- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

I Owe You (IOU) Form

Many people experience financial hardships, and it compels a person to borrow money from the person closest to them. If that same person borrows money from you, make sure that they deliver their promise. In these situations, an I Owe You (IOU) Form is the ideal instrument to document your transaction with the debtor. It’s a document that will hold them liable for their debt. Read further to know more about an I Owe You Form and the process of completing one. Read More

What Is an IOU (I Owe You) Form?

An IOU (I Owe You) Form is a form used by a person who is financially indebted to another. Two parties use it to document their transaction. Typically, the creditor or the person owed money to furnishes this to ensure that the other party delivers their promise. You’ll find this type of document to be beneficial when committing friends, family members, and business partners to their financial obligations.

How Do You Create an IOU (I Owe You) Form?

According to Debt Org, the millennial debt of ages 35 below accounts for credit cards (20%) and student loans (21%). Entertainment, clothes, and other irrelevant costs are what comprise 40% of their income. Contrary to a promissory note, this form is informal and only states the money owed to the creditor. A promissory note, however, indicates not only the money owed to the creditor but also the steps needed to pay the debt and the corresponding consequences if the debtor hasn’t settled the debt.

An IOU form is easy to make as long as you are guided. Below, we will show you tips on how to create an IOU form:

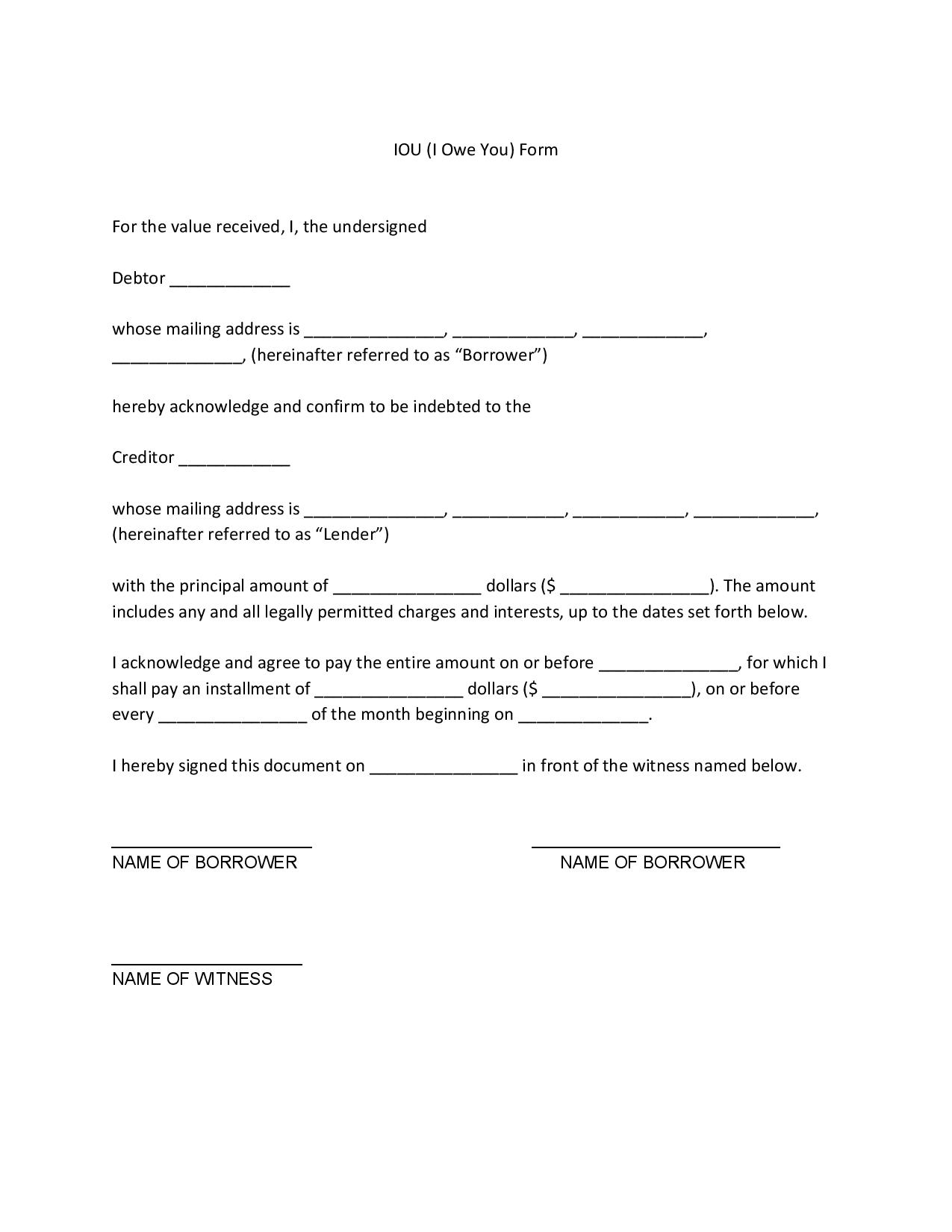

1. Identify Both Parties

First and foremost, you must identify the creditor and the debtor. The creditor is the person whom the money is owed to while the debtor is the person who owes the money. You may use a government-issued identification card to ensure the identity of the debtor. Use only legal and full names when identifying both parties. Their addresses must also be in the same form.

2. Specify the Amount

Second, specify the principal amount owed in words and figures. If there are any permitted charges or interests, indicate that it is in the principal amount. But before you charge any interests, research on your state’s laws regarding the maximum legal interest rate that you can impose on the debtor. Indicate also the currency of the amount.

3. Indicate the Date of Repayment

Third, indicate the date of repayment and whether you allow installment payments. Usually, installment payments should be on a designated day of the month. State the amount and their corresponding deadlines explicitly to avoid confusion on the debtor’s part.

4. Review the Form

Fourth, don’t forget to review the form after creating it. Read from start to finish and see to it that you have everything accurate. Overlooked mistakes can place you in the losing end, and you do not want that to happen. Review the form together with the debtor before signing the document.

5. Sign and Notarize the Document

Lastly, have your document notarized by signing in front of the notary public. Research your state laws if they require you to notarize the said document. But if it does not, a notarization is still highly recommended. You do not need both since it presents in front of the notary. Just as long as you sign it in front of the notary, you are good to go.

Aside from the signatures finalizing the document, you should have a witness.

Frequently Asked Questions

What is the difference between a promissory note and an IOU?

According to Expertistas, an IOU simply states that a debtor owes money to the creditor. Whereas a promissory note is more serious—it states that money is owed to the creditor, the steps needed to pay the debt, and the corresponding consequences if it is not paid. A promissory note, sometimes known as a personal loan agreement or a loan agreement.

Is an IOU enforceable?

Yes. An IOU is enforceable in court as long as you can provide proof. The debtor may state that the money was received as a gift or given as a benefit. You should be able to provide proof to prove otherwise in small claims hearing.

What should I put in my IOU?

Your IOU should have the identities of the debtor and the creditor with their mailing addresses, the repayment, their signatures, and the notary public’s acknowledgment. However, a notary public’s acknowledgment is not required in every state.

What is the purpose of a witness?

A witness sees to it that the signatures on the document are authentic. The witness should have no personal or financial interest in the content of the document, or they will not qualify. The witness should be the objective party and should not be a relative of either party. Moreover, the witness must be at least 18 years old and not under duress nor drugs when they sign the document. They will have to attest should the time for questioning regarding the document comes.

What is the effect of a notarized document?

Once you notarize a document, it becomes admissible in court. But first, the notary public must ensure that you were able to fulfill the requirements before approving the said document. All in all, notarization marks the authenticity of the material.

Time and time again, people experience financial hardship. And human as you are, you show solidarity by lending them a sum of money. Now, you are no innocent to people who are only good with promises but do not find ways to fulfill their promises. You are left with nothing but to cry with spilled milk. To prevent such a dilemma, you must set the rules in stone and hold the debtor liable from the beginning. This IOU form will do just that. This form will compel the debtor to pay the principal amount on time. Secure yourself and your money by using this IOU form.