A Personal Loan is a form of unsecured loan that you can use for personal purposes, like funding a home renovation project or paying for medical bills and emergencies. This type of loan is not usually for commercial or business use. Unlike other types of loans, a Personal Loan is unsecured, which means that it normally does not require an asset as collateral when you apply for one, but you would need Personal Loan Agreement Forms to set the terms and conditions of the loan you will take and to define the legal actions that can be taken in the event of a default.

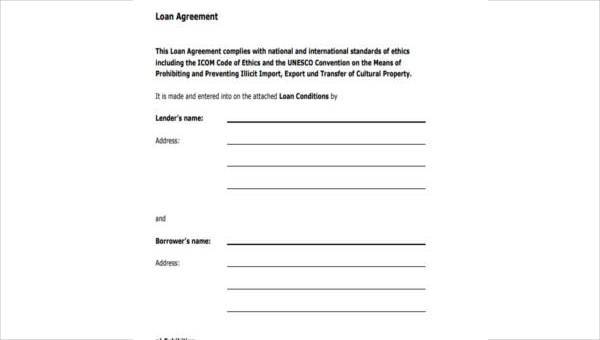

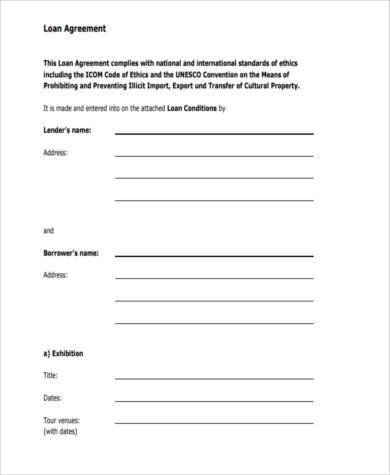

Free Personal Loan Agreement Form

Personal Money Loan Agreement Form

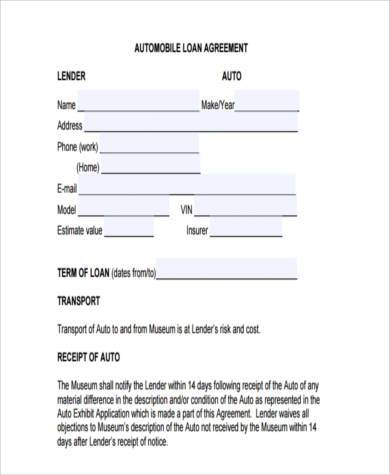

Personal Automobile Loan Agreement Form

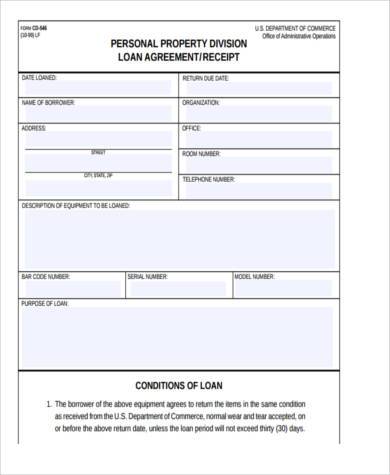

Personal Property Loan Agreement Form

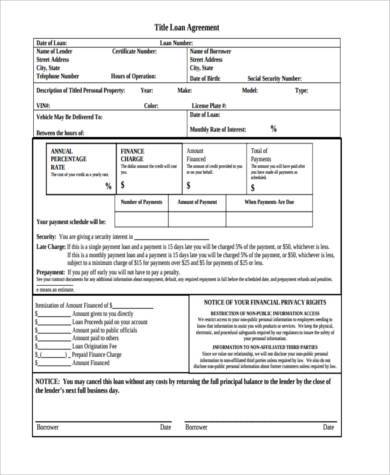

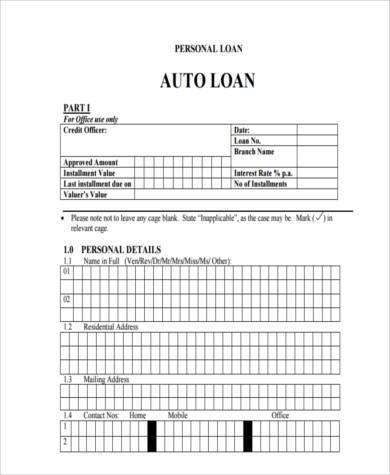

Personal Auto Loan Agreement Form

Characteristics of a Personal Loan

- Unlike a mortgage, a Personal Loan is usually short-term, lasting only 1 to 5 years. The longer the repayment period, the lower your monthly payments would be, but the higher your interest payment also.

- Personal Loans do not normally require a collateral. This is one of the reasons why Personal Loans are hard to get. This is also why Personal Loan Agreements are even more important, so that when the borrower defaults, the lender can file a lawsuit against you. Other options that the lender has are hiring a collection agency and reporting late payments to the credit bureaus, which can ultimately affect your credit score. This can lower your credit score, which would make it harder for you to get a loan in the future or harder to get a low interest rate.

- Personal Loans usually have fixed interest rates and a fixed repayment period, both of which will have to be stipulated in your signed Personal Loan Agreement.

- The amount you can borrow for a Personal Loan depends on your credit score, although there is usually a cap for how much you can borrow. The higher your credit score is, the higher the amount you can borrow will be. You may also see our Personal Agreement Forms for more samples and information.

Personal Loan Agreement Form in PDF

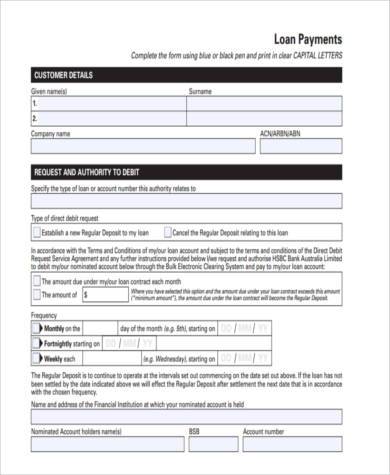

Personal Loan Payment Agreement Form

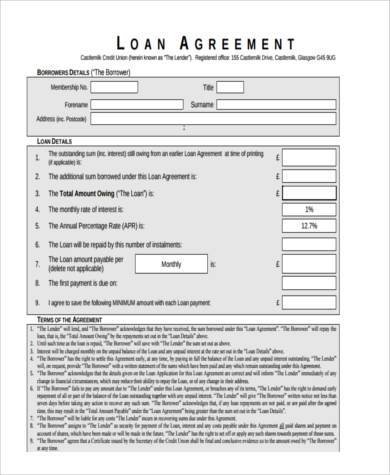

Generic Personal Loan Agreement Form

Personal Loan Agreement Form Example

Personal Loan Agreement Form in Word format

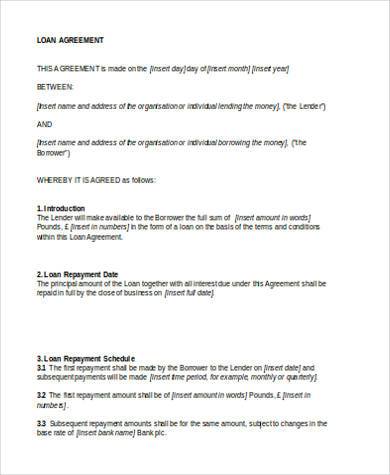

Parts of a Personal Loan Agreement Form

- Personal information of both the borrower and the lender

- Loan Amount and Purpose: You would need to indicate why you need the money and exactly how much you would need.

- Loan Interest Rate: This would depend on your credit score.

- Loan Term: This is the amount of time you will be given to pay back the loan, which is usually one to five years for a Personal Loan.

- Repayment: This is the amount you will pay back for a set frequency. How much will you be paying, and will the payments be monthly, bi-monthly or quarterly?

- Default Terms: If you default or can no longer pay back the loan, the agreement form should indicate what consequences there would be.

- Early Payment Terms: There is usually a payment for early payment, which would be indicated in this section.

- Loan Security: If there is ever a collateral, it should be stipulated in the agreement as well that if the borrower defaults, the assets used as collateral will be transferred to the lender.

After these terms and conditions have been stipulated, the borrower and the lender may then sign the Personal Loan Agreement Form. They can also have it notarized for additional security, especially if it doesn’t have a collateral involved. You may also see our Loan Agreement Forms for samples of other types of Loan Agreements.

Related Posts

FREE 9+ Sample Equipment Lease Agreement Forms in PDF | MS Word

FREE 9+ Sample Printable Lease Agreement Forms in PDF | MS Word

FREE 10+ Sample Pet Agreement Forms in PDF | MS Word

FREE 9+ Confidentiality Agreement Forms in PDF | MS Word

FREE 8+ Sample Custody Agreement Forms in PDF | MS Word

FREE 13+ Simple Rental Agreement Forms in PDF | MS Word

FREE 50+ Mortgage Forms Download – How to Create Guide, Tips

FREE 10+ Sample Service Level Agreement Forms in PDF | MS Word

FREE 8+ Personal Loan Agreement Forms in PDF | MS Word

FREE 9+ Sample Employee Loan Agreements in PDF | MS Word

FREE 8+ Student Loan Agreement Forms in PDF | MS Word

FREE 8+ Generic Rental Agreement Forms in PDF | MS Word

FREE 11+ Deposit Agreement Forms in PDF | MS Word

FREE 8+ Party Wall Agreement Form Samples in PDF | MS Word

FREE 7+ Sample Promissory Note Agreement Forms in PDF | MS Word