Embark on a journey to secure your legal affairs in Delaware with our Power of Attorney (POA) guide. This comprehensive resource provides insightful tips and user-friendly instructions for drafting and utilizing a Delaware POA form. Tailored to meet Delaware’s legal standards, our guide simplifies the process, ensuring your POA is robust and effective. Whether for financial, healthcare, or general matters, start here to create a POA that aligns with your needs and provides peace of mind.

What is the Delaware Power of Attorney Form?

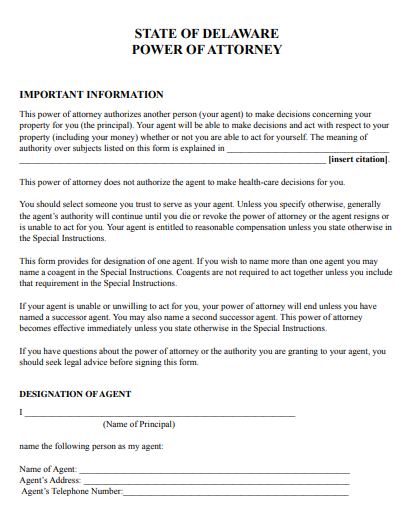

The Delaware Power of Attorney Form is a legal document that allows you to appoint someone else to make decisions and take actions on your behalf. This person, called an agent or attorney-in-fact, can manage things like your finances, property, or healthcare decisions, depending on what powers you give them. This form is used in Delaware to ensure someone you trust can handle your affairs if you’re unable to do so yourself.

What is the Best Sample Delaware Power of Attorney Form?

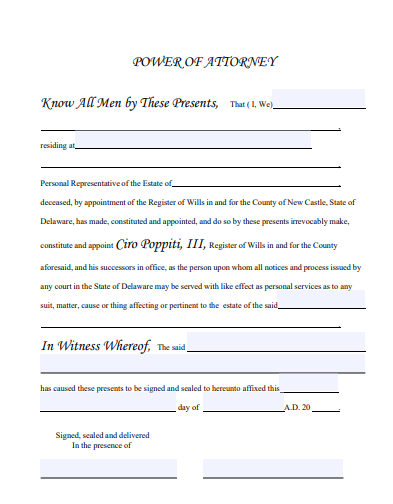

This sample Delaware Power of Attorney form is a template for granting someone the authority to make decisions on your behalf. It’s important to customize this form to your specific needs and ensure it complies with Delaware state law.

Delaware Power of Attorney Form

Section 1: Principal Information

- Full Name of Principal: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 2: Agent Information

- Full Name of Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

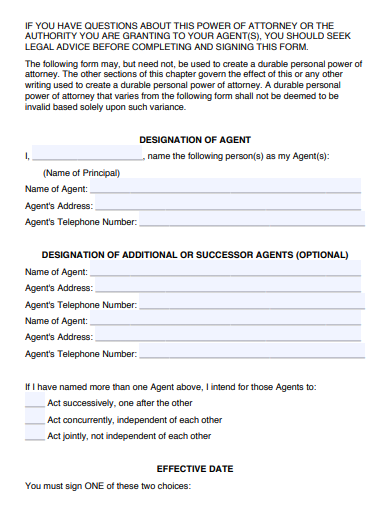

Section 3: Alternate Agent (Optional)

- Full Name of Alternate Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 4: Powers Granted

- Financial Decisions: [ ] Yes [ ] No

- Real Estate Transactions: [ ] Yes [ ] No

- Personal Property Transactions: [ ] Yes [ ] No

- Healthcare Decisions: [ ] Yes [ ] No

- Other (Specify): ____________________________

Section 5: Special Instructions

- Instructions: _______________________________________________________

Section 6: Duration

- Effective Date: _______________________

- Termination Date (if applicable): _______________________

- This Power of Attorney is:

- Durable (remains in effect if I become incapacitated)

- Non-Durable

Section 7: Signatures

- Principal’s Signature: _______________________ Date: _______________________

- Agent’s Signature: _______________________ Date: _______________________

- Alternate Agent’s Signature (if applicable): _______________________ Date: _______________________

Section 8: Acknowledgment

- Notary Public’s Acknowledgment: State of Delaware, County of ________________ On _______________________, before me, _______________________, Notary Public, personally appeared [Name of Principal], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument. I certify under PENALTY OF PERJURY under the laws of the State of Delaware that the foregoing paragraph is true and correct. Witness my hand and official seal: Signature _______________________ (Seal)

This sample Delaware Power of Attorney form is a foundational tool for authorizing another individual to make decisions on your behalf. It’s crucial to ensure all information is accurate and the form is notarized for legal validity. Consulting with a legal professional is recommended to customize this document to your specific needs.

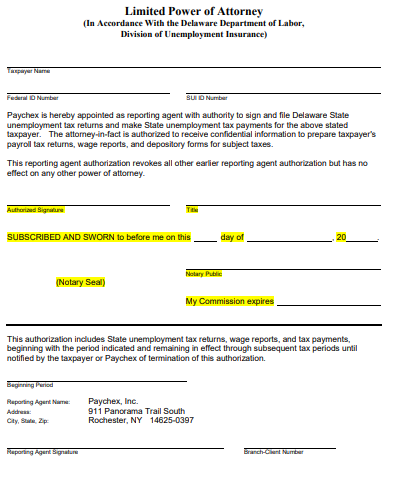

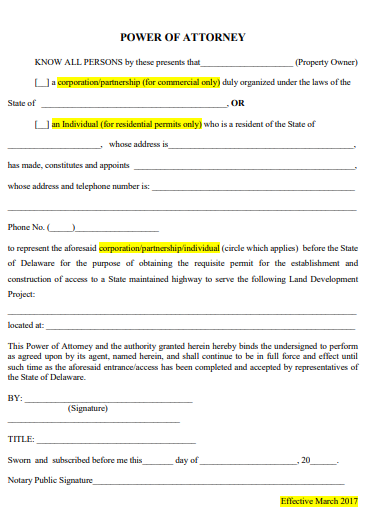

1. State of Delaware Power of Attorney Form

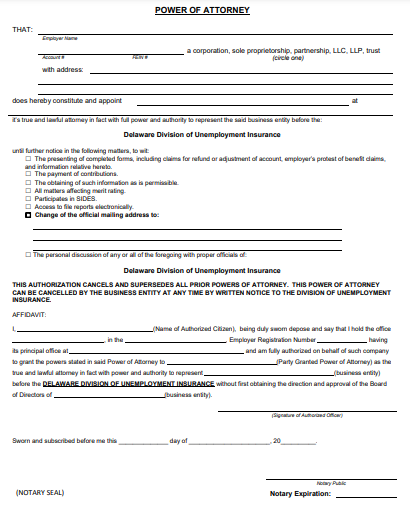

2. Delaware Standard Power of Attorney Form#

3. Delaware Sample Power of Attorney Form

4. Delaware Printable Power of Attorney Form

5. Delaware Power of Attorney Form

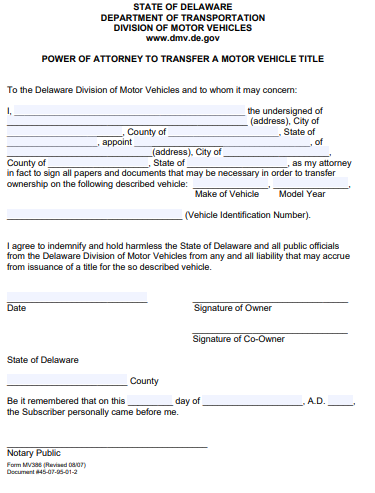

6. Delaware Motor Vehicle Power of Attorney Form

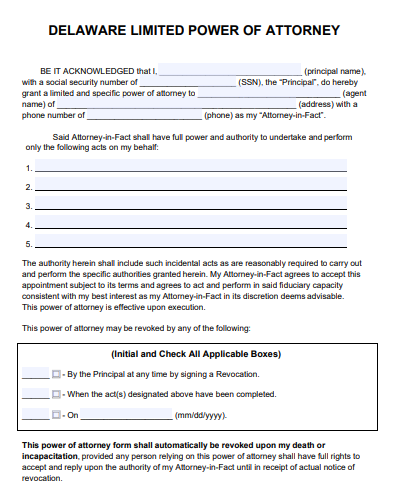

7. Delaware Limited Power of Attorney Form

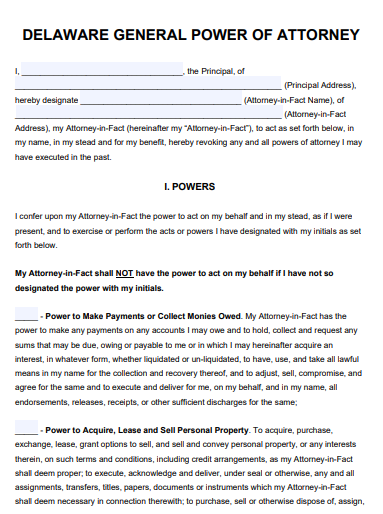

8. Delaware General Power of Attorney Form

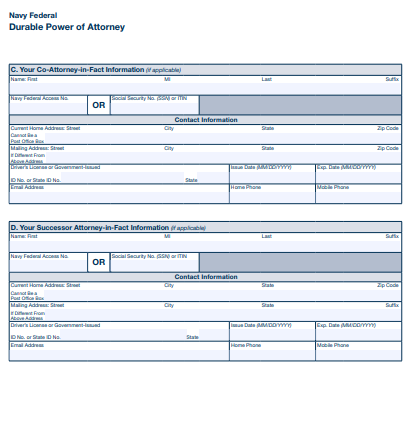

9. Delaware Durable Power of Attorney Form

10. Delaware Blank Power of Attorney Form

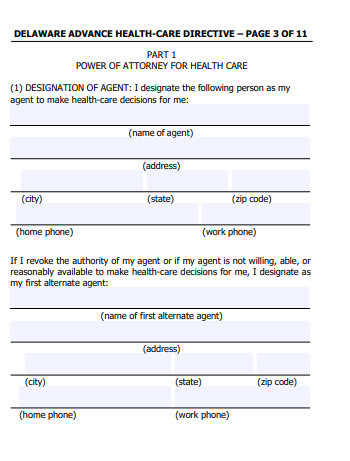

11. Delaware Advance Directive Power of Attorney Form

How do I get a power of attorney in Delaware?

To obtain a Power of Attorney (POA) in Delaware, follow these steps:

-

Determine the Type of POA Needed:

- Decide whether you need a General, Durable, Limited, or Healthcare POA based on your specific requirements.

-

Choose Your Agent:

- Select a trustworthy individual who will act as your agent (or Attorney-in-Fact). This person should be reliable and capable of handling the responsibilities you are delegating.

-

Draft the POA Document:

- Use a standard Delaware POA form or create a custom one. Ensure it includes your name, the agent’s name, the powers you are granting, and any limitations.

-

Specify Powers and Limitations:

- Clearly outline the authority you are giving to your agent. Be specific about what they can and cannot do.

-

Legal Requirements:

- Ensure you are mentally competent when signing the POA.

- The document should be signed voluntarily.

-

Sign in the Presence of a Notary:

- Delaware law requires that your POA be notarized. Sign the document in front of a notary public.

-

Inform Your Agent:

- Give a copy of the POA to your agent and discuss your expectations and any specific instructions.

-

Store the Document Safely:

- Keep the original POA in a secure location and inform your agent and a trusted family member or friend where it is kept.

-

Review and Update as Necessary:

- Regularly review your POA and update it if your circumstances or wishes change.

Remember, while you can draft and execute a POA on your own, consulting with a legal professional can provide additional assurance that your document is properly drafted and legally sound, especially in more complex situations.

What is the form for power of attorney for Delaware taxes?

The form used for granting Power of Attorney specifically for tax matters in Delaware is known as the “Form 2848 (Power of Attorney and Declaration of Representative).” This form is used to authorize an individual, typically a tax professional, to represent you and handle your tax matters with the Delaware Division of Revenue.

Form 2848 allows your appointed agent to access your tax records, communicate with the tax authorities on your behalf, and make decisions regarding your state tax affairs. It’s an essential document for anyone needing assistance with Delaware state tax issues, ensuring that their tax matters are managed efficiently and accurately by a trusted representative.

What is a limited power of attorney form in Delaware?

A Limited Power of Attorney form in Delaware is a legal document that grants a designated individual, known as the agent or attorney-in-fact, the authority to perform specific acts or make decisions on behalf of the principal (the person creating the Power of Attorney). Unlike a General Power of Attorney, which provides broad powers, a Limited Power of Attorney is tailored for particular tasks or situations.

For example, it might authorize the agent to handle financial transactions, sell a property, or make medical decisions, but only under certain circumstances or for a limited period. The powers granted are explicitly defined in the document and are confined to specific activities or timeframes. This type of POA is commonly used when the principal cannot manage certain affairs due to unavailability or other reasons but does not require a full-scale Power of Attorney.

What is Delaware form 700?

Delaware Form 700, also known as the “Power of Attorney” form, is a legal document used in the state of Delaware. This form allows an individual (the principal) to designate another person (the agent or attorney-in-fact) to make decisions and take actions on their behalf. The scope of authority granted to the agent can vary and is specified within the form.

Form 700 can be used for various purposes, including financial matters, business transactions, or other personal affairs. The principal can choose to grant broad powers or limit them to specific tasks or situations. It’s important for individuals using this form to clearly define the powers granted to ensure their intentions are accurately reflected and to prevent any misuse of authority.

As with any legal document, especially one that grants someone else decision-making power, it’s advisable to consult with a legal professional when completing Form 700 to ensure it meets all legal requirements and accurately represents the principal’s wishes.

What is the state tax in Delaware for non residents?

Non-residents who earn income in Delaware are subject to Delaware state income tax on that income. This means if you live in another state but work in Delaware, or if you have income from a Delaware source (like a rental property located in Delaware), you need to pay Delaware state income tax on that income.

The tax rates for non-residents are the same as for residents. Delaware has a graduated income tax system, with rates ranging from a low of 2.2% to a high of 6.6%, depending on the amount of income. It’s important to note that these rates and tax laws can change, so it’s advisable to check the most current information from the Delaware Division of Revenue or consult with a tax professional for the latest tax rates and regulations.

Additionally, non-residents are required to file a Delaware state income tax return if they have earned income in the state that exceeds the state’s filing threshold.

Does power of attorney need to be notarized in DC?

Yes, in the District of Columbia (Washington, D.C.), a Power of Attorney (POA) needs to be notarized to be legally valid. Notarization involves having the document signed in the presence of a notary public. The notary public verifies the identity of the person signing the document (the principal) and ensures that they are signing it willingly and with an understanding of its implications. This step is crucial for the legal enforceability of the POA in D.C., as it helps to prevent fraud and confirms the authenticity of the document.

How to Prepare a Delaware Power of Attorney Form

Step 1: Determine the Type of POA

- Decide whether you need a General, Durable, Limited, or Medical Power of Attorney, based on your specific requirements.

Step 2: Choose Your Agent

- Select a trustworthy individual to act as your agent (also known as an Attorney-in-Fact). Ensure they are capable and willing to handle the responsibilities.

Step 3: Draft the POA Document

- Use a standard Delaware POA form or draft one with the help of legal resources. Include your name, the agent’s name, and the powers you are granting.

Step 4: Specify Powers and Limitations

- Clearly outline the authority you are giving to your agent. Be specific about what they can and cannot do.

Step 5: Meet Legal Requirements

- Ensure you are mentally competent and understand the implications of signing the POA.

- The document must be signed voluntarily.

Step 6: Sign in the Presence of a Notary

- Sign the POA form in front of a notary public. Notarization is a legal requirement in Delaware for most POA documents.

Step 7: Inform Your Agent

- Discuss the POA with your agent, ensuring they understand their duties and your wishes.

Step 8: Distribute Copies

- Provide copies of the signed and notarized POA to your agent and any relevant institutions, such as banks or healthcare providers.

Step 9: Store the Document Safely

- Keep the original POA in a secure location and inform your agent and a trusted individual about its whereabouts.

Step 10: Regular Review and Update

- Regularly review your POA and update it if your circumstances or wishes change.

Creating a Power of Attorney in Delaware is a straightforward process that ensures your affairs are managed according to your wishes. While you can complete this process on your own, consulting with a legal professional is advisable for complex situations or for additional guidance.

Tips for Using Effective Delaware Power of Attorney Form

1. Choose the Right Agent

- Select someone trustworthy, reliable, and capable of handling responsibilities effectively.

2. Be Specific About Powers Granted

- Clearly define the scope of authority you are giving to your agent to avoid ambiguity.

3. Consider a Durable POA

- Opt for a Durable Power of Attorney if you want it to remain effective even if you become incapacitated.

4. Regularly Update Your POA

- Review and update your POA periodically to reflect any changes in your circumstances or wishes.

5. Understand the Legal Requirements

- Ensure your POA complies with Delaware state laws, including requirements for notarization.

6. Communicate with Your Agent

- Discuss your expectations and instructions with your agent to ensure they understand their role.

7. Keep the Document Accessible

- Store your POA in a safe but accessible place and inform your agent and family members where it is kept.

8. Consult with Professionals

- Seek advice from legal or financial professionals if you have complex needs or questions.

9. Avoid Coercion

- Ensure the POA is signed voluntarily and without any undue influence.

10. Consider Alternate Agents

- Appoint an alternate agent in case your primary agent is unable or unwilling to serve.

An effective Delaware Power of Attorney requires careful planning and clear communication. By following these tips, you can ensure that your POA serves its intended purpose and provides peace of mind for both you and your agent.

What Are the Power of Attorney Rights in Delaware?

In Delaware, a Power of Attorney grants an agent rights to act on behalf of the principal in financial, legal, or health matters, as specified in the POA document.

What Is a Limited Power of Attorney in Delaware?

A Limited Power of Attorney in Delaware allows an agent to perform specific tasks or handle certain affairs for a limited time or under specific circumstances.

How Do I Get a Power of Attorney in Delaware?

To get a Power of Attorney in Delaware, choose an agent, draft the POA document specifying powers, sign it in front of a notary, and inform your agent.

How Do I Revoke a Power of Attorney in Delaware?

To revoke a Power of Attorney in Delaware, create a written document stating the revocation, sign it, and notify your agent and any institutions relying on the original POA.

What Is a Statutory Power of Attorney in Delaware?

A Statutory Power of Attorney in Delaware follows a standard format provided by state law, covering general financial and property management powers unless modified.

What Is a Springing Power of Attorney in Delaware?

A Springing Power of Attorney in Delaware becomes effective only under specific circumstances, typically when the principal becomes incapacitated or unable to make decisions.

This guide offers a comprehensive overview of creating and using a Delaware Power of Attorney form. By understanding the types, rights, and processes involved, you can effectively manage your affairs or those of a loved one. Remember, regular updates and clear communication with your chosen agent are key to ensuring your POA remains an effective legal tool tailored to your needs.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips