- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

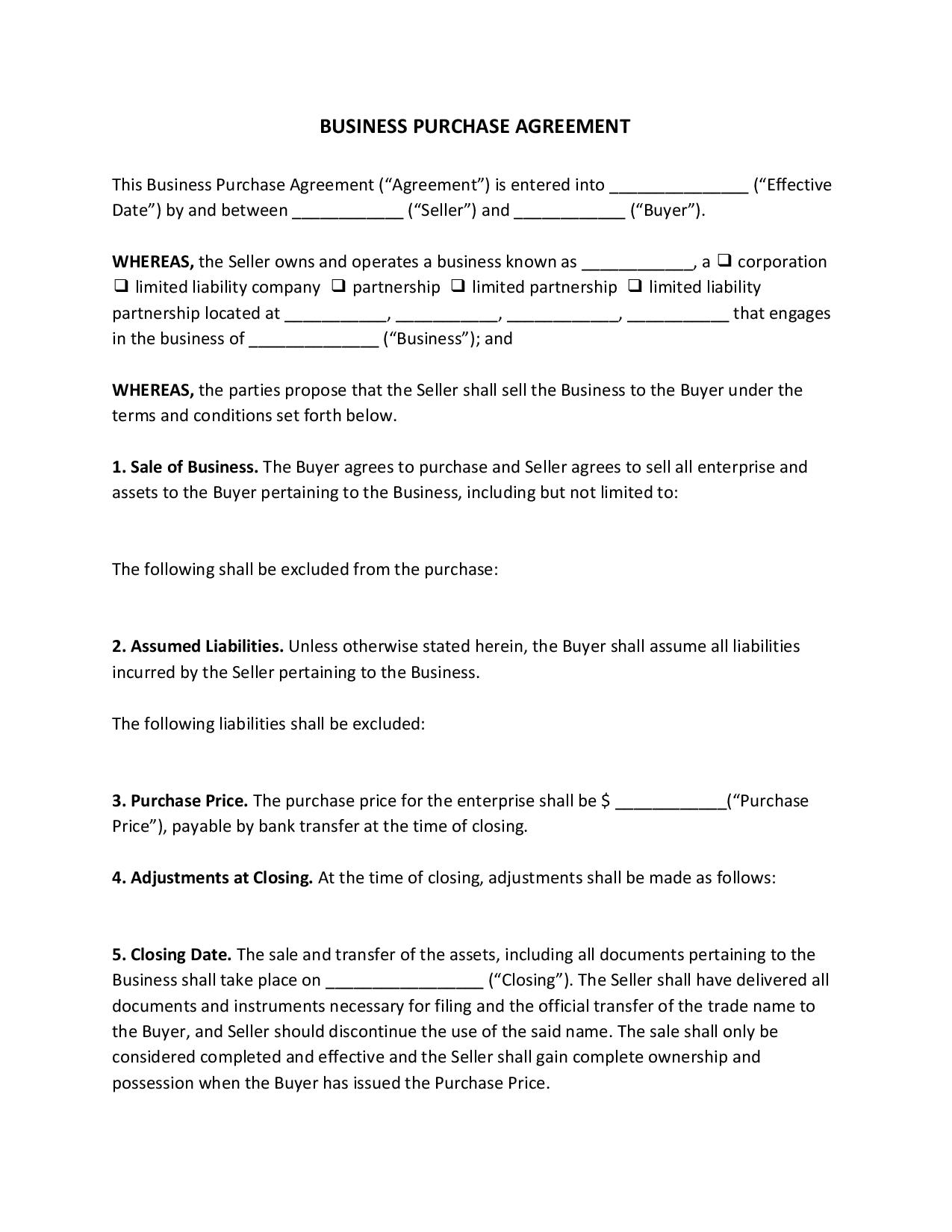

Business Purchase Agreement

Owning or acquiring a business is one of the wisest decisions to make if you want to have a passive income. And it’s also understandable if an individual wish to purchase a business instead of starting from scratch. Then some want to sell their business to a willing buyer. If you’re one of them, you’ll need to use a business purchase agreement. This agreement will serve as proof that, indeed, there is a legal transfer of ownership. More importantly, it will also serve as your protection. To know more about this type of agreement, continue reading below. Read More

Business Purchase Agreement

What Is a Business Purchase Agreement?

A business purchase agreement is a legal document used to transfer business ownership from a seller to a buyer. It establishes the terms and conditions of the sale as well as the background information of both parties. Most of the time, it’s the seller who furnishes this document to the buyer. According to Duomo, about 90% of Americans search for a business to buy but never complete the transaction. And although 50% of Americans dream of having a business, this does not guarantee success for most because they dive head-first despite their lack of education. Even though these people have stable careers, nothing could have ever prepared them when it comes to handling a business, which is why it’s essential to cover all bases right from the start. You can do so by making sure the agreement lays out the terms and conditions of the purchase effectively.

How Do You Write a Business Purchase Agreement?

A business purchase agreement consists of provisions that may eventually get complicated. But you need not worry because we have compiled helpful tips for you to create a business purchase agreement:

1. Introduce Both Parties

Every agreement always starts with the introduction of both parties. Introduce the seller and the buyer by stating your full legal names along with your mailing addresses. The mailing addresses must be complete with the city, state, and zip code.

2. Cite the Inclusions of the Purchase

Before the said purchase, the business has its tangible and intangible assets and liabilities. It is worth noting that, in most cases, these are automatically included in the purchase. But there are instances where you want to exclude some. Cite the included assets and liabilities, but make sure to cite the exclusions as well.

3. Provide the Purchase Price, Adjustments, and Closing Date

Provide the purchase price of the business and the mode of payment. Ideally, payments for a business purchase are made at the time of closing. So, indicate the closing date and all the paperwork that the seller needs to turnover. You can also include that the seller can no longer use the trade name after the official transfer. Note that business operations do not halt during the transaction. The purchase price might change to reflect the actual state of the business. So, include a list of adjustments at the time of closing.

4. Supply Conditions, Representations, and Warranties

Representations and warranties protect both the buyer and the seller. The warranty includes outlines that a party may take action against the other if a single representation is inaccurate. To make the document easily understandable, make sure to provide appropriate headings for these sections.

5. Include Other Relevant Provisions

Include other relevant supporting provisions such as notices, amendment, binding effect, headings, governing law, counterparts, severability, and absence of a waiver. You may also include other provisions that you think are necessary but are not included in the template you downloaded.

6. Sign the Purchase Agreement

An agreement can only be executed when it has the dated signatures of both parties. But before you sign the document, review the whole agreement with the buyer if there are any discrepancies. Once done, sign it with the other party and provide the buyer with a copy. These copies will serve as your records. Look up your state’s laws if they require you to notarize the agreement.

Frequently Asked Questions

How long should a business purchase agreement last?

The business purchase agreement typically lasts up to one year.

What should I in the business purchase agreement?

The provisions you must include in the said agreement are as follows: sale of the business, assumed liabilities, purchase price, adjustments at closing, closing date, conditions, representations, and warranties, notices, amendments, counterparts, binding effect, headings, governing law, severability, and absence of a waiver. However, don’t be limited to this list only, as you can add more when necessary.

Do I need a lawyer to draft my business purchase agreement?

No. You can create the agreement yourself as long as it is aligned with your state’s laws. However, if you are having doubts about the draft you made, you are free to consult a lawyer.

What makes an agreement or contract valid?

An agreement is valid when the following are present:

Offer – when the seller offers the business to the buyer.

Acceptance – when the buyer accepts the offer of the seller.

Capacity- both parties must be at least 18 years of age when signing the agreement. Aside from the age, there must also be consent—wherein either party wasn’t coerced or under distress or undue influence.

Consideration – where the seller agrees to sell the business for a purchase price.

Intention- both parties intended to agree.

What is the difference between an agreement and a contract?

An agreement is typically an informal arrangement between two parties that may consist of terms and conditions that are not enforceable by law. A contract, however, is a formal agreement between two parties with terms and conditions that are enforceable by law. An agreement that lacks one of the elements of a contract cannot be considered legal and valid.

Having a business is one effective way of getting a passive income. Aside from the uncompromised time it brings the owner, it can also be lucrative, especially in its peak season. When you decide to sell your business, some potential buyers want to continue its operations. Then, once you have decided to sell your business to them, you’ll need a business purchase agreement to ensure a smooth transaction. This agreement will bind you and the buyer to prevent unwanted disputes and misunderstandings.