- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

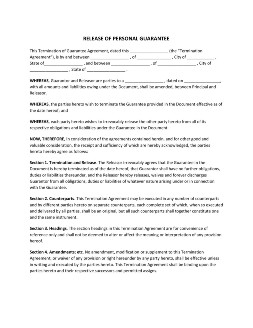

Release of Personal Guarantee Form

Guarantors and releasors are the principal parties involved in using a release of personal guarantee form. This form enables the guarantor to get off from the financial liabilities of the contract. Usually, releasors issue and guarantors request this form for loan agreements and lease documents right when the contract concludes. The release of personal guarantee form is not an itemized requirement of post-loan and lease transactions. However, some recommend having this to free from financial debt that the contract incurs. Read More

Release of Personal Guarantee Form

What is Release of Personal Guarantee Form?

A release of personal guarantee form is a document that contains the introduction comprising the releasor and guarantor’s identity, complete address, and the date that this form takes effect. Also, this covers the areas that the release applies to while concurring with the applicable state laws. This form functions to free the person from being legally bound to a contract. Before releasing this form, financial institutions usually request data on financial statements, business projections that address a particular economic state, current and future business strengths, business weaknesses, a mitigation plan, and collateral as a substitution for a personal guarantee. However, no specific obligation clause enables these financial institutions to grant a release of a personal guarantee.

How to Finish Up a Release of Personal Guarantee Form Within Minutes

Due to today’s busy pace, people long for easy-to-do tasks to somehow release them from being overwhelmed with things. This instance stimulates people to search for templates to use. Templates simplify the company documentation and maintain consistency of format and information collection. These templates also save the time and money of the person who does them. On the other hand, these templates enable customer satisfaction among users. In short, business templates provide users with easy ways of indulging and getting good at any transaction. If you wish to use the release of the personal guarantee form that we provide you herein, kindly check and follow the steps as a guide on how you can insert your details.

1. Access and Download the Release of Personal Guarantee Form

The template above has complete details of what a release of personal guarantee form consists of. You may download this and select which file format is conducive for you to use. You may download this form in a Word or a PDF file. Once you’ve decided what type you prefer, you may now open, edit, and save this form. You don’t have to start from scratch; we provide the details with the right format in it. You only have to fill each form with the needed details.

2. Fill the First Section with Necessary Information

Ensure that all information you add in your form has to be accurate to apply its purpose at hand. In the first part, you may add the date this agreement takes effect, name the parties involved, and designate who between them is the guarantor and the other as the releasor. Don’t forget that this form should comprise the current and complete address of both parties needed to be validated.

3. Proceed with the Succeeding Part

Next, you identify to what specific area this document applies to. You mention the name of the document with the execution date follows. Then, specify the laws of a particular state where you belong that governs the use and the effectiveness of this form. Again, make sure that the details you added accord with each section.

4. Sign and Let a Notary Execute this Form

The commonality among agreements is the signatures coming from both parties. In this case, don’t forget to match the name and signature with a date. Right after that, you add a notary acknowledgment for the parties to sign again. The Notary certifies the identity of all entities who took part in this agreement, not confirm the accuracy and validity of the document.

FAQs

Why is release of personal guarantee significant?

It is essential to provide a release of a personal guarantee form because this avoids you from being financially responsible and liable for any debts coming from accounts that releasors do not own. This document states that you are no longer obligated to an account you once linked to as collateral.

How to get released from a personal guarantee for a business loan?

For business loans, you may request about getting released from a personal guarantee by communicating or negotiating with the business bankers. As possible, you have to convince the banker that the release does not put the business loan at a higher risk. You have to provide the banker with proof about your statement. Bankers may refuse to remove your personal guarantee for specific grounds.

What information do I need to prepare when meeting with a business banker?

Upon request to release personal guarantees with the business banker, you have to prepare the following information:

1. Complete and accurate financial statement for the past two or three years

2. Rational and feasible business projections for the coming one to three years

3. Business finances (strengths and weaknesses)

4. Ways and plans on how to address business weaknesses

5. Collateral used in place of the personal guarantee

In what areas do banks decide for release refusal?

Business banks may refuse to take a personal guarantee from your business loan for reasons but not limited to low cash reserves, seasonal swings in revenues, and dependence on one or more accounts that would probably injure the cash flow once business lost in pace and operation.

Should I notarize this document?

You are not obliged to do so. However, notarization is highly recommended, especially when deterring fraud and identity theft. In case you are called into court, you will no longer testify whether your signature is authentic because notary will verify it for you.

Indeed, there are lots of ways to keep our work easy and fast. Despite the assistance guaranteed, as the author or the person involved in this agreement, you must understand the underlying responsibilities and liabilities of this document. Creating this document is crucial, much more keeping its effectiveness guaranteed. Thus, you need to create with knowledge, not just know until signed.