Navigating the complexities of legal documentation in Arizona? Our guide on the Arizona Power of Attorney (PoA) Form simplifies this process. Discover essential tips on effectively using and customizing your PoA form to fit your specific needs. Whether for healthcare, financial, or general purposes, our insights ensure you make informed decisions. Empower yourself with the knowledge to utilize these forms confidently, ensuring your affairs are managed precisely as you intend.

What is the Arizona Power of Attorney Form?

The Arizona Power of Attorney Form is a legal document that allows you to appoint someone to make decisions on your behalf. This person, known as your agent, can manage your financial, health, or other personal matters if you’re unable to do so yourself. The form specifies what powers your agent has, ensuring they act according to your wishes and within Arizona’s legal framework.

What is the best Sample Arizona Power of Attorney Form?

Best Sample Arizona Power of Attorney Form

Section 1: Principal Information

Full Name of Principal: _____________________________

Principal’s Address: _______________________________

City, State, Zip: ___________________________________

Phone Number: _____________________________________

Section 2: Agent Information

Full Name of Agent: _________________________________

Agent’s Address: ___________________________________

City, State, Zip: ___________________________________

Phone Number: _____________________________________

Section 3: Authority Granted

This Power of Attorney grants the following authority to the Agent:

- Financial Decisions: [ ] Yes [ ] No

- Real Estate Management: [ ] Yes [ ] No

- Healthcare Decisions: [ ] Yes [ ] No

- Business Operations: [ ] Yes [ ] No

- Legal Choices: [ ] Yes [ ] No

- Personal and Family Maintenance: [ ] Yes [ ] No

Specify other powers:

Section 4: Duration

This Power of Attorney is effective from [Start Date] ___________________ and shall remain in effect until:

- A specified date: _________________, or

- The occurrence of a specified event: _________________________________________________.

Section 5: Third Party Reliance

Third parties may rely upon the representations of the Agent as to all matters relating to any power granted to them.

Section 6: Revocation

This Power of Attorney may be revoked by the Principal at any time by providing written notice to the Agent.

Section 7: Signatures

Principal’s Signature: _____________________________

Date: ____________________________________________

Agent’s Signature: ________________________________

Date: ____________________________________________

Witness Signature (if required): ____________________

Date: ____________________________________________

Section 8: Notarization (If Required)

State of Arizona )

County of ____________ )

Subscribed and sworn before me on this ___ day of _________, 20.

Notary Public: _____________________________________

My Commission Expires: ____________________________

Instructions for Completing the Form:

- All fields should be filled out accurately.

- The Principal and Agent should carefully read and understand the powers being granted.

- The form should be signed in the presence of a witness and/or notarized, if required by state law.

- Keep copies of the signed document for future reference.

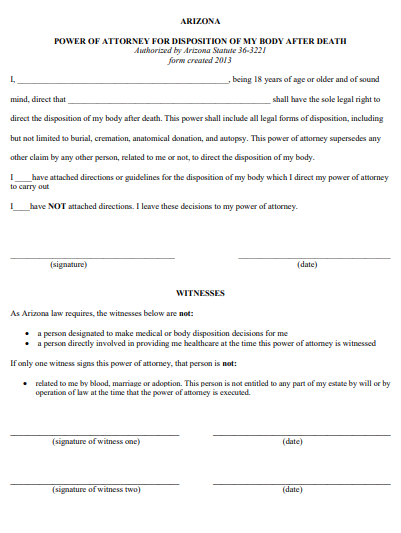

10+ Free Arizona (AZ) Power of Attorney Form

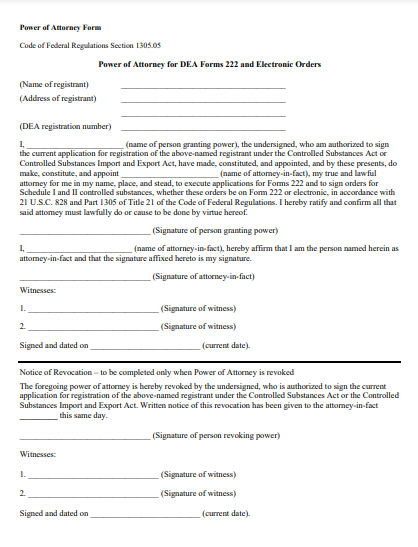

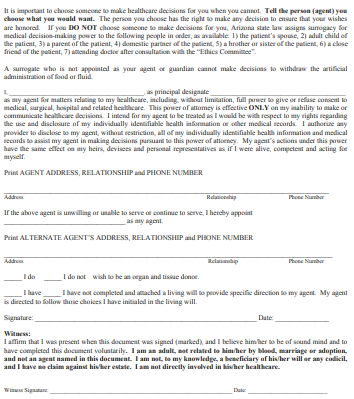

1. Arizona Power of Attorney Form

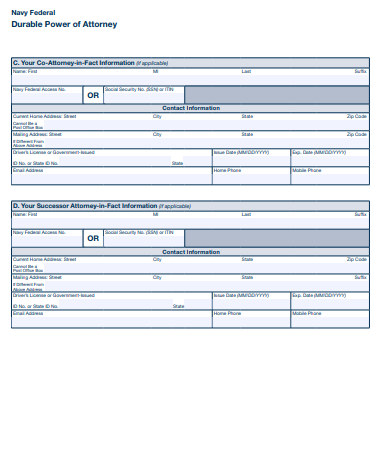

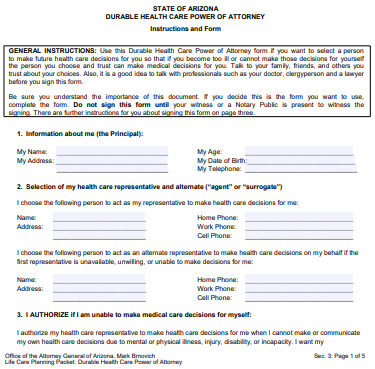

2. Arizona Durable Power of Attorney Form

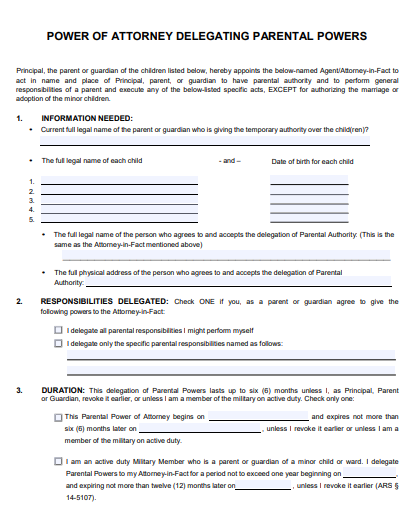

3. Sample Arizona Power of Attorney Form

4. Arizona General Power of Attorney Form

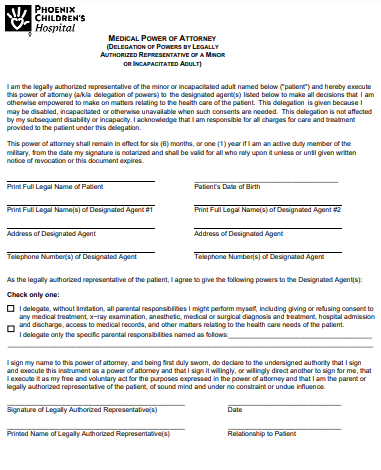

5. Arizona Medical Power of Attorney Form

6. Arizona Simple Power of Attorney Form

7. Arizona Blank Power of Attorney Form

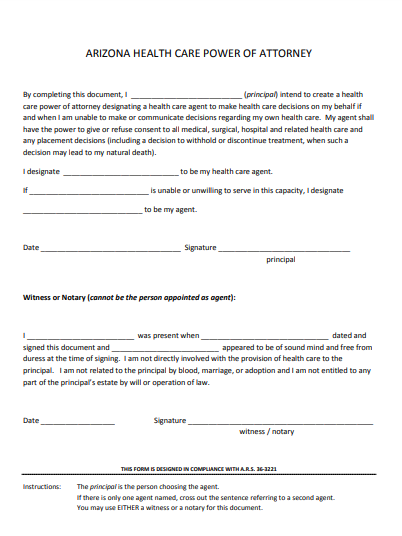

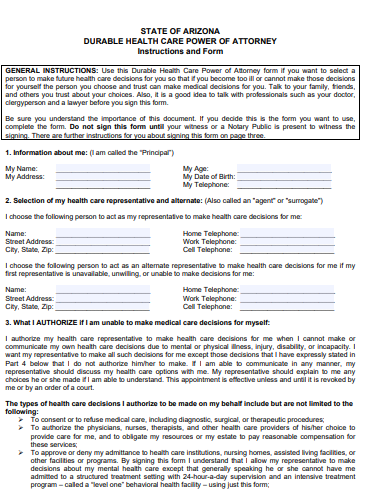

8. Arizona Health Care Power of Attorney Form

9. Arizona Specific Power of Attorney Form

10. Arizona Standard Power of Attorney Form

11. Arizona Limited Power of Attorney Form

How do I get power of attorney in Arizona?

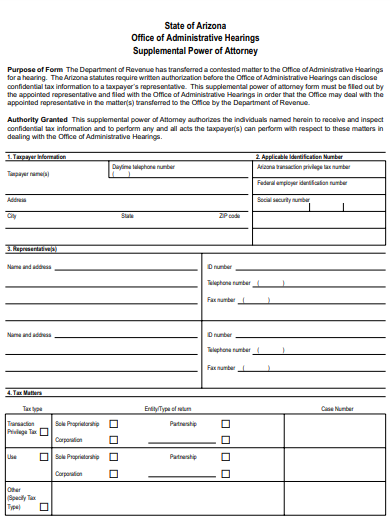

What is Arizona Form 285?

Arizona Form 285, officially known as the “General Granting of Authority,” is a legal document used in the state of Arizona. This form is designed to grant authority to an individual, known as an agent or attorney-in-fact, to conduct certain transactions on behalf of another person, known as the principal.

The scope of authority granted through Form 285 can be broad or limited, depending on the principal’s preferences and needs. It’s commonly used for financial matters, such as managing bank accounts, signing checks, or handling real estate transactions, but can also cover other areas as specified by the principal.

It’s important to note that while Form 285 is a powerful tool for delegating authority, it should be filled out with care and precision to ensure that the agent’s powers are clearly defined and align with the principal’s intentions. As with any legal document, consulting with a legal professional is advisable to ensure that it meets all necessary legal standards and requirements.

What is a Form 2848 in Arizona?

What is a special power of attorney in Arizona?

A Special Power of Attorney in Arizona is a legal document that grants a designated individual, known as an agent or attorney-in-fact, the authority to perform specific acts or make decisions on behalf of the principal (the person granting the power). Unlike a General Power of Attorney, which provides broad powers, a Special Power of Attorney is limited to particular tasks or situations.

Key characteristics of a Special Power of Attorney in Arizona include:

- Limited Scope: The agent’s powers are restricted to specific tasks, such as selling a property, managing certain financial transactions, or handling a legal matter.

- Clear Definition of Duties: The document must clearly outline the exact duties and responsibilities granted to the agent. This precision helps prevent misunderstandings and ensures that the agent’s actions align with the principal’s intentions.

- Duration: The Special Power of Attorney can be set for a limited time period or for a specific transaction. It becomes void once the specified task is completed or the time period elapses.

- Revocability: Like other types of Power of Attorney, it can be revoked by the principal at any time, as long as the principal is mentally competent.

- Legal Formalities: For validity, it must comply with Arizona state laws, including being signed by the principal and typically notarized.

A Special Power of Attorney is often used when the principal cannot handle certain affairs due to absence, illness, or other reasons and needs someone to act in a limited, specific capacity. As with any legal document, it’s advisable to consult with a legal professional to ensure that the Special Power of Attorney accurately reflects the principal’s needs and complies with Arizona law.

How much does it cost to get a power of attorney in Arizona?

Understanding Power of Attorney in Arizona

A Power of Attorney (POA) is a legal document that grants one person the authority to act on behalf of another. In Arizona, the costs associated with obtaining a POA can vary based on several factors.

Factors Influencing the Cost

- Type of POA: The cost can differ depending on whether it’s a General, Limited, Medical, or Durable Power of Attorney.

- Professional Assistance: Hiring a lawyer can increase the cost, but ensures legal accuracy.

- Complexity of the Document: More complex arrangements require more time and expertise, thus increasing the cost.

- Notary Fees: Notarization is essential for the POA to be legally valid in Arizona.

Average Costs in Arizona

- Legal Fees: Hiring an attorney can range from $100 to $500, depending on the complexity.

- Notary Fees: Typically around $5 to $20.

- Self-Prepared Forms: If you choose to do it yourself, the cost of forms can range from free to $100.

Additional Considerations

- Legal Aid: For those who cannot afford an attorney, legal aid services may offer assistance at a reduced cost or for free.

- Online Services: Online legal services offer POA forms and guidance at a lower cost than traditional attorneys.

The cost of obtaining a Power of Attorney in Arizona varies based on the type, complexity, and whether professional legal services are used. It’s crucial to balance cost with the need for a legally sound document.

This article provides a comprehensive overview of the costs associated with obtaining a Power of Attorney in Arizona, tailored for a US audience with global relevance. It includes essential keywords for SEO optimization, ensuring better ranking in search engines.

Does Arizona require a notary for power of attorney?

In Arizona, notarization is required for a Power of Attorney document to be legally valid. The notarization process involves having the document signed in the presence of a notary public, who verifies the identity of the signer and ensures that the signature is made willingly and under no duress. This requirement adds an extra layer of authenticity and protection against fraud, ensuring that the Power of Attorney document is legally enforceable in Arizona.

How long is a power of attorney good for in Arizona?

Related Posts

-

10+ Free New Hampshire (NH) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nevada (NV) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Nebraska (NE) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Montana (MT) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Missouri (MO) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Minnesota (MN) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Mississippi (MS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Massachusetts (MA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maryland (MD) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Maine (ME) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Louisiana (LA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kentucky (KY) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Kansas (KS) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Iowa (IA) Power of Attorney Form Download – How to Create Guide, Tips

-

10+ Free Indiana (IN) Power of Attorney Form Download – How to Create Guide, Tips