- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

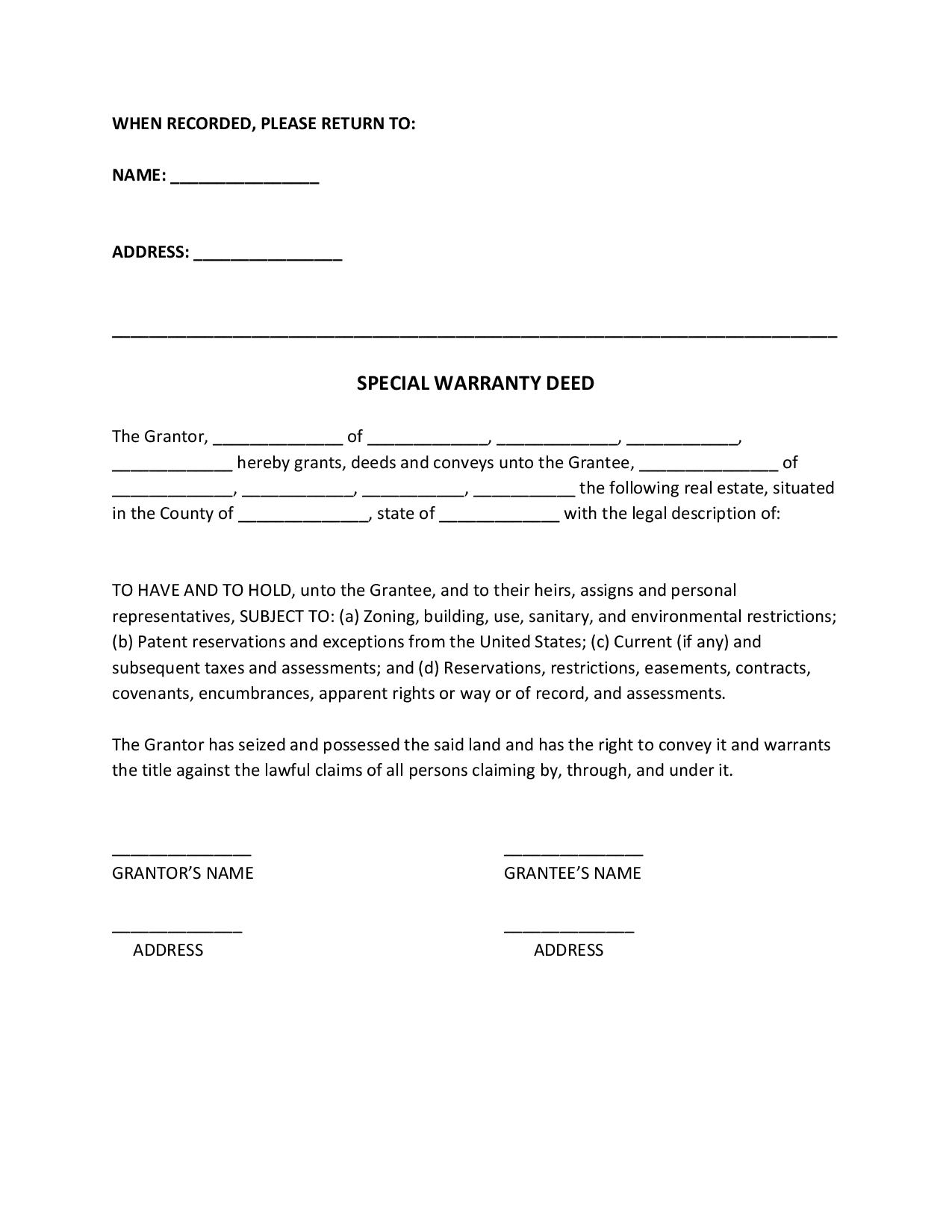

Special Warranty Deed

Warranty is one of the top priority things we look out for when buying property or any other useful equipment. It protects you from defects or encumbrances that arise after you bought the property or useful equipment. However, most warranties do not offer lifetime protection, especially in real estate. This special warranty deed form is encouraged if you offer a limited warranty to your grantee. This warranty appeases your buyer or grantee that there are no encumbrances or claims while it was under your ownership. Learn more about this type of deed form by reading below. Read More

What Is a Special Warranty Deed?

A special warranty deed is a type of deed wherein the grantor guarantees that the property was not encumbered during their ownership. This does not guarantee that there will be no encumbrances prior to the purchase of the grantor. This type of deed is commonly compared to a general warranty deed—a general warranty deed offers the grantee a general warranty that the property was not encumbered at all. No encumbrances from the date of purchase and when it is sold.

How to Create a Special Warranty Deed

A special warranty deed is discouraged to be used between two strangers because of the limited protection it provides. Hence, it is only advised that you use this deed form with someone who knows and trusts you enough. Below are tips on how you can create your special warranty deed:

1. Name the Parties Involved

Start your special warranty deed by including the complete names and addresses of the parties involved. The seller is known as the grantor and the buyer is known as the grantee. The names of both parties also make the deed form legal.

2. Stipulate the Legal Description of the Conveyed Property

All legal documents include a legal description of the property being conveyed. These are essential so that it would be easier to identify and locate the property by the professional surveyor. They are also accurate locators of the conveyed property.

3. Include a Statement That the Property Is Being Conveyed

Include a statement that says the property is being conveyed to the grantee. Aside from this, it must also explicitly state that the grantor is the legal owner and has the legal right to convey the property. The grantee must understand that the grantor only offers a warranty for the period they owned the property. The grantor must not be held responsible if there are encumbrances or claims prior to their ownership.

4. Sign the Deed Form

The deed form is only valid and enforceable as long as it is signed by the grantor and accepted and delivered by the grantee. Usually, the grantee does not need to sign the document, but in some counties, the grantee is required to sign. Require the grantee to sign the document as well to be safe. Remember, the signatures on the deed form must not be stamped, copied, nor printed—but original. If a married couple owns the conveyed property, then both of them shall sign the deed.

Before signing the deed, don’t hesitate to approach a qualified real estate lawyer to ensure that everything in the deed is legit and enforceable.

5. Notarize the Deed Form

The state that you currently live in may not require you to notarize the deed form. But in some states, they do; so, notarize the form to be safe. Note that you must sign the deed form in the presence of a qualified notary for it to be notarized.

After completing all the steps above, the deed must be recorded in the County Recorder’s Office or the County Clerk’s Office. Usually, the county requires additional requirements with the deed—and they are not advised to be stapled with the deed. Recording the deed will protect you from claims in the future, and all persons stated in the deed must be secured a copy.

Frequently Asked Questions

Why should I use a special warranty deed?

A special warranty deed guarantees the grantee that the property is free of encumbrances and claims under his ownership. However, anything beyond that, the grantor shall not be responsible anymore.

Who should prepare the special warranty deed?

The special warranty deed is created by the grantor. This entails that the person is the legal owner and has the legal right to convey the property to the grantee. If the creation of this special warranty deed proves to be daunting, there are free templates available online for you to work on. Just make sure to consult with a lawyer after to make sure everything is in place and accurate.

Should I notarize my deed?

That depends on your state. Your state may or may not require you to notarize your deed, but to be on the safe side, just notarize your deed. For it to be notarized, you must sign the deed in front of the notary public, together with the grantee.

When can the notary public not notarize a document?

According to ASN Notary, the notary cannot notarize a document if said document does not bear the original, actual signatures of the individuals concerned. If the notarial act is not indicated by the document or any person connected to the document, then the notary cannot notarize it as well.

Can a relative witness a legal document?

According to Legal Vision, there is no general rule prohibiting a relative, direct family member, or spouse to witness a legal document. This is acceptable as long as you don’t have personal interests nor a party to the agreement.

It is always a buyer’s aim to get a good bargain when eyeing a certain product. We want to make sure that the money we’re dishing out is proportionate to what we are receiving. To build confidence, we provide warranties to protect the buyer from unexpected defects or damages. In the area of real estate, this special warranty deed serves as the limited warranty of your purchased real estate. It pays to appease the mind of your grantee.