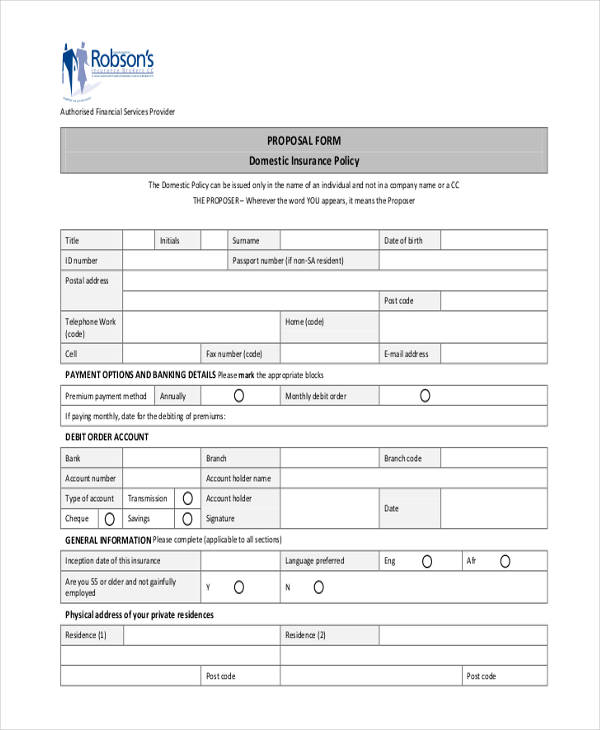

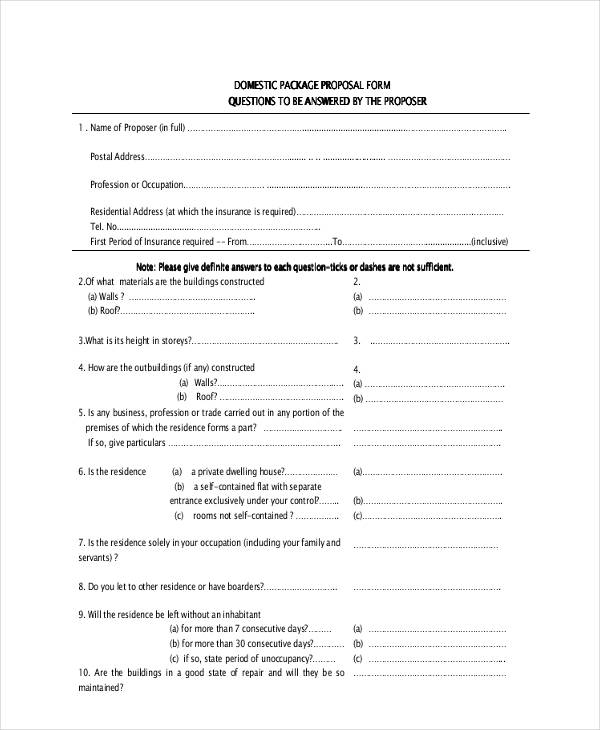

Domestic Insurance Proposal Forms

Free Domestic Insurance

Domestic Package Proposal

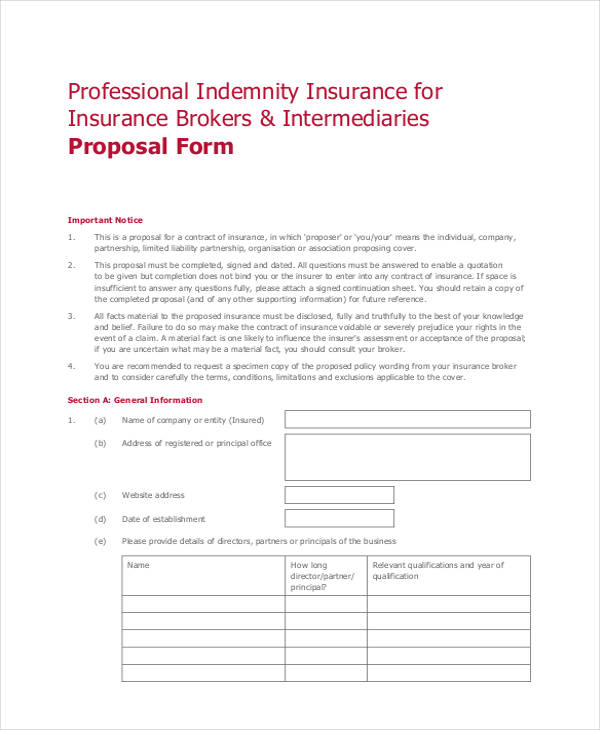

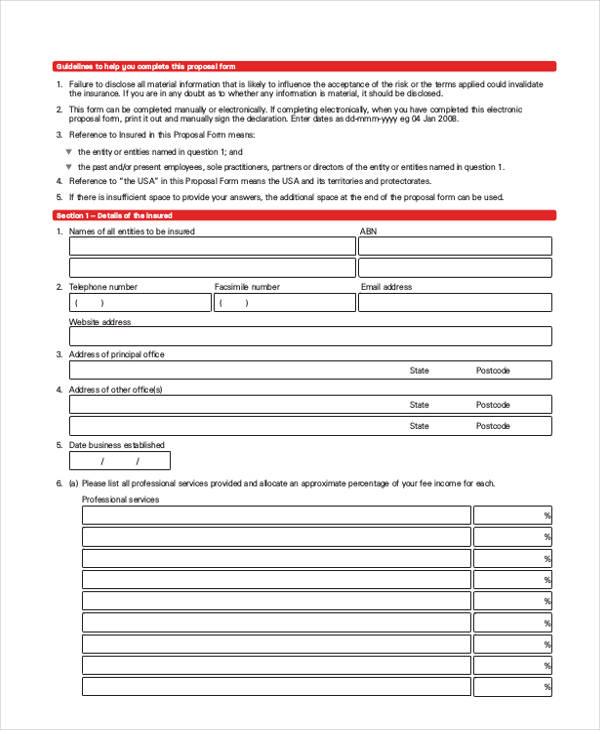

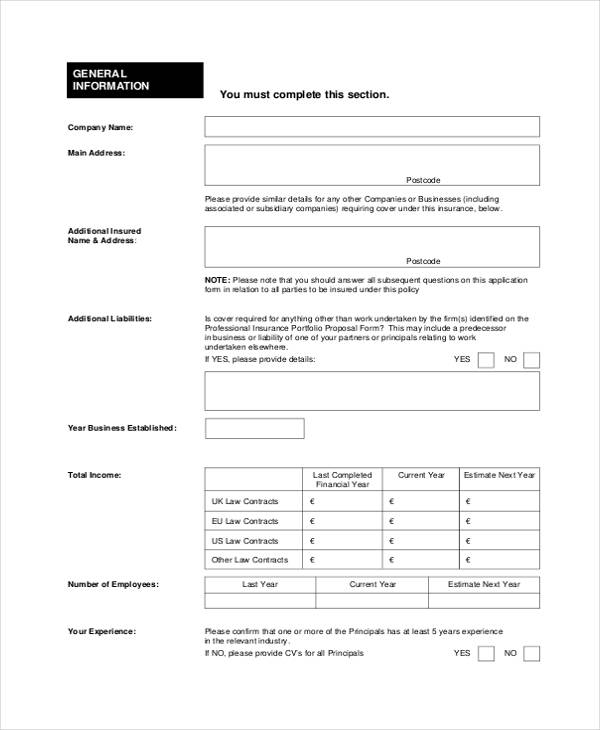

Professional Insurance Proposal Formats

Professional Indemnity Proposal

Professional Insurance Portfolio Proposal

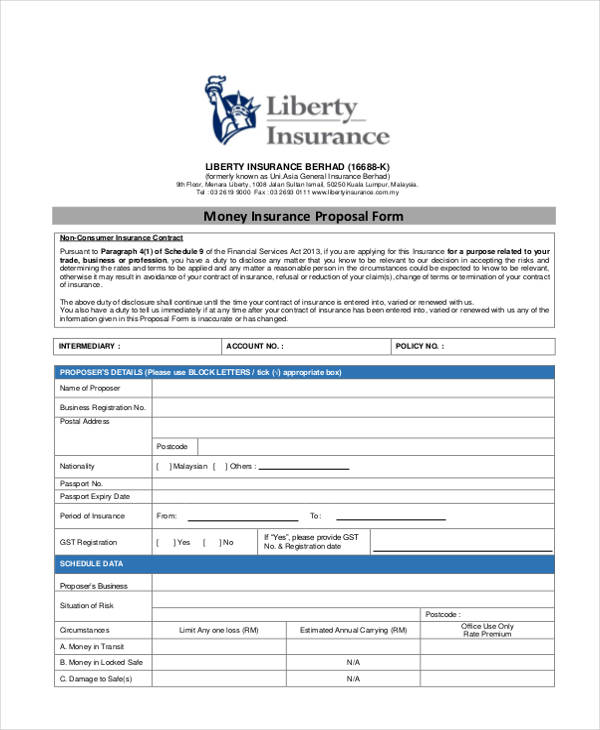

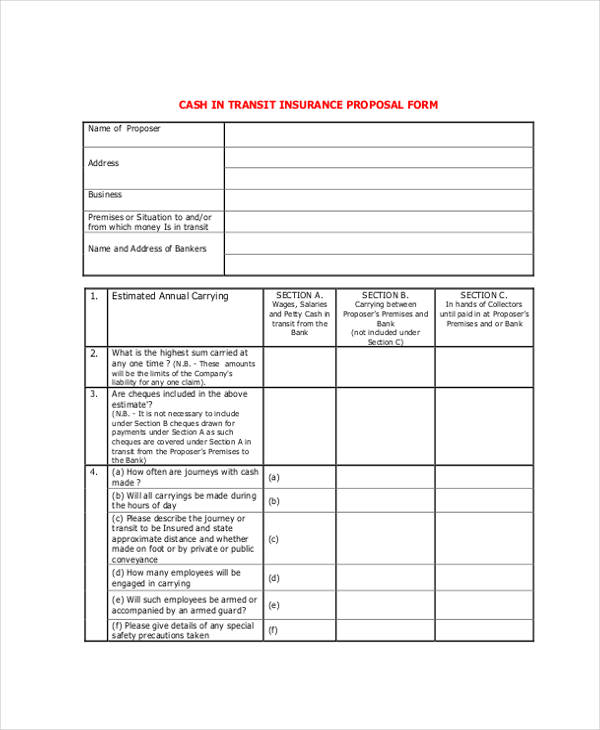

Money Insurance Proposal Forms

Money Insurance Proposal Form

Insurance of Money Transit Proposal

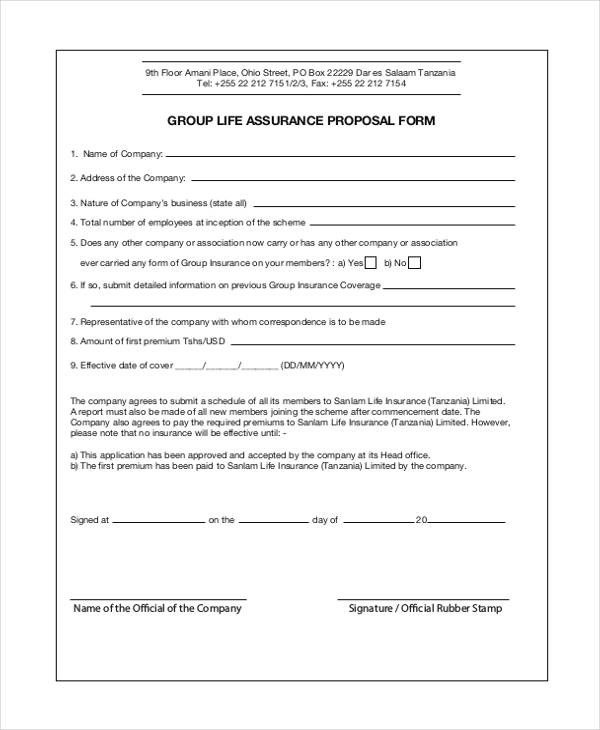

Life Insurance Proposal Format

Group Life Assurance Proposal

Taxi Insurance Proposal Forms

Driver Taxi Proposal Form

Commercial Taxi Proposal Form

Business Insurance Proposals

Business Interruption Proposal

Business Travel Insurance

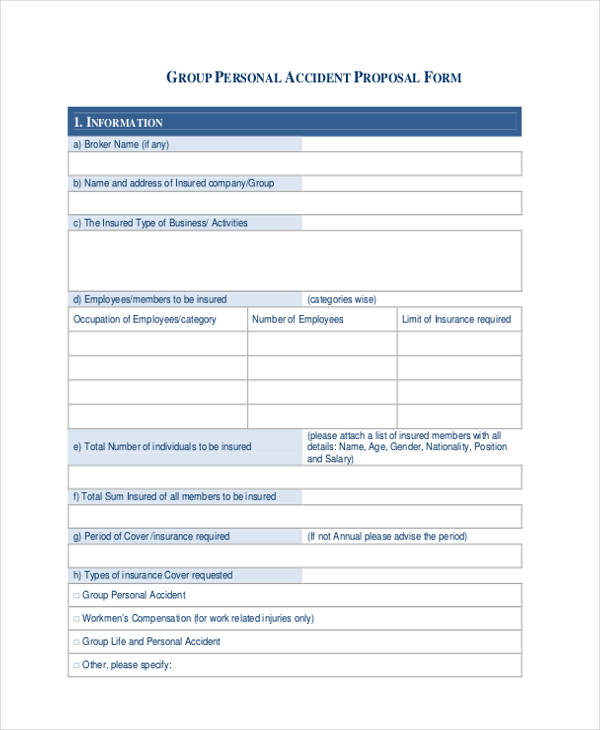

Group Personal Accident Proposal

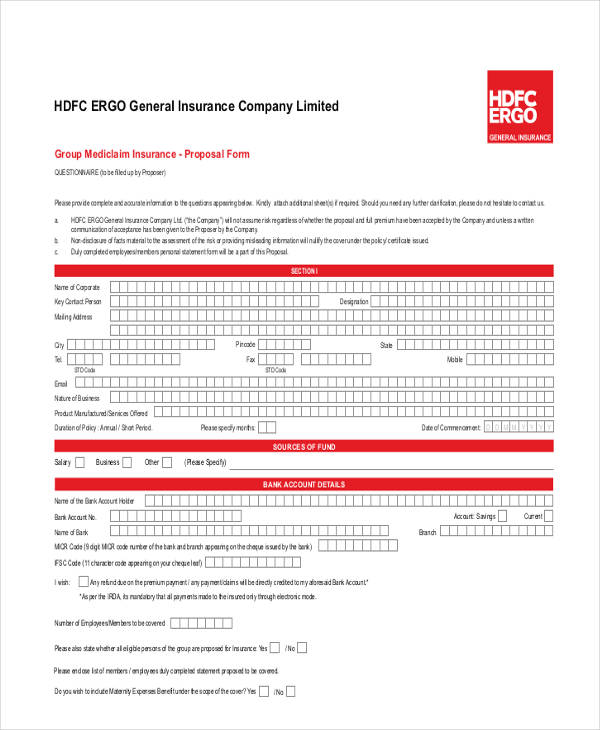

Medical Insurance Proposal Forms

Group Medical Insurance Proposal

Home Insurance Proposal Form

Basic Insurance Proposal Form

What are the Uses of an Insurance Proposal Form?

There are many reasons why one should obtain an Insurance Proposal Form. To name a few, a Proposal Form is used as grounds or basis to:

- To bring out information. It is important for an insurer to know the basic details of the proposer (name, address, contact details, occupation, and even the medical history).

- To draw out a quotation. Sometimes the proposal consists of a request to the insurers for a quotation on prices and terms.

- To know the coverage. Most of the proposal forms summarize the cover that is to be obtained under the insurance contract but this coverage must conform to the policies of the insurance system.

- To advertise. In the midst of a proposal, advertising other products may be accomplished.

- To establish a warranty. Proposal forms can actually warrant a revelation of truth throughout the insurance coverage.

Basically, the use of Insurance Proposal Forms resemble Event Proposal Forms where you’ll also find details of the budget you have to which an event coordinating company might conform to when planning out your nect event.

Related Posts

-

What is Importance of Proposal Forms in Insurance? [ Roles, Elements ]

-

Cleaning Proposal Form

-

What is a Project Proposal Form? [ Tips, Guidelines ]

-

How to Write a Proposal Form? [ Definition, Guidelines ]

-

What is a Proposal Evaluation Form? [ Uses, How to, Guidelines ]

-

Proposal Form

-

Seminar Proposal Form

-

Field Trip Proposal Form

-

FREE 9+ Course Proposal Forms in PDF

-

FREE 8+ Video Proposal Forms in PDF | MS Word

-

FREE 9+ Book Proposals Forms in PDF | MS Word

-

FREE 9+ Bid Proposal Forms in PDF | MS Word

-

Proposal Evaluation Form

-

FREE 8+ Proposal Summary Forms in PDF | MS Word

-

FREE 8+ Program Proposal Forms in PDF | MS Word