- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

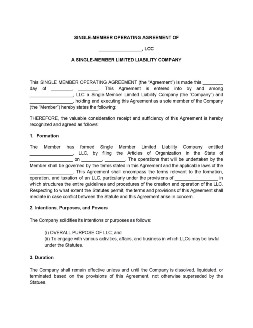

Single-Member LLC Operating Agreement

Many people in business try to form a business or organization without a checklist or without knowing the fundamental paperwork that goes with it. A company operating as an LLC especially needs to have complete business formation documents, and one of those is a single-member operating agreement. Having a Single Member LLC Operating Agreement solidifies the status of an LLC as a separate entity from the personal assets of the owner or the member. This might sound simple as compared to another LLC type, which is the multi-member LLC operating agreement, but nothing separates the necessity for you to understand its entire context. Read on to know more. Read More

Single-Member LLC Operating Agreement

What is a Single-Member LLC Operating Agreement?

As mentioned earlier, a single-member LLC operating agreement is a legal form business that consists of one member only. The document is simply a separate entity from the member personally. Whatever revenue the single-member gained and the expenses deducted along with the operation, this revenue will be passed through a tax rate similar to the owner’s level. The LLC will reflect in the member’s federal tax return, but he or she is not personally responsible for the debts and obligations attached to the company. Since the State creates disparities among the agreement’s context, then one must take note of the state coverage before finalizing the entire content of it. If you have a small business or a real estate and you want to be part of an LLC, you must know what comprises the limitations of the contact.

How Do You Create a Single-Member LLC Operating Agreement?

In forming a Single-Member LLC, there are steps to follow. The first is to take the membership process. Some find a name reservation first under their State’s business database. Then, they proceed in creating the Articles of Organizations. Like any other process, the member will later pay the needed filing fee. After the payment process, the member will now start writing an operating agreement. In filling the agreement with the necessary parts, the member must outline the business’s ownership appropriately. Before getting an Employer Identification Number (EIN), the member should be aware of the following steps aiming to construct an LLC agreement that best fits the needs of the member.

1. Start with the Official Title of this Agreement

As a member, if you have decided to create from scratch, you have to start with putting the official title of this agreement. The title typically follows this format “Sole Member Operating Agreement of (name of the Company) LLC.” You have to state the name of your LLC first. But before you fill it out on this page, you have to ensure that you’ve searched it in the business database of your State so that you can use a title that has no duplicate. After that, you include the phrase “A Single Member Limited Liability Company” at the bottom part of the title.

2. Proceed with an Introduction

Unlike other written materials, the introduction should not be fancy or lengthy to give an idea of what the agreement is. Instead, you have to ascertain that you directly described the agreement. This must be short and understandable. The first paragraph consists of the exact date that this agreement will be valid with complete details of the date, month, and year. Next, you add the names of the involved party. With this, there are two parties that you need to mention, the name of LLC and its sole member. Even if you have mentioned what type this agreement would be, you have to restate it again in this paragraph.

3. Mention the Purpose, Member Authority, and the Governing Law

Right after completing the introduction, you may proceed to the body of this agreement. First of all, you need to mention the purpose of having this LLC concretely. Next, incorporate the use and powers of the LLC and the member. In this process, be reminded that you have to create according to rules and laws available in your State. After the purpose, you now include the rights, powers, and the member’s obligations.

4. Add a Notary Acknowledgment

Once you have stated all the regulations explicitly, you may now proceed in adding a notary acknowledgment in the last part of the form. This part makes your agreement valid and solidifies your intent to create this LLC and become its sole member. More importantly, you, some witnesses (if you have), and the notary public shall now affix their signatures). In this particular case, you have to state the name clearly.

FAQs

Why is a Single-Member LLC Operating Agreement necessary?

The primary importance of a single-member LLC operating agreement is its security for liability protection. It protects the member’s personal assets from the company’s business assets.

Does a Single-Member LLC Operating Agreement need Articles of Organization?

Yes, a single-member LLC operating agreement needs the articles of organization. Articles of the organization is a document filed along with the forming the LLC.

Can a husband and wife have a Single-member LLC?

When the LLC is set up in this case, one spouse is the owner and the other spouse functions as the employee.

This document may serve as a protection for a member against the company’s debts and obligations. However, the member must ensure that the agreement is legal to function according to its purpose. If creating the company is an intricate procedure, then creating an agreement has to be of its pure details, as well. More importantly, in proving the authenticity of this document, the contract shall be evaluated by a notary public, affixed a signature between you, as the member, and the notary public.