- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

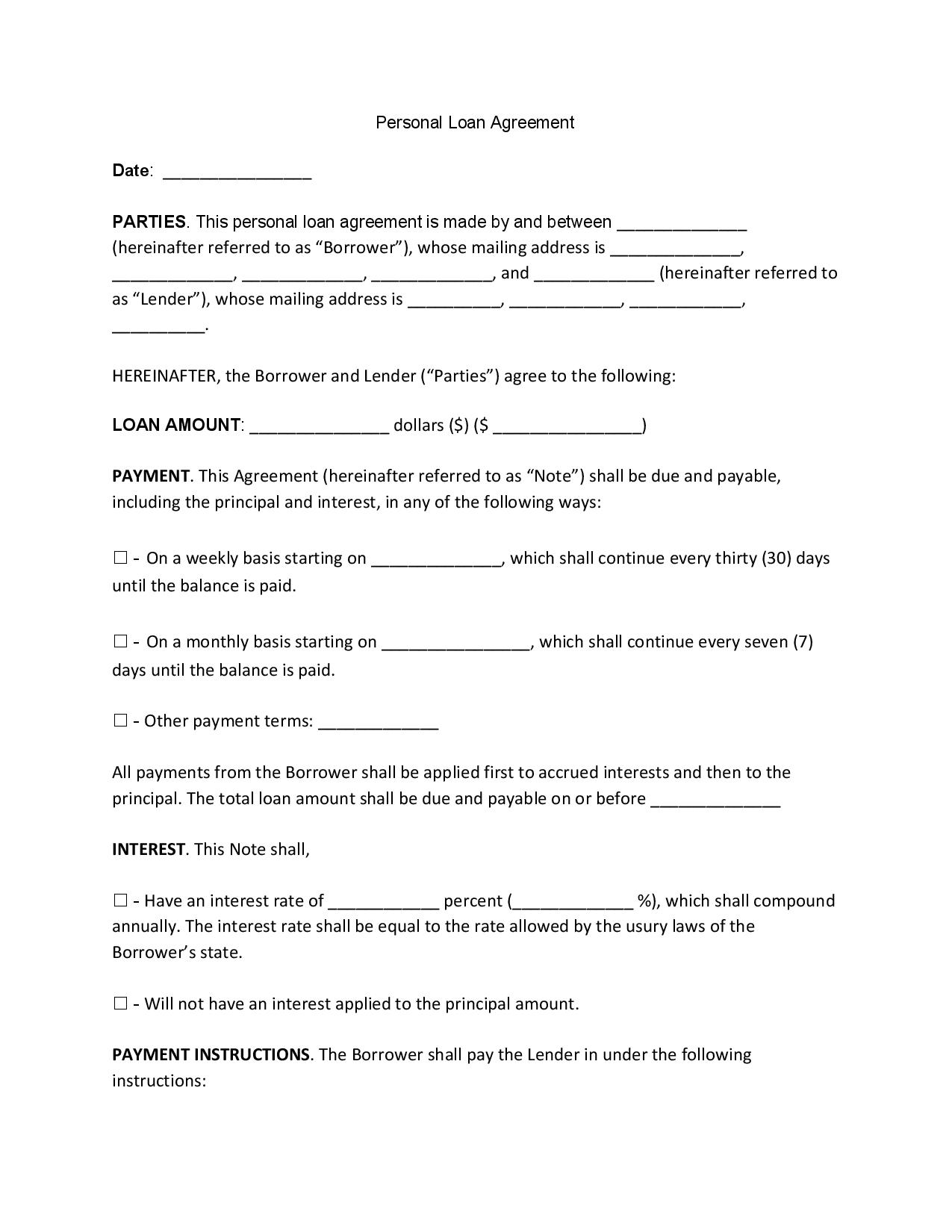

Personal Loan Agreement

All of us have gone through the plight of financial struggles. Our income is not always enough to sustain our home and school expenses. That’s why there is an option to get a personal loan made available by banks and financial institutions. But before we get approved for a personal loan, we have to sign a personal loan agreement first. This type of agreement lays out the terms and conditions that the borrower has to abide by to get approval for the loaned amount. Learn more about what constitutes an enforceable personal loan agreement by reading this article. Read More

What Is a Personal Loan Agreement?

A personal loan agreement is a legally binding document used to bind the borrower to the terms and conditions regarding the loan. The purpose of this agreement is to ensure that the borrower pays on time with accrued interest. The lender may be a financial institution, a bank, or an individual. Moreover, the computation of the interest is per annum.

How to Create a Personal Loan Agreement

1. Identify Both Parties

The first and primary step to creating a personal loan agreement is to identify the parties involved. Indicate the full names and the mailing addresses of the borrower and the lender. The lender can be the name of the company representative, the company name, or both. Lastly, verify the identity of the borrower by securing a government-issued identification card.

2. Detail the Loan Amount and Payment Terms

Indicate the loan amount in both words and digits. The payment terms should indicate that the payment is on an installment basis and is payable on a designated date. Indicate whether the borrower should pay on a weekly or monthly basis. If you have another option, make sure to specify it in the document.

3. State the Interest and Payment Instructions

No banks and financial institutions offer an interest-free loan. However, if your bank or financial institution is an exception, state it. Indicate the interest rate in words and figures for the borrower to understand clearly. But remember, the interest rate you impose must be aligned with your state’s maximum usury rate. After that, list the payment instructions for the borrower.

4. Include Any Late Fees and Security

Late fees are standard when getting a personal loan. Indicate any late payments you want to impose on the borrower if you allow one. For the security provision, ask the borrower for the real or personal property as security or collateral for the unpaid amount. If the said property does not reach the payable amount, then the borrower still must pay the remaining amount.

5. Include Other Additional Provisions

Include other additional provisions regarding the loan, such as the prepayment, remedies, acceleration, subordination, waivers by borrower, expenses, governing law, and successors. The document must explicitly state these provisions to avoid confusion on the borrower’s end. Apart from that, these provisions must be governed by the state where it operates.

6. Sign the Agreement

Frequently Asked Questions

Do I need to notarize the personal loan agreement?

It depends on the state that you belong to. Some states do not require you to notarize the legal document. Nevertheless, experts highly recommend it. A notarized personal loan agreement makes the whole thing official. It also helps you avoid legal complications.

What are the five types of personal loans?

- Fixed-Rate – when the interest rate remains the same throughout the repayment period.

- Variable Rate – when the interest rate is bound to a third party.

- Co-Sign – when the borrower has undesirable credit and needs someone else to pay.

- Secure – in case of default, the borrower needs to put collateral as payment security.

- Unsecured – the borrower does not need to put collateral, but in case of default, their assets may be confiscated legally.

Are personal loans a good idea?

Yes, personal loans can be a good idea if you have excellent credit. But if your credit is below satisfactory, there is a possibility that your interest rate will be so high—even higher than credit card rates.

What is the ideal reason for getting a personal loan?

Paying off your credit cards is one of the ideal reasons for getting a personal loan. You may be offered a low-interest rate, and the amount of interest you pay and the time it takes to pay off your credit are reduced.

What is considered financial hardship?

According to Credit.org, loss of income, divorce, death, injury or illness, change of employment status, natural disasters, and military deployment are considered examples of financial hardship.

Banks and financial institutions even understand what it means to be empty-handed. It is difficult to get by, especially if your personal needs and obligations are not met because of financial shortage. But banks and financial institutions are clever enough to secure the money and not get played. With the significant amount of money being loaned, it’s wise to hold the borrower liable from the beginning. Help secure your finances now with a personal loan agreement.