- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

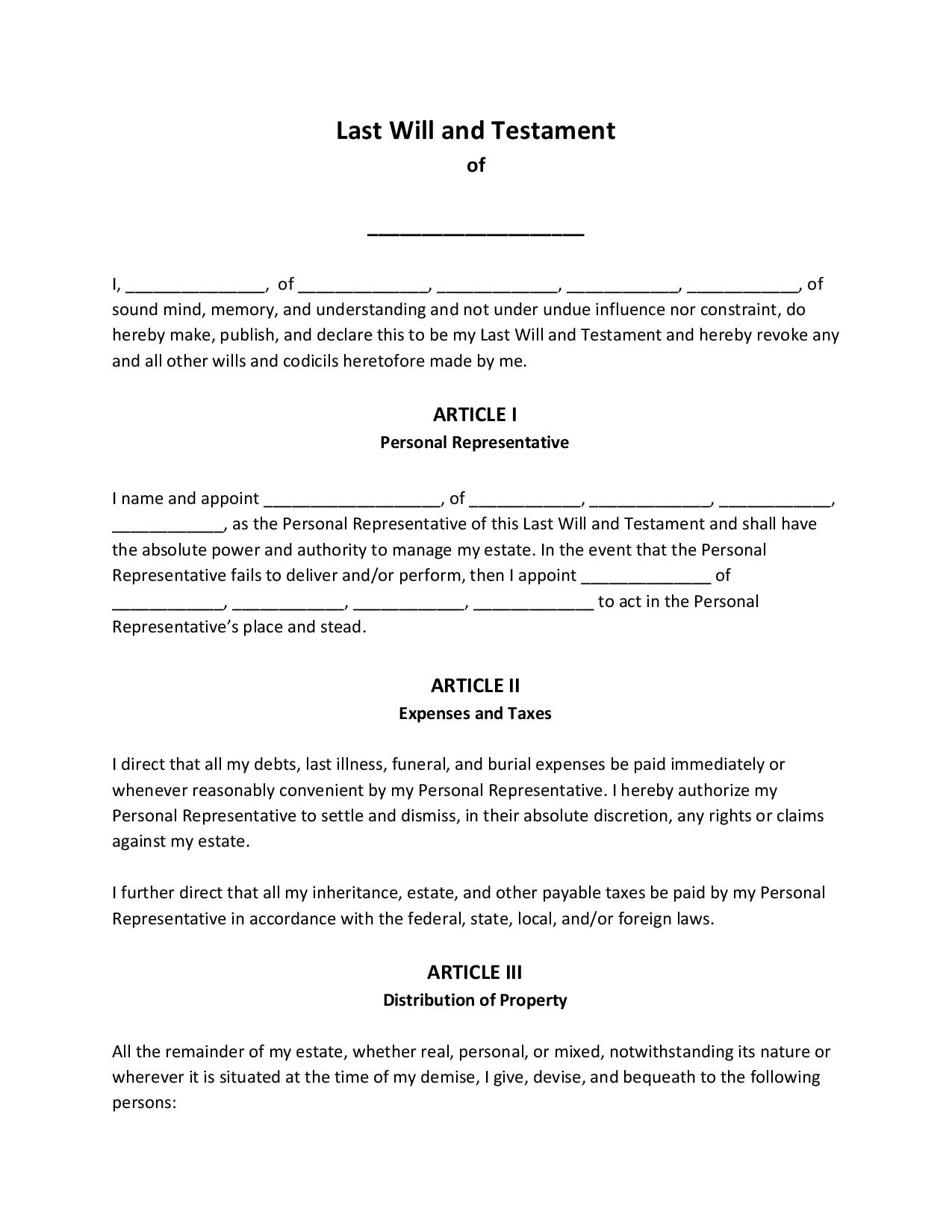

Last Will and Testament

No one in history has ever predicted their death. Unexpected deaths have dug up issues and disputes over assets among family members. To prevent this unnecessary mess, make sure to craft a last will in advance. This legal document dictates what happens to your assets and beneficiaries after you pass away. Consider it as your way of looking after them, even if you are not physically present anymore. If you want to more about this legal document, continue reading below. Read More

What Is a Last Will and Testament?

A last will and testament is a legal document that comprises a person’s final wishes regarding their assets and beneficiaries after they pass away. The testator, who is the owner of the will, appoints someone, an executor, to carry out the instructions contained in the will. The management of the assets—whether to distribute them to the beneficiaries, donate them to a charity, sell, or dispose of them, are all here. You can also the custody of the dependents. The document will only be effective once you die.

How to Create a Last Will and Testament?

Despite the importance of a last will and testament, more than 50% of people do not have one. By failing to make one, the state that you belong to can make a will for you. Although this might sound convenient, in reality, your assets go to the people that the state chooses. To ensure that your assets go to the people that you want it to go, start making a will now.

Below, we will show you the tips on how to create your last will and testament seamlessly:

1. Make a List of Your Assets

List all your real and personal property before you divide it among your beneficiaries. A complete list will be easier for you to know what goes to who. This includes your property that belongs to another state. And don’t forget to inform your beneficiaries that they are to receive a portion of your assets.

2. Identify Your Beneficiaries

Once you have made a complete list of your assets, make a separate list of your beneficiaries. Your beneficiaries can either be your spouse, children, a charity, close friends, and relatives. You should not enlist your pet as a beneficiary—instead, you may appoint a caretaker to look after your pet. See to it that their full names are there to certify their identities.

3. Appoint a Guardian

Appointing a guardian for your minor children is only advisable if you are the only surviving parent. Your chosen guardian should be one that you trust around your children. It can either be a family member, a relative, or a close friend. Choose a substitute guardian in case your first choice cannot fulfill their duty. Discuss this matter with them to acquaint your children with the guardian.

4. Assign an Executor

Your executor will be the one to carry out the instructions in your will. So, like your guardian, you must fully trust and rely on this executor to divide the assets to your beneficiaries. Your executor will handle your funeral expenses, settle debts (if any), and will act in the best interests of your assets. This person may be a close friend or a lawyer. You should also appoint a substitute executor in case the first choice cannot fulfill their duty.

5. Consult with Your Lawyer

Your will is only as good as it gets if you write it correctly. So, if you feel like your document needs more supporting details, don’t be afraid to consult with your lawyer. Let them assess the paper because you want to make sure that you won’t be at the losing end.

Bring at least two witnesses with you and sign the document in the presence of the notary public. Your state may not require you to notarize the document, but for efficiency purposes, you may want to do so.

Frequently Asked Questions

What are the properties that I cannot transfer to my beneficiaries in my will?

According to Legal Match, these properties are community properties, funds that come from an employee retirement plan, life insurance policy funds, investment, and securities. Then properties that are co-owned, properties in a living trust, and funds that are payable on death.

What are the grounds that make a will invalid?

Fraud, falsification, and coercion will make a will invalid. Even if you unknowingly complete the will under these three and someone proves it in the court of law, then it becomes invalid. Make sure that the will has testamentary intent, the testator is of sound mind, and the will has been executed in a proper ceremony.

Should my lawyer create my will?

No, a lawyer does not need to create your will. You only need to state where your assets will go and assign a guardian for your minor dependents. But, if you want to be sure you can also consult with your lawyer.

Is my will still valid if I move to another state?

Your will operates under the state that you are in. If you move to another state, some provisions may be invalid because of that state’s occurring laws. It is wise to consult your lawyer first to ensure that your will is up to date.

Where should I store my will?

Your will should be stored in safe, or any place with heightened security or that requires a password. You should only share details with the persons whom you trust, such as your spouse, children, other beneficiaries, or your lawyer.

As much as you want to care and look out for your loved ones after you have died, you cannot just do so. Instead, we leave them behind along with our worldly possessions. It’s a scary thought, isn’t it? That’s why as early as now, we have to slowly craft our last will and testament to protect not just our loved ones, but also our assets. By doing so, we are leaving them armed and prepared in case we go sooner than expected. Start crafting your will as early as today.