- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

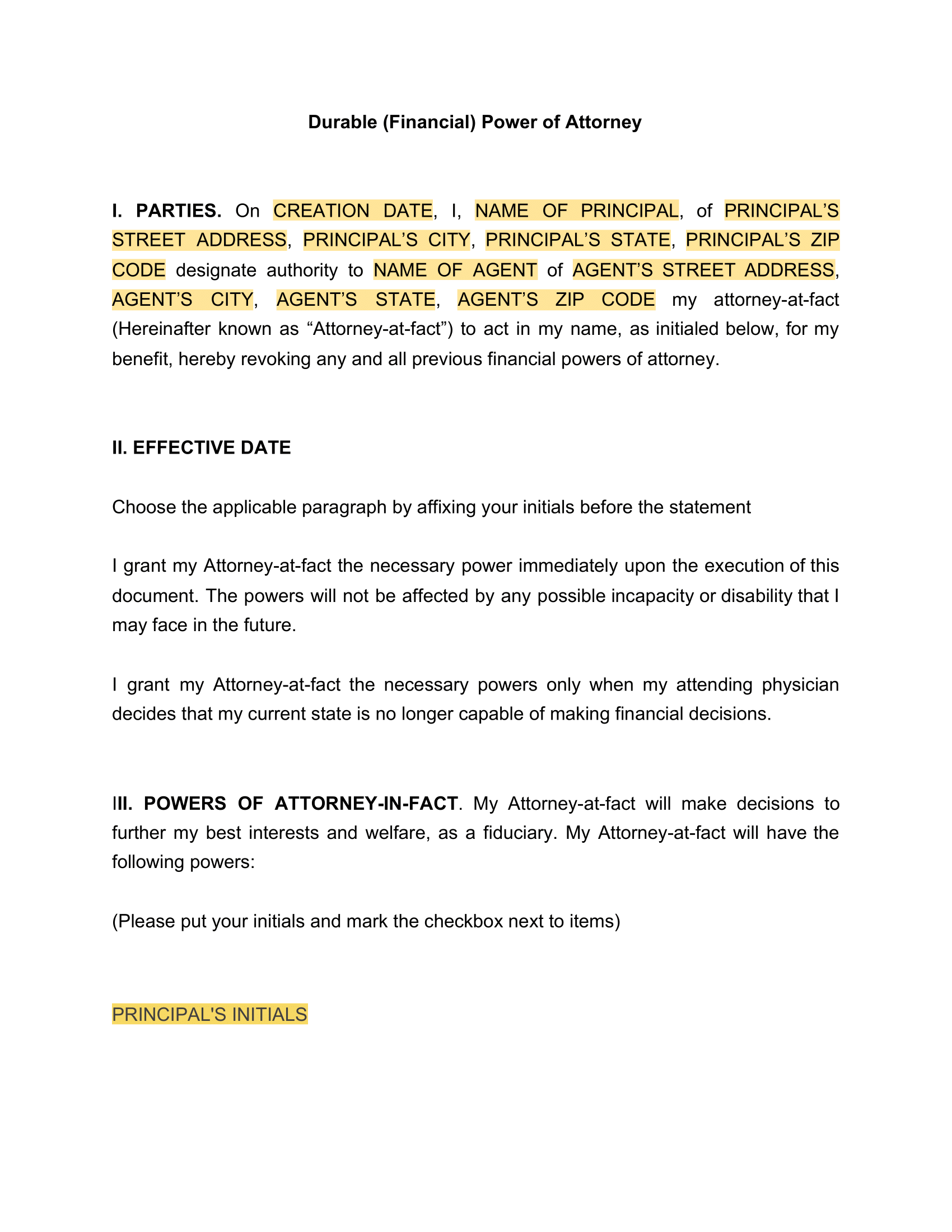

Durable (Financial) Power of Attorney

People aim for high-paying jobs to earn as much as they can until they retire. They put through with sacrifices and, sometimes unnecessary hassle, to gain every buck. Thus, it is just right for each person to have a proper plan in handling their finances, both for the short-term and long term. An example of a long-term plan for securing your finances is by preparing a durable financial power of attorney form early on. Read More

Durable (Financial) Power of Attorney

What Is a Durable (Financial) Power of Attorney Form?

In general, a power of attorney is a legal document that grants a representative the powers of attorney over specified or all financial or legal matters. A durable financial power of attorney form, in particular, focuses on managing the financial matters of an individual. The form contains the extent of the power granted to the chosen attorney-in-fact. It covers everything from managing existing bank accounts, insurance, and retirement plans. This form comes in handy when you are no longer capable of making such critical decisions.

How Do You Create a Durable (Financial) Power of Attorney Form?

Most people refuse to create a financial power of attorney beforehand because there is no sense of urgency. Rather, creating one is associated with one’s incapability of making such decisions. However, one must always keep in mind that a power of attorney is subject to multiple revisions, similar to last wills. If you decide that you want to create one early on, here are some of the basic steps and tips on how to create a financial power of attorney form.

1. Identify Your Attorney-In-Fact

The form starts with an introduction of the parties involved in the arrangement. The principal or the creator of the document states their legal name and respective mailing address. As for the other party, which is the appointed attorney-in-fact, it must be someone that the principal personally chose. The relationship concretized in a power of attorney is based on trust. Thus, the goal of the principal is to choose an agent or attorney-in-fact who they can fully trust. It must also be someone who they know is capable of handling all the financial matters.

2. Establish the Form’s Effectiveness

A short but critical part of the form determines the start of the form’s effectiveness. By affixing the principal’s initials to either one of the choices, it determines whether the form becomes effective immediately or when the principal becomes incapable. This is a critical detail that will either allow the agent to perform their duties immediately or if they have to be on standby. If the principal chooses to change the attorney-in-fact, later on, they can also choose to change their option for the document’s effectiveness.

3. Determine the Extent of the Power

The next part of the form is essentially a list of the tasks appointed to the agent or attorney-in-fact. This is a list of the financial tasks and responsibilities and their respective descriptions. The principal is free to choose which of the following tasks they are willing to be managed by the agent. It is a guide for both parties; the guideline on what they can and cannot do. It sets the boundaries between the camps.

4. Review Supporting Clauses

The remaining clauses in the form include a list of possible additional clauses that the principal would like to include. Other than that, it also discusses the authority and liability of the attorney-in-fact. Arrangements about possible reimbursements of the attorney-in-fact’s expenses while carrying out the tasks are also concretized by a single clause. The agreement is then ended by stating the governing state law of the entire arrangement.

5. Need for Witnesses and Notary

States have different requirements when it comes to the power of attorney documents. Some require at least two non-related witnesses to sign the document together with the principal and attorney-in-fact. Moreover, notarization may also be required. If so, make sure that both parties must stand witness before a notary public before signing the document. Signing it beforehand will affect the validity of the entire arrangement.