- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

Promissory Note

There are several instances wherein an individual is forced to borrow a significant sum of money from another. Loaning from another person provides less hassle and requires fewer paperwork than loaning from the bank or other financial institutions. One necessary document in a person-to-person loan is a promissory note. If you have plans to be a lender, you must draft and sign a promissory letter, even if the borrower is a close family member. Know more about promissory notes by reading this article. Read More

What Is a Promissory Note?

A promissory note is a written document that records the borrower’s promise to pay back the lender’s money. It records how much the debt is, how the borrower will pay, and when the borrower should complete the payment. The note can either be a simple note that records the lump sum payment on a specific date or a demand promissory note where the lender demands for the payment according to their will. Aside from person-to-person loans, promissory notes are also useful for demanding payments for student loans,

How Do You Create a Promissory Note?

Contrary to common belief, a promissory note has several clauses that ensure the successful repayment of the debt. This note is basically an agreement between parties that make them liable and accountable for possible non-compliance. So, if you are about to engage in personal loans, here are some steps and tips on how to create a complete promissory note.

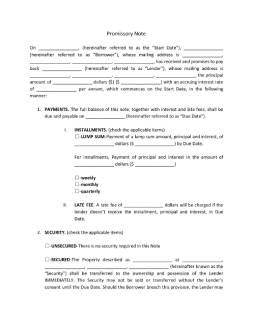

1. Identify the Parties

The accuracy of the essential details is highly critical for any legal document. It also holds true for promissory notes. The first clause for this document requires the identification details of both parties. It requires the name of either party and their respective mailing addresses. Other essential details presented in the first clause of this document is the starting date of the loan and the agreed interest rate of the debt.

2. Know the Nature of the Loan

Upon the introduction of the loan’s interest rate, the document dives more into the details of the loan. The succeeding part of the material introduces the nature of the loan. Present the total sum of the loan and the method of payment. Also, go over the need for security or collateral.

3. Finalize the Payment Terms

The most important information present in the promissory note is the agreed payment terms. The terms include, but not limited to, the agreement regarding the date of the payment, late fees, interest in cases of default or late payment, repayment, and acceleration of dues. These terms go hand in hand with the definition of the loan. As these details of the arrangement are critical, their statements must be straightforward and direct. Both parties must also agree on when the payment is due, whether it may be weekly, monthly, or quarterly. The presence of this valuable detail in the legal document holds the borrower liable for timely payment.

4. Review the Supplementary Clauses

After the clauses regarding the nature of the loan and the preferred payment method, there are remaining clauses that support the framework of the entire arrangement. These are the supplementary clauses that cover the agreement regarding attorney’s fees, severability of the contract, and possible integration. Both parties must be well-acquainted with these clauses in case both parties have an arrangement with circumstances that can be solved by these clauses.

5. Review Before Signing

Lastly, conclude the document by the statement regarding the governing state law. Before either of the parties sign the document, they are free to review the clauses according to the existing state laws. As the lender, reviewing and cross-checking the paper with the established laws help in making sure that you can avoid conflicts. Once the review is done, the parties can now sign the document to make the arrangement valid and enforceable.

FAQs

What are the different types of promissory notes?

There are several types of promissory notes. These notes differ according to where you want to use them. These are the following forms: simple promissory, student loans, real estate, personal loan, car or automobile, commercial, and investment. All of these serve the same purpose.

What happens if I do not pay for my promissory note?

As a promissory note is considered as a legal document, a legal lawsuit may be filed for non-payment of the debt bound by the document. The lender has the right to make the borrower accountable. And if you were able to secure collateral was secured in the agreement, the lender will take the collateral.

What makes a promissory note invalid?

A promissory note will be good as null and invalid if the terms and conditions are unclear or not written properly. Also, it becomes null when one party decides to alter the clauses of the contract without the consent of the other party. Lastly, the contract becomes invalid when the lender does not have the right to claim the debt.

Does a promissory note expire?

Aside from the due date of the contract, the contract expires according to the statute of limitations. The statute of limitations refers to the period of limitation that allows either party to take legal action regarding the issue. For promissory notes, the statute of limitation is six years after the due date. During the six years, the lender can hold the borrower accountable for their non-payment.

What if someone defaults on a promissory note?

When someone commits a default, it means that they were not able to perform their obligation according to the contract. So, if someone defaults on a promissory note, the lender can raise the issue to the court and file for a petition.

Understandably, some people second guess when it comes to letting other people borrow their money and other assets. The doubt of not getting paid back is present. But, this doubt is replaced with security when both parties use and sign a promissory note. With this document, both parties are bound and liable to perform their obligations until the loan is paid off.