Navigate the complexities of the Indiana Power of Attorney Form with ease. Our comprehensive guide offers invaluable insights and practical tips to help you understand and effectively use this crucial legal document. Whether you’re appointing a trusted individual for financial decisions or planning for healthcare scenarios, our expert advice ensures you’re well-prepared. Stay informed and secure with our essential tips on utilizing the Indiana Power of Attorney Form to its fullest potential.

What is the Indiana Power of Attorney Form?

The Indiana Power of Attorney Form is a legal document that allows you to appoint someone else to manage your affairs. This person, known as your agent, can make decisions about your finances, health, or property when you’re unable to do so yourself. It’s a way to ensure that your matters are handled according to your wishes, even if you’re not in a position to oversee them personally. This form is particularly important in Indiana for ensuring your choices are respected in critical situations.

What is the Best Sample Indiana Power of Attorney Form?

A Power of Attorney (POA) form is a crucial legal document. In Indiana, it enables an individual to appoint someone to manage their affairs. This template provides a clear and comprehensive format for creating a POA form tailored to Indiana’s legal requirements.

Sample Indiana Power of Attorney Form

Section 1: Principal Information

- Full Name of Principal: _______________________

- Address: _______________________

- City, State, Zip: _______________________

- Phone Number: _______________________

Section 2: Agent Information

- Full Name of Agent: _______________________

- Address: _______________________

- City, State, Zip: _______________________

- Phone Number: _______________________

Section 3: Alternate Agent (Optional)

- Full Name of Alternate Agent: _______________________

- Address: _______________________

- City, State, Zip: _______________________

- Phone Number: _______________________

Section 4: Powers Granted

This Power of Attorney grants the following powers to the Agent:

- Financial Decisions: _______________________________________

- Real Estate Transactions: _______________________________________

- Personal Property Transactions: _______________________________________

- Healthcare Decisions: _______________________________________

- Legal Matters: _______________________________________

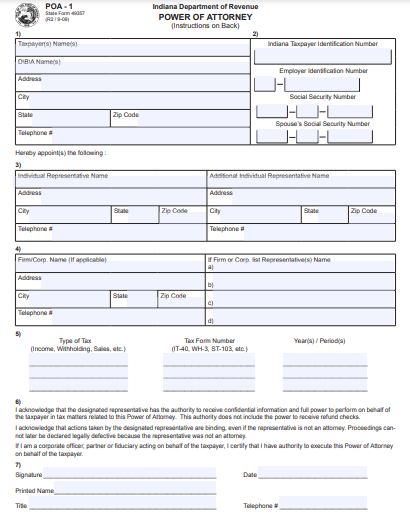

- Tax Matters: _______________________________________

- Other Powers: _______________________________________

Section 5: Duration of Power of Attorney

- Effective Date: _______________

- Termination Date: _______________

Section 6: Special Instructions :

_____________________________

Section 7: Signatures

- Principal’s Signature: _______________________

- Date: _______________________

- Agent’s Signature: _______________________

- Date: _______________________

- Alternate Agent’s Signature (if applicable): _______________________

- Date: _______________________

Notarization

This document was acknowledged before me on [Date] by [Name of Principal].

- Notary Public’s Signature: _______________________

- Date: _______________________

- My Commission Expires: _______________________

This template for an Indiana Power of Attorney form is designed to be adaptable and comprehensive. It’s important to tailor it to the specific needs of the Principal and ensure compliance with Indiana state laws. Consulting a legal professional is advisable for personalized guidance and validation.

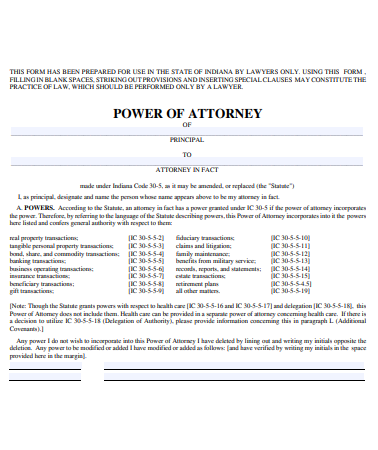

1. Indiana Blank Power of Attorney Form

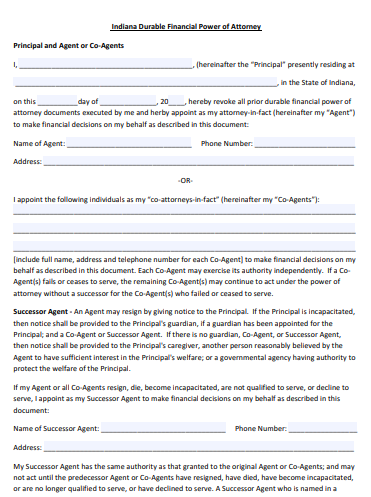

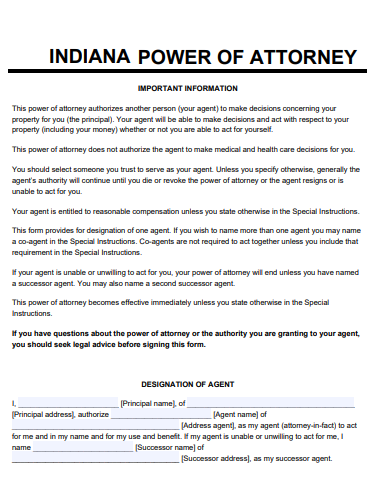

2. Indiana Durable Financial Power of Attorney Form

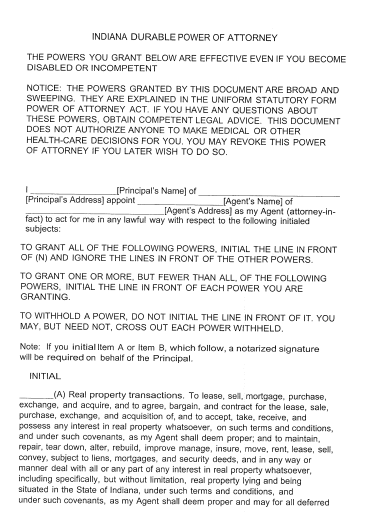

3. Indiana Durable Power of Attorney Form

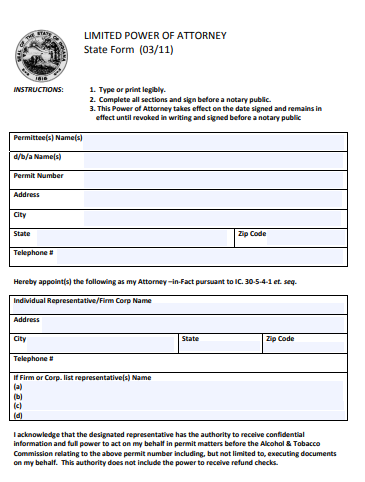

4. Indiana Limited Power of Attorney Form

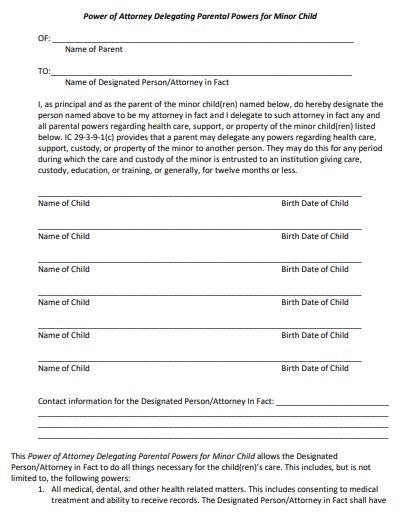

5. Indiana Minor Child Power of Attorney Form

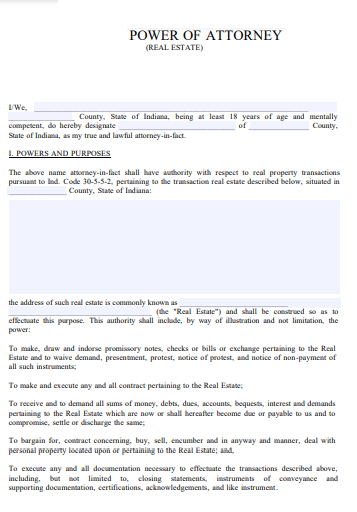

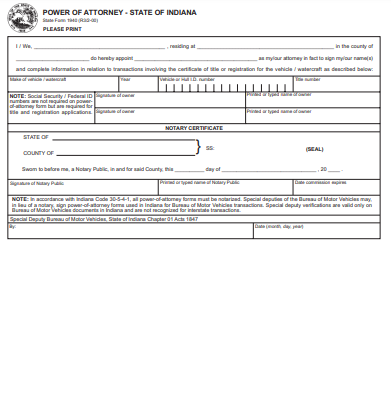

6. Indiana Power of Attorney Form for Real Estate

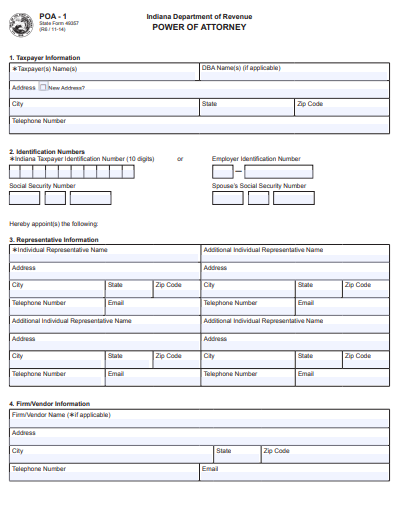

7. Indiana Power of Attorney Form

8. Indiana Standard Power of Attorney Form

9. Sample Indiana Power of Attorney Form

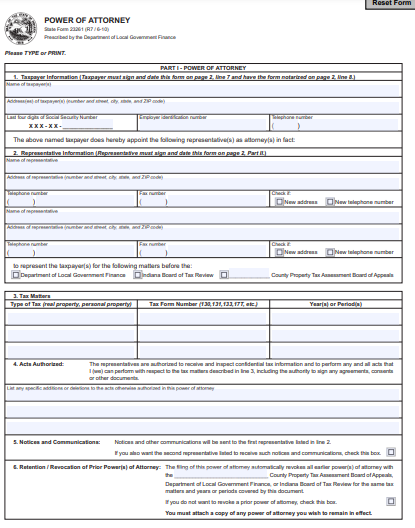

10. State of Indiana Power of Attorney Form

11. General Indiana Power of Attorney Form

How Do I Get Power of Attorney Papers in Indiana?

Acquiring Power of Attorney papers in Indiana involves understanding state-specific legal requirements. This process includes selecting an agent, drafting the POA document, and ensuring proper notarization. It’s crucial to follow Indiana’s legal guidelines for a valid POA.

Examples:

- Consult a Legal Professional: Engage an attorney specializing in Indiana law to draft a POA document, ensuring legal compliance.

- Online Legal Forms: Utilize reputable online platforms offering Indiana-specific POA forms for a quick start.

- State Government Resources: Access Indiana’s state government website for official POA forms and guidelines.

- Local Legal Aid Societies: Seek assistance from local legal aid organizations for guidance and free or low-cost POA forms.

- Financial Institutions: Some banks provide POA forms tailored to financial matters, aligning with Indiana’s legal standards.

How Much Does a Power of Attorney Cost in Indiana?

The cost of a Power of Attorney in Indiana varies based on the complexity of the document and professional fees. It can range from free DIY forms to higher costs for attorney-drafted documents, typically influenced by specific needs and legal advice.

Examples:

- DIY Online Forms: Free or low-cost POA forms available online, with varying degrees of customization.

- Attorney Drafted POA: Costs associated with hiring an attorney to draft a POA, reflecting the complexity of the document.

- Notary Public Fees: Charges for notarizing the POA, a necessary step in Indiana.

- Legal Aid Services: Sliding scale fees offered by legal aid for those who qualify, based on income.

- Flat Fee Legal Services: Some attorneys offer flat-rate pricing for standard POA documents.

What is the Difference Between Durable Power of Attorney and Power of Attorney Indiana?

Understanding the distinction between a Durable Power of Attorney and a standard Power of Attorney in Indiana is crucial for effective estate planning and personal affairs management.

| Feature | Durable Power of Attorney | Standard Power of Attorney |

|---|---|---|

| Duration | Remains in effect even if the principal becomes incapacitated. | Typically ceases if the principal becomes incapacitated. |

| Purpose | Often used for long-term planning, including health and financial decisions. | Generally used for specific transactions or limited time periods. |

| Legal Requirements | Must explicitly state its durability in the document. | Does not require specific language regarding durability. |

| Revocation | Can only be revoked by the principal if they are mentally competent. | Can be revoked anytime as long as the principal is competent. |

| Use Cases | Ideal for aging individuals or those with health concerns. | Suitable for temporary or transaction-specific authorizations. |

Who Can Override a Power of Attorney in Indiana?

In Indiana, overriding a Power of Attorney requires legal intervention or specific circumstances. It involves court actions, principal’s decisions, or conditions outlined in the POA document itself.

Examples:

- Principal’s Revocation: The principal can revoke the POA if they are mentally competent.

- Court Intervention: A court can override a POA if it finds the agent is acting improperly.

- Expiration of POA: A POA can be overridden by its own terms if it has an expiration date.

- New POA: Execution of a new POA by the principal can override the previous one.

- Agent’s Inability to Serve: If the agent is unable or unwilling to serve, the POA can be overridden.

Does POA End at Death in Indiana?

In Indiana, a Power of Attorney automatically terminates upon the death of the principal. This legal cessation ensures that the agent’s authority does not extend beyond the principal’s lifetime.

Examples:

- Principal’s Death: The moment the principal passes away, the POA ceases to be effective.

- Estate Executor Role: Post-death, the executor of the estate, not the POA agent, manages affairs.

- No Post-Mortem Transactions: Agents cannot conduct transactions on behalf of the deceased principal.

- Legal Notification: Legal requirement to notify relevant parties of the principal’s death to cease POA.

- Asset Distribution: Responsibility for asset distribution shifts to the estate’s executor or court-appointed administrator.

What is the Best Power of Attorney Form?

The best Power of Attorney form in Indiana is one that is legally compliant, tailored to specific needs, and clearly outlines the scope of authority granted to the agent.

Examples:

- State-Specific Forms: Forms that adhere to Indiana’s legal requirements for POAs.

- Customized Legal Documents: POA forms tailored by legal professionals to fit individual circumstances.

- Comprehensive Financial POAs: Forms that thoroughly cover financial management aspects.

- Healthcare POA Forms: Specifically designed for healthcare decisions, aligning with Indiana laws.

- Durable POA Forms: Ideal for long-term planning, ensuring validity even if the principal becomes incapacitated.

Does a POA Have to Be Recorded in Indiana?

In Indiana, recording a Power of Attorney is not generally required but is recommended for real estate transactions. Recording ensures legal recognition and facilitates the agent’s ability to act effectively.

Examples:

- Real Estate Transactions: Recording a POA when dealing with property matters for legal validity.

- Optional Recording: For non-real estate matters, recording is optional but can add legitimacy.

- County Recorder’s Office: POAs are recorded at the local county recorder’s office.

- Protection Against Future Disputes: Recording can prevent future disputes regarding the POA’s validity.

- Ease of Access: Recorded POAs are easier for institutions to verify and accept.

How to Prepare an Indiana Power of Attorney Form

Introduction: Creating an Indiana Power of Attorney (POA) form is a pivotal step in ensuring your affairs are managed according to your wishes. This guide provides a detailed, step-by-step approach to preparing an effective POA form, focusing on clarity and legal compliance.

Step 1: Understanding Indiana POA Requirements

- Research Indiana Laws: Familiarize yourself with Indiana’s specific legal requirements for a POA.

- Determine the Type of POA: Decide whether you need a general, durable, healthcare, or limited POA.

Step 2: Selecting Your Agent

- Choose a Trusted Individual: Your agent should be someone you trust implicitly to manage your affairs.

- Discuss Responsibilities: Clearly communicate the responsibilities and expectations with your chosen agent.

Step 3: Drafting the Document

- Use a Standard Form or Attorney Services: Utilize a state-specific form or hire an attorney for a customized POA.

- Include Essential Information: Clearly state your name, the agent’s name, and the powers granted.

Step 4: Defining the Powers

- Be Specific: Clearly outline the scope of powers, whether financial, medical, or general.

- Consider Limitations: If necessary, include any limitations to the agent’s powers.

Step 5: Signing and Notarization

- Follow Signing Requirements: Ensure the POA is signed according to Indiana law, typically in the presence of a notary.

- Notarize the Document: Have the POA notarized to add a layer of legal validation.

Step 6: Distributing Copies

- Provide Copies to Relevant Parties: Give copies to your agent, financial institutions, and healthcare providers as necessary.

- Keep the Original Safe: Store the original document in a secure location.

Step 7: Regular Updates

- Review Periodically: Regularly review and update your POA to reflect any changes in your situation or relationships.

Tips for Using Effective Indiana Power of Attorney Form

An Indiana Power of Attorney form is a powerful tool for managing your affairs. These tips focus on maximizing its effectiveness through clear communication and legal precision.

Tip 1: Clear Communication

- Discuss with Your Agent: Have an open conversation with your agent about your wishes and expectations.

- Inform Family Members: To avoid conflicts, inform family members of your POA arrangements.

Tip 2: Legal Accuracy

- Ensure Legal Compliance: Make sure your POA adheres to Indiana’s legal standards.

- Seek Legal Advice: Consider consulting an attorney for advice, especially for complex situations.

Tip 3: Specificity in Powers Granted

- Define Powers Clearly: Be explicit about what the agent can and cannot do.

- Avoid Vague Language: Use clear and concise language to prevent misunderstandings.

Tip 4: Consider a Durable POA

- Plan for Incapacity: A durable POA remains effective if you become incapacitated, ensuring continuous management of your affairs.

Tip 5: Regular Reviews and Updates

- Update as Needed: Life changes such as marriage, divorce, or the birth of a child may necessitate updates to your POA.

- Revoke if Necessary: Understand the process for revoking a POA if your agent no longer meets your needs.

Tip 6: Safe and Accessible Document Storage

- Secure Storage: Keep the original document in a safe but accessible place.

- Accessibility: Ensure your agent and relevant parties know where to find the POA if needed.

Tip 7: Avoiding Misuse

- Monitor the Agent’s Actions: Stay informed about the actions taken by your agent.

- Set Boundaries: Establish clear boundaries and guidelines for the agent to follow.

An Indiana Power of Attorney is a strategic tool for managing your affairs. By following these steps and tips, you can ensure that your POA is effective, legally compliant, and aligns with your communication and management goals.

What Are the Rules for Power of Attorney in Indiana?

In Indiana, a Power of Attorney must be in writing, signed by the principal, and notarized. It should clearly state the powers granted and comply with state laws.

What Are the Limitations of a Power of Attorney?

A Power of Attorney cannot grant an agent the ability to change the principal’s will, vote in their stead, or perform duties assigned only to the principal.

Can You Have More Than One Power of Attorney in Indiana?

Yes, in Indiana, you can appoint multiple agents in a Power of Attorney, either to act jointly or separately in different matters.

Does Power of Attorney Have to Be Filed in Indiana?

Filing a Power of Attorney is not mandatory in Indiana, except for real estate transactions where it must be recorded.

Whose Signature Is Required for Power of Attorney?

The signature required for a power of attorney is primarily that of the principal, the person granting the authority. Additionally, a notary public must often witness and authenticate the signing process.

Creating an Indiana Power of Attorney form requires careful attention to detail and adherence to state laws. By following our comprehensive guide and tips, you can ensure your document is legally binding and accurately reflects your wishes. Remember, consulting with a legal expert can provide additional assurance in this important process.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Illinois (IL) Power of Attorney Form Download – How to Create Guide, Tips