Navigating the complexities of the Illinois Power of Attorney Form can be daunting. Our guide simplifies this process, offering practical tips and clear instructions. Whether you’re appointing a trusted individual for financial decisions or healthcare directives, understanding this form is crucial. We provide essential insights into selecting agents, filling out the form accurately, and ensuring legal compliance. Empower yourself with knowledge to make informed decisions in Illinois’s legal landscape.

What is the Illinois Power of Attorney Form?

The Illinois Power of Attorney Form is a legal document that allows an individual, known as the ‘principal’, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This form is used in Illinois to grant authority in areas like finances, health care, or property management. It becomes effective under circumstances specified by the principal, such as illness or absence, ensuring their affairs are handled as per their wishes.

What is the Best Sample Illinois Power of Attorney Form?

Creating an Illinois Power of Attorney (POA) form is a crucial step for ensuring your personal and financial matters are handled according to your wishes, especially in times when you are unable to manage them yourself. The following sample illustrates a standard format for an Illinois POA form. It’s important to remember that this is a basic template and should be customized to fit your specific needs. Consulting with a legal professional is highly recommended to ensure that the form meets all legal requirements and accurately reflects your intentions

ILLINOIS POWER OF ATTORNEY FORM

SECTION 1: PRINCIPAL’S INFORMATION

Full Name of Principal: _____________________________

Principal’s Address: _______________________________

City: _______________ State: Illinois Zip: _______

Phone Number: ___________________________________

SECTION 2: AGENT’S INFORMATION

Full Name of Agent: _______________________________

Agent’s Address: _________________________________

City: _______________ State: Illinois Zip: _______

Phone Number: ___________________________________

SECTION 3: AUTHORITY GRANTED

I, [Principal’s Full Name], hereby appoint [Agent’s Full Name] as my Attorney-in-Fact (“Agent”) to act in my capacity to do any and all of the following:

- Financial Decisions: To handle, manage and make decisions regarding my financial affairs including but not limited to banking transactions, property management, investment decisions, and handling of personal assets.

- Health Care Decisions: To make health care decisions on my behalf including medical treatment options, access to medical records, and discussions with health care providers.

- Real Estate Matters: To buy, sell, lease, or manage real estate properties on my behalf.

- Legal Affairs: To represent me in legal matters, sign documents, and make decisions that are in my best interest.

This Power of Attorney shall become effective on [Effective Date] and will remain in effect until [End Date or Condition], unless I revoke it sooner.

SECTION 4: DURABILITY

This Power of Attorney shall continue to be effective in the event I become disabled, incapacitated, or incompetent.

SECTION 5: SIGNATURES

Principal’s Signature: ___________________________

Date: _______________

Agent’s Signature: ______________________________

Date: _______________

Witness 1 Signature: ____________________________

Date: _______________

Witness 2 Signature: ____________________________

Date: _______________

Notary Acknowledgment

State of Illinois, County of _______________

On [Date], before me, [Notary’s Name], personally appeared [Principal’s Name], known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public’s Signature: ________________________

Date: _______________

My Commission Expires: _______________

Note: This form is a sample and should be tailored to fit your specific needs. It is recommended to consult with a legal professional before finalizing a Power of Attorney document.

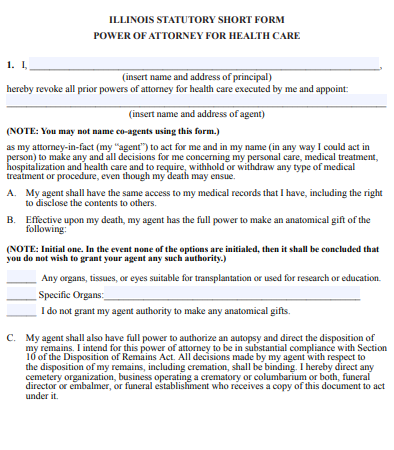

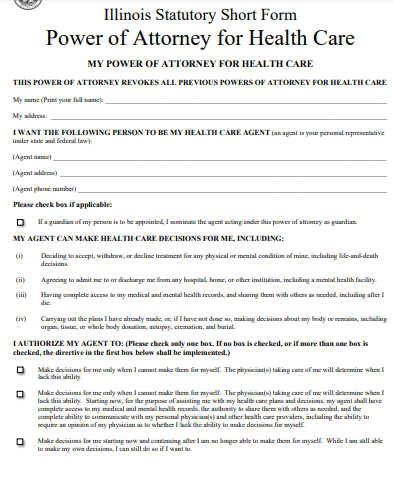

1. Illinois Statutory Power of Attorney Form

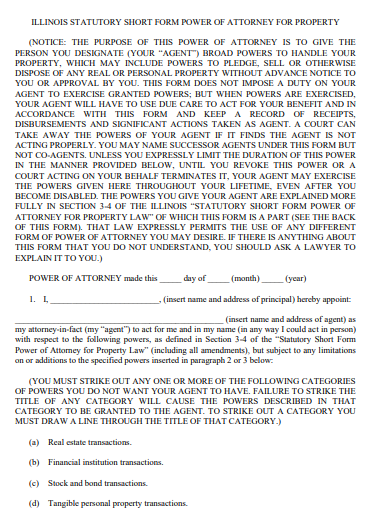

2. Illinois Standard Power of Attorney Form

3. Illinois Printable Power of Attorney Form

4. Illinois Power of Attorney Short Form

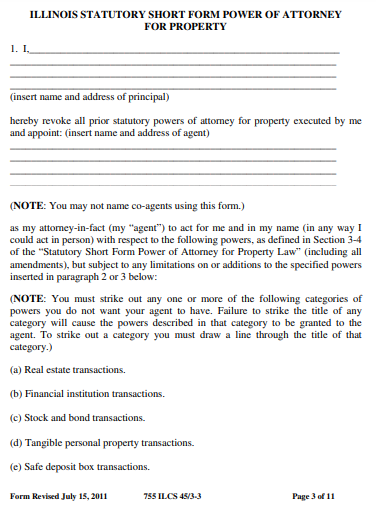

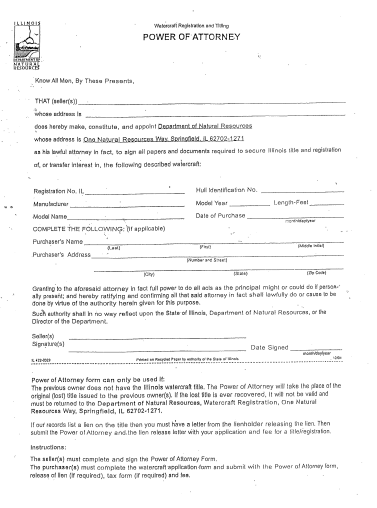

5. Illinois Power of Attorney Form for Property

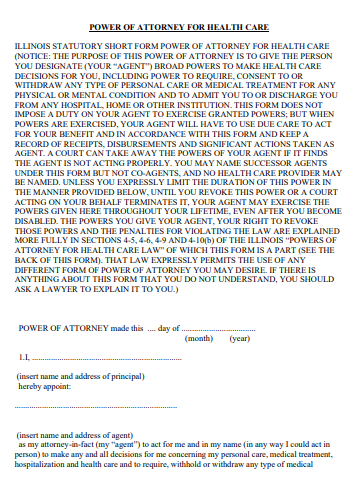

6. Illinois Medical Power of Attorney Form

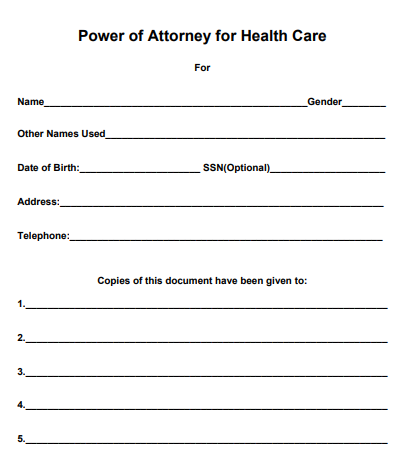

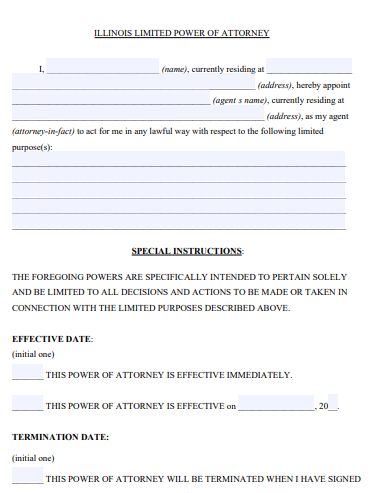

7. Illinois Limited Power of Attorney Form

8. Illinois Health Care Power of Attorney Form

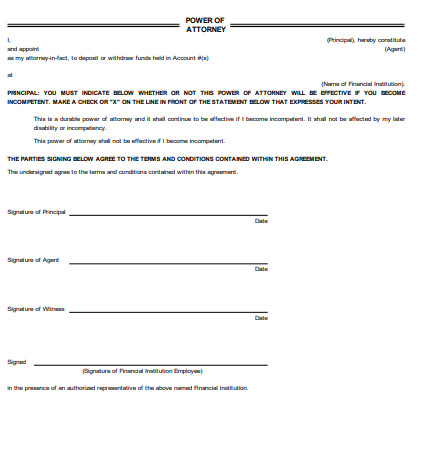

9. Illinois Durable Power of Attorney ForM

10. Illinois Blank Power of Attorney Form

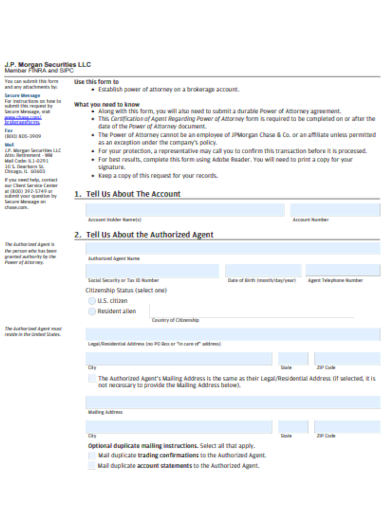

11. Financial Illinois Power of Attorney Form

How do I get power of attorney in Illinois?

Obtaining a Power of Attorney in Illinois involves selecting a trusted individual as your agent and completing the relevant legal form. It’s crucial to ensure the form complies with Illinois law, clearly outlining the agent’s powers and responsibilities. The process includes signing the document in the presence of a notary and witnesses, ensuring its validity. This legal tool is vital for managing affairs when you’re unable to do so yourself.

Examples:

- Choosing a Family Member: Selecting a sibling or adult child to manage your finances if you’re abroad.

- Appointing a Trusted Friend: Designating a close friend to make healthcare decisions during a medical procedure.

- Using a Professional Agent: Hiring a lawyer or financial advisor for complex estate management.

- Temporary Arrangement: Granting power of attorney during a specific period, like a lengthy overseas trip.

- For Business Owners: Delegating business decisions to a partner during an extended absence.

What is form IL-2848?

Form IL-2848, primarily used in Illinois, is a legal document authorizing a representative to act on behalf of an individual in tax matters. This form is essential for appointing a tax professional to handle tax filings, disputes, and negotiations with the Illinois Department of Revenue. It ensures that your tax affairs are managed efficiently and in compliance with state laws.

Examples:

- Tax Dispute Representation: Authorizing a tax attorney to represent you in a tax dispute.

- Filing Assistance: Allowing a CPA to file your state taxes.

- Tax Negotiation: Empowering a representative to negotiate tax settlements.

- Audit Representation: Designating someone to represent you during a state tax audit.

- Tax Advice: Seeking professional advice on complex tax issues.

What is an Illinois Statutory Short Form Power of Attorney?

The Illinois Statutory Short Form Power of Attorney is a standardized legal document used to grant an agent authority to handle specific matters, like property, financial, or health decisions. This form simplifies the process of creating a power of attorney, ensuring it adheres to Illinois state laws and is widely recognized and accepted.

Examples:

- Financial Management: Granting an agent authority to handle banking and investment decisions.

- Real Estate Transactions: Authorizing an agent to sell or purchase property on your behalf.

- Healthcare Decisions: Appointing someone to make medical decisions if you’re incapacitated.

- Business Operations: Delegating business-related decisions during your absence.

- Elderly Care: Assisting seniors in managing their day-to-day financial affairs.

Do I need a lawyer for power of attorney in Illinois?

While it’s not mandatory to hire a lawyer for creating a power of attorney in Illinois, legal guidance ensures that the document is correctly drafted and valid. A lawyer can provide tailored advice, ensuring the form meets your specific needs and complies with state laws, offering peace of mind in its execution.

Examples:

- Complex Estates: Seeking legal advice for intricate financial estates.

- Business Interests: Ensuring business assets are properly managed.

- Healthcare Directives: Tailoring medical decision-making powers.

- Avoiding Disputes: Minimizing family conflicts over power delegation.

- Legal Compliance: Ensuring the form adheres to Illinois legal standards.

How long does power of attorney last in Illinois?

In Illinois, the duration of a power of attorney depends on the type and terms specified in the document. It can last indefinitely, until revoked, or until the principal’s death. A durable power of attorney remains effective even if the principal becomes incapacitated, ensuring continuous management of affairs.

Examples:

- Indefinite Duration: A power of attorney with no specified end date.

- Condition-Based Termination: Ending upon the principal’s recovery from incapacity.

- Fixed Term: A power of attorney valid for a specific time, like during a trip.

- Revocation: The principal actively revoking the power of attorney.

- Principal’s Death: Automatically terminating upon the principal’s death.

Can you do your own power of attorney in Illinois?

In Illinois, individuals can create their own power of attorney without a lawyer. However, it’s crucial to follow state guidelines to ensure its validity. This includes using the correct form, specifying powers granted, and adhering to signing and witnessing requirements. Self-preparation can be cost-effective but demands careful attention to legal details.

Examples:

- DIY Online Forms: Utilizing online resources to draft a standard power of attorney.

- Library Resources: Accessing legal form books at local libraries.

- Community Workshops: Attending a legal workshop for guidance.

- Notary Services: Ensuring proper notarization of the document.

- Witness Requirements: Having the document witnessed as per state law.

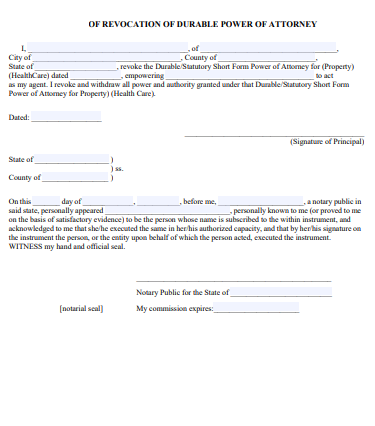

How do I change my power of attorney in Illinois?

Altering a power of attorney in Illinois involves revoking the existing document and creating a new one. This process requires a written revocation notice and ensuring the new power of attorney is legally drafted, signed, and notarized. It’s important to inform all relevant parties of the change.

Examples:

- Revocation Document: Drafting a formal revocation of the previous power of attorney.

- New Agent Appointment: Selecting a different individual as your new agent.

- Updated Terms: Modifying the scope or terms of the power granted.

- Notifying Financial Institutions: Informing banks and other entities of the change.

- Healthcare Directive Updates: Changing your healthcare representative.

Can you have 2 power of attorneys in Illinois?

In Illinois, it’s possible to appoint multiple agents in a power of attorney. However, it’s essential to specify whether they can act independently or must make decisions jointly. This approach can provide balanced decision-making but requires clear communication and coordination among the agents.

Examples:

- Joint Agents: Appointing two children to make decisions together.

- Separate Powers: Assigning different agents for financial and healthcare decisions.

- Independent Action: Allowing each agent to act without the other’s consent.

- Coordinated Efforts: Agents working together for complex decision-making.

- Alternate Agents: Designating a secondary agent if the primary is unavailable.

How to Prepare an Illinois Power of Attorney Form

Preparing an Illinois Power of Attorney (POA) Form is a critical process for ensuring your affairs are managed according to your wishes. This step-by-step guide will walk you through creating an effective and legally compliant POA in Illinois.

Step 1: Understanding the Types of POA

- General POA: Grants broad powers over your financial and personal affairs.

- Healthcare POA: Allows an agent to make healthcare decisions on your behalf.

- Durable POA: Remains in effect even if you become incapacitated.

Step 2: Selecting Your Agent

- Choose someone trustworthy and reliable.

- Consider their ability to handle responsibilities and make decisions in your best interest.

Step 3: Drafting the POA Form

- Use a standard Illinois POA form or seek legal assistance for customization.

- Clearly define the scope of powers and any limitations.

Step 4: Completing the Form

- Fill in your details and the agent’s details accurately.

- Specify the powers granted and any conditions or limitations.

Step 5: Signing and Witnessing

- Sign the form in the presence of a notary public.

- Illinois law may require witness signatures; ensure compliance.

Step 6: Distributing Copies

- Provide a copy to your agent and any relevant institutions (banks, healthcare providers).

- Keep the original in a safe but accessible place.

Step 7: Reviewing and Updating

- Regularly review the POA and update it as necessary.

- Communicate any changes to your agent and relevant parties.

Tips for Using an Effective Illinois Power of Attorney Form

An Illinois Power of Attorney Form is a powerful tool for managing your affairs. Here are tips to ensure its effectiveness and proper use.

Tip 1: Be Specific in Powers Granted

- Clearly outline the extent of powers given to avoid ambiguity.

- Tailor the powers to suit your specific needs and circumstances.

Tip 2: Choose the Right Agent

- Select an agent who understands your values and can communicate effectively on your behalf.

- Consider their geographical proximity and availability.

Tip 3: Communicate with Your Agent

- Discuss your expectations and the extent of their responsibilities.

- Ensure they understand their role and are willing to take it on.

Tip 4: Legal Compliance

- Ensure the form complies with Illinois state laws.

- Regularly update the form to reflect any legal changes.

Tip 5: Avoiding Misuse

- Monitor the agent’s actions where possible.

- Set up safeguards, like requiring periodic accounting or co-agent approvals for major decisions.

Tip 6: Accessibility of the Document

- Keep the POA document in a secure yet accessible location.

- Inform your agent and family members where the document is stored.

Tip 7: Revocation and Amendments

- Understand the process for revoking or amending the POA.

- Communicate any changes promptly to all involved parties.

An effective Illinois Power of Attorney Form requires careful preparation, clear communication, and regular updates. By following these guidelines, you can ensure that your affairs are managed efficiently and in accordance with your wishes.

What are the Rights of a Power of Attorney in Illinois?

In Illinois, a power of attorney grants rights to make decisions about finances, healthcare, and property, as specified in the document, respecting the principal’s wishes.

What are the Limitations of a Power of Attorney?

A power of attorney’s limitations include inability to change the principal’s will, make decisions after the principal’s death, and act beyond granted powers.

Is Illinois Power of Attorney Valid in Other States?

Generally, an Illinois power of attorney is valid in other states, but it’s advisable to check specific state laws for any additional requirements.

What are the New Rules of Power of Attorney?

New rules of power of attorney emphasize enhanced protections against abuse, clearer definitions of authority, and stricter requirements for legal validity.

What is a Durable Power of Attorney Form in Illinois?

A durable power of attorney in Illinois remains effective even if the principal becomes incapacitated, allowing the agent to continue managing affairs.

The Illinois Power of Attorney Form is a vital legal tool, ensuring your affairs are managed as per your wishes. This guide provides clarity on creating and using the form effectively. By understanding the steps, rights, and limitations, and following our tips, you can confidently prepare a POA that reflects your needs and complies with Illinois law.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips