If you go to your local bank or lending firm, for example, and ask them for a loan, they would most likely instruct you to fill out a credit application form first. Credit application forms are used when banks and other business establishments want to extend credit to their customers.

A completed credit application form serves as your introduction to the bank. Filling out this form is as easy as filling out a job application form since the form will require personal financial information. Other firms may require additional documents like proof of income and tax returns which will also be indicated on the form.

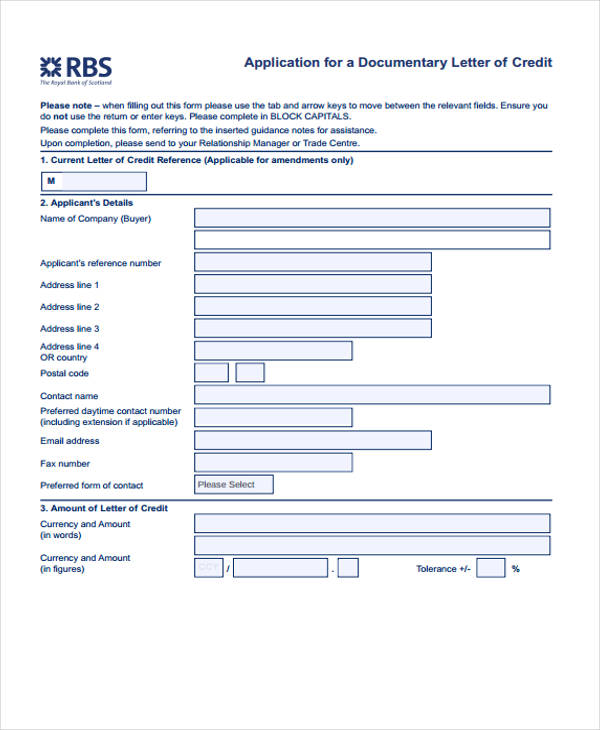

Documentary Credit Application Form

Documentary Letter Credit Application Form

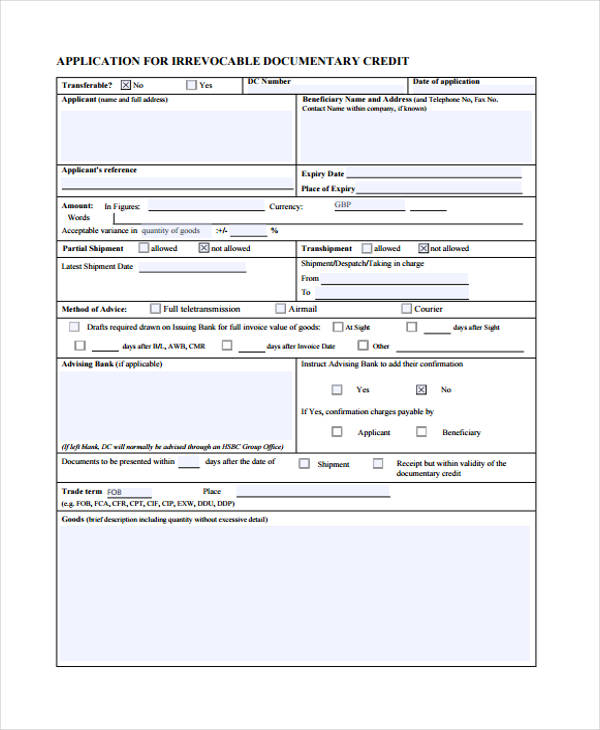

Irrevocable Documentary Credit Application Form

When to Require Credit Application Forms (For Business Establishments)

Aside from banks and established lending firms, business owners may also create their own credit application forms if they want to extend credit to their customers.

As a business owner, here are a few indicators that will tell you when to do so:

- Your business is expanding

- You competitors are doing it

- You want to carefully select those you want to extend credit to

- You want more customers

- You want to formalize your credit application process

If you are thinking of doing this for your business, you may also check the format of business credit application forms.

When to Use Credit Application Forms (For Private Individuals)

Anyone may fill out a credit application form and file for a loan or pay for an item in installment. As a private individual, though, you should exercise this privilege carefully. Remember that you still have to maintain a healthy credit rating. This means that the number of loans you incur should be directly proportional to your source of income.

You should also only resort to filing for a new credit application after making sure that your other loans (if present) are paid on time and/or were already paid for. Lastly, you may try filling out credit application form samples at first. Then let it sit for a week or two before checking whether or not you still need that credit application or not.

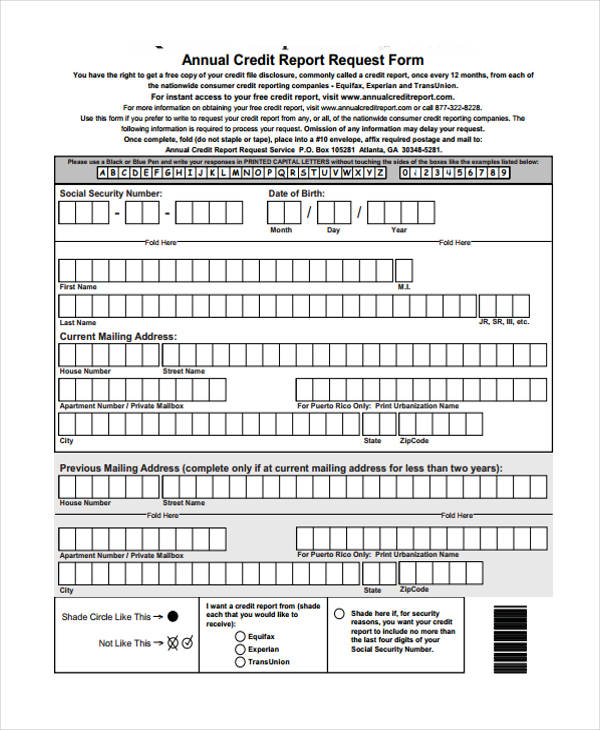

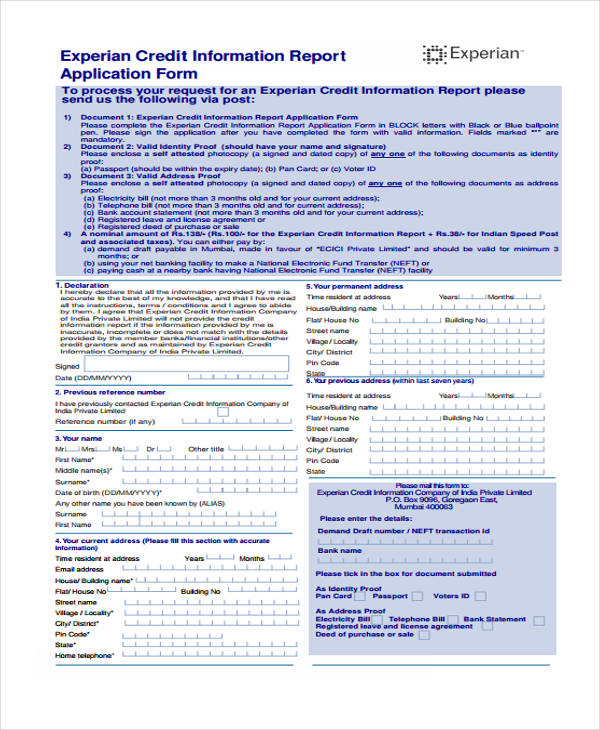

Credit Report Application Form

Annual Credit Report Application Form

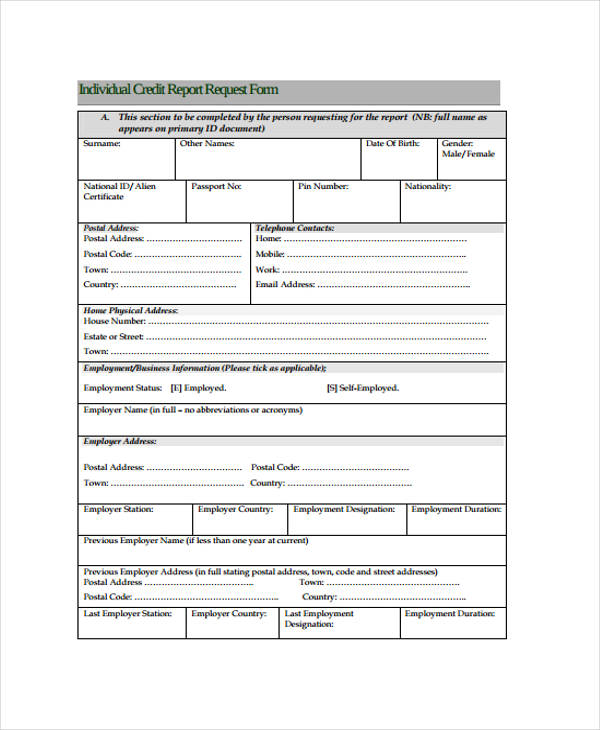

Individual Credit Report Application Request Form

Example Credit Report Application Form

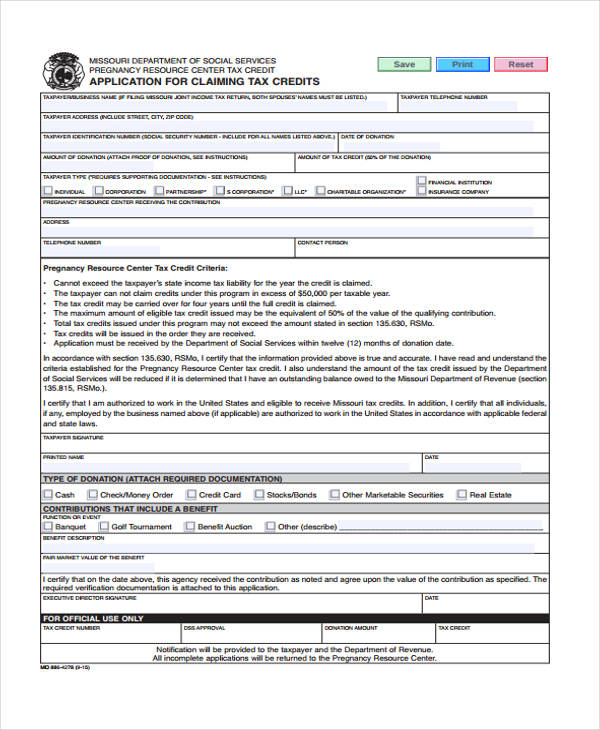

Tax Credit Application Form

Tax Credit Claim Application Form

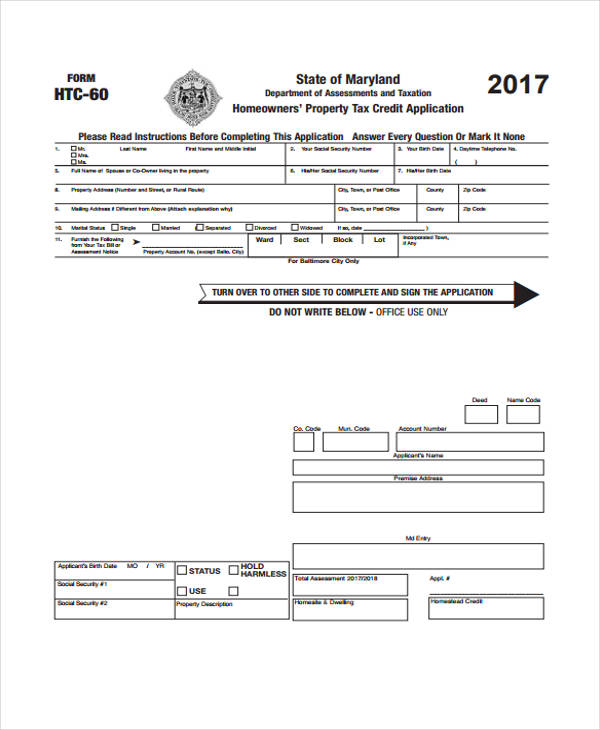

Homeowners Tax Credit Application Form

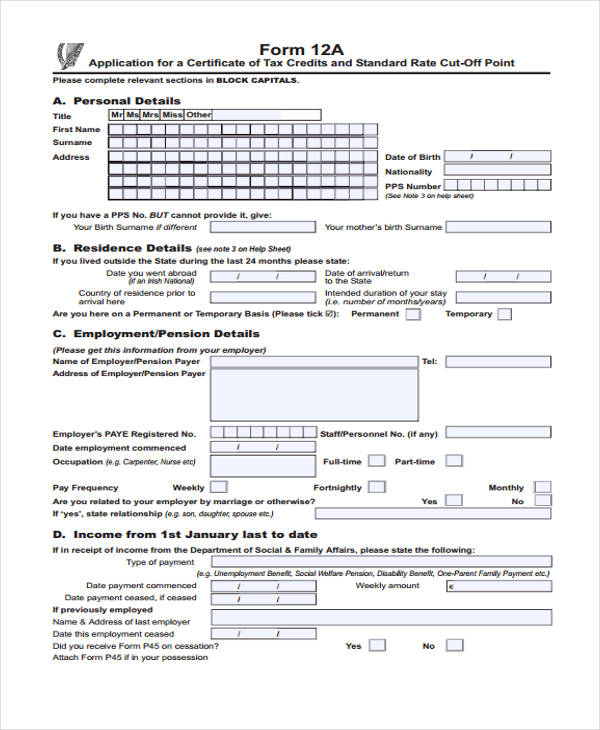

Application for a Certificate of Tax Credits

Purpose of Credit Application Forms

Credit application forms serves a variety of purposes. Among these are:

- Simplifies the credit application process. When starting out a new business, business application forms need to be submitted to simplify this lengthy process. The credit application process is also simplified by using credit application forms.

-

Screens out bad debtors. When a company have a process in place for accepting credit requests, they are able to see which customers more likely to pay them back through the requirements that they submit. Companies are then able to minimize their risk by not extending credit to these customers or by limiting the amount that they can borrow.

-

Attracts more customers. When businesses are starting out, extending credit to customers may come naturally as a way to nurture the owner-customer relationship. However, this is approach does not take into consideration any new customers who may be able to pay as well as any old customer. By setting up a credit approval process using credit application forms, you open up your business to more possibly-paying customers.

-

Sets guidelines for lending money. Using credit application forms lets your customers know that a process is being followed when they ask for credit/loan. Customers are also more likely to submit required documentation proving their financial capacity. This leads to a more thorough assessment of a client’s ability to pay back his/her loans.

-

Gives credibility to your business. By being able to extend credit, your company image receives a boost. Whether you are a lending firm or a commodity selling firm, using official credit application forms strengthens your company’s lending practices.

-

Limits risks. In connection with the second purpose, credit application forms helps businesses to limit the risks associated with lending to others. There are safeguards that your company can follow to ensure that you only get good payers.

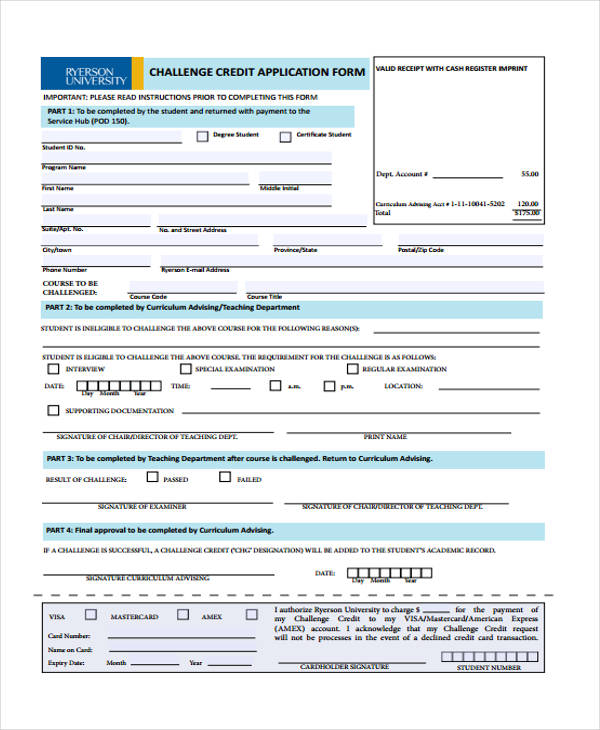

Challenge Credit Application Form

Challenge Credit Course Application Form

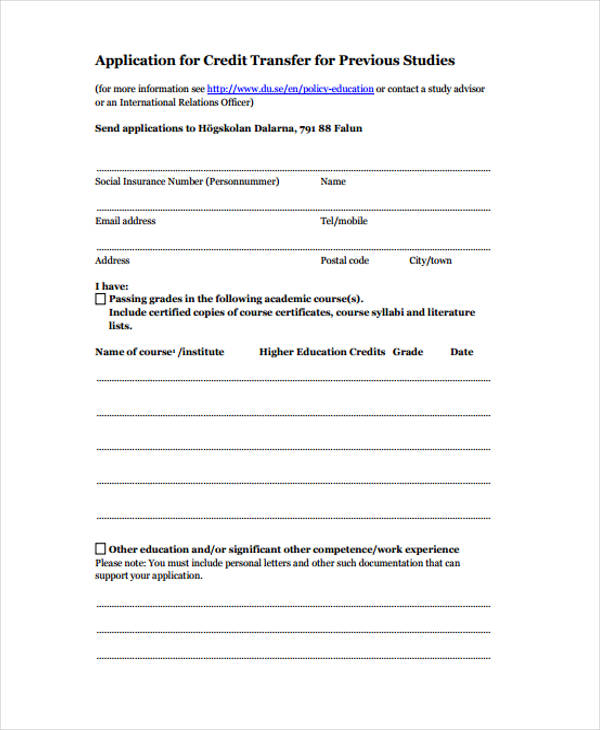

Studies Credit Application Form

Previous Studies Credit Application Form

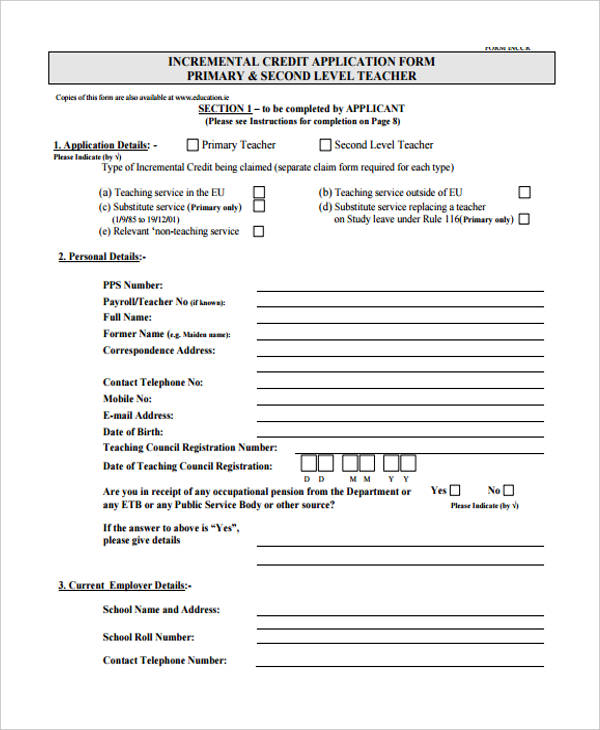

Incremental Credit Application Form

Sample Incremental Credit Application Form

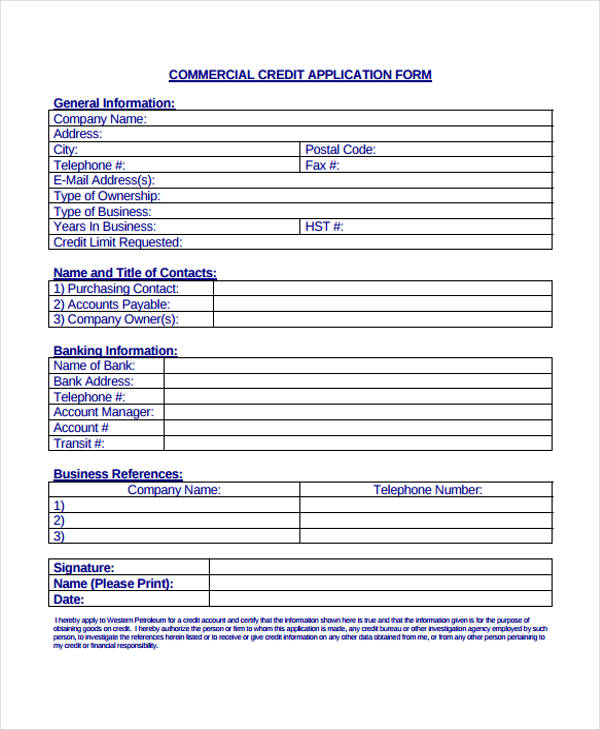

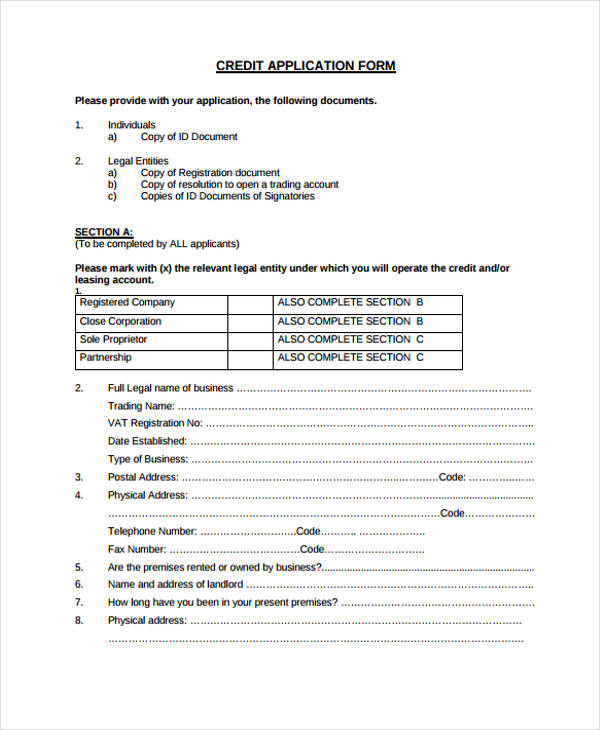

Commercial Credit Application Form

Free Commercial Credit Application Form

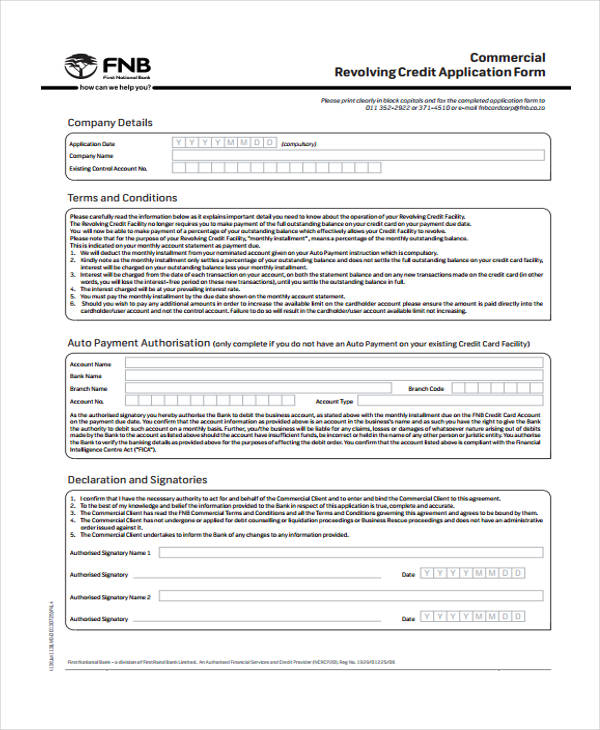

Commercial Revolving Credit Application Form

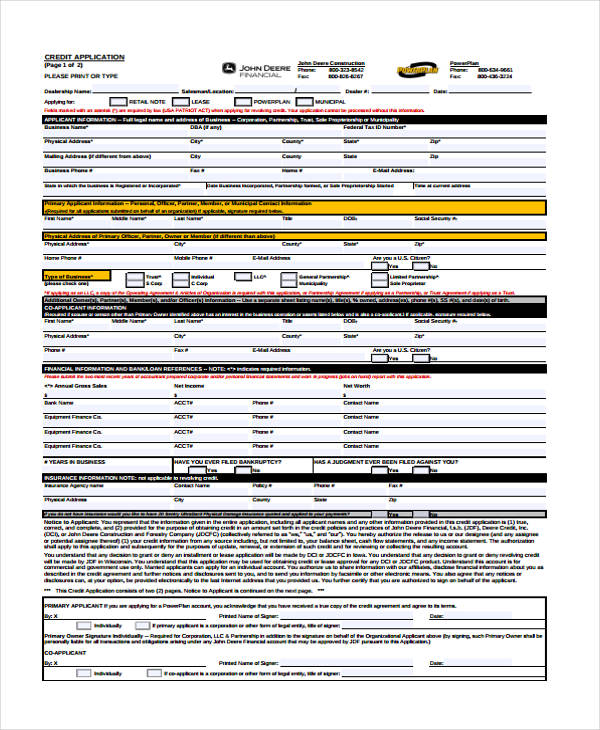

Business Credit Application Form

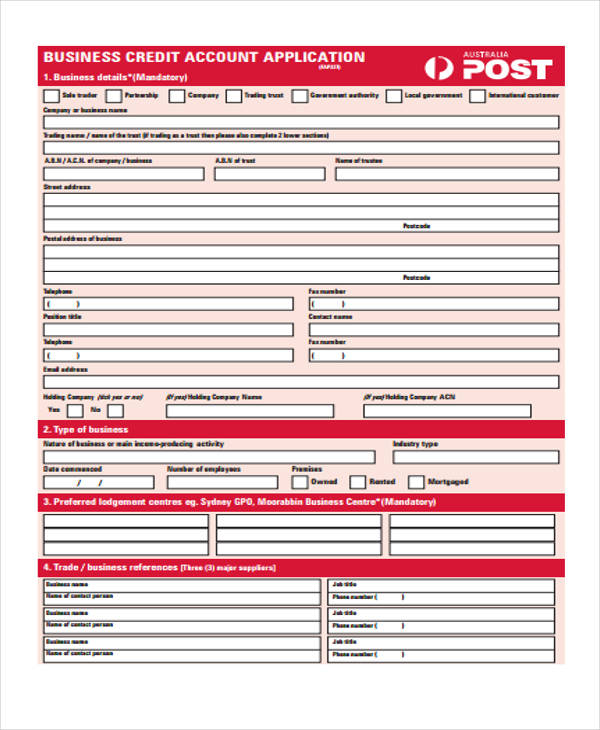

Business Credit Account Application Form

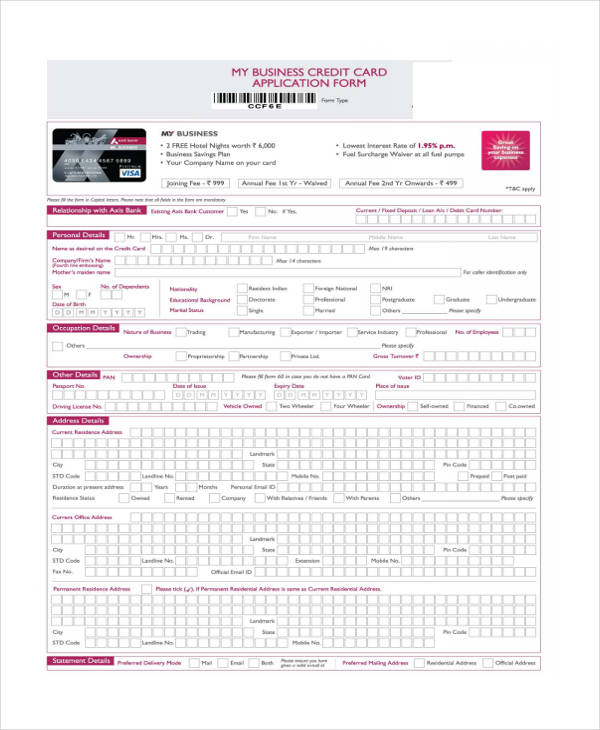

Business Credit Card Application Form

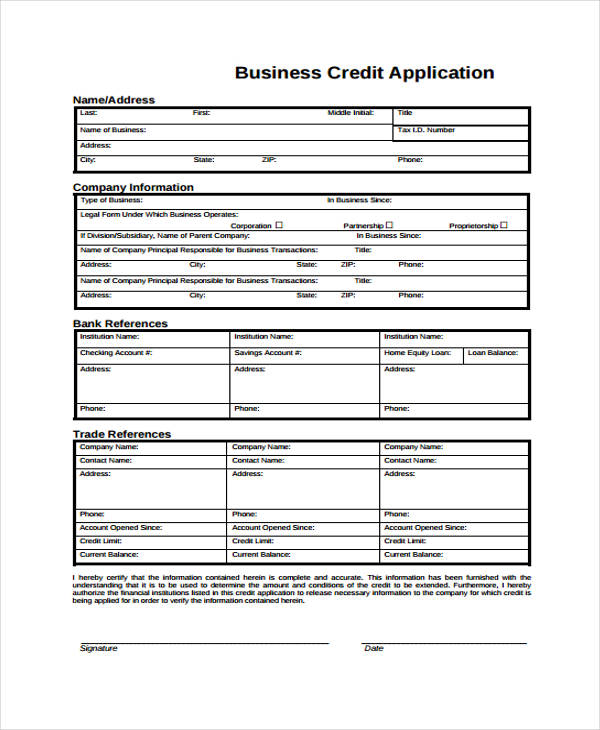

General Business Credit Application Form

What to Include in Your Credit Application Form

Most credit application forms will ask for the same pieces of information – most of these financial information. The basic personal information required in these forms are just like the ones required in a printable application form. If you are preparing your credit application forms, make sure include the following:

- Latest income tax returns

- Latest bank certificates and bank statements

- Land titles or deeds and list of other assets and properties

- Accurate financial data like name, past addresses, source of income, job description, annual salary

- Past and present credit card history

- Latest credit card statements

- Credit rating and history

What Credit Application Form to Use

The online world is rife with different companies offering credits and loans. Thus, the subsequent credit application forms needed to file for a loan are also varied.

To avoid confusion and incorrectly filling out target application forms, always ask the company where you are applying for a loan first if they have a standard credit application form used. If yes, obtain a copy in their official website and begin filling it out.

Different credit applications exist for pension credits, tax credits, and housing credits that some states and governments may offer. So make sure to ask your local government office aide first to know which form to correctly fill out.

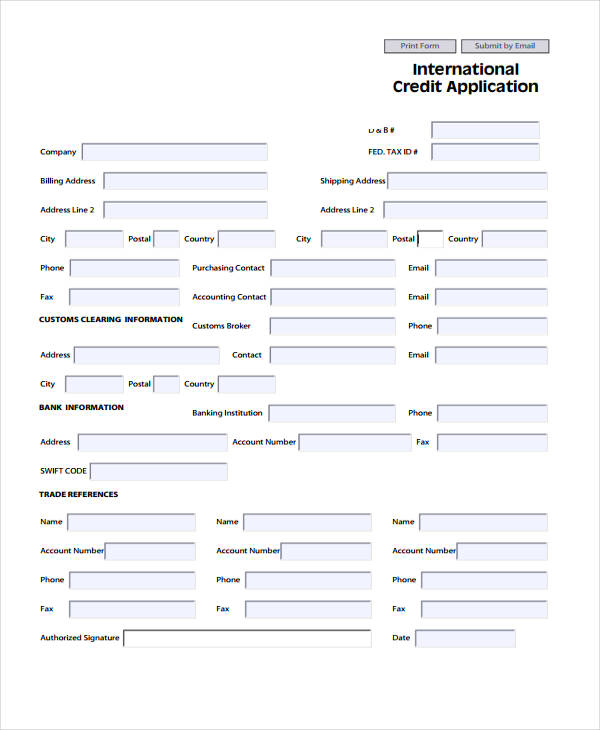

International Credit Application Form

Free International Credit Application Form

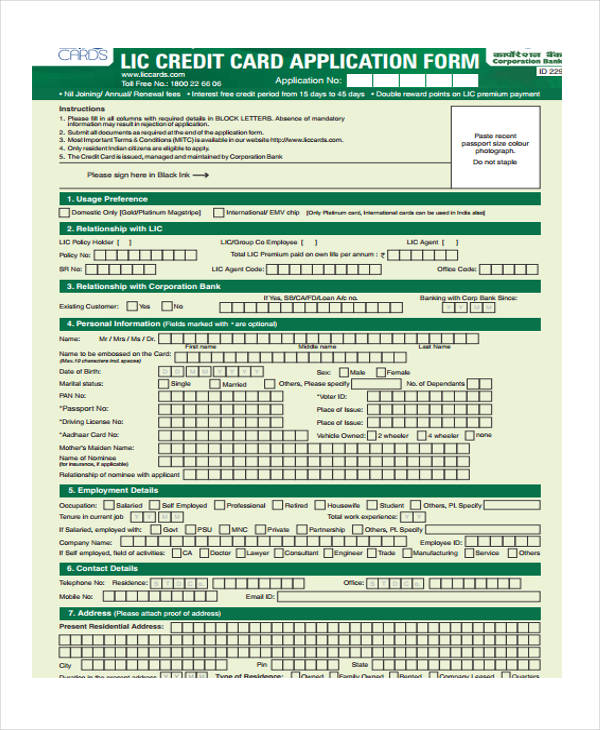

Credit Card Application Form

Bank Credit Card Application Form

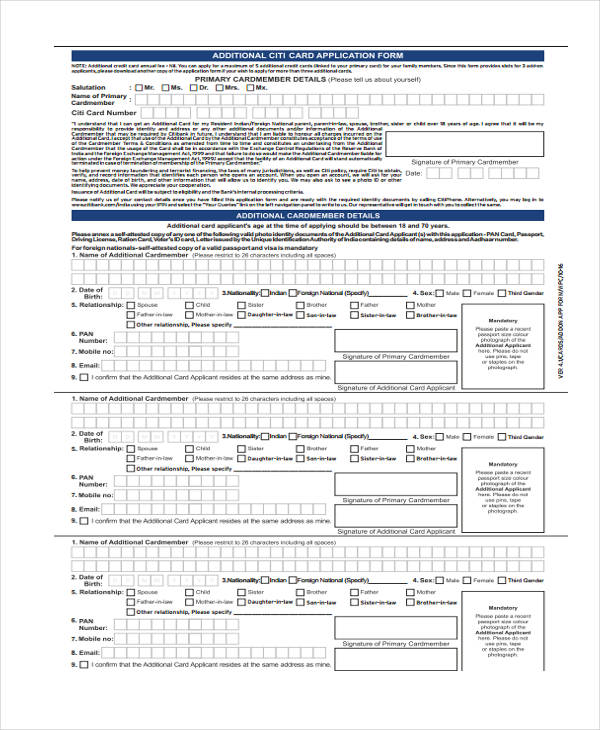

Additional Credit Card Application Form

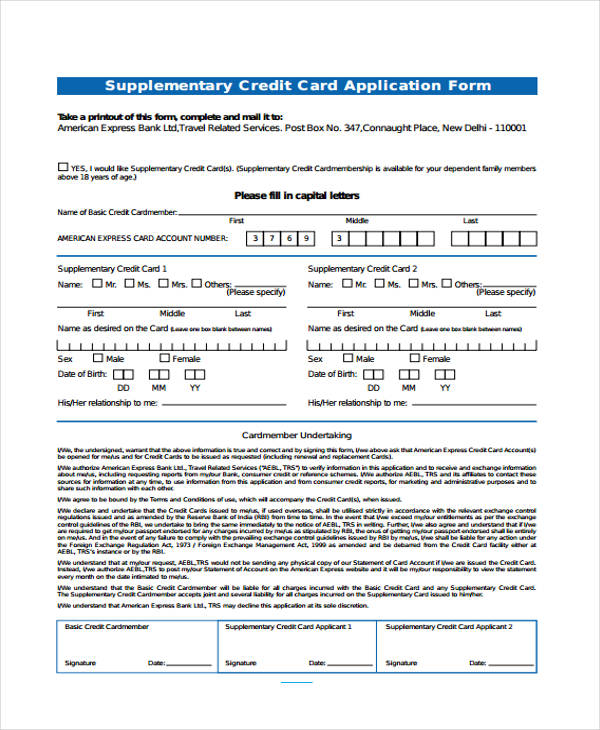

Credit Card Supplementary Application Form

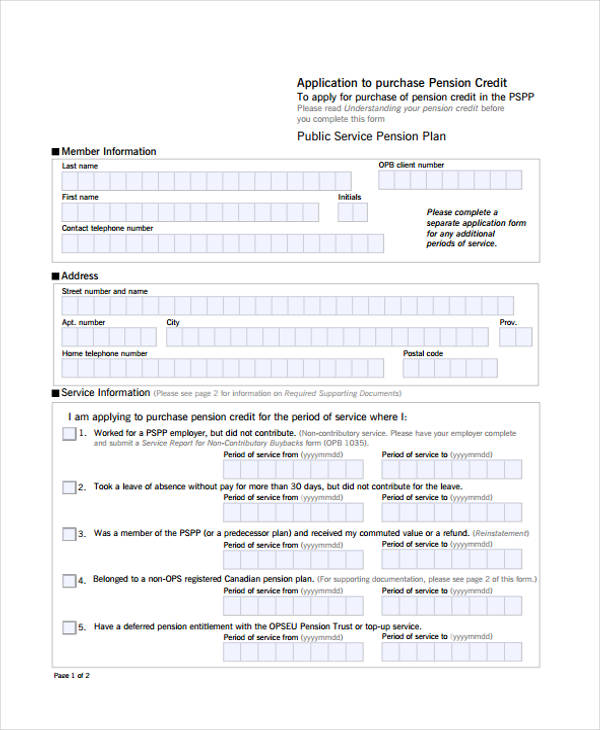

Pension Credit Application Form

Purchase Pension Credit Application Form

Free Credit Application Form

Credit Application Form Example

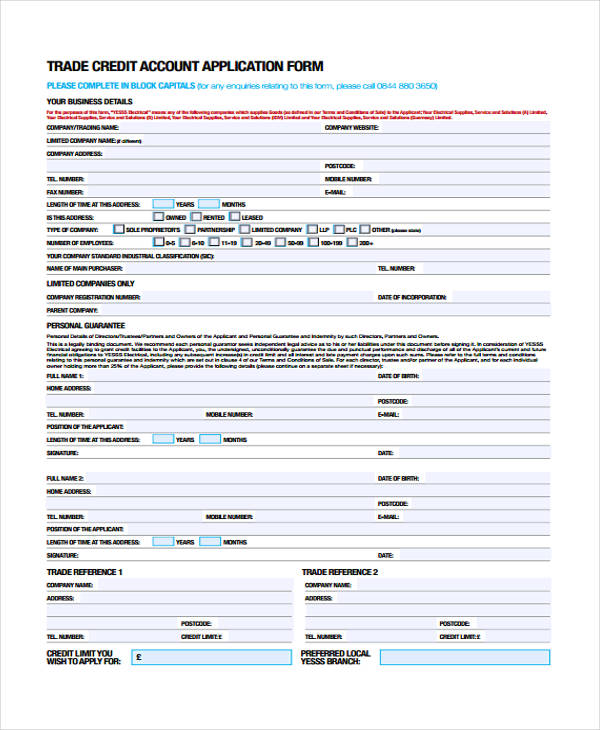

Credit Account Application Form

Trade Credit Account Application Form

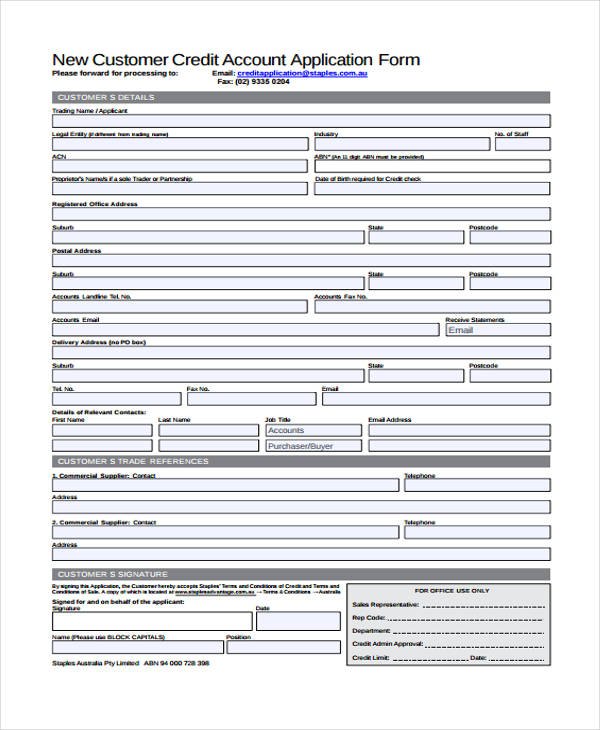

New Customer Credit Account Application Form

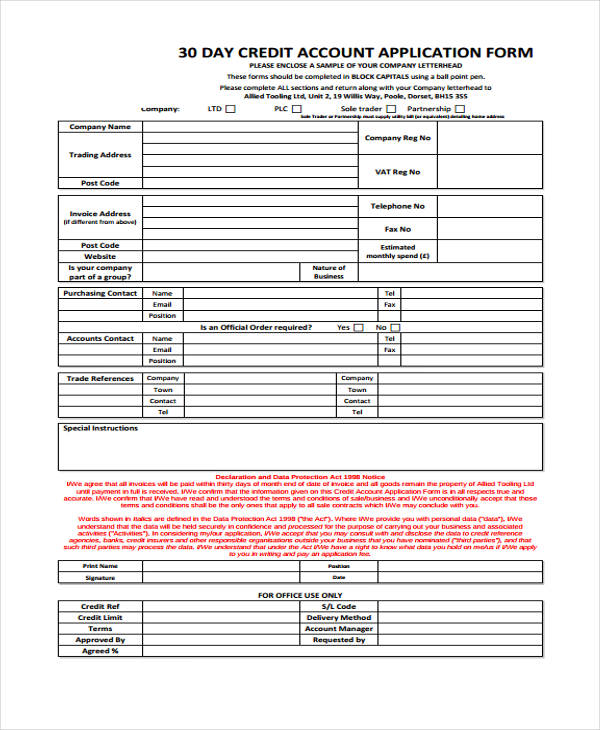

30 Day Credit Account Application Form

Guidelines for Filling Out A Credit Application Form

The amount of financial information required in a credit application form is vastly different from the information required in a rental apRead the fine printplication form or vendor application forms. That is why you need to prepare for these additional requirements. Listed below are other tips that will help guide you in this task:

- Make sure your financial data is consistent. Credit application forms are used to determine your capacity to pay back the loan. A financial institution may flag your application if they find inconsistent information in your form and other documents.

- Be prepared for a credit check. Credit checks usually accompany a credit application form submission. This allows a lending firm to objectively see your payment history and behavior as a consumer.

- Include proof of property ownership. When applying for a bigger loan, financial institutions may ask for a collateral. In this case, you may present property deeds and titles. Lending institutions see this as a guarantee that you will make payments and avoid losing your home. The bank can seize the property if you are unable to pay back your loan.

- Read the fine print. Some credit application forms serve as the agreement for a loan and loan terms and conditions will b stipulated on the form. Make sure to read the form and if you have questions reqarding it, ask a bank representative or contact a lawyer to enlighten you.

Related Posts

FREE 4+ Car Loan Application Forms in PDF | MS Word

FREE 32+ Medical Application Forms in PDF

FREE 17+ Sample Grant Application Forms in PDF | MS Word | Excel

FREE 35+ Parking Application Forms Download – How to Create Guide, Tips

FREE 13+ Sample Employment Application Forms in PDF | MS Word | XLS

FREE 10+ Examination Application Forms in PDF | Ms Word

FREE 9+ Sample Business Application Forms in PDF | MS Word

FREE 9+ Sample School Application Forms in PDF | MS Word

FREE 32+ Scholarship Application Forms in PDF | MS Word | XLS

FREE 10+ Varieties of Marriage Application Forms in PDF | MS Word

FREE 11+ Scholarship Application Form Samples in PDF | MS Word | Excel

FREE 11+ Sample School Application Forms in PDF | MS Word | Excel

FREE 51+ Application Forms in PDF | MS Word | Excel

FREE 11+ Security Application Forms in PDF | MS Word

FREE 10+ Nurse Application Forms in PDF | Ms Word