- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

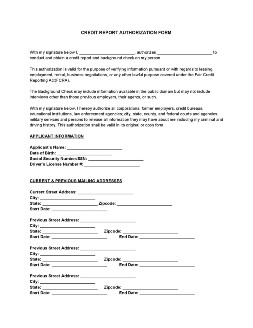

Credit Report Authorization

Lending your money or property to a total stranger may put your business at risk. And, you must first see if they’re trustworthy enough before allowing them to lay their hands on your valuables. Do so by letting your applicants sign a credit report authorization first. Learn more about determining your applicant’s trustworthiness by reading on in this article. Read More

Credit Report Authorization

- What Is a Credit Report Authorization Form?

- How To Complete a Credit Report Authorization Form

- Frequently Asked Questions

- Why do we need a credit report authorization before getting a glimpse of the applicant’s credit history?

- Where do we submit an applicant’s credit report authorization after they signed it?

- What else do I need to include in a credit report authorization form aside from the summary of the applicant’s rights under the FCRA?

- What are the most important elements of a good credit report authorization form?

What Is a Credit Report Authorization Form?

Loans and leases are businesses that involve a lot of risks, and not for the faint of heart. But, you can minimize such risks by requiring your applicants to sign credit report authorization first.

A credit report authorization is a consent form that obtains an applicant’s permission to have a credit background performed on them. In this form, applicants must provide their personal information along with their SSN or social security number, driver’s license number, and their addresses for the last 7 years. After that, the applicant must sign this consent form and a credit background check will then be conducted subsequently.

Aside from obtaining the applicant’s consent, a credit report authorization also contains a summary of the applicant’s rights under the FCRA or the Fair Credit Reporting Act. This summary shows that is credit background check is legally requested under the law and does not violate the applicant’s privacy in any way.

How To Complete a Credit Report Authorization Form

Credit background checks are necessary before anyone can secure a personal loan, or say, rent an apartment. But before you can have a glimpse of an applicant’s credit history, you have to obtain their permission first—as required by the FCRA. For that, you must have an authorization form ready for your applicants to sign on. To do that, here are some tips on how to make applicants complete a credit report authorization form.

1. Inform the Applicant of Its Purpose

Before letting an applicant sign a credit report authorization form, they must first be aware of why and what it is for. This is so that they are fully informed about credit background check’s necessity, as well as emphasize that their privacy and sensitive information will be fully secured. Additionally, this is also to inform them of any fees they might be required to pay, especially if they’re applying for a lease agreement.

2. Ask for the Applicant’s Personal Information

Now that you’ve informed and explained why a credit background check and their authorization is necessary, the next thing to do is to ask for their personal information. Such information includes their names and their identification numbers—SSN and driver’s license number. Along with this, they will also need to disclose their addresses for the past 7 years as well. This step also means letting them start filling-out the authorization form itself.

3. Let the Applicant Sign the Authorization Form

After filling out the credit report authorization form, let the applicant sign and agree to the credit report authorization. This means that the applicant permits a credit background check to be made on them. Aside from that, signing the authorization form also means permitting their previous employers, schools, and government agencies to release information about the applicant as well.

4. Submit and Request for a Credit Report

Lastly, submit the credit report authorization form to a credit bureau or reporting agency after the applicant signed on it. There are several credit bureaus or reporting agencies where you can submit the authorization form to. You can choose to submit the authorization form in either one of them or submit the form to all of them for better results.

Frequently Asked Questions

Why do we need a credit report authorization before getting a glimpse of the applicant’s credit history?

Having a credit report authorization is needed because the FCRA limits the persons or entities who can request for someone’s credit report without authorization. The FCRA regulates credit reporting and ensures that no one without authorization can check someone’s credit history. Checking one’s credit history is necessary for employment, loans, and rental applications, and an applicant’s consent is likewise needed before a credit report is released.

Where do we submit an applicant’s credit report authorization after they signed it?

A credit report authorization form is submitted to credit reporting agencies or bureaus after an applicant has signed it. There are three major credit reporting agencies or bureaus where you can submit an applicant’s credit report authorization form. These agencies and bureaus are namely Experian, Equifax, and TransUnion. You can submit an applicant’s credit report authorization form to any of these agencies or bureaus, or you may choose to submit the authorization to all of them for better results.

What else do I need to include in a credit report authorization form aside from the summary of the applicant’s rights under the FCRA?

Aside from the summary of the applicant’s rights under the FCRA, credit report authorizations are also governed by different state laws. These may include laws about releasing someone’s criminal and felony records, employment records, among others. So if you’re creating a credit authorization form for future use, you should check and include the summaries of these laws when doing so.

What are the most important elements of a good credit report authorization form?

Credit report authorization forms are legal documents that secure an applicant’s authorization to release their credit reports to you. This so that you can determine whether an application for a certain job, loan or lease should be approved or denied. A good credit report authorization form should include these elements if you’re creating one for future use. These elements are:

- The applicant’s social security number;

- The applicant’s date of birth;

- The applicant’s driver’s license number; and

- The applicant’s residential history for the past seven (7) years.

Determining someone’s trustworthiness is an utmost necessity for business’s—other than the need for generating profit. And one way of measuring somebody’s trustworthiness is by having a closer look at one’s credit history. But trust is a give and take affair, where you must secure one’s credit report authorization before laying your hands on their credit history.