A payroll change form is a document which is used by the payroll department of a company for employees and staff who have concerns in their payroll information. The form will allow employees to update their details, specifically those which can affect their payroll. In addition, payroll change forms can also be used for documenting pay adjustments and the attendance of employees or the staff of a company.

Why Payroll Change Forms Are Important?

The payroll department of a company is the one who manages and maintains the records of the employees’ wages, commissions, work hours rendered, and even bonuses obtained within a specific time period. In order for them to have accurate data and records, the employees of the company should ensure that any changes, updates, and alterations about their personal and employment data must be informed to the management and the payroll department. This is why payroll forms, especially payroll change forms are used.

In addition, payroll change forms also contribute to the step-by-step system that the company mandates in their data collection procedure. This ensures that an employee has followed the system of the company and have been informed about the various documents to enclose to verify the changes.

Why Use Payroll Change Forms in Excel Format?

In a company, one of the most critical job responsibility is managing the company’s payroll account since this involves computing the salaries and wages of employees. This means that errors are not welcome in a payroll department and information must be accurate at all times to avoid disputes and issues. For this, the best and the simplest program or software application to use is a spreadsheet program such as the Microsoft Excel software application. Other benefits of using a payroll change form in excel format are as follows:

- Low cost: A spreadsheet program can simply be installed into a device and can be used sufficiently. All the company has to deal with is to pay the license of the developer once compared to having another vendor or a partner company who will be handling the payroll. Also, after a payroll change form is made, the company can reuse the file over and over again, or yet change the entry fields depending on what information will be needed.

- Easy to use and versatile: There will be no need for placing underlines and other placeholders when making payroll change forms in Excel because of the readily available rows and columns which can serve as a guide that will align the labels and the required data to be disclosed by the employee. In addition, a payroll change form in excel can also be merged with other spreadsheet files, and be converted to other formats such as in “.PDF” or portable document file format.

- Formulas and preset functions: If the changes disclosed by the employee will affect the financial side or computations of the payroll department, then the payroll staff or the document-maker can incorporate formulas and codes into the change form. By doing this, the process of computing payments, amounts, and any item which must be mathematically updated will be easier because of the formulas.

Varieties of Payroll Change Forms in Excel

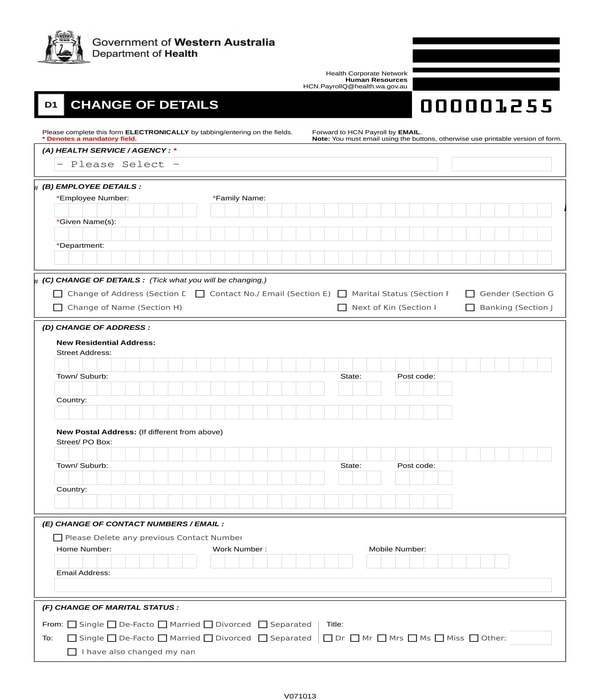

Payroll Change of Details Form – This variety of payroll change form in excel is suitable for any type of data or details to be changed by an employee. In the form, the employee must first disclose his employee information such as his employee number and the department that he is assigned in. Then, he must choose which section to complete based on the details that he will be changing. The changes which can be documented in this form would be the employee’s address changes, legal name, email address, marital status, next of kin, gender, and banking or bank account information.

Payroll Change of Details Form

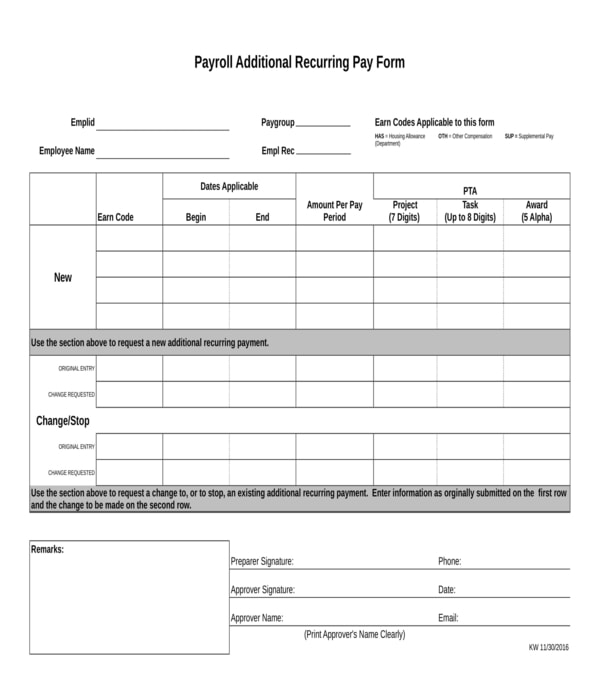

Payroll Change Recurring Pay Form – Employees who choose to mandate a recurring pay procedure to be conducted by the company in lieu of the loans that they need to pay regularly are the users of this payroll change form variety. The information needed to be disclosed in this form would be the details of the employee’s recurring payment such as the amount to be obtained per pay period and the start and end dates for providing the payments. In addition, the signatures of the staff who prepared the documents for the process, and the approval committee of the company will also have to be incorporated in order to complete the form.

Payroll Change Recurring Pay Form

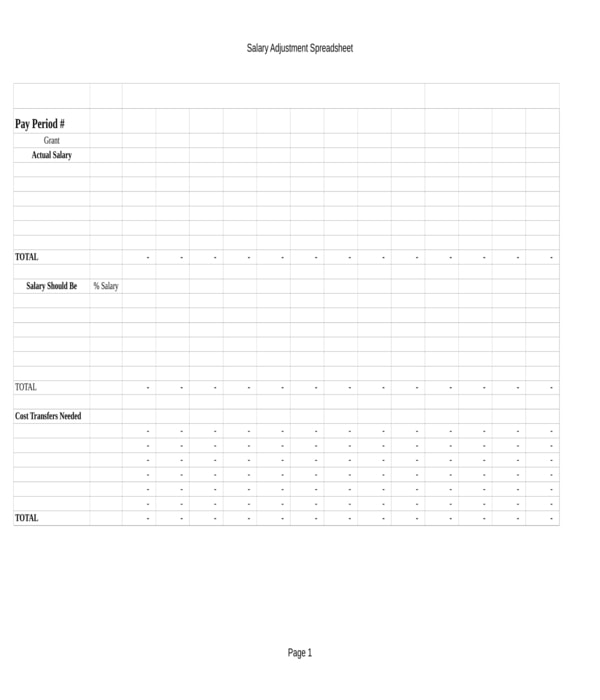

Payroll Change Salary Adjustment Form – This form is intended to be used by an employee who is also a beneficiary of a grant or financial aid program. There are three sections in the form which must be filled out by the employee. The first section is for the details of the actual salary while the second section is allotted for the particulars of the salary changes. And lastly, in the third section, the employee will have to disclose the cost transfer which will be needed for the completion of the change request.

Payroll Change Salary Adjustment Form

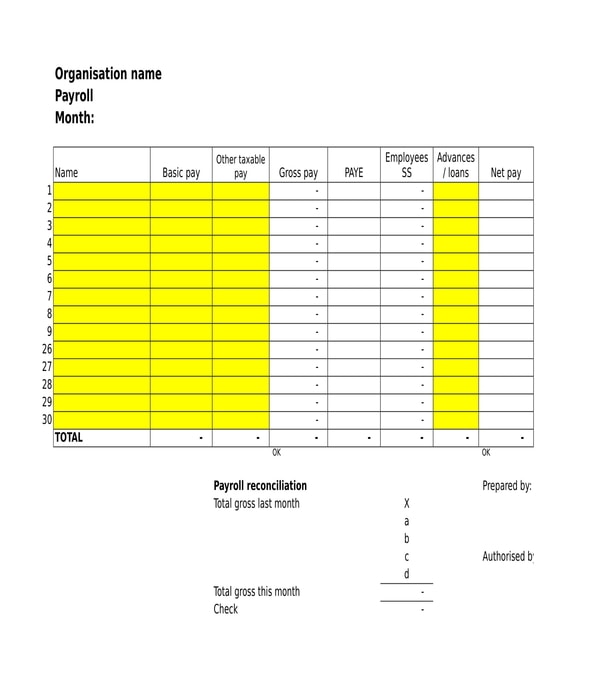

Payroll Change Update Form – The bigger the company, the more critical the role of the payroll staff will be. On the other hand, if the company or the organization is only composed of a number of people, then a simple payroll change form can be used for updating payroll data and information. Specifically, a payroll change update form is the right document to use for small companies as it collects the names of the employees and staff in one table along with the amount of their basic pay, taxable pay, gross pay, and their net pay.

Payroll Change Update Form

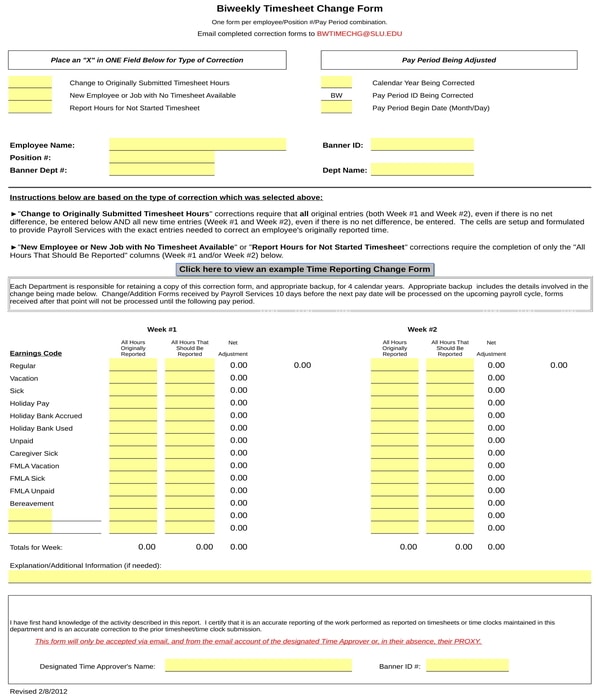

Payroll Timesheet Change Form – Time or work hour discrepancies must be avoided at all times by any company. This is the purpose of a payroll timesheet change form which can be used by employees who have seen discrepancies in the recorded number of working hours that they have rendered. In the form, the employee can specify the type of correction that he is reporting, the pay period to be adjusted, and the work or service hours details to be verified by the payroll department.

Payroll Timesheet Change Form

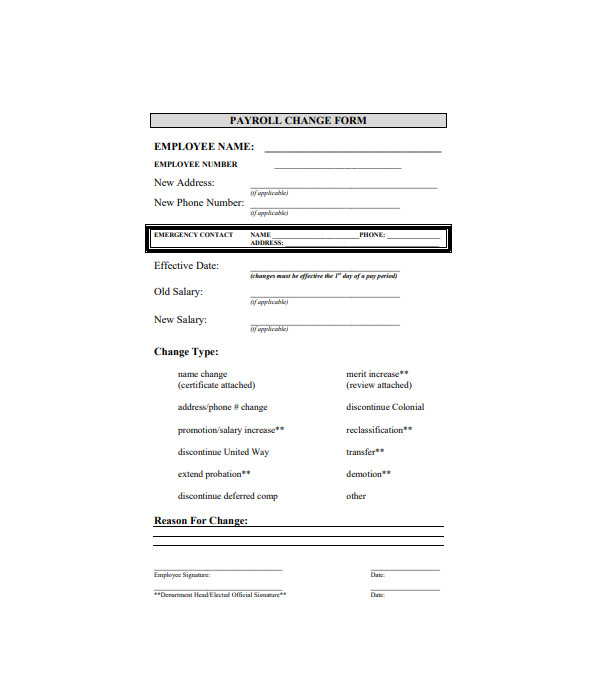

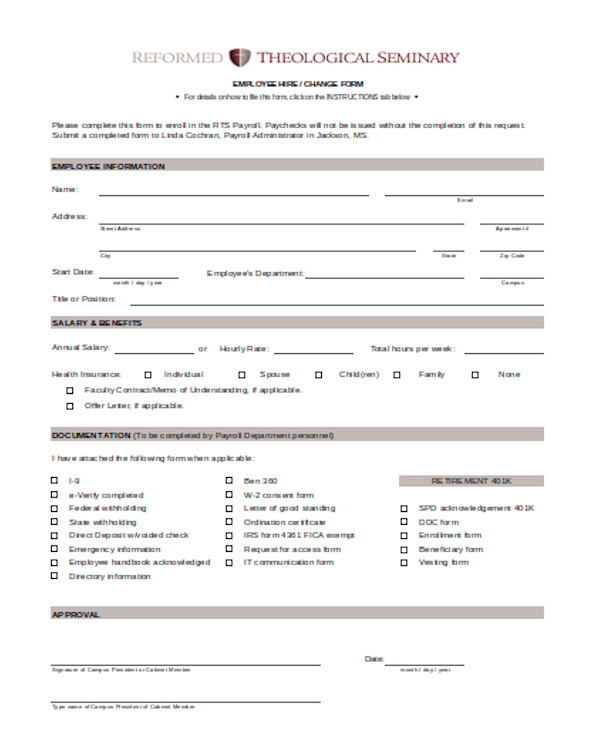

Employee Payroll Change Form

Basic Payroll Change Form

With the different varieties of payroll change forms in excel formats, companies will be able to choose which document fits their needs and will aid their payroll departments towards achieving accurate data and success in payroll procedures and processes.

Related Posts Here

-

Menu Form

-

Event Planner Form

-

FREE 16+ Ticket Order Forms in PDF | MS Word | Excel

-

Employee Dress Code Policy Form

-

Rental History Form

-

Advertising Contract Form

-

Service Agreement Form

-

Income Statement Form

-

Accident Statement Form

-

Performance Review Form

-

Event Contract Form

-

Contest Registration Form

-

Waiting List Form

-

Restaurant Schedule Form

-

Mobile Home Bill of Sale