- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

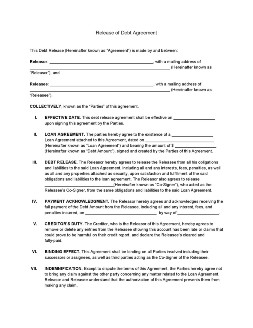

Release of Debt Agreement

Lending is primarily based on trust between two parties. The lender’s trust towards the borrower’s promise to pay, and, the borrower’s towards the lender’s promise to releases them thereafter. And as such, the creation of a release of debt agreement formalizes the borrower’s redemption from the instrument that binds them and the lender’s acknowledgment of the satisfaction of the loan. Read More

Release of Debt Agreement

- What Is a Release of Debt Agreement

- How To Create Release of Debt Agreement

- Frequently Asked Questions

- What does a personal guarantee mean in a release of debt agreement?

- Are co-signers also released from the debt in a release of debt agreement?

- Does a release of debt agreement apply to extended loans and debts?

- Do release of debt agreements have any requirements for notarization?

- Who will be the releasor of the release of debt agreement for an assigned loan?

What Is a Release of Debt Agreement

A release of a debt agreement expresses the lender’s willingness to release a borrower from their obligations to the loan agreement. The debt release done right after the borrower fulfills their obligations to the debt agreement, and upon fully paying the debt amount. Additionally, this agreement also constitutes the lender’s promise and duty to clear borrowers’ debt accounts, which in turn, helps the borrower redeem his or her credit reputation.

How To Create Release of Debt Agreement

Lending is a contractual agreement between the lender and the borrower, in which, the former agrees to releases the latter after the settlement of the debt. Releasing the borrower from the obligations of the loan agreement is a lender’s subsequent duty to the contract. Now, here’s how you can release someone who owes you money with the creation of a release of a debt agreement.

1. Specify the Details of the Debt Release

Creating a release of debt agreement revolves around the idea of relinquishing your claims against the borrower. Thus, it is essential for the agreement to specify the details of the debt release. To do so, you must introduce the parties of the agreement—the releasor and the releasee—along with their names and addresses. Then, set the debt release’s effective date, conditions for the borrower’s release, its co-signers, and personal guarantees. This will then define the scope of the agreement, and the limitations of its enforcement

2. Mention the Loan Agreement

Relieving the borrower from their obligations to the loan agreement is the primary purpose of a release of debt agreement. And along with that, is the termination of the loan agreement as well. In creating this agreement, you must mention the loan agreement itself. This includes indicating the type of loan entered, the date it was created, as well as the total debt amount and other valuable considerations. This step provides some background information that further consolidates the purpose of this agreement.

3. Acknowledge the Loan Payment

Releasing the borrower by way of this agreement requires the acknowledgment of the payment made. This means confirming the borrower’s payment of the owed amount, including interest, penalties, and other valuable considerations, as well as the method of which the payment was made. This acknowledgment will mark the beginning of the debt release and the subsequent termination of the loan agreement.

4. Clear the Releasee’s Records

A debt release wouldn’t be complete without clearing the borrower’s account. So in creating a release of debt agreement, it is also important for you to guarantee the redemption of the borrower’s credit reputation. For you to do this, simply declare your commitment to remove any records that may affect the borrower’s credit scores, and declare his accounts cleared and full-paid. Moreover, you must also guarantee the confidentiality of the information inside this agreement as well.

5. Complete the Agreement with Your Signatures

The same as personal loan agreements, a release of debt agreement wouldn’t be valid and unenforceable without your signature as well as those of the releasee. Your signatures also indicate the authenticity of the contents of the agreement. To further the validity and authenticity of the document, sign the agreement in front of a public notary along with two or three witnesses.

Frequently Asked Questions

What does a personal guarantee mean in a release of debt agreement?

Personal guarantees are properties are attached to a loan agreement to guarantee the payment of a debt. These can either be movable or immovable properties such as cars, jewelry, houses, or a parcel of land. These personal guarantees or securities are subsequently released after the full satisfaction of the borrower’s debt.

Are co-signers also released from the debt in a release of debt agreement?

Yes, since co-signers are also bound along with the borrower to the obligations in a loan agreement. Likewise, the parties must also provide a copy of the release of debt agreement to the co-signer, as well.

Does a release of debt agreement apply to extended loans and debts?

Yes. Extended loans are accessory agreements to the original loan agreement signed by the lender and the borrower. Thus, a release of debt agreement also applies to them as loan agreements do.

Do release of debt agreements have any requirements for notarization?

A release of debt agreement is notarized to authenticate the validity of their content. However, the necessity of notarizing these documents may also depend on the laws of the state in which these documents are executed.

Who will be the releasor of the release of debt agreement for an assigned loan?

If a loan was transferred or assigned to another lender, the new lender will act as the releasor to the release of debt agreement. The new lender shall also bear the responsibility of clearing the borrower’s accounts and record upon satisfaction and payment of the debt.

Releasing a borrower from their debts can be equally relieving to the lender. It means that borrowers can redeem their credit reputation, as well as, giving lenders one less problem to worry about. Aside from these, releasing someone from their debts also furthers the trust between you and your borrowers, as well as with the people around you. But for you to effectively do this, you must formalize their release with a release of debt agreement.