- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

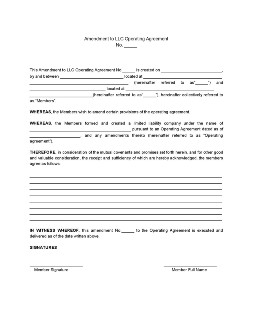

Amendment to LLC Operating Agreement

Changes are constant. And most of the time, changes are necessary. This rings true in business organizations such as an LLC. In their formative stages, LLCs would often go through some changes and adjustments before they can establish operational stability. And as with many things in business, any Amendments to an LLC’s Operating Agreement should be made in writing. Learn more about his type of agreement by reading on in this article. Read More

What Is an Amendment to the LLC Operating Agreement?

Several factors influence changes and adjustments in an organization, more so with LLCs. Sometimes, these factors might lead people to amend the company’s core document, which is its operating agreement. Whether it’s adjusting the distribution of dividends or granting new privileges to members, an amendment to the LLC operating agreement is an internal document that formalizes any changes to the company’s operational and organizational structure.

How To Make an Amendment to the LLC Operating Agreement

Changes and adjustments to an operating agreement are necessary for an LLC to function and operate seamlessly. And like any updates and changes in business, these should be well documented in writing as well. Here’s how you can amend your LLC’s operating agreement with these few simple steps and tips.

1. Review the LLC’s Operating Agreement

Before making any amendments to your LLC’s operating agreement, you should review the operating agreement first. Operating agreements are internal documents that layout your company’s organizational, management, and operational structure. And it may have provisions that may make any amendments invalid. Also, you should hold a meeting with other members first before amending your company’s operating agreement.

2. Make a List of Changes or Additions to the Operating Agreement

Along with a copy of the operating agreement, list down the sections that you need to amend or the provisions you need to change. It is better to do this step while holding a meeting with the shareholders since most operating agreements wouldn’t allow any amendments without the shareholders knowing about it. Also, it makes it easier for modifications to make if shareholders can voice out their suggestions as well.

3. Write the Amendment to the LLC Operating Agreement

After reviewing the LLC’s operating agreement and listing the changes or amendments to it, you can now begin writing the amendment to the LLC’s operating agreement. To get started, you must first introduce the document by stating its amendment number along with the names and addresses of the amendment’s authors. Then, include the purpose of the amendment as well as its relation to the LLC’s operating agreement. Include the date when the operating agreement was established.

4. Transfer Your List of Changes to the Amendment

Next, transfer the list of changes or amendments that you prepared beforehand on the document itself. Also, you must cite or mention the sections that need revision or the provisions modified while writing down the list of changes to the LLC’s operating agreement. More importantly, you must make sure that other members approve the changes that you’ll list on the document of the company.

5. Sign the Amendment to the LLC Operating Agreement

Lastly, right after completing all the steps listed above, sign the amendment to the LLC operating agreement along with other members. This formalizes the validity of the amendments to the LLC’s operating agreement and signifies the member’s acceptance of the said changes. Moreover, you may also let other members sign on an annex if the operating agreement mentions a specific number of members needed to make an amendment.

Frequently Asked Questions

Who can author an amendment to the LLC operating agreement?

Amendments to an LLC operating agreement can be authored only by the members of the company. Single or several members of a board authorize the agreement depending on the LLC’s organizational structure and the requirements for amendments as specified by the LLC’s operating agreement.

When is an amendment to an LLC operating agreement needed?

An amendment to the LLC’s operating agreement may be necessary on the following circumstances:

- When its terms no longer reflect the responsibilities of its members as their focus might shift as the business is growing;

- When its terms no longer reflect the operations of the business as the company expands over time; and

- When its terms no longer reflect the or asset contributions as members may wish to invest more capital or acquire more shares.

How many signing members should an amendment to an LLC operating agreement have?

An amendment to the LLC’s operating agreement may have one or two signing members depending on the LLC’s organizational structure, especially if your company is a single-member LLC or otherwise. Or, it can have a specific number of signing members depending on the LLC’s operating agreement’s requirements for amendments, like a two-thirds vote from the majority, for example.

What are the reasons why LLC operating agreements are amended?

LLCs decide to amend their operating agreements when the company needs to adapt to the changes as the company grows and expands, or when the company itself undergoes certain changes that affect it as a whole. Most of these may either be of the following:

- When an owner leaves the company

- When a new owner is added to the company

- When there’s a need to change the timing of distributions

- When there’s a need to change the percentage of dividends

- When there’s a new additional capital invested

- When the conditions call for change in managerial and organizational structure

Do we need to notarize an amendment to the LLC operating agreement?

No. Since an amendment to the LLC operating agreement is an internal document. This document doesn’t require notarization for it to be enforceable. You may, however, notarize an amendment to the LLC operating agreement by attaching a separate notary statement.

Changes are done to make a company, such as an LLC, stronger and better than it was, and stronger and better as it should be. It may call for changes in its structure to achieve them. And if you find the necessity to amend or change your company’s operating agreement, you need to document and formalize these changes properly in writing. After that, you’ll be more ready to plan further for the stability and success of your organization.