- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

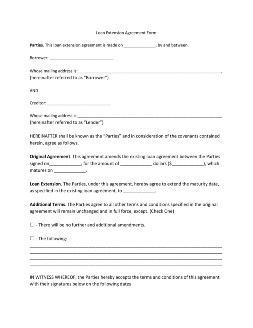

Loan Extension Agreement

There are times when borrowers may need an extra amount of time to repay the amount of what is owed. As Lenders, on the other hand, we may choose to be generous enough to grant such an extension. And for that matter, you will need to put such an extension in writing inside a loan extension agreement. Read More

Loan Extension Agreement

- What Is a Loan Extension Agreement?

- How To Create a Loan Extension Agreement

- Frequently Asked Questions

- Do I need to meet with the borrower before creating a loan extension agreement?

- Is a loan extension similar to a lease extension agreement?

- What other types of loans are loan extension agreements used in?

- Does a borrower need to request a loan extension before I can create a loan extension agreement?

- Do I need to attach the loan extension agreement to the original loan agreement?

What Is a Loan Extension Agreement?

A loan extension agreement allows borrowers an extra amount of time for their loans to mature. This agreement amends the original loan agreement by restructuring the borrower’s payment schedule, including the setting of the new maturity date in place of the original one. Also, a loan extension agreement may include additional terms and conditions to the loan agreement to guarantee the borrower’s repayment of the loan.

How To Create a Loan Extension Agreement

Loan extensions exist in every type of loans, such as family loans and promissory notes, to name a few. And, these are often granted to borrowers who lenders find and consider trustworthy or to someone who has no record of delinquency. Loan extensions must be documented in an agreement as with any loans in general. And to do that, here are the steps on how to create a loan extension agreement.

1. Identify The Parties of The Loan

First off, every agreement starts by identifying the parties involved. The parties in a loan extension agreement are namely the lender and the borrower, just as with every type of loan agreement. Identify the parties by introducing their respective names along with their mailing addresses. Identifying the parties defines the roles that each of them plays inside the agreement.

2. Mention The Original Loan Agreement

A loan extension agreement extends the maturity period specified in the original loan agreement. To some extent, a loan extension agreement is somewhat an accessory agreement to the original loan agreement. With that mentioned, it is also essential to say the original loan agreement, including its effective date and the original maturity date, when writing a loan extension agreement.

3. Set The New Maturity Date

Since a loan extension agreement extends the maturity date of a borrower’s loan, it’s imperative to set a new maturity date in replacement to the original maturity date. To do this, simply write the day, month, and year of the extended maturity date. Doing so gives a more definitive payment schedule as well as providing the borrower with a realistic period to pay for his or her loan.

4. Include Additional Terms and Conditions if Necessary

Extending the maturity date of a borrower’s loan is a favor in itself. And as with many favors, most of them are likely to have additional terms and conditions tied around them. If you wish or need to add some terms and conditions with regards to the extension of the loan, all you need to do is enumerate them on the section reserved for them. Including additional terms and conditions will help make the loan extension more comprehensive for the borrower concerning the payment of the loan itself.

5. Sign the Agreement, Notarize if Needed

Lastly, sign the loan extension agreement with the borrower right after outlining the structure of the loan extension. That way, it signifies you and the borrower agree with the terms and conditions of the loan extension. Moreover, you may also need to notarize the loan extension agreement if in case the original loan agreement is notarized. Then it authenticates the extension of the loan in place of the previous term of the loan agreement.

Frequently Asked Questions

Do I need to meet with the borrower before creating a loan extension agreement?

Yes, you need to. Firstly, because a loan extension is something you can’t grant to the borrower unless they expressly need so. And, because you also need to know the circumstances that made the borrower request for a loan extension. Aside from these, it is also important to meet the borrower so that you can discuss and agree on the terms and conditions of the loan extension agreement.

Is a loan extension similar to a lease extension agreement?

While both extension agreements extend the term of their respective transactions, they, however, differ in some respects. More obviously, a loan extension applies to loans in general, while a lease extension applies only to leasing. Moreover, loan extensions cover the payment and extinguishing the borrower’s obligations to the lender while lease extensions do the opposite.

What other types of loans are loan extension agreements used in?

Loan extension agreements are documents that extend the maturity period of a loan agreement. These are often used in different types of loans, such as the following:

- auto loans;

- business loans;

- construction loans;

- mortgages;

- payday loans;

- personal loans;

- family loans; and

- school loans.

Does a borrower need to request a loan extension before I can create a loan extension agreement?

Yes. As mentioned, loan extension agreements are created right after a borrower requests for such an extension to the lender. However, this doesn’t necessarily mean that the borrower immediately gets a loan extension right away. The borrower must first have the lender’s approval before having his or her loan extended.

Do I need to attach the loan extension agreement to the original loan agreement?

Yes. A loan extension agreement extends a loan’s maturity date in place of that of the loan’s original maturity date. It only means that attaching the loan extension agreement to the original load agreement signifies that the obligation of the borrower towards the lender has not yet extinguished. This also helps the borrower that he or she has not defaulted nor is delinquent to the payment of the loan itself.

Loan extensions are a generous favor that lenders could grant to their borrowers. However, such favor should not be given freely without anything to guarantee your interest—the repayment. A loan extension agreement allows you to show your generosity towards the borrower without putting everything at risk.