Embark on a seamless journey with the Connecticut Power of Attorney (POA) form, a crucial tool for delegating legal authority. Our guide illuminates the path to creating a robust POA, tailored to Connecticut’s legal landscape. Discover invaluable tips for effective usage, ensuring your financial, health, and legal affairs are managed precisely as you intend. This introduction is your gateway to mastering the Connecticut POA, blending legal savvy with practical insights.

What is the Connecticut Power of Attorney Form?

The Connecticut Power of Attorney Form is a legal document that allows you (the principal) to appoint someone else (the agent or attorney-in-fact) to make decisions on your behalf. This form is used in Connecticut for various purposes, such as handling financial matters, making healthcare decisions, or managing property. It ensures that your affairs are taken care of according to your wishes, especially if you’re unable to make decisions yourself.

What is the Best Sample Connecticut Power of Attorney Form?

This sample Connecticut Power of Attorney form is a template for granting someone the authority to make decisions on your behalf. It’s important to customize this form to your specific needs and ensure it complies with Connecticut state law.

Connecticut Power of Attorney Form

Section 1: Principal Information

- Full Name of Principal: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 2: Agent Information

- Full Name of Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 3: Alternate Agent (Optional)

- Full Name of Alternate Agent: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Email Address: ____________________________

Section 4: Powers Granted

- Financial Decisions: [ ] Yes [ ] No

- Real Estate Transactions: [ ] Yes [ ] No

- Personal Property Transactions: [ ] Yes [ ] No

- Healthcare Decisions: [ ] Yes [ ] No

- Other (Specify): ____________________________

Section 5: Special Instructions

- Instructions: _______________________________________________________

Section 6: Duration

- Effective Date: _______________________

- Termination Date (if applicable): _______________________

- This Power of Attorney is:

- Durable (remains in effect if I become incapacitated)

- Non-Durable

Section 7: Signatures

- Principal’s Signature: _______________________ Date: _______________________

- Agent’s Signature: _______________________ Date: _______________________

- Alternate Agent’s Signature (if applicable): _______________________ Date: _______________________

Section 8: Acknowledgment

- Notary Public’s Acknowledgment: State of Connecticut, County of ________________ On _______________________, before me, _______________________, Notary Public, personally appeared [Name of Principal], who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument. I certify under PENALTY OF PERJURY under the laws of the State of Connecticut that the foregoing paragraph is true and correct. Witness my hand and official seal: Signature _______________________ (Seal)

This sample Connecticut Power of Attorney form is a foundational tool for authorizing another individual to make decisions on your behalf. It’s crucial to ensure all information is accurate and the form is notarized for legal validity. Consulting with a legal professional is recommended to customize this document to your specific needs.

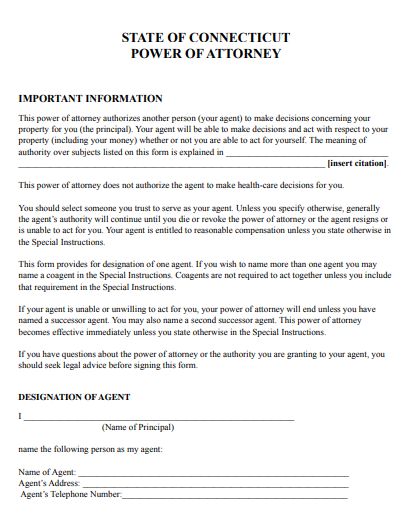

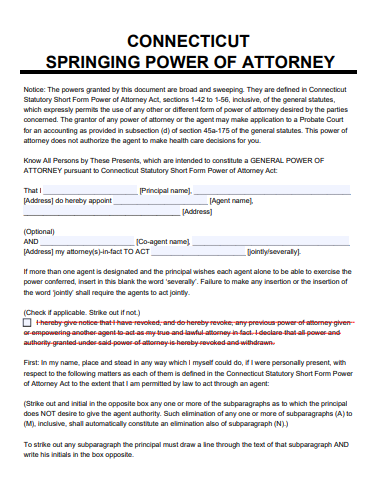

1. State of Connecticut Power of Attorney Form

2. Sample Connecticut Power of Attorney Form

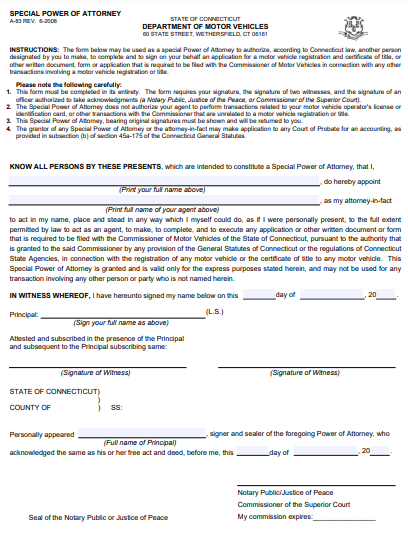

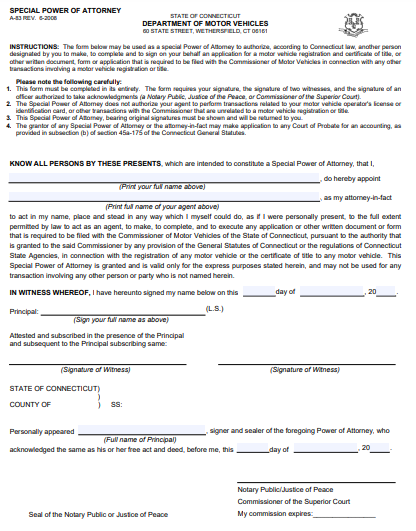

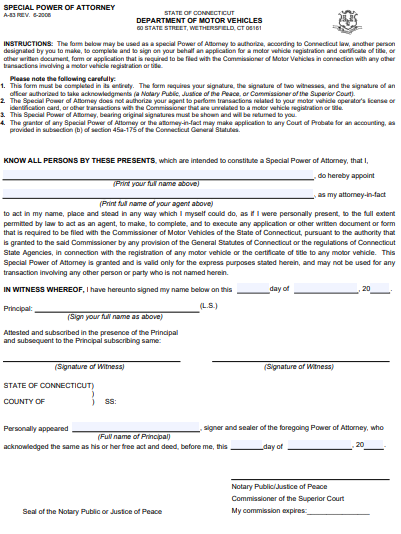

3. Connecticut Vehicle Power of Attorney Form

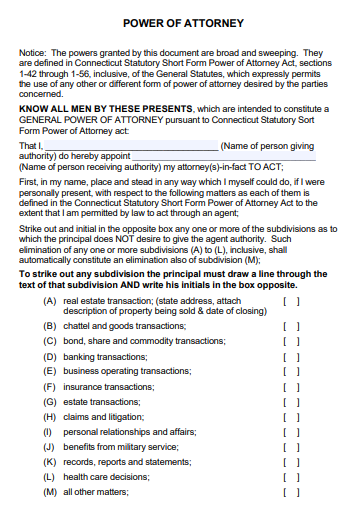

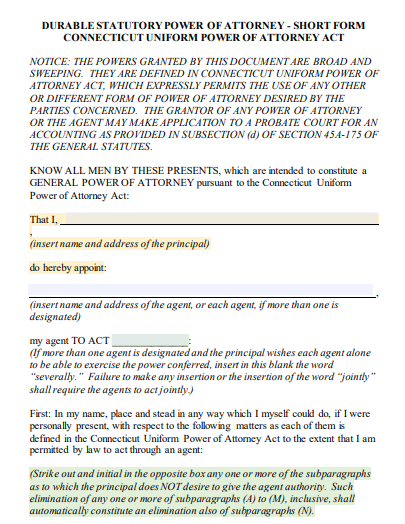

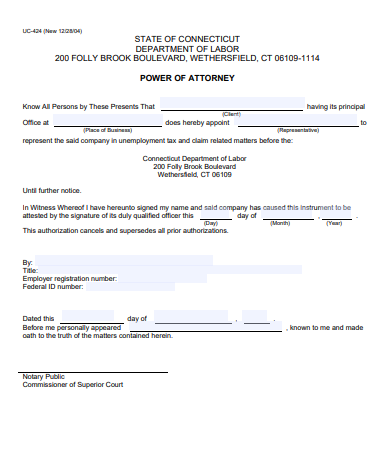

4. Connecticut Standard Power of Attorney Form

5. Connecticut Special Power of Attorney Form

6. Connecticut Simple Power of Attorney Form

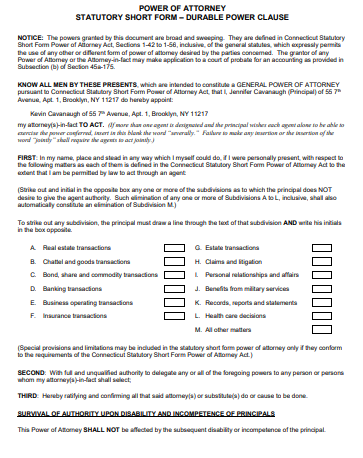

7. Connecticut Power of Attorney Short Form

8. Connecticut Power of Attorney Form

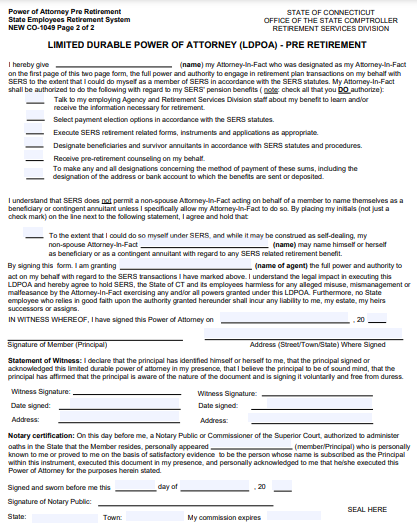

9. Connecticut Limited Power of Attorney Form

10. Connecticut Durable Power of Attorney Form

11. Connecticut Blank Power of Attorney Form

How do you get power of attorney in Connecticut?

To get a Power of Attorney (POA) in Connecticut, follow these steps:

-

Determine the Type of POA Needed:

- Decide whether you require a General, Durable, Limited, or Healthcare POA, based on your specific needs.

-

Choose Your Agent:

- Select a trustworthy individual who will act in your best interests as your agent (or Attorney-in-Fact).

- Draft the POA Document:

- Use a standard Connecticut POA form or create a custom one. Ensure it includes your name, the agent’s name, and the powers you are granting.

-

Specify Powers and Limitations:

- Clearly outline the authority you are giving to your agent. Be specific about what they can and cannot do.

-

Legal Requirements:

- Ensure you are mentally competent when signing the POA.

- The document should be signed voluntarily.

-

Sign in the Presence of a Notary:

- Connecticut law requires that your POA be notarized. Sign the document in front of a notary public.

-

Inform Your Agent:

- Give a copy of the POA to your agent and discuss your expectations and any specific instructions.

-

Store the Document Safely:

- Keep the original POA in a secure location and inform your agent and a trusted family member or friend where it is kept.

-

Review and Update as Necessary:

- Regularly review your POA and update it if your circumstances or wishes change.

Remember, while you can draft and execute a POA on your own, consulting with a legal professional can provide additional assurance that your document is properly drafted and legally sound, especially in more complex situations.

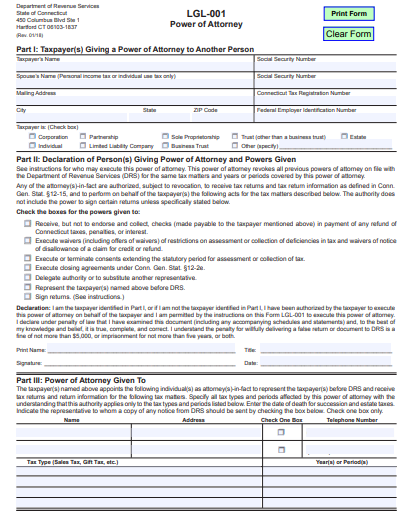

What is the power of attorney form for CT taxes?

The Power of Attorney form specifically for Connecticut taxes is known as the LGL-001 Form or “Department of Revenue Services (DRS) Power of Attorney.” This form is used to authorize an individual, typically a tax professional, to represent you and handle your tax matters with the Connecticut Department of Revenue Services. The LGL-001 allows your appointed agent to access your tax records, communicate with the DRS on your behalf, and make decisions regarding your state tax affairs. It’s an essential document for anyone needing assistance with Connecticut state tax issues, ensuring that their tax matters are managed efficiently and accurately by a trusted representative.

How long is a power of attorney good for in CT?

In Connecticut, the duration of a Power of Attorney (POA) depends on the type of POA and any specific terms stated within the document. Generally:

- Durable Power of Attorney: This remains effective until the principal’s death unless it is revoked earlier by the principal. It continues to be effective even if the principal becomes incapacitated.

- Non-Durable Power of Attorney: This type of POA is typically valid until the principal becomes incapacitated, revokes the POA, or it reaches a specified end date mentioned in the document.

- Specific End Date: If the POA document specifies an end date, it will be valid until that date unless revoked earlier.

- Revocation: A POA can be revoked at any time by the principal as long as they are mentally competent to make this decision.

It’s important to clearly state the intended duration or conditions for termination in the POA document to avoid any ambiguity. If there are no specific terms regarding its duration, the POA generally remains in effect until the principal’s death or revocation.

What is a limited power of attorney form in CT?

A Limited Power of Attorney form in Connecticut is a legal document that grants an appointed person, known as the agent or attorney-in-fact, the authority to act on behalf of the principal (the person who creates the Power of Attorney) in specific matters or situations. Unlike a General Power of Attorney, which provides broad powers, a Limited Power of Attorney is used for particular tasks or for a set period. For example, it might be used to allow the agent to handle financial transactions, sell property, or make decisions about a specific event while the principal is unavailable. The powers granted in this form are clearly defined and restricted to certain activities, and it typically ends either after the specified task is completed or at a time stated in the document.

Do you need a lawyer for power of attorney in CT?

In Connecticut, it is not legally required to have a lawyer to create a Power of Attorney (POA). You can draft a POA document yourself using standard forms or online resources. However, consulting with a lawyer is advisable, especially in complex situations or if you have specific legal questions. A lawyer can ensure that the POA accurately reflects your wishes, is tailored to your specific needs, and complies with Connecticut state laws. They can also provide valuable advice on choosing an agent and the powers to grant. While not mandatory, legal guidance can add a layer of security and clarity to the process.

Does a power of attorney need to be notarized in CT?

Yes, in Connecticut, a Power of Attorney (POA) needs to be notarized to be legally valid. Notarization involves having the document signed in the presence of a notary public. The notary public verifies the identity of the person signing the document (the principal) and ensures that they are signing it willingly and with an understanding of its implications. This step is crucial for the legal enforceability of the POA in Connecticut, as it helps to prevent fraud and confirms the authenticity of the document.

How to Prepare a Connecticut Power of Attorney Form

Step 1: Determine the Type of POA

- Decide whether you need a General, Durable, Limited, or Medical Power of Attorney, based on your specific requirements.

Step 2: Choose Your Agent

- Select a trustworthy individual to act as your agent (also known as an Attorney-in-Fact). Ensure they are capable and willing to handle the responsibilities.

Step 3: Draft the POA Document

- Use a standard Connecticut POA form or draft one with the help of legal resources. Include your name, the agent’s name, and the powers you are granting.

Step 4: Specify Powers and Limitations

- Clearly outline the authority you are giving to your agent. Be specific about what they can and cannot do.

Step 5: Meet Legal Requirements

- Ensure you are mentally competent and understand the implications of signing the POA.

- The document must be signed voluntarily.

Step 6: Sign in the Presence of a Notary

- Sign the POA form in front of a notary public. Notarization is a legal requirement in Connecticut for most POA documents.

Step 7: Inform Your Agent

- Discuss the POA with your agent, ensuring they understand their duties and your wishes.

Step 8: Distribute Copies

- Provide copies of the signed and notarized POA to your agent and any relevant institutions, such as banks or healthcare providers.

Step 9: Store the Document Safely

- Keep the original POA in a secure location and inform your agent and a trusted individual about its whereabouts.

Step 10: Regular Review and Update

- Regularly review your POA and update it if your circumstances or wishes change.

Creating a Power of Attorney in Connecticut is a straightforward process that ensures your affairs are managed according to your wishes. While you can complete this process on your own, consulting with a legal professional is advisable for complex situations or for additional guidance.

Tips for Using Effective Connecticut Power of Attorney Form

1. Choose the Right Agent

- Select someone trustworthy, reliable, and capable of handling responsibilities effectively.

2. Be Specific About Powers Granted

- Clearly define the scope of authority you are giving to your agent to avoid ambiguity.

3. Consider a Durable POA

- Opt for a Durable Power of Attorney if you want it to remain effective even if you become incapacitated.

4. Regularly Update Your POA

- Review and update your POA periodically to reflect any changes in your circumstances or wishes.

5. Understand the Legal Requirements

- Ensure your POA complies with Connecticut state laws, including requirements for notarization.

6. Communicate with Your Agent

- Discuss your expectations and instructions with your agent to ensure they understand their role.

7. Keep the Document Accessible

- Store your POA in a safe but accessible place and inform your agent and family members where it is kept.

8. Consult with Professionals

- Seek advice from legal or financial professionals if you have complex needs or questions.

9. Avoid Coercion

- Ensure the POA is signed voluntarily and without any undue influence.

10. Consider Alternate Agents

- Appoint an alternate agent in case your primary agent is unable or unwilling to serve.

An effective Connecticut Power of Attorney requires careful planning and clear communication. By following these tips, you can ensure that your POA serves its intended purpose and provides peace of mind for both you and your agent.

What Are the Requirements for a Power of Attorney in CT?

In Connecticut, a Power of Attorney must be in writing, signed by the principal, and notarized. The principal must be mentally competent at the time of signing.

How Long Does a Power of Attorney Last in CT?

A Power of Attorney in Connecticut lasts until the principal’s death unless it’s revoked earlier or has a specified end date. A Durable POA remains valid if the principal becomes incapacitated.

What Are the Limitations of a Power of Attorney?

A Power of Attorney cannot grant an agent authority to change the principal’s will, make decisions after the principal’s death, or act against the principal’s best interests.

Who Can Be a Witness for a Power of Attorney in CT?

Connecticut does not require witnesses for a Power of Attorney to be valid, but having a witness can provide additional legal strength, especially if the POA is ever contested.

What Is a Durable Power of Attorney for Health Care in CT?

A Durable Power of Attorney for Health Care in Connecticut allows an agent to make healthcare decisions for the principal if they become incapacitated, including treatment choices and end-of-life care.

Understanding and creating a Connecticut Power of Attorney form is a crucial step in ensuring your affairs are managed according to your wishes. This guide provides essential tips and steps for drafting an effective POA. Regular updates, clear communication with your agent, and adherence to Connecticut’s legal requirements are key to making your POA a reliable and powerful legal tool.

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips