Embark on securing your future with the Florida Power of Attorney (POA) form, a pivotal legal tool for delegating decision-making authority. Our guide simplifies the process, offering essential tips and insights for effective usage. Whether for financial, healthcare, or personal matters, understanding how to correctly use a Florida POA ensures your interests are safeguarded. Dive into our resource for a seamless experience in managing your legal affairs with confidence and clarity.

What is the Florida Power of Attorney Form?

The Florida Power of Attorney Form is a legal document that allows you to appoint someone else, known as an agent, to make decisions and take actions on your behalf. This could include managing your finances, property, or making healthcare decisions. The form gives this person the authority to act in your place for matters you specify, either for a particular task, for a set period, or ongoing, depending on your needs.

What is the Best Sample Florida Power of Attorney Form?

This sample Florida Power of Attorney form is a template for authorizing an individual to make decisions on your behalf. It’s important to tailor this form to your specific needs and ensure it complies with Florida state law.

Florida Power of Attorney Form

Section 1: Principal Information

- Full Name of Principal: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 2: Agent Information

- Full Name of Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 3: Alternate Agent (Optional)

- Full Name of Alternate Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 4: Powers Granted

- Financial Decisions: [ ] Yes [ ] No

- Real Estate Transactions: [ ] Yes [ ] No

- Personal Property Transactions: [ ] Yes [ ] No

- Healthcare Decisions: [ ] Yes [ ] No

- Other (Specify): ____________________________

Section 5: Special Instructions

- Instructions: _______________________________________________________

Section 6: Duration

- Effective Date: _______________________

- Termination Date (if applicable): _______________________

- This Power of Attorney is:

- Durable (remains in effect if I become incapacitated)

- Non-Durable

Section 7: Signatures

- Principal’s Signature: _______________________ Date: _______________________

- Agent’s Signature: _______________________ Date: _______________________

- Alternate Agent’s Signature (if applicable): _______________________ Date: _______________________

Section 8: Acknowledgment

- Notary Public’s Acknowledgment: State of Florida, County of ________________ On _______________________, before me, _______________________, Notary Public, personally appeared [Name of Principal], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument. I certify under PENALTY OF PERJURY under the laws of the State of Florida that the foregoing paragraph is true and correct. Witness my hand and official seal: Signature _______________________ (Seal)

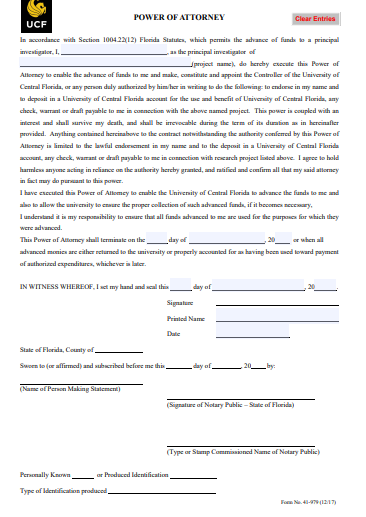

This sample Florida Power of Attorney form is a foundational tool for authorizing another individual to make decisions on your behalf. It’s crucial to ensure all information is accurate and the form is notarized for legal validity. Consulting with a legal professional is recommended to customize this document to your specific needs.

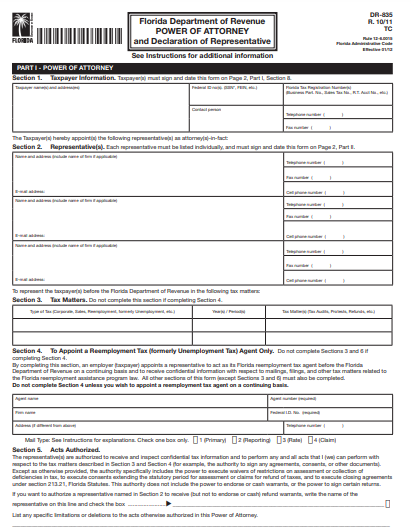

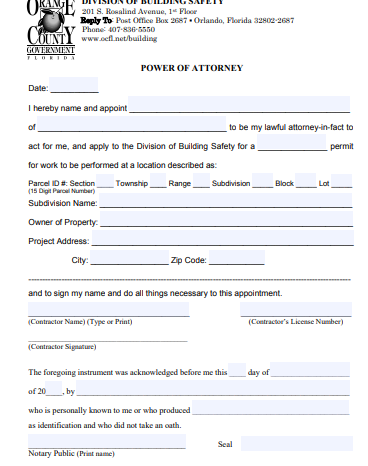

1. Free Florida Power of Attorney Form

2. Florida Simple Power of Attorney Form

3. Florida Printable Power of Attorney Form

4. Florida Power of Attorney Form

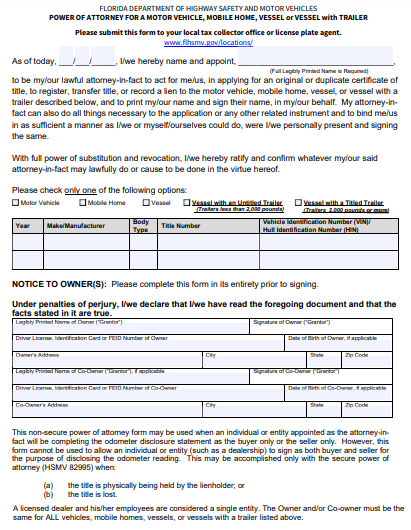

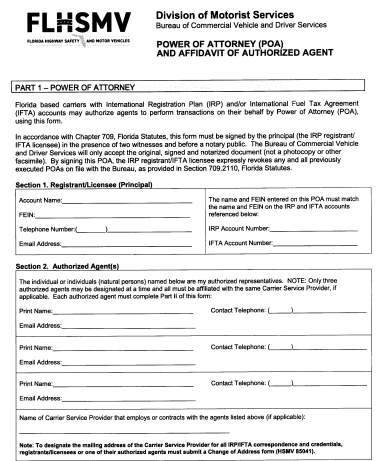

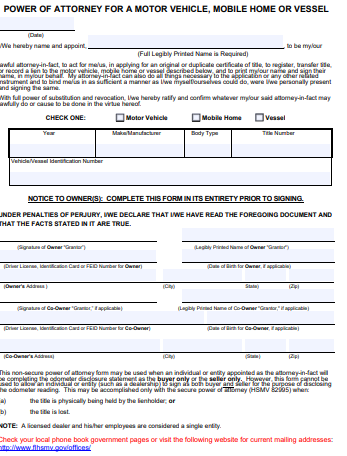

5. Florida Motor Vehicle Power of Attorney Form

6. Florida Minor Power of Attorney Form

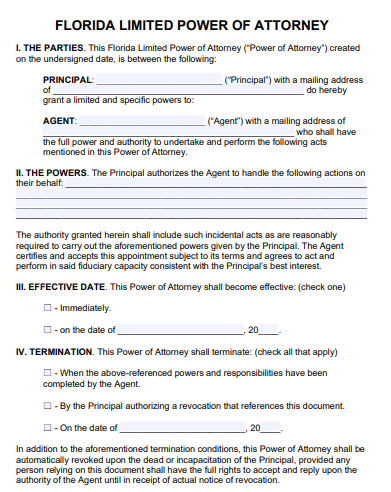

7. Florida Limited Power of Attorney Form

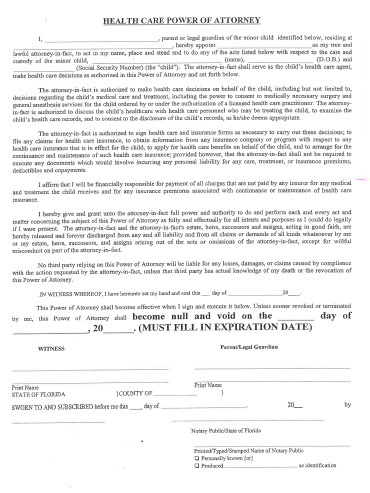

8. Florida Health Care Power of Attorney Form

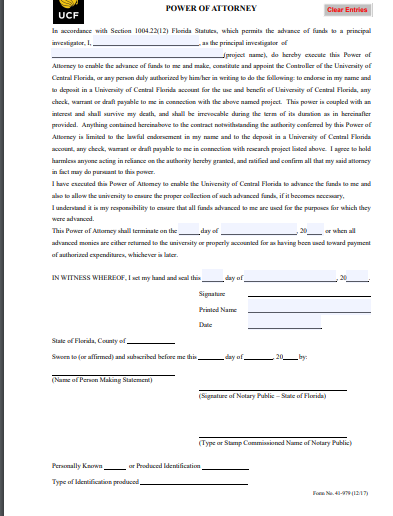

9. Florida General Power of Attorney Form

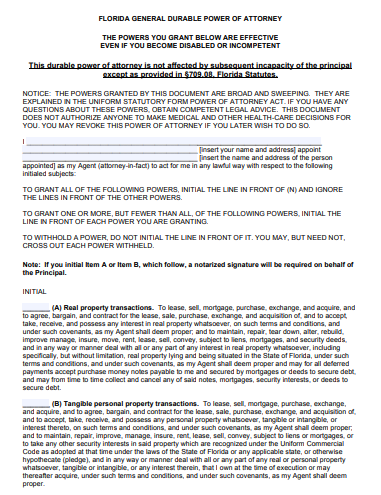

10. Florida Durable Power of Attorney Form

11. Florida Blank Power of Attorney Form

How do I get a power of attorney in Florida?

To get a Power of Attorney in Florida, follow these steps:

-

Determine the Type of POA Needed:

- Decide whether you need a General, Durable, Limited, or Medical Power of Attorney based on your specific requirements.

-

Choose Your Agent:

- Select a trustworthy individual to act as your agent (or Attorney-in-Fact). This person should be reliable and capable of handling the responsibilities you are delegating.

-

Draft the POA Document:

- Use a standard Florida POA form or create a custom one. Ensure it includes your name, the agent’s name, the powers you are granting, and any limitations.

-

Specify Powers and Limitations:

- Clearly outline the authority you are giving to your agent. Be specific about what they can and cannot do.

-

Legal Requirements:

- Ensure you are mentally competent when signing the POA.

- The document should be signed voluntarily.

-

Sign in the Presence of a Notary:

- Florida law requires that your POA be notarized. Sign the document in front of a notary public.

-

Inform Your Agent:

- Give a copy of the POA to your agent and discuss your expectations and any specific instructions.

-

Store the Document Safely:

- Keep the original POA in a secure location and inform your agent and a trusted family member or friend where it is kept.

-

Review and Update as Necessary:

- Regularly review your POA and update it if your circumstances or wishes change.

Remember, while you can draft and execute a POA on your own, consulting with a legal professional can provide additional assurance that your document is properly drafted and legally sound, especially in more complex situations.

Does Florida have a statutory form power of attorney?

The Florida Statutory Power of Attorney form includes standard provisions and allows the principal (the person granting the power) to specify the exact powers granted to the agent (the person receiving the power). It’s important to carefully review and understand the powers being granted when using this form, as it can grant broad authority to the agent.

For specific or more complex needs, it’s advisable to consult with a legal professional to ensure that the Power of Attorney is appropriately tailored to your situation and legally sound.

How much does it cost for a power of attorney in Florida?

The cost of obtaining a Power of Attorney in Florida can vary depending on several factors. Here are the key components that can affect the cost:

- Professional Legal Fees: If you choose to have a lawyer draft your Power of Attorney, the cost can vary significantly based on the complexity of your needs and the lawyer’s rates. Typically, attorney fees for drafting a standard Power of Attorney might range from a few hundred to several thousand dollars.

- Notarization Fees: Florida law requires that a Power of Attorney be notarized. Notaries in Florida can charge up to $10 per notarial act, as set by state law.

- Additional Costs: If your situation requires more than a standard Power of Attorney, such as a Durable Power of Attorney or one with specific, complex stipulations, the cost may increase. This could be due to additional legal advice, document preparation, or more complex notarization.

- DIY Forms: If you opt to use a do-it-yourself (DIY) form from a reputable source and handle the process yourself, your primary cost will be notarization. However, it’s crucial to ensure that any DIY form complies with Florida law and accurately reflects your wishes.

In summary, the cost for a Power of Attorney in Florida can range from as little as the notarization fee (if you do it yourself) to several thousand dollars if you require extensive legal assistance. It’s always a good idea to get a few quotes from local attorneys or legal services to understand the potential costs better.

Do you need a notary for power of attorney in Florida?

Yes, in Florida, a Power of Attorney (POA) must be notarized to be legally valid. The notarization process involves signing the document in front of a notary public. The notary’s role is to verify the identity of the person signing the POA (the principal) and to ensure that they are signing it willingly and with an understanding of its implications. This step is crucial for the legal enforceability of the POA in Florida, as it helps to prevent fraud and confirms the authenticity of the document.

Who can witness a Florida POA?

In Florida, a Power of Attorney (POA) must be signed in the presence of two witnesses, in addition to being notarized. The requirements for who can serve as a witness for a POA in Florida are as follows:

- Adults: Witnesses must be at least 18 years old.

- Mentally Competent: Witnesses should be mentally competent, meaning they understand the nature of the document they are witnessing.

- Disinterested Parties: Ideally, witnesses should be disinterested parties. This means they should not be individuals who stand to benefit from the POA or have a vested interest in the principal’s affairs. While this is not a strict legal requirement in Florida, it is a best practice to avoid potential conflicts of interest or challenges to the document’s validity.

It’s important to note that the notary public who notarizes the POA can also serve as one of the witnesses. However, the agent being granted power in the POA should not act as a witness.

Following these guidelines helps ensure the legal validity of the POA and can protect against challenges to its authenticity or the principal’s intentions.

Is a foreign power of attorney valid in Florida?

In Florida, a Power of Attorney (POA) executed in a foreign country can be valid, but there are specific conditions that must be met for it to be recognized and enforceable. Here are the key points to consider:

- Compliance with Florida Law: The foreign POA must comply with the legal requirements of Florida law. This means it should be consistent with Florida’s standards regarding the execution, content, and scope of POAs.

- Notarization and Authentication: Typically, a foreign POA should be notarized in the country of origin. Additionally, it may need to go through a process of authentication or apostille (if the country is a member of the Hague Apostille Convention) to verify the notary’s authority. This process confirms that the document is legitimate and the notary is authorized to act in that jurisdiction.

- Translation: If the POA is in a language other than English, a certified translation may be required. The translation should be accurate and complete to ensure that the terms of the POA are clearly understood and enforceable in Florida.

- Scope and Authority: The powers granted in the foreign POA must be consistent with what is permissible under Florida law. Florida may not recognize certain powers if they conflict with state laws or public policy.

- Legal Consultation: Given the complexities involved in recognizing a foreign POA, it’s advisable to consult with a Florida attorney who has experience in international legal matters. They can provide guidance on the validity of the foreign POA and any steps needed to ensure it is recognized in Florida.

In summary, while a foreign POA can be valid in Florida, it must meet specific criteria and may require additional steps for authentication and translation. Legal consultation is recommended to navigate these requirements.

How to Prepare a Florida Power of Attorney Form

Preparing a Power of Attorney (POA) form in Florida is a crucial step in managing your affairs, whether for financial, legal, or health-related matters. This guide provides a comprehensive, step-by-step approach to help you create a Florida Power of Attorney form effectively and legally.

Step 1: Understanding Power of Attorney

Before drafting a POA, understand its purpose. A Power of Attorney is a legal document allowing you to appoint someone (an “agent” or “attorney-in-fact”) to make decisions on your behalf. In Florida, POAs can be durable, springing, medical, or limited, each serving different needs.

Step 2: Choose the Right Type of POA

- Durable Power of Attorney: Remains in effect even if you become incapacitated.

- Springing Power of Attorney: Becomes effective upon a specific event, usually the principal’s incapacity.

- Medical Power of Attorney: Allows your agent to make healthcare decisions for you.

- Limited Power of Attorney: Grants limited powers to the agent for specific tasks or time frames.

Step 3: Selecting Your Agent

Choose a trustworthy individual as your agent. This person should be reliable, willing to act on your behalf, and capable of making decisions aligned with your preferences.

Step 4: Drafting the Document

- Identify the Parties: Clearly state your name and the name of your appointed agent.

- Define the Powers: Specify the powers granted to your agent. Be as detailed as possible to avoid ambiguity.

- Determine the Duration: For a durable POA, indicate that it remains effective during incapacity. For a limited POA, specify the time frame or task.

Step 5: Legal Requirements

In Florida, a POA must be:

- In Writing: The POA document must be written clearly and concisely.

- Signed by the Principal: You must sign the document or direct someone else to sign in your presence.

- Witnessed: Two adult witnesses must be present during the signing.

- Notarized: A Florida notary public must notarize the document.

Step 6: Signing the Document

Arrange a meeting with your witnesses and a notary. Sign the document in their presence, ensuring they fulfill their roles correctly.

Step 7: Storing the POA

Once signed and notarized, store the POA in a secure location. Provide copies to your agent and any relevant institutions, such as banks or healthcare providers.

Step 8: Review and Update as Necessary

Regularly review your POA. Update it to reflect changes in your life circumstances or if you wish to change your agent.

Creating a Power of Attorney in Florida is a responsible way to ensure your affairs are handled according to your wishes. By following these steps, you can prepare a legally binding and effective POA tailored to your needs.

Tips for Using Effective Florida Power of Attorney Form

Creating and using a Power of Attorney (POA) form in Florida involves more than just filling out a document. It’s about ensuring that your wishes are clearly communicated and legally enforceable. Here are essential tips to help you use a Florida POA form effectively:

1. Clearly Define the Scope of Authority

- Be Specific: Clearly outline the powers you are granting to your agent. Avoid vague language to prevent confusion or misuse of authority.

- Tailor to Your Needs: Customize the POA to suit your specific requirements, whether it’s for financial matters, healthcare decisions, or both.

2. Choose the Right Agent

- Trust and Reliability: Select someone you trust implicitly. This person should understand your values and be capable of making decisions that align with your preferences.

- Discuss Responsibilities: Have an open conversation with your chosen agent about your expectations and their willingness to take on the role.

3. Understand the Different Types of POAs

- Durable vs. Non-Durable: A durable POA remains in effect if you become incapacitated, while a non-durable POA does not.

- Medical vs. Financial: Decide whether you need separate POAs for healthcare and financial decisions, or if one comprehensive document is sufficient.

4. Comply with Florida Legal Requirements

- Witnesses and Notarization: Ensure your POA is signed in the presence of two adult witnesses and notarized, as required by Florida law.

- Regular Updates: Laws and personal circumstances change. Regularly review and update your POA to ensure it remains valid and relevant.

5. Communicate with Relevant Parties

- Inform Your Agent: Make sure your agent has a copy of the POA and understands its contents.

- Notify Financial Institutions: If the POA includes financial powers, inform banks and other institutions about the POA and your agent.

6. Consider a Springing POA

- Control Over Activation: A springing POA becomes effective only under certain circumstances, such as your incapacitation, offering more control over when it is activated.

7. Seek Legal Advice

- Professional Guidance: Consult with a Florida attorney specializing in estate planning or elder law to ensure your POA meets all legal requirements and accurately reflects your wishes.

8. Safe Storage and Accessibility

- Secure Location: Keep the original POA document in a safe but accessible place. Provide copies to your agent and any relevant institutions.

- Digital Copies: Consider having digital copies available for easy access when needed.

An effective Florida Power of Attorney form is a powerful tool in managing your affairs. By following these tips, you can ensure that your POA is legally sound, clear in its directives, and reflective of your wishes.

What are the Legal Requirements for a Power of Attorney in Florida?

In Florida, a Power of Attorney must be in writing, signed by the principal, witnessed by two adults, and notarized to be legally valid.

How Long Does a POA Last in Florida?

A POA in Florida lasts until the principal’s death, revocation by the principal, or if it’s a Durable POA, until the principal becomes incapacitated.

Is a Florida Power of Attorney Valid in Other States?

Yes, a Florida Power of Attorney is generally recognized in other states, but it’s advisable to check specific state laws for any additional requirements.

Can You Have More Than One Power of Attorney in Florida?

Yes, in Florida, you can appoint multiple agents in separate POAs for different purposes, like healthcare and financial matters.

Is Power of Attorney Public Record in Florida?

No, Power of Attorney documents are not typically public record in Florida. They are private documents unless filed with a court.

Can a Power of Attorney Get Paid in Florida?

Yes, a Power of Attorney in Florida can be paid for their services if the POA document explicitly provides for compensation.

Understanding and correctly preparing a Florida Power of Attorney form is crucial for effective legal and personal affairs management. By adhering to Florida’s legal requirements, choosing the right agent, and understanding the scope and duration of the POA, you can ensure your wishes are honored and your interests are protected. Regular updates and clear communication with involved parties are key to maintaining its effectiveness.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips