- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

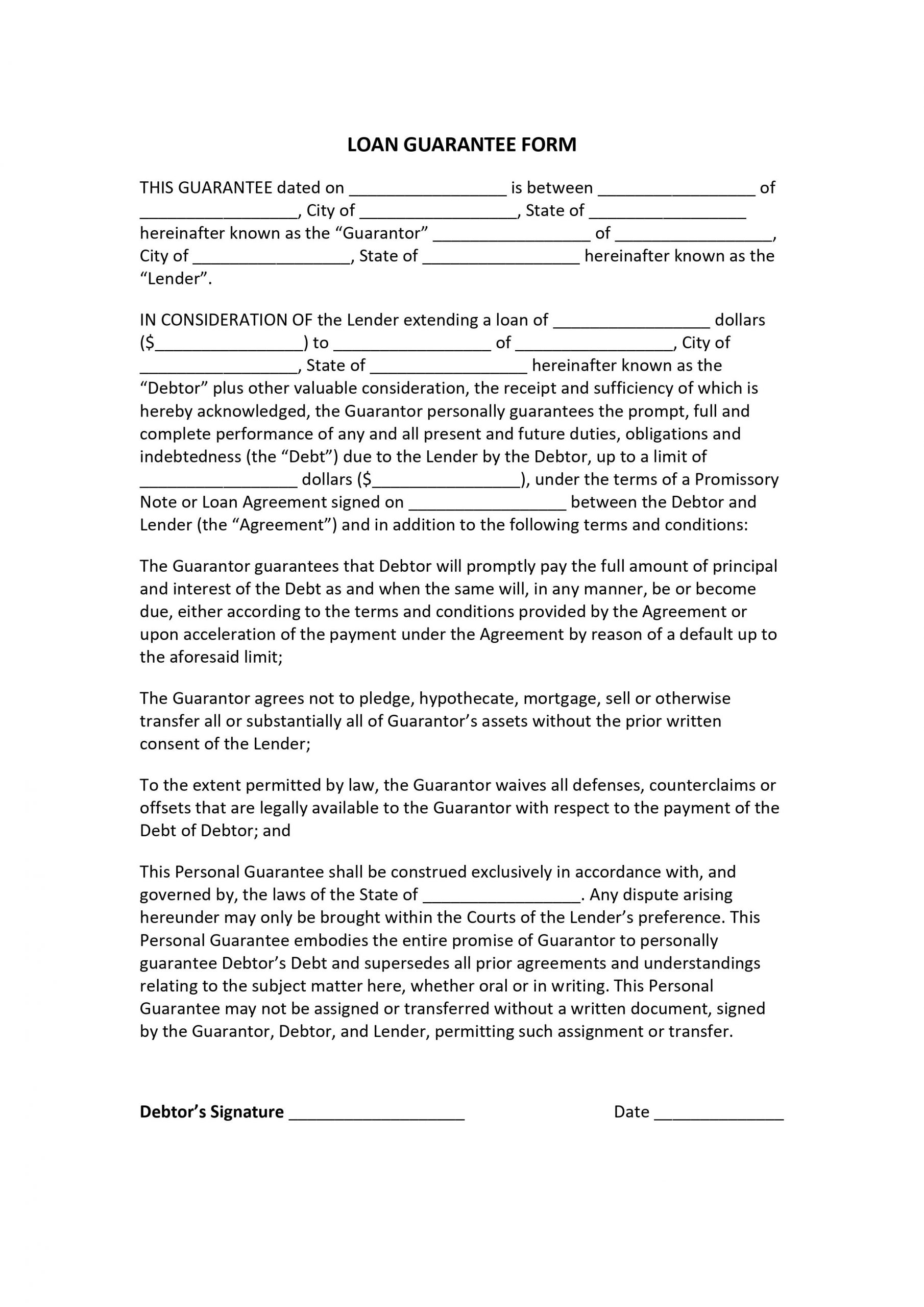

Loan Guarantee Form

While debt allows us to buy homes and cars, and send our kids to college, some Americans are still struggling to climb out of it. According to Debt.org, 14 trillion US dollars was the consumer’s debt in the third quarter of 2019. Although some legal protections can help pay back money owed to creditors, many debtors have an inadequate credit history. That is why a loan guarantee form is important if a debtor is compromised in paying their loan. Find out more about a loan guarantee form and how it secures the lender’s finances with this article. Continue reading below. Read More

What Is a Loan Guarantee Form?

A loan guarantee form is a document used in loan arrangements. Generally, it allows a guarantor to pay back money owed to a lender if the borrower has insufficient resources to repay. Even though it would be difficult for some to loan because of low earnings and other liabilities, looping a guarantor can change a lender’s perspective. It means a higher chance of loan approval, lower interest rate, and favorable borrowing terms. Because loan has tricky nature and money is contentious, a loan guarantee form gives both debtor and creditor security for better financing options.

How To Create an Effective Loan Guarantee Form In Four Easy Steps

What happens if a debtor cannot pay back a loan? In most cases, the parties involved will enter a repayment plan, which is an agreement with the lender allowing the borrower to pay the debt monthly with the set amount. If the debtor fails to follow the agreement, he or she will be in trouble with the court order. For the creditor, the court’s intervention is an effective way to regain the money. However, a loan guarantee form can prevent pursuing expensive lawsuits. Here are tips in creating a loan guarantee form in MS Word and PDF file formats. More on this below:

1. Identify the Parties Involved

Ideally, a loan guarantee form starts with the introduction of the parties. Whether the document is for personal or company use, all parties should be careful with the names they will use—and this should be factual. The parties can use the name of the company or name of an individual. If you choose the latter, make sure it is legal; the one that can be supported with other legal documents. Provide the parties complete address, execution, and effective dates too. Identifying these details clarifies the parties’ participation in the loan arrangement.

2. Indicate the Loan Amount

A typical loan requires a contract and a loan guarantee form from the lender and borrower. These are fundamental means to prompt the guarantor to take over repayment if the debtor fails to do so. It means the guarantor is subject to similar terms as the borrower. So, it is important to indicate the total loan amount and balance in the document. Since lending standards vary on location, specify the loan’s origin as well. This way, legal contexts, and specific provisions will be clear.

3. Provide the Loan Terms and Guarantor’s Obligations

One crucial part of a loan guarantee form is the terms and conditions. Since it describes the loan arrangement and terms, it requires details like loan limit and due date. Although some stipulations are written in the official loan agreement, the guarantor’s obligations should be specified in the loan guarantee form. The form has to layout guidelines for the repayment. And, it should also explain the possible outcome when the debtor stumbles into a pitfall. Thus, make sure to communicate the expectations clearly before signing the form.

4. Notarize the Document and Sign

The loan guarantee form does not end after the terms and conditions because it needs to be notarized in the presence of a witness or two. Check on your place’s notary requirements first because it depends on the state laws. After that, let the debtor, creditor, and guarantor sign the loan guarantee form. This signifies that the parties involved agreed on the guidelines set out in the document. If you want to be sure of the legitimacy of the loan guarantee form, consult with an attorney to ask questions and settle concerns regarding the loan arrangement.

Frequently Asked Questions

Are SBA loans guaranteed?

The government guarantees any Small Business Administration (SBA) loan. Mostly, banks issues this guarantee to small businesses in the United States. Up to 85% of loans of $150,000 or less and 75% of loans of more than $150,000 the SBA can guarantee.

What is a government-guaranteed debt?

A government-guaranteed debt or federally guaranteed obligations are debt securities in the United States. They issue this guarantee to be risk-free and receive full faith and credit of the federal government. Selling these securities will finance the federal debt.

How do you value a loan guarantee?

To obtain the value of the guaranteed obligation/loan, discount the expected cashflow (principal and coupon payments under the risky rate) to the guaranteed rate. The value of the non-guaranteed loan can be obtained by discounting at the risky rate.

To guarantee payment from a debtor, lenders should use a loan guarantee form. In a win or lose situation of any lending arrangement, a creditor may not gain payback by settling with the usual protection methods. And, a debtor may find it hard to loan money because of an insufficient financial statement. The way around this is signing a loan guarantee form. It protects the lender’s interest without compromising the borrower and guarantor’s accounts.