- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

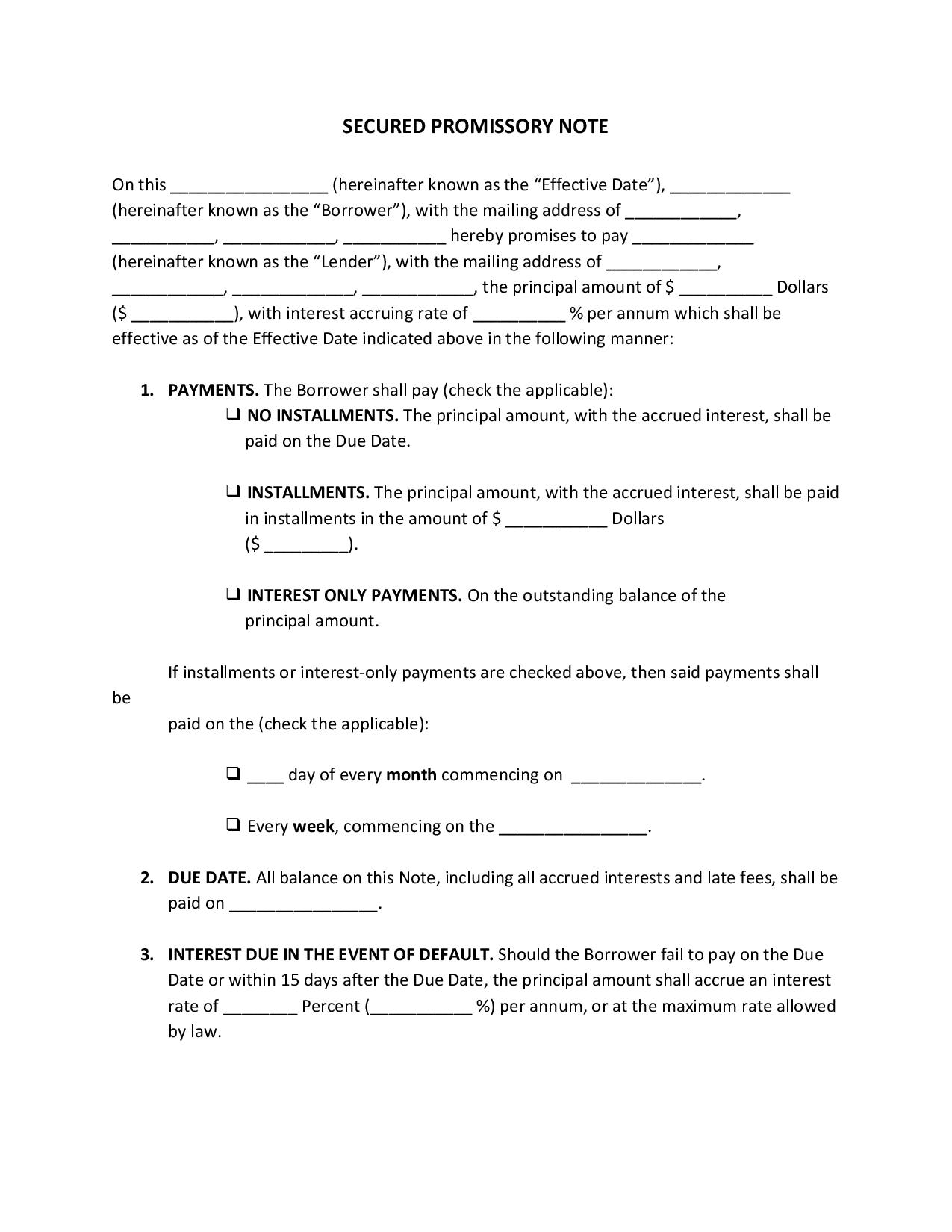

Secured Promissory Note

Money is a resource that not everyone has. The shortage of it compels a person to borrow money from a colleague, a friend, or a family member. A secured promissory note is the perfect document to use if lending money has never been a problem for you. This type of promissory note gives you a sense of security in case the borrower fails to issue loan payment. The security may come in a vehicle or real estate. Know your way around this instrument by reading further. Read More

What Is a Secured Promissory Note?

A secured promissory note is an agreement or contract between the lender and the borrower. It is a more secure type of promissory note that provides collateral to the lender in case the borrower defaults. The asset may be real or a personal property—as long as the asset is equivalent to the amount being loaned. The unsecured promissory note, however, leaves the lender open to risks of not being paid. Even if they seek legal action, if the borrower cannot pay the unpaid balance, then the lender will have to settle with the loss. Unsecured promissory notes are commonly given to borrowers with excellent credit.

Secured promissory notes require a second document. If it’s a real property, the document would be either a mortgage or a deed of trust. However, if it’s a personal property, the document would be a security agreement.

How to Create a Secured Promissory Note?

A secured promissory note should bind the borrower to its terms and conditions. Create a comprehensive secured promissory note by following the tips below:

1. Make Sure Secured Is Understood By the Borrower

A secured promissory note is entirely different from the ordinary promissory note. Make sure the borrower understands this type of promissory note before they sign. You can help them understand by discussing this face-to-face. With this thorough discussion, you can dispel possible altercations in the future.

2. Format the Terms and Conditions

The terms and conditions are what make the agreement effective and enforceable. Carefully set the payment terms (presence or absence of installments; payment upon due date), interests in terms of late due, acceleration, steps for repayment, and other relevant provisions. You must also emphasize the default clause, any grace periods, and who should shoulder the attorney’s costs and fees.

3. Identify the Collateral

The collateral should be worth the amount being loaned by the borrower. When stating the collateral, it should include all its distinguishing features such as the identification number, registration number, etc. You should also do your part by conducting state record searches to determine whether the collateral has been pawned to secure a previous note.

4. Observe State Laws

Each state has a different approach when it comes to secured promissory notes. They have different mortgage processes when it comes to collateral. Or for an in-depth understanding of the matter, you can hire a promissory note lawyer to better understand your state laws.

5. Sign the Promissory Note

After a careful review of the agreement with the borrower, sign the promissory note. Secured promissory notes can only be executed with dated signatures. You are also encouraged to let the public know that you are interested in the property as security in the promissory note by filing a UCC Financing Statement.

Frequently Asked Questions

What makes a promissory note secure?

A secured promissory note requires the borrower to provide a real or personal property as collateral. This is done to ensure that the borrower pays the due amount on time. And if they fail to do so, you can seize the collateral as payment for the loaned money. Secured promissory notes require a second document. If the collateral is a real property, the document would be either a mortgage or a deed of trust. However, if the collateral is a personal property, the document would be a security agreement.

Who should write the secured promissory note?

Lenders or creditors should write the secured promissory note. They are free to use a template for this note as long as all the mandatory provisions are provided. They are also free to consult with a lawyer in case of missing provisions that could put them in the losing end. The due date should be clearly specified—whether on the specified date or upon demand.

Who keeps the secured promissory note while it’s being repaid?

The lender or creditor should keep the secured promissory note while it’s being repaid. But ideally, for personal both parties’ personal records, both parties should obtain copies of the secured promissory note. Once it’s paid, the copies should still be kept for personal records.

What validates a secured promissory note?

A promissory note is only valid and enforceable once it is signed by both parties. If the borrower has a co-signer, then they are also required to sign the promissory note as well. Promissory notes are considered written agreements—however, verbal agreements are acceptable as well. But if disputes are to rise in the future, verbal agreements are difficult to enforce in the court of law.

What is the difference between a loan agreement and a promissory note?

According to Legal Nature, both instruments serve the same purpose. However, a loan agreement the loan agreement is more comprehensive than a promissory note. A loan agreement comprises additional obligations and promises of both parties and to include a guarantor as co-signer. Both instruments require you to specify a collateral for the agreement.

For some people, it is hard to resist squandering, especially if it involves luxurious items that they need to show off. That is why it is no shock how far people would go just to obtain money and pacify their itch. Being the generous person that you are, you try to look past this flaw by being sympathetic yet smart. This secured promissory note will ensure that you get your payment back—whether in cash or property. Call it a formal and legal version of tit for tat. They take away your money, and you take something of theirs. This note will secure payment of the money they loaned and will minimize delinquency. Be wise from the getgo.